Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Credit Card Authorization Form - How-to Guide Long Read

Understanding credit card authorization forms

A credit card authorization form is a crucial document that businesses use to obtain the necessary permissions from cardholders. This form allows sellers to charge a specific amount to a customer's credit card while also protecting both parties from potential disputes. By acquiring this written authorization, merchants can significantly reduce the risk of chargebacks, which occur when a customer disputes a transaction and seeks a refund through their bank.

Chargebacks not only incur financial losses for businesses but can also lead to reputational damage and higher processing fees. Thus, a well-constructed credit card authorization form serves as a safeguard. Merchants are encouraged to use these forms whenever they process credit card transactions, especially in situations lacking direct customer interaction, such as e-commerce.

Do credit card authorization forms help prevent chargeback abuse?

Chargeback abuse occurs when customers falsely claim they did not authorize a transaction to receive their money back. This practice can severely impact a merchant's bottom line. By utilizing credit card authorization forms, sellers can effectively mitigate some risks associated with chargeback abuse. These forms provide documented proof that a customer has authorized a transaction, thereby defending against fraudulent claims.

Moreover, well-maintained records of authorization forms can reinforce a merchant's case when disputing illegitimate chargebacks with credit card companies. This added layer of accountability serves to deter potential abusers while simultaneously enhancing transaction legitimacy in the eyes of banks.

Essential components of a credit card authorization form

A comprehensive credit card authorization form must include specific fields to capture essential customer and transaction details. These generally encompass the cardholder's name, billing address, credit card number, expiration date, and the transaction amount to be charged. Optionally, sellers may want to include a statement confirming that they have received and agreed to the terms outlined in the document.

Ensuring compliance with security standards, such as the Payment Card Industry Data Security Standard (PCI DSS), is vital during this process. A reputable business should avoid storing sensitive information like the CVV code too, as it can pose significant security risks.

Why doesn’t this credit card authorization form have a space for ?

The CVV, or Card Verification Value, is a security feature that helps prevent unauthorized transactions. However, most credit card authorization forms do not include a field for the CVV. This omission is intentional due to PCI DSS regulations, which stipulate that merchants should not store CVV data. If compromised, CVV data can create a security loophole, leading to fraudulent activities. Therefore, not including this field helps in adhering to these compliance requirements.

It’s essential for businesses to perform thorough due diligence regarding customer data storage. Always prioritize protecting customer information, even in forms of authorization. Establishing a robust data handling process ensures adherence to regulations while fostering trust with customers.

Practical guidance on using credit card authorization forms

Understanding when to use a credit card authorization form is paramount for sellers. These forms are especially critical in scenarios such as over-the-phone transactions, online sales where physical product delivery is involved, or for retaining a customer's card information for subscription services. Using authorization forms in these instances can ensure a merchant has documented consent from the customer, reducing the likelihood of subsequent chargebacks.

The benefits are multifaceted. Not only do these forms protect against chargebacks, but they also increase professional credibility. When customers see that a business takes payment security seriously, it builds trust and encourages repeat transactions. Merchants should incorporate authorization forms as a standard part of their transaction process whenever appropriate.

How should store signed forms and for how long?

Storing signed credit card authorization forms requires a strategic approach to maintain compliance and optimize document management. The first step is to choose a secure storage method, ensuring that access is restricted to authorized personnel only. Digital storage solutions are often favored due to ease of access and organization, as well as the ability to back up important documents.

In terms of duration, it's generally prudent to retain authorization forms for a minimum of four to five years unless otherwise mandated by specific industry regulations or contract agreements. This ensures that businesses have sufficient documentation to address any disputes or audits that may arise.

Leveraging technology for document management

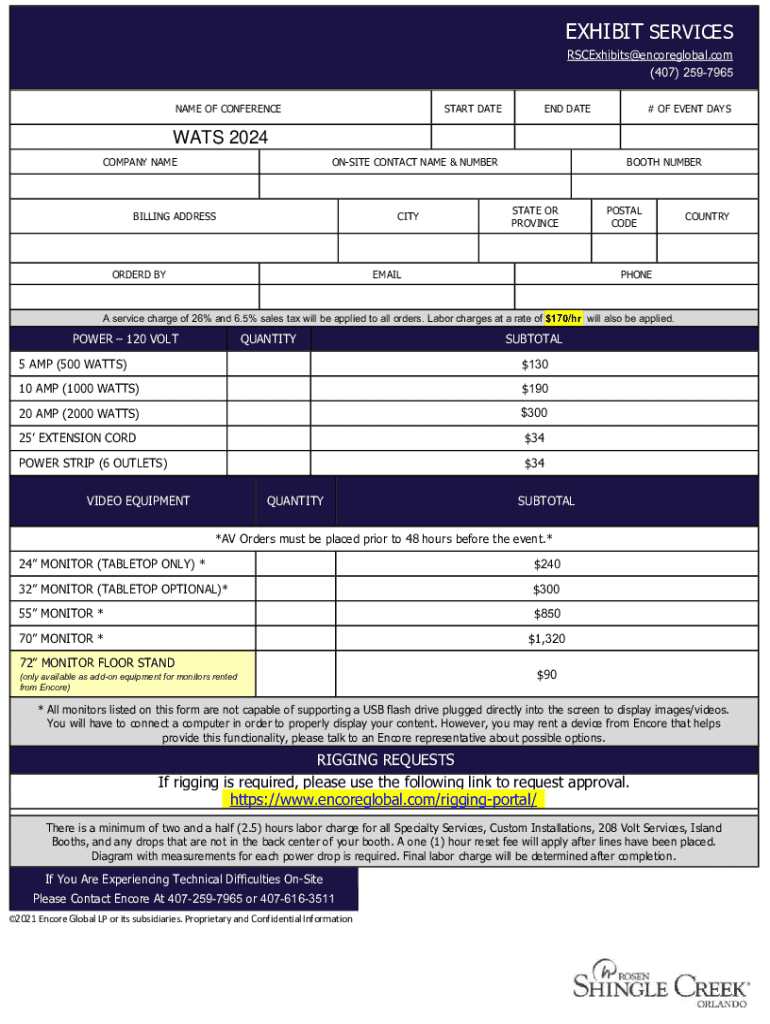

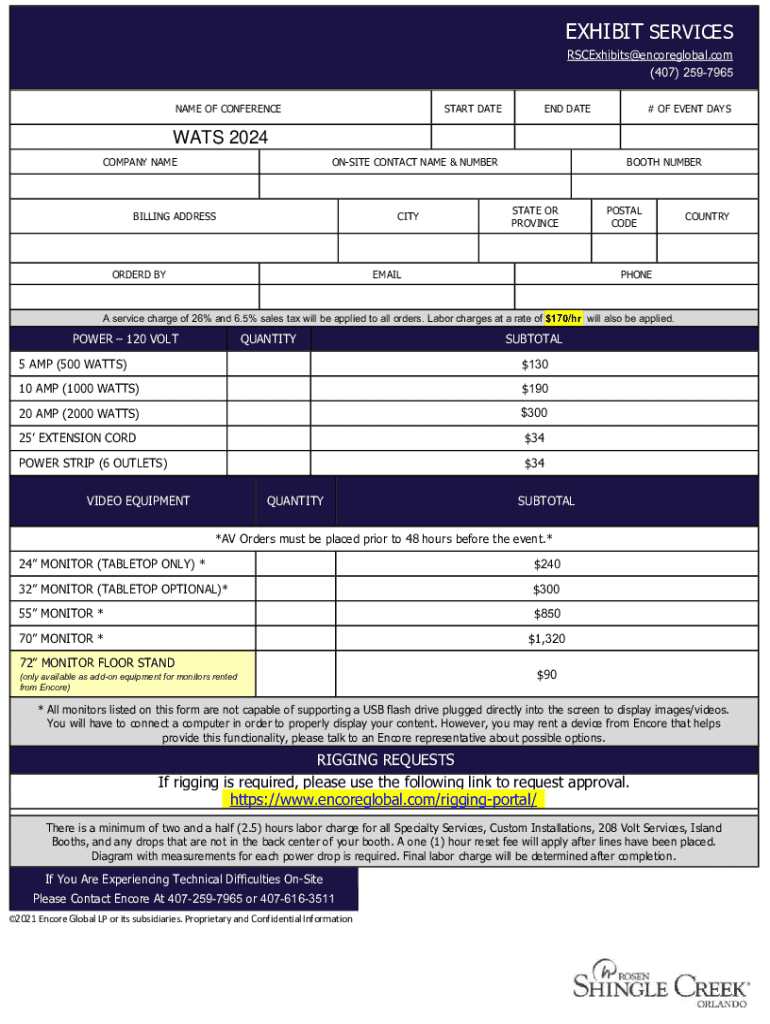

Document management has become significantly more efficient with modern technology, notably tools like pdfFiller. Editing a credit card authorization form digitally can enhance accuracy and professionalism. To edit a credit card authorization form on pdfFiller, users can easily upload their existing document or start from a template. The user-friendly interface allows for seamless form modification where one can add fields, adjust text, or include specific information as needed.

Once the authorization form is ready, pdfFiller provides options for secure electronic signatures. This feature empowers businesses to simplify the signing process while maintaining the legality and enforceability of the document. Signing electronically is not only convenient but also ensures every version is traceable and secure.

Collaborative features of pdfFiller

Collaboration among teams can significantly streamline the process of managing credit card authorization forms. Using platforms like pdfFiller, multiple users can work on a single document, making real-time edits and comments. This collaborative approach minimizes the risk of errors and ensures that everyone involved has the most updated information at their fingertips.

Additionally, pdfFiller provides workflow management features that can help assign tasks, set deadlines, and track the document’s journey from creation to completion. This not only enhances productivity but also ensures that all necessary approvals are obtained before finalizing the authorization process.

FAQs about credit card authorization forms

Understanding the legal landscape regarding credit card authorization forms is vital for merchants. Legally, while it’s not mandated for every transaction, many industries recognize the importance of using authorization forms to safeguard against chargebacks. Regulations vary depending on the country and the type of transactions undertaken, so it’s essential to be well-versed in legal obligations applicable to your business.

Moreover, businesses should also be aware of the concept of 'card on file,' which facilitates the storing of customer credit card information for recurring payments or quick checkouts. While this practice offers convenience for both businesses and customers, it also carries risks, such as potential unauthorized transactions if the data is not adequately protected.

Interactive tools at pdfFiller

To empower users in creating customized credit card authorization forms, pdfFiller offers interactive tools that simplify the form creation process. Users merely need to select the type of form they require, and the platform guides them through adding fields and customizing layout options to suit their brand or business needs.

This user-friendly interface ensures that even those with minimal technical expertise can create professional-looking forms. Additionally, once completed, the forms can easily be saved digitally and shared for processing. It eliminates all the friction traditionally associated with form gathering in physical establishments.

Best practices for financial transactions

Accepting credit card payments requires adopting best practices that ensure customer satisfaction and security. Merchants should explore various payment processing options, including online payment gateways, mobile payment applications, and point-of-sale systems that facilitate credit card transactions. Each option comes with its pros and cons, making it imperative for businesses to choose ones that align with their operational needs.

Ensuring secure transactions is also a top priority. Strategies to optimize payment security include implementing SSL certificates on websites, conducting regular security audits, and keeping transaction data encrypted. Such measures not only help in preventing fraud but also in fostering customer trust in your payment processes.

What is a payment gateway? (And why you don’t need one)

A payment gateway is a technology that facilitates online payments for businesses. However, depending on the business model, particularly for small enterprises or service providers, using a payment gateway may not always be necessary. Alternatives like using direct bank transfers or third-party payment apps can offer greater flexibility for handling transactions.

Choosing not to use a traditional payment gateway can save on fees and simplify the payment process, but merchants should ensure they still implement robust security measures to protect customer payment information. These considerations will support running a secure and efficient payment system without the overhead costs associated with larger payment processing solutions.

Sign up for updates and resources

Staying informed about updates and best practices in document management and payment processing is increasingly vital for success. By subscribing to our newsletter, users gain access to exclusive content, insights, and tools designed to enhance document security and improve transaction processes. This connection ensures that businesses remain compliant while supporting their financial goals.

Additionally, users can share information to receive tailored content that aligns with their specific needs. Such engagement provides a personalized experience that can lead to discovery of new resources and valuable insights tailored to their operational concerns.

Related topics of interest

In addition to understanding the ins and outs of credit card authorization forms, business owners can benefit from exploring related topics that can further enhance their operations. For instance, learning how to start a free online store can open new revenue streams, while setting up recurring invoices can streamline the billing process. Moreover, securing customer data is paramount, so reviewing tips specifically aimed at protecting sensitive information should remain top-of-mind.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit card authorization form directly from Gmail?

How can I send credit card authorization form for eSignature?

How do I edit credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.