Get the free Credit Card Application

Get, Create, Make and Sign credit card application

How to edit credit card application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card application

How to fill out credit card application

Who needs credit card application?

Your Guide to the Credit Card Application Form

Understanding credit card applications

The credit card application process is a crucial step in managing your finances effectively. It determines not only your eligibility for a card but also affects your credit score and spending habits. Applying for a credit card allows you to establish credit history, making future borrowing and financing more accessible. Understanding the various types of credit cards available is essential as they come with different benefits and drawbacks that cater to diverse financial needs.

Eligibility criteria for credit card applications vary by issuer but generally include specific age requirements, income levels, and credit score benchmarks. Most issuers require applicants to be at least 18 years old. Moreover, they typically evaluate your income to determine if you can manage monthly payments, often with minimum thresholds set to ensure that clients can uphold their financial commitments.

Preparing your credit card application form

Before completing your credit card application form, it's essential to gather the necessary documentation. This preparation not only speeds up the process but also ensures accuracy, which is vital for your application’s success.

Understanding credit card terms and conditions is equally important. Familiarity with interest rates (APR), potential fees associated with the card, and credit limits can affect your choice. For instance, knowing whether a card has an annual fee or what the penalty interest rates may be can save you from unexpected charges.

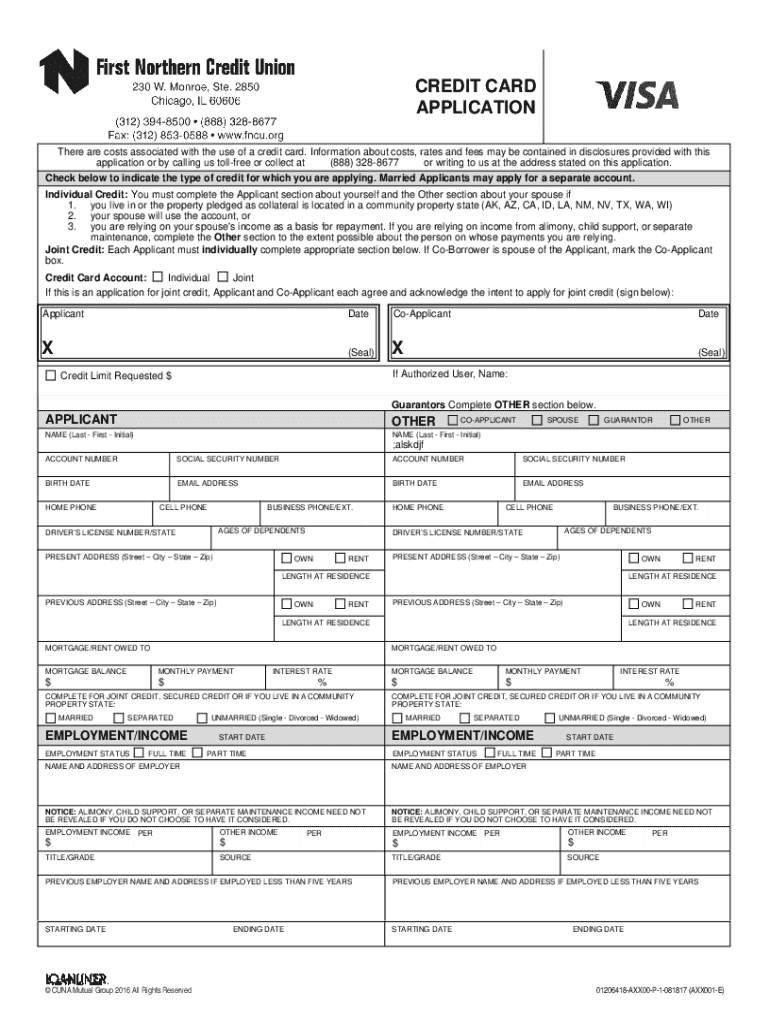

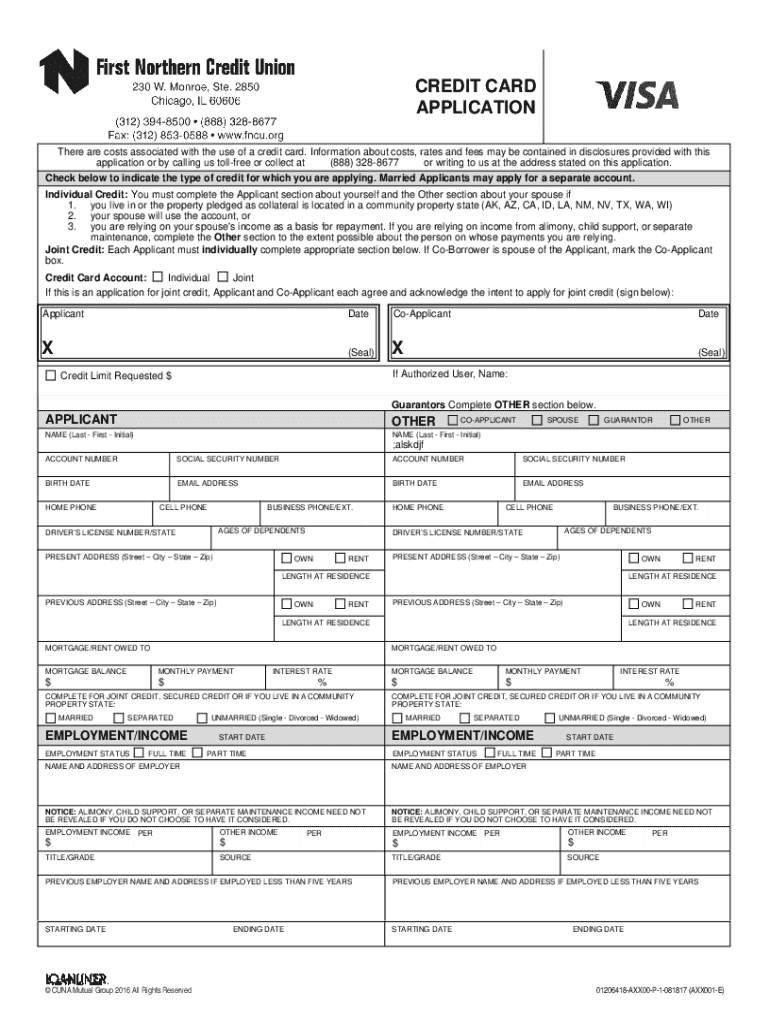

Step-by-step guide to filling out the credit card application form

Filling out a credit card application form may seem daunting, but it becomes manageable when broken down into steps. Start by accessing the application form, which can usually be completed online or offline.

Tips for a successful credit card application

To enhance your chances of a successful credit card application, avoid common mistakes that applicants often make. One critical error is submitting inaccurate information, which can lead to delays or denials. Before submitting, double-check all entries for errors.

Utilizing pdfFiller’s editing and collaboration tools can streamline your form-filling experience. The platform allows you to edit PDFs seamlessly, collaborate with family members or financial advisors for input, and ensure everything is accurate before submission.

Interactive tools for your credit card journey

pdfFiller offers various interactive tools that aid in making informed decisions about your credit card application. A credit card comparison tool can showcase various features across cards, helping you select one that aligns with your financial goals.

Navigating potential challenges

The journey towards credit card approval is not without its challenges, and understanding how to address potential obstacles is vital. If your application is denied, it's essential to carefully review the denial letter. This document will typically outline the reasons for rejection, allowing you to address specific issues before trying again.

In case of issues with form submission, such as technical difficulties, having a plan can alleviate stress. pdfFiller offers technical troubleshooting tips, and customer support can provide assistance if needed.

Your credit card approval journey

Understanding the approval process can help you stay informed and prepared. Typically, you can expect to receive feedback within a few minutes to a couple of days after your application submission, depending on the issuer. As they review your information, you may have questions come up regarding your creditworthiness and how lenders assess risk.

Once you receive your new card, the next steps typically involve activation and online account management. Setting up your account online allows for easy monitoring of your spending and timely payments, which are crucial for maintaining a healthy credit score.

Real-life experiences: customer journeys

Learning from others' experiences can be incredibly valuable when navigating the credit card application process. Many individuals share their success stories, detailing how they overcame initial setbacks and eventually secured the cards that best fit their financial needs. These insights can illuminate effective strategies, making the process feel less intimidating.

Next steps: making the most of your new credit card

Once your new credit card arrives, use it responsibly to get the most out of it. Effective credit management techniques can enhance your financial footing while preventing potential pitfalls such as accruing debt. It's advisable to track your spending and maintain low balances relative to your credit limit, as this is critical not just for managing payments but also for fortifying your credit score.

Final thoughts: your credit empowerment

Utilizing tools like pdfFiller throughout your credit journey can greatly enhance your experience. With a cloud-based platform designed for seamless document management, you can fill out, edit, and eSign your credit card application form anywhere. This flexibility empowers you to ensure you have the necessary documents in order and are applying with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit card application from Google Drive?

How do I complete credit card application online?

How can I fill out credit card application on an iOS device?

What is credit card application?

Who is required to file credit card application?

How to fill out credit card application?

What is the purpose of credit card application?

What information must be reported on credit card application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.