Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Credit Card Authorization Form - How-to Guide Long-Read

Understanding credit card authorization forms

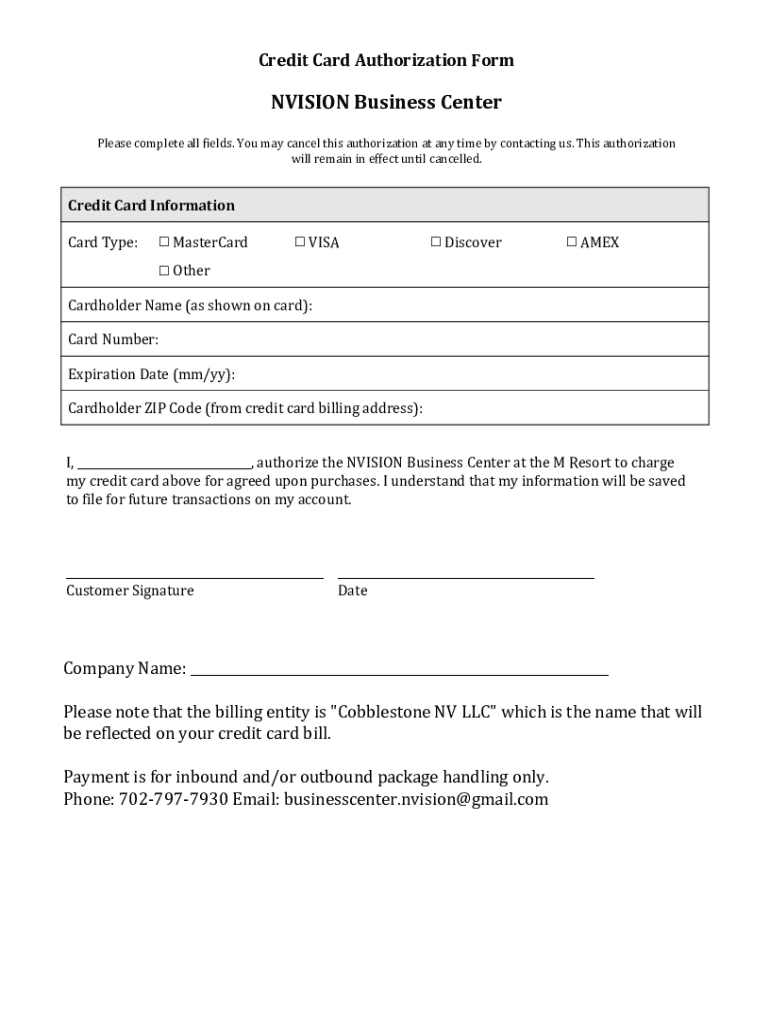

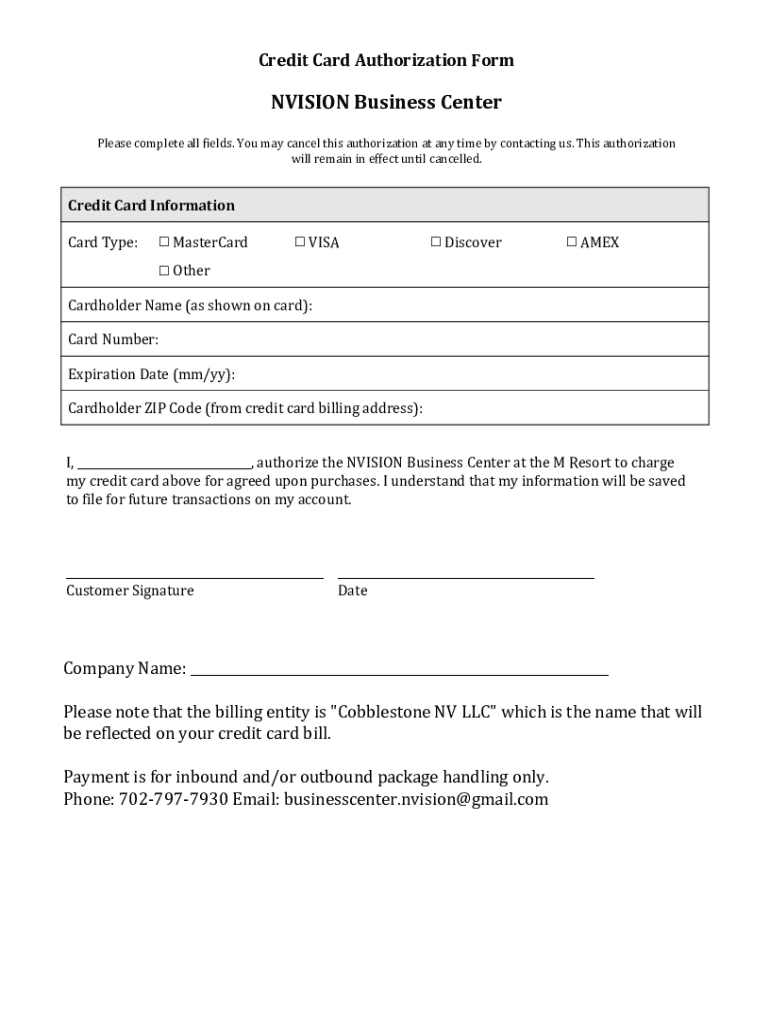

A credit card authorization form serves as a vital document that allows businesses to obtain explicit permission from a customer to charge their credit card for goods or services. This form not only acts as a contract but also provides a safeguard against chargebacks, ensuring that the payment method utilized is authorized.

Utilizing a credit card authorization form is essential for any transaction requiring a payment in advance. It establishes trust between the customer and the business, clarifying the terms of the transaction and minimizing disputes. With the rise of online transactions, using this form has become even more critical in protecting both parties involved.

Getting started with credit card authorization forms

Identifying when to use a credit card authorization form is crucial for ensuring smooth transactions. These forms are especially beneficial for scenarios where a business needs to charge a client for services that may take place over a period, such as event planning, service contracts, or for hotel and rental reservations.

Businesses should also consider issuing a credit card authorization form during any significant transaction such as a purchase of equipment or when monthly billing occurs. It gives both the customer and the provider peace of mind that payment is secured and authorized.

Key components of an effective credit card authorization form include the following:

Creating your credit card authorization form

Filling out a credit card authorization form accurately is essential for ensuring the process goes smoothly. Start with verifying that all client information is correctly entered. The credit card number should be typed in without spaces or unnecessary characters to avoid confusion during processing.

Next, you need to complete the credit card details section, ensuring no digits are omitted, and safeguard the CVV number to maintain security. Follow up with obtaining the client’s signature, confirming that they understand and agree to the terms laid out in the form.

Customizing your form is also important to reflect your business needs. You might want to include additional clauses pertinent to your transaction type or a privacy policy statement. pdfFiller provides editable templates that simplify this process, allowing you to create a personalized form tailored to your specific requirements.

With pdfFiller’s tools, users can access templates, utilize digital signing features, and collaborate effectively on documents. These capabilities streamline the creation and modification of credit card authorization forms, tailored to different use cases.

Managing and storing credit card authorization forms

Once you've obtained completed credit card authorization forms, ensuring their safe storage is crucial. It’s important to adopt best practices that prioritize security, such as encrypting digital copies and securing physical forms in locked file cabinets.

Consider the legal requirements surrounding the retention of these forms. Many jurisdictions recommend keeping these records for a specific period—commonly between three to seven years. Regular audits on your stored forms for compliance with this timeframe help prevent unnecessary legal issues.

Furthermore, having an efficient retrieval system ensures that you can access these forms when needed. Digitally stored forms can be cataloged with searchable tags to expedite finding them during disputes or audits.

Legal considerations and compliance

Many businesses wonder if they are legally obligated to use credit card authorization forms. This largely depends on the jurisdiction and the nature of the transaction. While not always mandated, using these forms is highly recommended as a best practice to safeguard against potential legal disputes.

In addition to understanding the legal requirements, businesses must also ensure compliance with relevant payment processing regulations such as PCI-DSS. These regulations outline data security standards that protect cardholder data and are crucial for any business handling sensitive payment information.

Advanced topics related to credit card authorizations

A significant consideration for businesses is understanding what 'card on file' means. Keeping a card on file allows businesses to process future transactions quickly without requiring the customer to resubmit their card details. However, this also increases the responsibility to safeguard personal data diligently.

Many common questions arise around credit card authorization forms, such as their necessity or best practices for use. Addressing these FAQs helps demystify their role in transactions and reinforces the importance of their proper handling, which can significantly reduce chargebacks alongside robust authorization forms.

Lastly, integrating additional strategies to minimize chargebacks will further fortify your business against loss. Using clear transaction descriptions and ensuring premium customer service can also go a long way in reducing misunderstandings that lead to chargeback disputes.

Resources and templates

Accessing downloadable credit card authorization form templates is convenient with pdfFiller. Users can find an extensive library of ready-to-use forms that can be customized to suit their specific business needs.

Seeing examples of completed authorization forms can also be incredibly helpful. These visual aids not only clarify how to fill out the form correctly but also prevent any potential errors that could lead to disputes.

Related tools and solutions

For businesses looking to streamline their payment processing, selecting the right payment gateway is key. Various systems offer different features that can harmonize with credit card authorization processes. Some may simplify recurring billing, while others provide robust fraud protection tools.

Additionally, integrating QR codes for faster transactions in conjunction with credit card authorizations can enhance the customer experience. QR codes allow for efficient, contactless payment methods that are gaining popularity in today’s market.

Stay informed

Subscribing to relevant newsletters offers insights into the latest document management trends. Staying informed about changes and innovations in the world of credit card processing can improve your business operations significantly.

Joining online communities dedicated to payment processing and document management encourages knowledge sharing. Engaging with peers can also provide valuable support and strategies that can assist in optimizing your use of credit card authorization forms and related processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete credit card authorization form online?

How do I make edits in credit card authorization form without leaving Chrome?

How do I edit credit card authorization form on an iOS device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.