Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Credit Card Authorization Form: A How-To Guide

Understanding credit card authorization forms

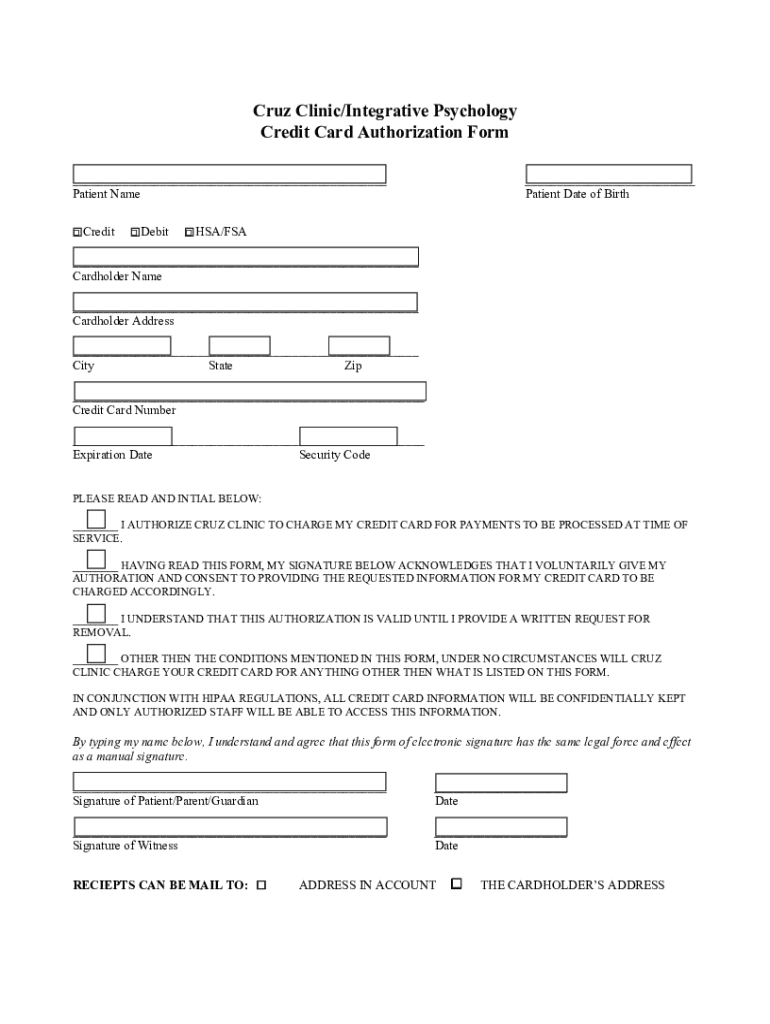

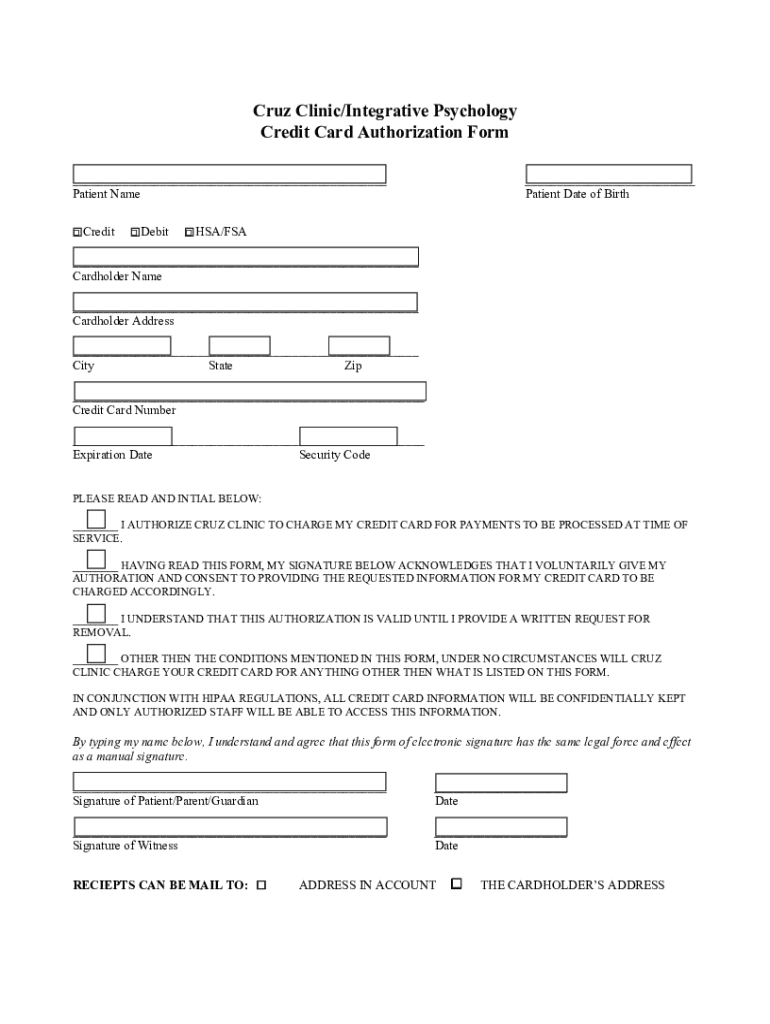

A credit card authorization form is a crucial document used in various business transactions to secure payment from customers. This form allows a business to charge a customer’s credit card with specific details outlined within the document. Commonly utilized in industries such as eCommerce, hospitality, and rental services, the authorization form acts as proof of consent for the transaction that is about to occur.

The importance of a credit card authorization form in business transactions cannot be overstated. Such forms protect businesses from chargebacks and fraudulent activities while establishing a trustworthy relationship between businesses and customers. They serve as a buffer against disputes and potential financial losses, ensuring that both parties are clear on payment terms.

Components of a credit card authorization form

A well-structured credit card authorization form includes several essential components. Initially, customers must provide their personal information, such as name, address, and contact details. Following that, there's a designated space for payment specifics, which includes the amount to be charged, the date of the transaction, and any relevant notes if it's a recurring payment.

Another significant section of the form is the signature area. This not only validates the authorization but is also legally binding, indicating that the customer agrees to the charges. Optional additions, like CVV verification explanations, can enhance security measures, while dedicated space for additional authorization notes allows for flexibility during specific transactions.

Types of credit card authorization forms

Understanding the types of credit card authorization forms is vital for choosing the right one for your needs. Single transaction forms are designed for one-time payments and are straightforward in nature. In comparison, recurring transaction forms accommodate subscriptions or ongoing services, providing flexibility for businesses with repeated billing cycles.

Card-on-file agreements are another variant, allowing businesses to store a customer’s credit card information securely for future transactions. Industry-specific variations may emerge, particularly in sectors such as eCommerce, where online safety is paramount, or rental transactions, which may require more stringent authorization measures due to fluctuating charges.

Filling out the credit card authorization form

Completing a credit card authorization form correctly is crucial to prevent any transactional issues. Start by accurately entering personal information in the designated fields. Next, specify the payment details, including the exact amount, the date when the payment should be processed, and, if applicable, the frequency for recurring payments.

Common mistakes include typos in credit card numbers or missing signatures. To avoid errors, double-check all provided information before submission. Choose between electronic and paper forms depending on what suits your business model. Utilizing platforms like pdfFiller allows users to easily fill and eSign forms digitally, enhancing accuracy and streamlining the process.

Managing and storing completed forms

Once completed, managing and storing credit card authorization forms securely is paramount. Opt for digital storage solutions that comply with security protocols to protect sensitive information. Businesses must consider using platforms that offer encryption and secure access controls to prevent unauthorized access and data breaches.

Additionally, retain completed forms for a specific duration. It's generally recommended that businesses keep these forms for at least three years. Compliance with regulations like PCI DSS is critical to avoid potential penalties or loss of customer trust, especially when handling sensitive data like credit card information.

Legal considerations surrounding credit card authorization forms

Businesses might wonder if they are legally obligated to use credit card authorization forms. While not mandated by law, these forms offer legal protection. They help establish consent, reducing liability for unauthorized transactions. Knowing your obligations and rights as a business helps maintain compliance and protect customer trust.

Moreover, customer rights concerning payment disputes must be well understood. Consumer protection laws serve as a safeguard for customers, meaning any misuse of their credit card information can lead to significant ramifications for businesses. Awareness of these laws not only fosters a healthy business practice but also reassures customers that their financial information is handled responsibly.

Pros and cons of using credit card authorization forms

Using credit card authorization forms has numerous advantages for businesses, the most significant being the streamlining of payment processes. These forms help reduce the risk of chargebacks and fraud by clearly documenting a customer’s consent for transactions. Additionally, they foster an environment of trust, allowing customers to share their payment information with confidence.

However, there are potential drawbacks that businesses must consider. Complications may arise during disputes, particularly if there's a lack of clarity or if the form isn't filled out correctly. Furthermore, customers may hesitate to provide their personal information due to privacy concerns, making it crucial for businesses to reassure customers about the security of their data.

Common questions and answers about credit card authorization forms

Many businesses have questions when it comes to credit card authorization forms, particularly regarding the absence of certain fields. For example, why might a form lack space for the CVV code? The decision usually stems from comfort and security concerns — some businesses prefer not to request the CVV to mitigate security risks. It’s essential for customers to feel safe when filling out these forms.

Handling declined authorizations can also be problematic. In such cases, businesses should communicate clearly with the customer, explaining the reasons behind the decline and offering alternative solutions to complete the transaction. Addressing customers’ concerns about filling out the form can improve their confidence and your overall business relationship.

Success stories: Real-life applications of credit card authorization forms

Various businesses have successfully implemented credit card authorization forms to enhance their payment processes. Take, for example, an eCommerce retailer that adopted these forms to secure customers’ payment details. By implementing a user-friendly credit card authorization form, the business saw a 30% reduction in payment disputes due to increased clarity on transaction agreements.

Another case involves a rental service that incorporated a credit card authorization form to manage security deposits. By clarifying terms and conditions in the document, this company improved customer satisfaction significantly, as clients appreciated the transparency and professionalism displayed during transactions.

Interactive tools and resources

For businesses seeking to streamline their processes, pdfFiller offers a variety of customizable credit card authorization templates. Users can access these templates directly from the platform, ensuring ease of filling, editing, and eSigning documents securely online. The platform simplifies this process, providing users with the necessary tools to make informed edits while handling sensitive information.

As a next step, businesses should consider integrating credit card authorization forms into their payment systems. By adopting these forms, they can enhance transaction security and build stronger relationships with their customers. Utilizing pdfFiller’s tools allows for a seamless transition into more efficient document management.

Related topics and further reading

Expanding your knowledge beyond credit card authorization forms can enhance your overall financial management strategy. Topics such as choosing the best POS system for small businesses and understanding payment processing fees can provide comprehensive insights into the broader aspects of effective payment management. Additionally, integrating documentation practices into your financial strategy can significantly help in managing cash flow and reducing financial risks.

By delving into these related topics, individuals and teams can improve their overall document and financial management practices, paving the way for streamlined operations and enhanced profitability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete credit card authorization form online?

How can I fill out credit card authorization form on an iOS device?

How do I fill out credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.