Get the free Cdtfa-245-cor-1 Rev. 5 (2-25)

Get, Create, Make and Sign cdtfa-245-cor-1 rev 5 2-25

How to edit cdtfa-245-cor-1 rev 5 2-25 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cdtfa-245-cor-1 rev 5 2-25

How to fill out cdtfa-245-cor-1 rev 5 2-25

Who needs cdtfa-245-cor-1 rev 5 2-25?

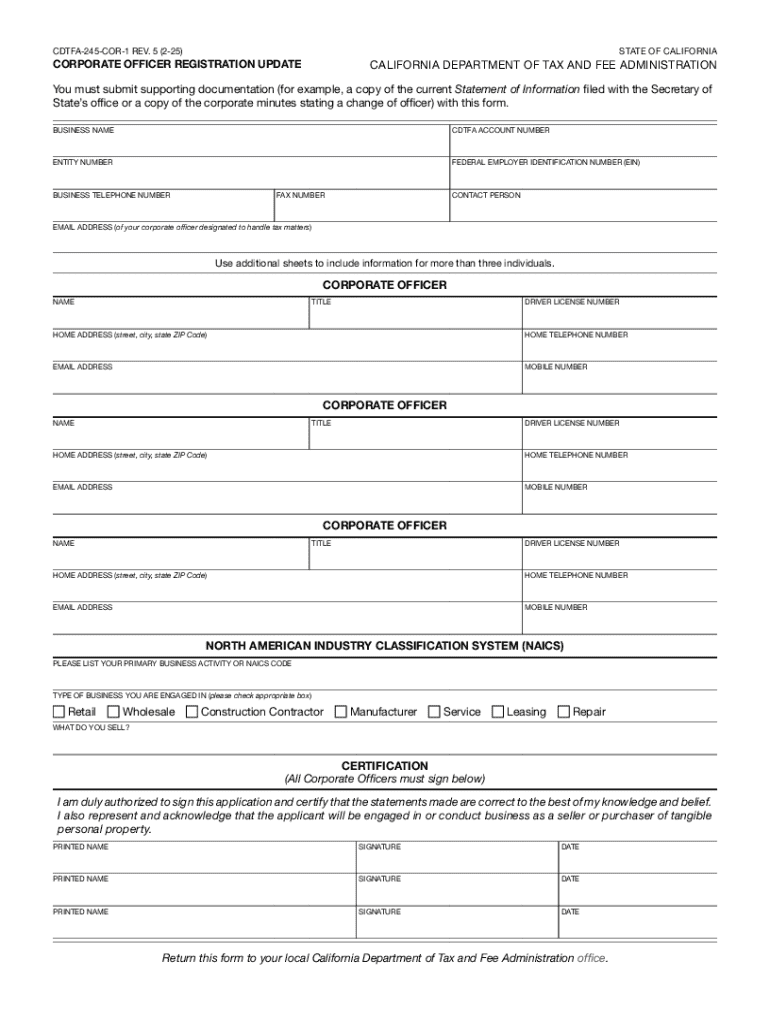

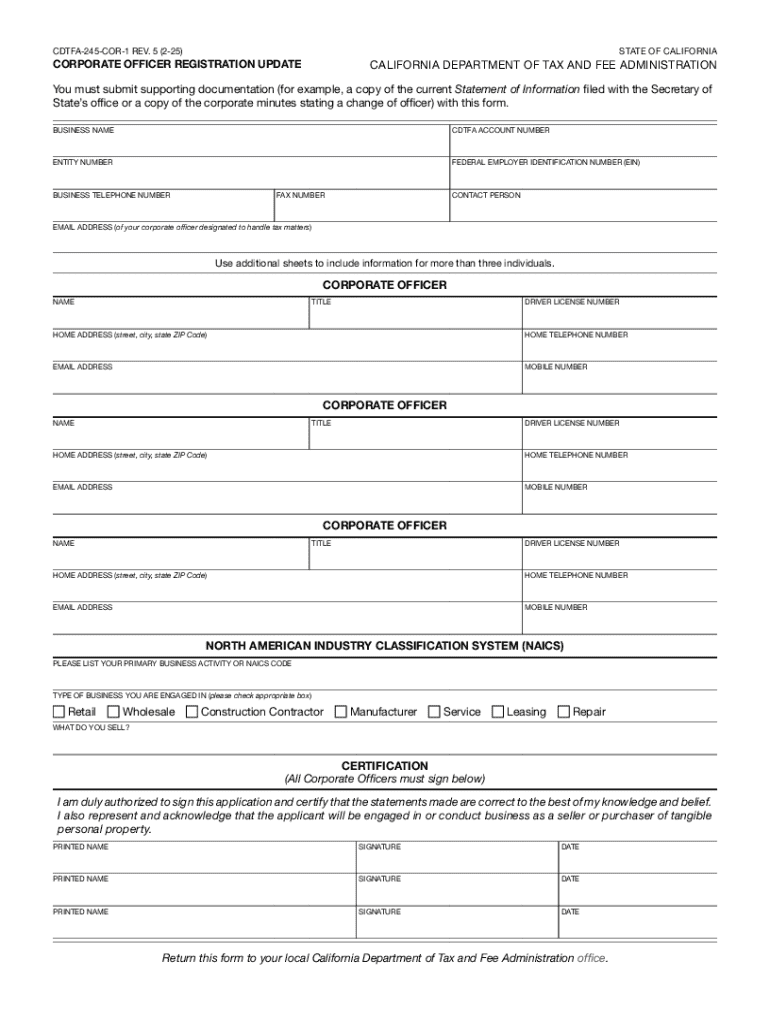

Comprehensive Guide to the CDTFA-245-COR-1 Rev 5 2-25 Form

Overview of the CDTFA-245-COR-1 Rev 5 2-25 Form

The CDTFA-245-COR-1 Rev 5 2-25 form plays a critical role in California’s tax compliance framework. This document is a crucial tool for businesses to report changes to their tax liabilities, ensuring accurate calculations are submitted to the California Department of Tax and Fee Administration (CDTFA).

Understanding the importance of this form helps individuals and businesses avoid costly penalties and ensure they remain in good standing with California tax regulations.

Navigating the pdfFiller platform

pdfFiller is a robust cloud-based document management solution that simplifies the creation, editing, and management of various forms, including the CDTFA-245-COR-1. By leveraging pdfFiller's tools, users can easily navigate through the complexities of tax forms.

Utilizing pdfFiller for completing the CDTFA-245-COR-1 form offers remarkable advantages, making the process more efficient and user-friendly. With an intuitive interface, users can quickly access and fill out the necessary fields.

Detailed insights into the CDTFA-245-COR-1 form

Diving deeper into the CDTFA-245-COR-1 form, it’s structured into several key sections that capture essential information required by the CDTFA. Understanding each element of the form is vital for accurate submission.

Each section has specific data requirements that must be meticulously filled out to ensure compliance. Failing to do so can lead to rejections or delays.

Step-by-step guide to completing the CDTFA-245-COR-1 form

Completing the CDTFA-245-COR-1 form requires careful preparation and attention to detail. Before starting, gather all necessary documentation, including previous tax returns and current financial records. Understanding each section will streamline the completion process.

The form entails specific sections, and proper guidance will ensure each is filled out accurately.

Once completed, a final review and verification are critical. Ensure all figures and information are correct and match your prior filings.

Interactive tools and features on pdfFiller

pdfFiller incorporates numerous interactive tools that enhance the experience of working with the CDTFA-245-COR-1 form. Collaboration becomes effortless as team members can communicate directly within the document.

Real-time interactions allow for immediate feedback and modifications, streamlining the overall process.

Editing and managing your CDTFA-245-COR-1 form

As you work on the CDTFA-245-COR-1 form, pdfFiller allows you to edit and manage your document effectively. Modifications can be made easily, ensuring your form remains accurate.

With pdfFiller, users can save and share their progress seamlessly, giving flexibility in document handling.

Troubleshooting common issues

While using the CDTFA-245-COR-1 form, users may encounter several common issues. Being aware of these challenges can help in resolving them swiftly.

The comprehensive support resources from pdfFiller provide solutions and guidance for common problems.

Additional considerations

Managing sensitive documentation like the CDTFA-245-COR-1 form requires awareness of safety and security protocols. pdfFiller adheres to stringent compliance standards, ensuring users’ data is protected throughout the process.

Understanding legal standards for electronic forms is essential as more businesses adopt digital solutions.

Future updates and revisions to the CDTFA-245-COR-1 form

Keeping informed about updates to the CDTFA-245-COR-1 form is crucial for tax compliance. Regulatory changes can affect how businesses should report their taxes.

Employing services like pdfFiller ensures that users have access to the latest versions of forms, minimizing the risk of submitting outdated information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete cdtfa-245-cor-1 rev 5 2-25 online?

Can I create an eSignature for the cdtfa-245-cor-1 rev 5 2-25 in Gmail?

How do I edit cdtfa-245-cor-1 rev 5 2-25 on an Android device?

What is cdtfa-245-cor-1 rev 5 2-25?

Who is required to file cdtfa-245-cor-1 rev 5 2-25?

How to fill out cdtfa-245-cor-1 rev 5 2-25?

What is the purpose of cdtfa-245-cor-1 rev 5 2-25?

What information must be reported on cdtfa-245-cor-1 rev 5 2-25?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.