Get the free Form Adv

Get, Create, Make and Sign form adv

Editing form adv online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form adv

How to fill out form adv

Who needs form adv?

Understanding Form ADV: A Comprehensive Guide

Understanding Form ADV: A comprehensive overview

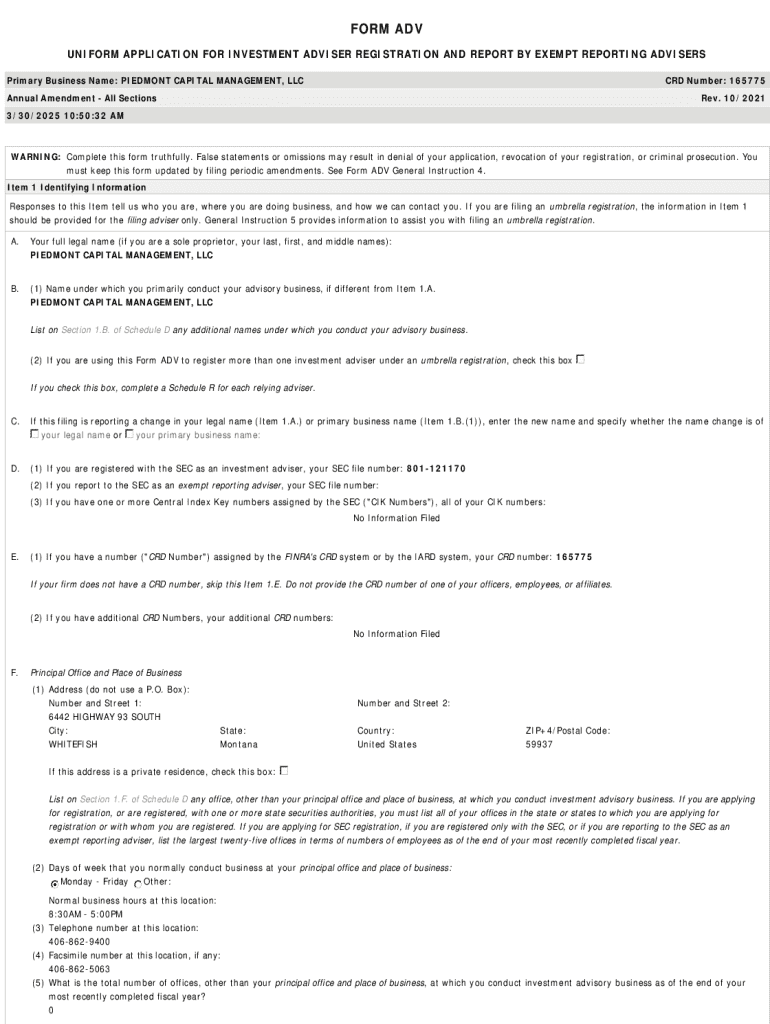

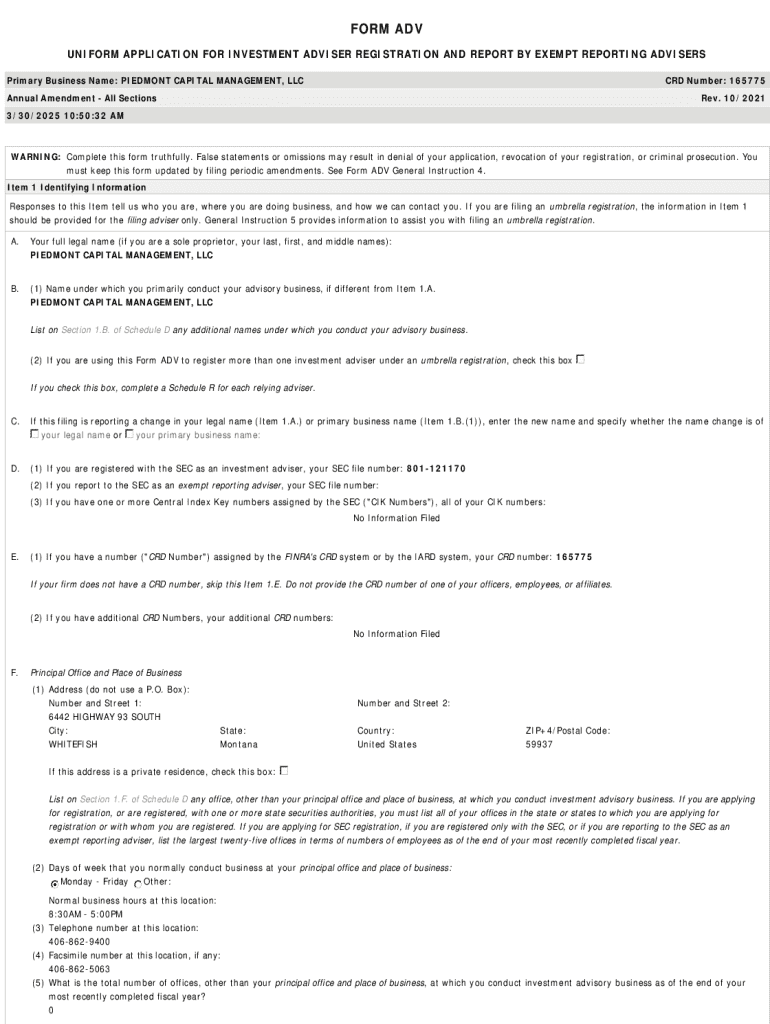

Form ADV is a crucial document that investment advisors in the United States must file with the Securities and Exchange Commission (SEC) and state regulators. It serves as a comprehensive disclosure form that provides investors with essential information about the advisory firm, its services, and its compliance history.

Form ADV is significant for investors as it allows them to make informed decisions. Investors can identify potential firms’ backgrounds, fee structures, and areas of expertise. It ensures transparency, enabling potential clients to assess whether an advisor aligns with their financial goals and investment strategies.

The structure of Form ADV

Form ADV is divided into two main parts, each serving a specific purpose. Part I includes general information about the advisory firm while Part II, often referred to as the Firm's Brochure, contains detailed information about services offered and a clear disclosure of fees.

Part : General information about the firm

Part I of Form ADV requires investment advisors to disclose crucial business information, including their ownership structure, the types of clients they serve, and their disciplinary history. Every registered investment advisory firm must file Part I as part of their ongoing compliance requirements.

Who must file Form ADV Part

All investment advisors who manage assets or provide investment advice for a fee are required to file Form ADV Part I. This ensures the SEC and relevant state authorities have a clearer picture of the advisory landscape.

Part : The firm's brochure

Part II, or the firm’s brochure, is a detailed document that outlines the advisory services offered by the firm, the fees charged for these services, and any conflicts of interest the firm may have. This document is particularly designed to be user-friendly and understandable for clients.

Accessing and interpreting Form ADV

Investors can easily access a firm’s Form ADV online through the SEC's EDGAR system or the Investment Adviser Public Disclosure (IAPD) website. These platforms provide a user-friendly interface for locating and comparing different investment advisors.

Requesting via email or physical mail

If online resources are inadequate, investors can request a firm’s Form ADV directly via email or physical mail. Firms are mandated to provide these documents upon request, ensuring that transparency is maintained.

Interpreting the data

Understanding Form ADV requires familiarity with specific terminology and the context behind the data presented. It’s essential to question discrepancies between what a firm claims in their marketing materials and what is reported in their Form ADV.

Key highlights of Form ADV to review

Several critical elements in Form ADV can significantly influence investment decisions. Reviewing the performance history of the advisor helps set realistic expectations for investment outcomes. Fees and commissions outlined in Form ADV can impact net returns, so understanding these costs is essential.

Managing conflicts of interest

Form ADV also sheds light on potential conflicts of interest that a firm may have. Transparency in this area is crucial, as conflicts can lead to biased recommendations, which could adversely affect investment performance.

Tips for analyzing Form ADV effectively

When analyzing Form ADV, it is helpful to create a checklist of key items to review. Focus on critical sections of both Part I and Part II, including ownership history, experience, and fee structures. Engaging your instinct about red flags can make a significant difference in your advisor selection process.

Real-world applications of Form ADV data

Utilizing Form ADV data can have real-world implications for investors. There are numerous case studies illustrating instances where investors avoided costly mistakes by scrutinizing Form ADV disclosures.

Interviews with financial advisors on importance of transparency

Insights from financial advisors reflect the critical nature of transparency that Form ADV enforces. Advisors appreciate that it brings accountability and establishes trust between them and their clients.

How Form ADV helps in choosing a financial advisor

Form ADV is an essential tool when it comes to due diligence in advisor selection. Investors can compare multiple advisories using information from Form ADV side-by-side, which assists in choosing the advisor who best meets their needs.

Creating a balanced portfolio based on Form ADV insights

By understanding the insights from Form ADV, investors can make informed decisions when creating a balanced portfolio, tapping into the strengths highlighted in each advisor’s disclosures.

Frequently asked questions about Form ADV

Understanding frequent inquiries surrounding Form ADV can enhance the knowledge of both investors and advisors. Common questions often revolve around regulatory compliance, filing frequency, and the limitations of disclosures.

Additional tips for financial planning

Incorporating Form ADV into your financial research strategy enhances decision-making. By making an effort to regularly review Form ADV disclosures and update your knowledge on advisors, you invest in the long-term health of your portfolio.

Long-term benefits of regularly reviewing Form ADV

Long-term engagement with Form ADV fosters a culture of informed investing, promoting safer choice of advisors and sustainable investment growth. Staying updated on disclosures creates better alignment of financial goals between the advisor and client.

Interactive tools for Form ADV users

Using tools available on pdfFiller allows for a more comprehensive experience dealing with Form ADV. With robust document creation solutions, financial advisors can provide prospective clients with easily editable and accurate Form ADV documents.

pdfFiller’s document creation solutions for financial advisors

pdfFiller's cloud-based platform enables users to manage documents seamlessly. Advisors can create, edit, sign, and collaborate on Form ADV forms, benefiting from an efficient workflow.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form adv without leaving Google Drive?

Where do I find form adv?

Can I create an eSignature for the form adv in Gmail?

What is form adv?

Who is required to file form adv?

How to fill out form adv?

What is the purpose of form adv?

What information must be reported on form adv?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.