Get the free Consequential Loss Insurance Proposal Form

Get, Create, Make and Sign consequential loss insurance proposal

How to edit consequential loss insurance proposal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out consequential loss insurance proposal

How to fill out consequential loss insurance proposal

Who needs consequential loss insurance proposal?

Consequential loss insurance proposal form how-to guide

Understanding consequential loss insurance

Consequential loss insurance is designed to cover losses that occur as a result of a direct physical loss of property. This type of insurance is targeted at businesses that may suffer a loss of income due to an interruption in operations caused by incidents like natural disasters, theft, or equipment failure. While many business owners recognize the need for property insurance, the nuanced protection offered by consequential loss insurance is equally critical.

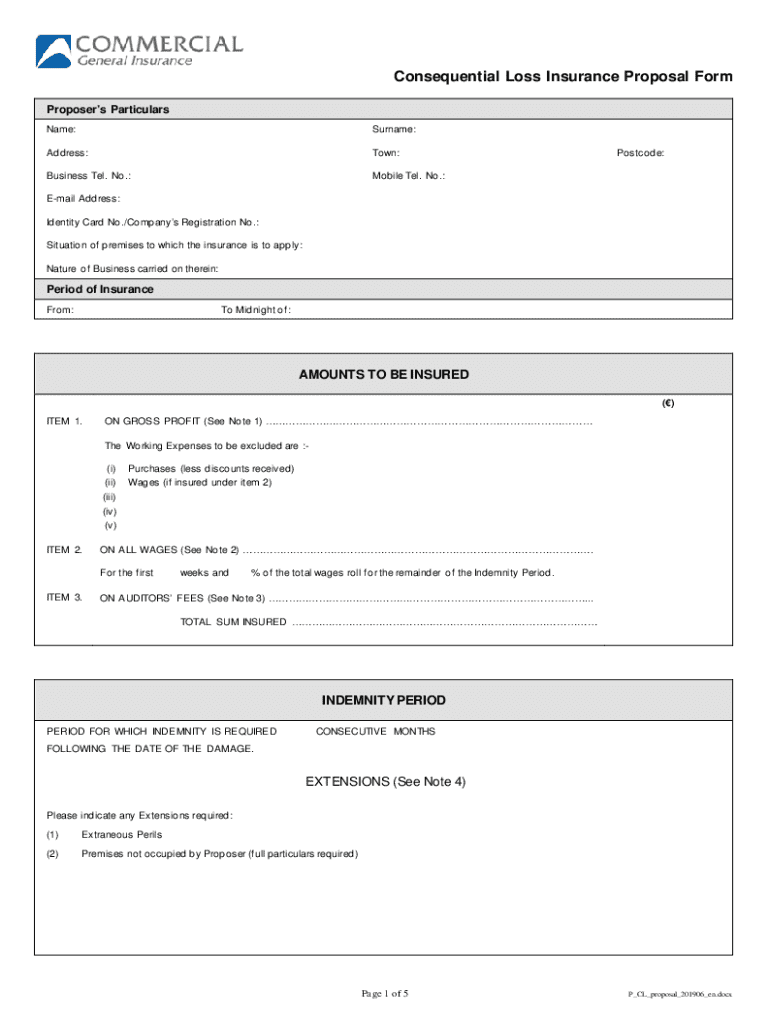

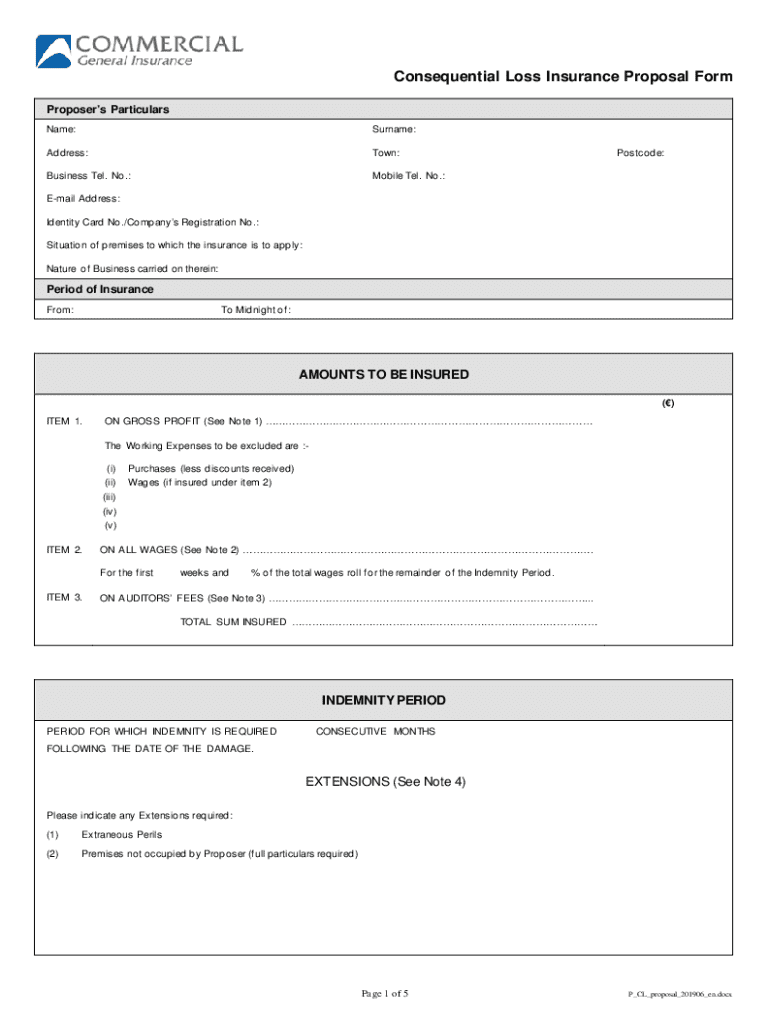

The proposal form serves as a critical entry point into the insurance process. It gathers essential details about the business and its assets, helping underwriters assess risk and determine appropriate coverage. Completing the proposal accurately is vital because inadequate information can lead to denial of claims when unexpected events occur.

To navigate the proposal form effectively, it's essential to familiarize yourself with key terminologies, including indemnity periods, average earnings, and gross profit. Understanding these terms will aid in a smoother experience when filling out your form and managing your insurance.

Key components of the consequential loss insurance proposal form

The consequential loss insurance proposal form consists of several key components that provide a comprehensive overview of the entity seeking coverage. Each section requires careful consideration and specificity to ensure the proposer’s interests are adequately represented.

Filling out the proposal form

Filling out the consequential loss insurance proposal form can be a straightforward process if approached methodically. Start by accessing the form through pdfFiller, where you can easily locate insurance proposal templates tailored to your needs.

Navigate through the sections of the form by familiarizing yourself with each highlight before inputting data. Each field should be filled with accurate information to avoid processing delays. Be thorough—if a section doesn’t apply to your business, note that clearly to avoid confusion later.

Editing and preparing your proposal form

Once you have filled out the proposal form, it’s important to review and make necessary edits for clarity and accuracy. Utilizing pdfFiller tools can enhance this process. The platform provides advanced PDF editing features that allow users to make adjustments with ease.

Adding comments and annotations can be beneficial for identifying areas needing attention or discussing specific details with team members. Effective collaboration enhances the quality of the proposal before official submission.

Signing and submitting the proposal form

After editing is complete, the next step is signing your proposal form. With pdfFiller's e-signature functionality, this process is quick and compliant with legal standards, making it an efficient solution for businesses.

Follow the e-signing procedure step-by-step, ensuring that each party who needs to sign has access. Once signed, your completed form can be submitted through various methods, which may include email, fax, or direct submission via the insurance company's portal.

Managing your insurance proposal efficiently

Effective management of your insurance proposal goes beyond completion and submission. Using pdfFiller’s comprehensive suite, you can archive your proposal securely for future reference, ensuring that you have records at hand when needed.

Tracking the status of your submission can help you stay informed and prepared for any next steps. Should you need to make amendments—be it due to changes in business operations or additional assets—pdfFiller provides a straightforward method for making necessary updates.

Troubleshooting common issues

Even with a well-prepared proposal form, issues can arise during the submission or processing phases. Familiarize yourself with common problems that can occur, such as missing signatures, incomplete fields, or submission delays.

If you encounter problems, several resources are available to assist you in completing and submitting your form. Reach out to your insurance provider for guidance or consult pdfFiller’s support features for troubleshooting assistance.

Real-life case studies and examples

Understanding the impact of a consequential loss insurance proposal form can be more tangible through real-life examples. Cases where businesses successfully filed claims after active interruptions have illustrated the importance of accurately detailing risks and potential losses. For example, a manufacturing company that faced unexpected machinery failures could recoup substantial losses by having comprehensive documentation set forth in their proposal.

Conversely, businesses that submitted incomplete proposals often faced significant delays or, in some cases, denied claims due to insufficient information. Learning from these examples highlights the need to prioritize accuracy and thoroughness in your proposal form to avoid costly mistakes.

Conclusion of process overview

Navigating the consequential loss insurance proposal form may seem daunting initially, but understanding its importance is invaluable for business protection. With a detailed approach, utilizing tools like pdfFiller can streamline the process significantly, ensuring your business is well-prepared for unforeseen events.

By leveraging the power of a proper proposal form, businesses not only safeguard their interests but also position themselves strategically to manage risks effectively and recover from potential disruptions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send consequential loss insurance proposal to be eSigned by others?

How can I get consequential loss insurance proposal?

How do I make edits in consequential loss insurance proposal without leaving Chrome?

What is consequential loss insurance proposal?

Who is required to file consequential loss insurance proposal?

How to fill out consequential loss insurance proposal?

What is the purpose of consequential loss insurance proposal?

What information must be reported on consequential loss insurance proposal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.