Get the free Form 10-k

Get, Create, Make and Sign form 10-k

Editing form 10-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-k

How to fill out form 10-k

Who needs form 10-k?

Understanding Form 10-K: Your Comprehensive Guide

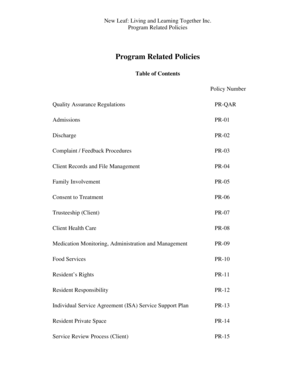

Overview of Form 10-K

Form 10-K is a comprehensive report filed annually by publicly traded companies with the SEC (Securities and Exchange Commission). This document provides a detailed overview of a company's financial performance and is crucial for investors, analysts, and other stakeholders who want to understand the company's operations and financial condition.

The primary purpose of the Form 10-K is transparency. It serves to inform shareholders and potential investors about the company’s operations, financial results, risk factors, and management performance. Understanding this document is essential for making informed investment decisions.

All publicly traded companies in the United States are required to file Form 10-K each year. This requirement ensures that investors have access to consistent and comparable financial information, which promotes transparency in the markets.

Structure of a Form 10-K

A Form 10-K includes several key sections that allow for a comprehensive analysis of a company's financial health and operational risks. The structure is divided into four main parts:

Typically, a 10-K can be a lengthy document, ranging from 100 to over 200 pages, depending on the complexity of the business. Companies are generally given 60 to 90 days after the close of their fiscal year to file this form.

Key components of the Form 10-K

The key components of Form 10-K include essential sections that delve into financial performance. These sections are critical for analysts and investors alike in making informed decisions.

Filing process for Form 10-K

Filing a Form 10-K requires adherence to specific deadlines set by the SEC. Companies must be aware of the key filing deadlines based on their fiscal year-end date, with the most common deadline being 60 days for larger companies.

The filing process involves preparing a detailed report that may require input from various departments within the company, including finance, legal, and compliance. Companies file this report electronically through the SEC’s EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system.

Tips for reviewing and analyzing Form 10-Ks

When reviewing a Form 10-K, certain metrics and sections can help investors gauge a company’s performance effectively. It’s essential to focus on revenues, profit margins, and overall financial health.

Common questions about the Form 10-K

Investors frequently have questions surrounding the Form 10-K, especially concerning its nuances and filing requirements. Understanding these answers can facilitate better investment decisions.

Resources for further learning

For individuals and teams seeking a comprehensive, access-from-anywhere document creation solution, platforms like pdfFiller provide a range of interactive tools for managing documents, including Form 10-K.

Understanding related forms and compliance

In addition to Form 10-K, companies are also required to file related forms like Form 10-Q and Form 8-K. These forms serve different purposes but collectively ensure comprehensive disclosure of a company’s financial and operational status.

Five percent ownership reporting

Companies must adhere to regulations regarding reporting five percent ownership stakes. This is crucial because it can highlight significant investors and their potential influence on a company’s decisions.

This ownership reporting requirement relates to the Form 10-K as companies must disclose major shareholders in order to keep investors informed about who holds significant stakes in the business.

Additional insights on financial statements

The financial statements included in the Form 10-K offer a wealth of information. A detailed breakdown of these documents can often reveal insights beyond just the raw numbers.

Learning resources and templates

Utilizing resources such as pdfFiller not only allows for efficient document management but also provides access to templates that can assist companies while filling out Form 10-K.

External resources and tools

Useful external resources can enhance the understanding of Form 10-K and improve financial analysis. Websites dedicated to financial research, investment analysis, and company performance metrics are invaluable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 10-k directly from Gmail?

How do I make changes in form 10-k?

How do I complete form 10-k on an iOS device?

What is form 10-k?

Who is required to file form 10-k?

How to fill out form 10-k?

What is the purpose of form 10-k?

What information must be reported on form 10-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.