Get the free Case 21-19750

Get, Create, Make and Sign case 21-19750

How to edit case 21-19750 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out case 21-19750

How to fill out case 21-19750

Who needs case 21-19750?

Comprehensive Guide to the Case 21-19750 Form

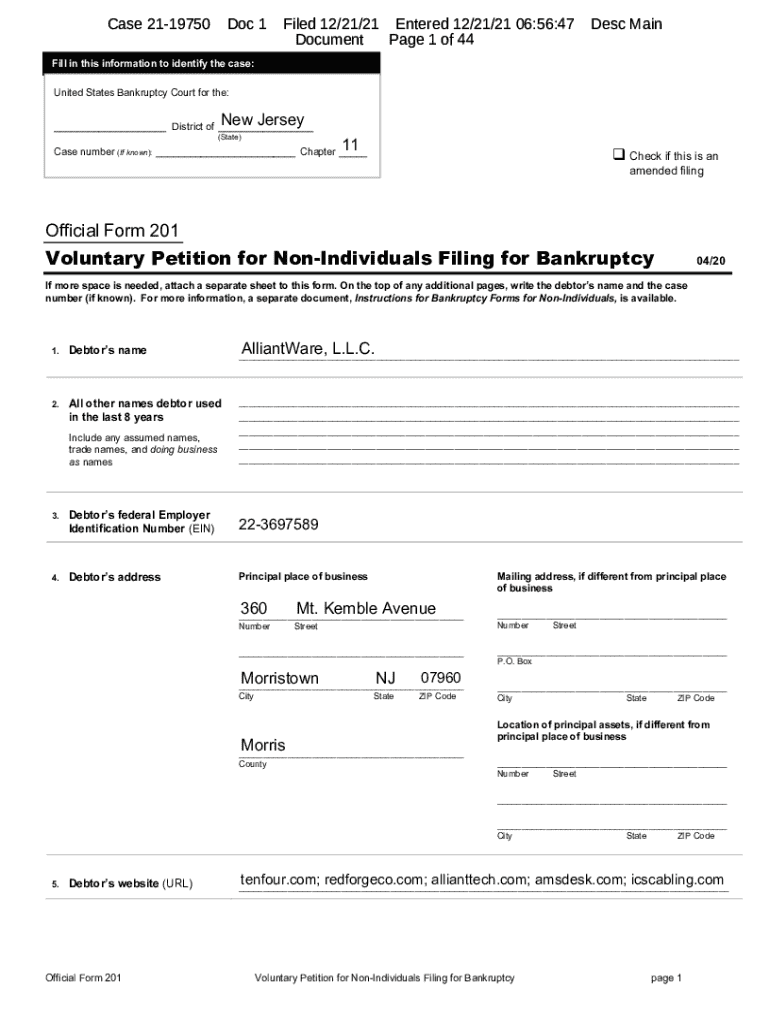

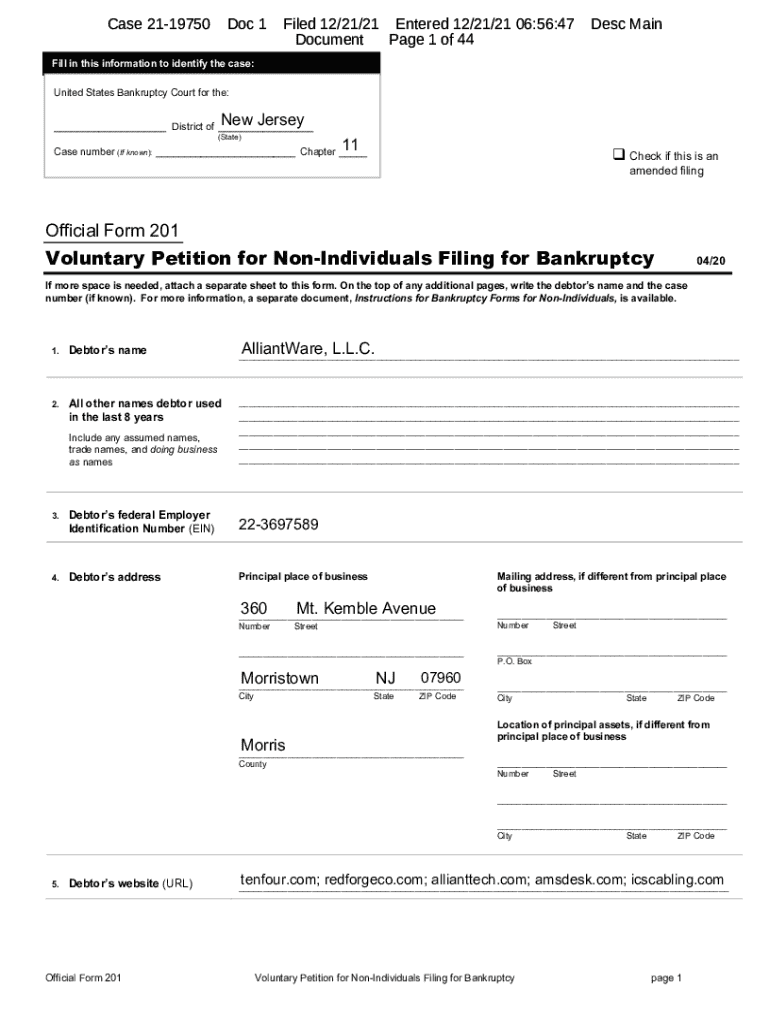

Understanding Case 21-19750

The Case 21-19750 form is a crucial document in certain legal and administrative processes. It serves as a formal application related to debt and financial obligations, primarily in bankruptcy scenarios. This form is vital for both individuals and businesses seeking the closure or restructuring of their financial commitments under the supervision of the court. By accurately filled out, this form ensures that claims are acknowledged and processed effectively, significantly affecting the outcomes for the parties involved.

The importance of filing the Case 21-19750 form cannot be overstated. Failure to complete the form accurately can lead to delays in processing, denial of claims, or even legal repercussions. Understanding the nuances and requirements of this form is essential, as it lays the groundwork for subsequent steps in the bankruptcy proceedings. Thus, individuals and teams must familiarize themselves with every aspect of this form to navigate the complexities of financial relief adeptly.

Key components of the Case 21-19750 form

The Case 21-19750 form comprises several sections, each designed to capture crucial information relevant to the case at hand. Understanding these components is vital for effective and accurate submissions. The form usually includes sections such as debtor identification, details of claims, and specific circumstances surrounding the financial obligations.

Essential fields include the debtor's name, address, and identification number, which help verify the identity of the applicant. Additionally, a detailed description of the financial claim, including amounts owed and relevant supporting documentation, is required. Understanding what each section entails will ensure completeness and reduce the risk of errors or omissions, which could adversely affect the outcome of the case.

Major dates related to Case 21-19750

Filing deadlines are critical to the Case 21-19750 form process. It's imperative to be aware of the statutory timeframes during which the form must be submitted following a bankruptcy petition. Missing these deadlines can have severe consequences, including the rejection of your claims or potential legal actions from creditors.

Awareness of these dates can help applicants strategize better and ensure timely submission, laying a strong foundation for their cases.

Filling out the Case 21-19750 form

Completing the Case 21-19750 form requires careful attention to detail. Here’s a step-by-step guide to help you navigate the filling out of the form.

Common pitfalls often include inaccurate debtor information or missing signatures. Double-checking each section and ensuring all required fields are filled can prevent delays in the processing of your claims.

Submitting the Case 21-19750 form

Once the Case 21-19750 form is completed, the next step is submission. Knowing where and how to submit the form is vital to its acceptance and processing. Generally, this form should be submitted to the court handling the bankruptcy case.

If electronic submission is an option, familiarize yourself with guidelines specific to your jurisdiction. This could include preferred formats, acceptable file types, and any accompanying certifications that may be necessary. Ensure that all required signatures — whether from the debtor or additional witnesses — are included to avoid rejection of the form.

Post-submission: What to expect

Upon submitting the Case 21-19750 form, you should expect a confirmation of receipt. This often serves as a vital record of your submission time and acknowledgment by the court of your claims.

Processing times can vary based on court schedules and volumes; therefore, keeping track of your submission dates is crucial. Following submission, be prepared for additional steps, which may include responding to queries from the court or creditors.

What to do if issues arise

Errors in the Case 21-19750 form can complicate proceedings, but remedies exist. Common issues include incorrect information or missing attachments. If such errors occur, immediate correction is vital. Contact the court or your legal advisor for specifics on how to amend your submission.

For persistent issues or inquiries, knowing who to contact for assistance can also expedite resolution. Keeping a record of communications can provide clarity and aid in addressing concerns.

Frequently asked questions (FAQs)

Using pdfFiller for Case 21-19750

pdfFiller provides a comprehensive suite of tools to aid in editing, signing, and managing the Case 21-19750 form. With seamless editing features, users can quickly make changes, add text, or attach files directly to their documents without hassle.

Collaboration tools support teams in working together, ensuring that all necessary information is present before submission. Moreover, the cloud-based nature of pdfFiller ensures that documents can be accessed from anywhere, offering flexibility and convenience. Users can also troubleshoot through pdfFiller's robust support resources if any questions arise.

Personalizing your document experience

Customization is key to having a streamlined experience with the Case 21-19750 form. pdfFiller allows users to tailor their forms according to individual needs, providing templates and interactive tools that enhance usability.

Using pdfFiller’s advanced features not only improves productivity but also ensures that each document is personalized to reflect the specific requirements of the case being addressed, allowing for a more efficient workflow.

Legal considerations and compliance

When filling out the Case 21-19750 form, understanding the legal implications is essential. Accurate and honest submissions are crucial not only for compliance but also for protecting oneself against potential charges of fraud or misrepresentation.

Filing incorrect information can lead to significant penalties, so applying due diligence in preparing your submissions ensures that you safeguard your rights while effectively pursuing your claims.

Final checklist before submission

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my case 21-19750 in Gmail?

Where do I find case 21-19750?

How do I edit case 21-19750 online?

What is case 21-19750?

Who is required to file case 21-19750?

How to fill out case 21-19750?

What is the purpose of case 21-19750?

What information must be reported on case 21-19750?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.