Get the free Charterer’s Liability Insurance - Proposal Form

Get, Create, Make and Sign charterers liability insurance

How to edit charterers liability insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out charterers liability insurance

How to fill out charterers liability insurance

Who needs charterers liability insurance?

Charterers Liability Insurance Form: A Comprehensive How-to Guide

Understanding charterers liability insurance

Charterers liability insurance is a specialized form of marine insurance designed to protect charterers against liabilities they may incur while operating a vessel. This coverage addresses various risks, including damage to the vessel, third-party liability, and even personal injury claims. As charterers manage vessels under their control, understanding the terms of their liability becomes crucial.

Having charterers liability insurance is vital for anyone engaged in shipping activities. This insurance not only protects against financial losses but also ensures compliance with contractual obligations. A charterer without adequate insurance may face significant out-of-pocket expenses in the event of an accident or incident at sea.

Charterers, shipowners, and operators involved in leasing vessels need this coverage. It is essential for individuals and businesses chartering ships for transport or trade purposes to safeguard themselves from unforeseen liabilities.

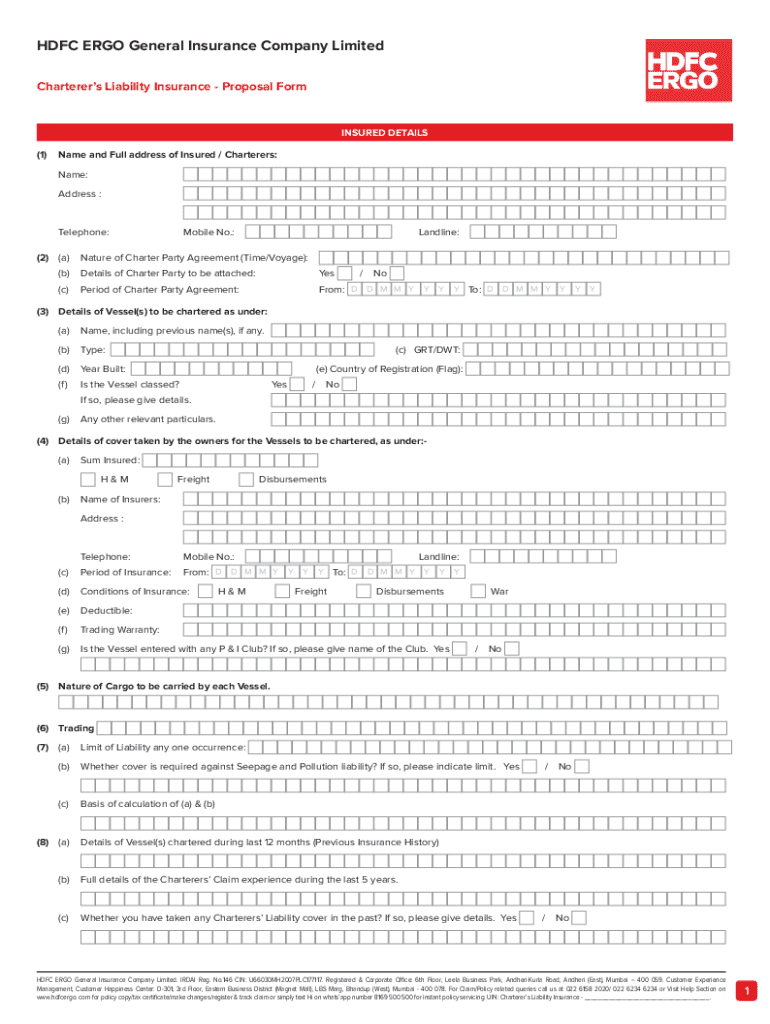

Key components of the charterers liability insurance form

The charterers liability insurance form is structured to gather specific information critical for assessing risk and determining coverage. Understanding the sections of the form is vital for ensuring accuracy and completeness to prevent delays in obtaining coverage.

Key components of the form include personal or company details, a description of the intended commercial activity, information regarding the vessel such as type, size, and usage, specified coverage limits, and any special considerations that pertain to the operations. Each section must be filled out with precision.

Step-by-step guide to completing the form

Completing the charterers liability insurance form requires careful attention to detail. The guide below outlines the steps that need to be taken to ensure the form is filled out correctly and submitted without issues.

Step 1: Gather required information

Before accessing the form, compile all relevant documents. This may include your business registration, details about the vessel, and any previous insurance policies. Having these documents at hand will make filling out the form smoother.

Step 2: Access the charterers liability insurance form

You can retrieve the charterers liability insurance form directly from pdfFiller. Whether you prefer filling out forms online or downloading a PDF for offline use, pdfFiller provides accessible solutions tailored to your needs.

Step 3: Filling out the form

Carefully fill out each section according to the prompts. Ensure all entries are accurate and complete to avoid any delays in processing. When providing details, err on the side of transparency, as this will help prevent complications later on.

Step 4: Reviewing your information

After completing the form, review all inputted information carefully. This step is essential to avoid mistakes that could lead to delays or rejections. Create a checklist to ensure all sections are filled accurately before finalizing.

Step 5: Signing the form electronically

Once reviewed, you can sign the form electronically using pdfFiller’s user-friendly eSignature tool. This feature allows you to finalize documents quickly and securely, ensuring a valid signature is attached without the need for physical documentation.

Editing and customizing the form

pdfFiller offers robust tools to edit and customize your charterers liability insurance form. Users can easily tweak existing entries, add additional clauses, or insert notes as required. This flexibility is invaluable for businesses needing to tailor their insurance documents to specific circumstances.

Additionally, the collaboration features enable teams to work on the document together efficiently. This means multiple stakeholders can review, suggest edits, and approve the document within the same platform, streamlining the workflow and speeding up the process.

Submitting the charterers liability insurance form

Submitting your charterers liability insurance form is the final step in acquiring coverage. Depending on the insurer’s preference, you may submit the form online through a designated portal or in a physical format. Check with your insurance provider on the preferred submission method to avoid coverage gaps.

Timing is critical when submitting insurance forms. Ensure that any required documents accompany your submission, and schedule submissions well before any contractual deadlines to ensure you have adequate coverage before operations commence.

Managing your charterers liability insurance

Once your charterers liability insurance is in place, monitoring and managing the policy becomes crucial. Keep track of renewal dates and regularly review your policy to adapt to changing business needs. Changes in chartering activities may necessitate adjustments to coverage limits.

Consider scheduling periodic reviews (e.g., annually) to align your insurance with current operations. This proactive strategy helps ensure that you remain adequately protected against liabilities over time, avoiding gaps in coverage when chartering activities change.

Common questions about charterers liability insurance

For many, charterers liability insurance can be clouded with questions and misconceptions. Some frequently asked questions include:

These questions illuminate essential aspects of charterers liability insurance, allowing charterers to make informed decisions regarding their coverage needs.

Benefits of using pdfFiller for your insurance needs

pdfFiller is your all-in-one document solution for handling charterers liability insurance forms. The platform simplifies the creation, editing, signing, and management of insurance documentation, providing a seamless experience from start to finish.

Accessibility is a key feature, as pdfFiller can be accessed from any device, thereby empowering users to complete their insurance needs on the go. This level of convenience is crucial for busy professionals managing various tasks.

Collaboration features facilitate efficient teamwork, allowing multiple users to work on a document simultaneously and finalize it swiftly, ensuring everyone involved is kept in the loop and can contribute.

Real-life scenarios and use cases

Real-life scenarios demonstrate the importance of charterers liability insurance and its application. For instance, a shipping company may face damage claims due to accidents at sea. Having charterers liability insurance can help mitigate these financial risks, ensuring the business remains solvent and able to operate.

One user, a small logistics firm, noted how pdfFiller saved them time and ensured accuracy in their insurance documentation. Thanks to the collaborative features, their team could efficiently manage edits, leading to swift approvals and over 20% faster processing times on their forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete charterers liability insurance online?

How do I make changes in charterers liability insurance?

How do I make edits in charterers liability insurance without leaving Chrome?

What is charterers liability insurance?

Who is required to file charterers liability insurance?

How to fill out charterers liability insurance?

What is the purpose of charterers liability insurance?

What information must be reported on charterers liability insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.