Get the free Continuous Bond Form

Get, Create, Make and Sign continuous bond form

How to edit continuous bond form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out continuous bond form

How to fill out continuous bond form

Who needs continuous bond form?

A Comprehensive Guide to Continuous Bond Forms

Understanding continuous bonds

Continuous bonds are legal agreements that provide financial security and assurance for various obligations over an extended period. Unlike one-time bonds that are only effective for a single event or transaction, continuous bonds cover ongoing risks and liabilities, making them crucial in industries like customs, immigration, and commercial transactions. By securing a continuous bond, businesses and individuals can streamline their operations, minimize risks, and maintain compliance with regulatory requirements.

The importance of continuous bonds is underscored by their widespread use across various sectors. Industries such as import/export, real estate, and construction often rely on these bonds to ensure the fulfillment of contracts, adherence to laws, and financial responsibility. Continuous bonds not only provide peace of mind to parties involved but also serve to reinforce trust within commercial transactions.

Types of continuous bonds

Continuous bonds come in various forms, each tailored to different applications and regulatory needs. Understanding the specific types of continuous bonds available is crucial for individuals and businesses looking to secure their obligations effectively.

Customs continuous bonds

Customs continuous bonds are essential for businesses involved in international trade. They serve as a guarantee that importers and exporters will adhere to customs regulations and pay any related duties and taxes. Various regulatory requirements govern these bonds, including the need for accredited customs brokers to facilitate transactions. Importers must ensure that they stay compliant with the U.S. Customs and Border Protection (CBP) guidelines, which often entail submitting financial statements to verify bonding capacity.

Immigration continuous bonds

Immigration continuous bonds are typically required for individuals seeking to contest deportation or secure an immigration status, indicating that they will adhere to all immigration regulations. For applicants, these bonds are critical during the immigration process, as they need to provide evidence of their ability to meet financial obligations. Understanding the nuances of immigration laws and how these bonds operate can improve the chances of success in immigration applications.

Commercial continuous bonds

Commercial continuous bonds cover a variety of situations, from contractor license bonds to permit bonds required for local business operation. These bonds ensure that businesses comply with state regulations regarding professional conduct and industry standards. Companies find commercial continuous bonds beneficial as they help secure client trust while ensuring compliance, ultimately leading to smoother project execution and growth opportunities. Examples include performance bonds and bid bonds, which serve essential roles in construction projects.

How to obtain a continuous bond

Acquiring a continuous bond involves several steps that potential applicants must follow to ensure they meet all requirements. Understanding the eligibility criteria and the application process can make this journey less daunting.

Several factors can affect approval for a continuous bond, such as credit score and business type. A strong credit profile often plays a crucial role in obtaining favorable bond terms, while the nature of the business operation can determine the risk associated with issuing the bond.

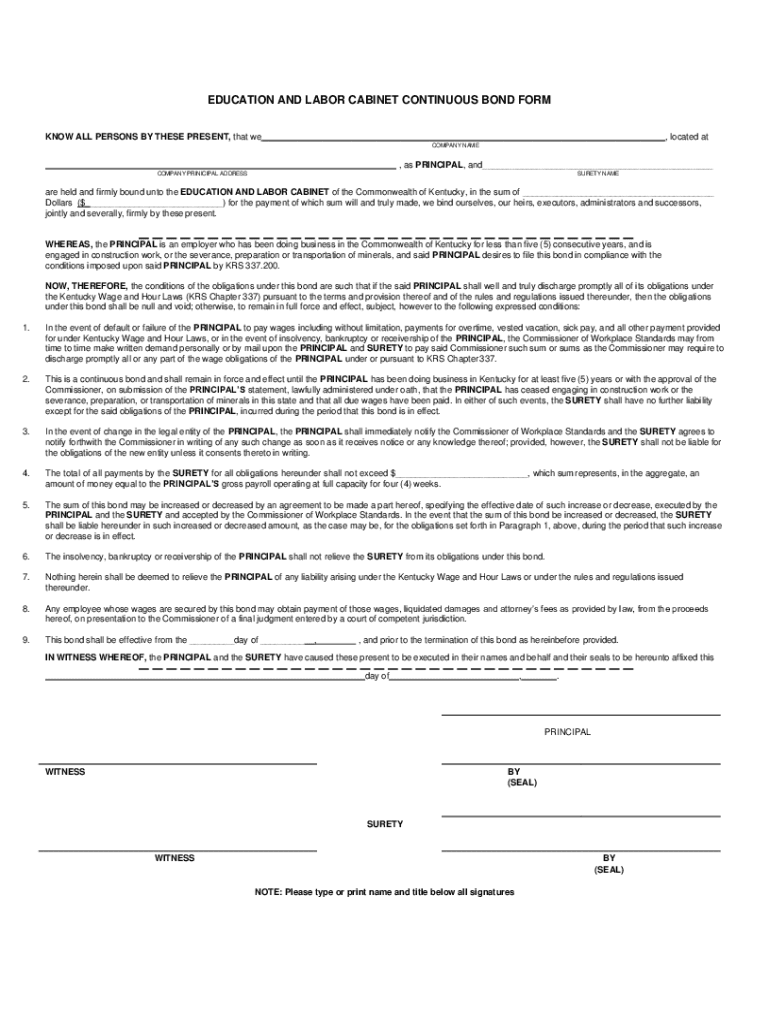

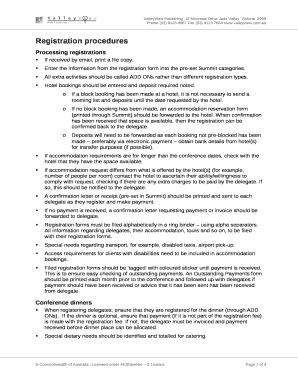

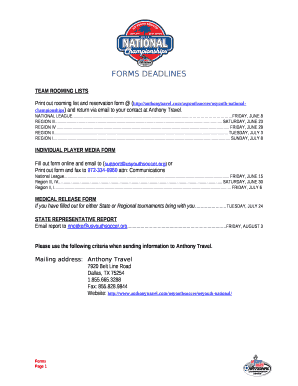

Filling out the continuous bond form

Completing the continuous bond form requires careful attention to detail, ensuring that all required components are accurately filled out. Mistakes can lead to delays in approval or even denial of the bond application.

Providing accurate and comprehensive information about your personal details, business history, and financial background is crucial. Incomplete or incorrect forms can not only delay the process but may also negatively impact your bond approval. Furthermore, potential applicants should be prepared to follow up with additional documentation if requested by the surety provider.

Managing continuous bonds

Managing continuous bonds effectively is vital for maintaining compliance and ensuring ongoing coverage. Post-acquisition, bondholders must follow specific guidelines to keep their bonds in good standing.

Awareness of your bond’s requirements allows businesses to avert potential issues before they escalate. Regular communication with surety providers for necessary adjustments can pave the way for continued compliance and operational success.

FAQs about continuous bonds

Understanding continuous bonds can often raise questions. Here are some frequently asked questions to clarify common misconceptions and guide potential applicants.

Real-life applications of continuous bonds

Continuous bonds have tangible impacts across various sectors. Case studies can illustrate their importance and how they benefit businesses in different contexts.

For instance, a construction company might use a continuous bond to ensure compliance with local regulations while building commercial properties. A case study with positive outcomes highlights how such bonds facilitate smoother project deliveries and foster healthy relationships with clients and regulators.

Testimonials from businesses underscore how continuous bonds enhance trustworthiness and assist in navigating regulatory landscapes, paving the way for growth and expansion.

Advantages of e-signing continuous bond forms

E-signatures have revolutionized how businesses manage documentation, including continuous bonds. The ability to e-sign forms streamlines the application process, saving time and resources while enhancing efficiency.

Leveraging e-signatures facilitates timely execution of important documents and ensures that all parties maintain an efficient workflow, reducing overall processing time.

Interactive tools and resources

Tools and resources play a significant role in the continuous bond application process. Providing accessible and user-friendly templates and calculators can help facilitate decisions around bonding.

Interactive tools enhance user experience significantly, allowing individuals and teams to navigate the continuous bond landscape more confidently and efficiently.

Key highlights of using pdfFiller for continuous bonds

pdfFiller serves as an all-encompassing platform for managing continuous bond documents. With features tailored for seamless editing and collaboration, users can enjoy a streamlined process when handling bonding requirements.

With pdfFiller, businesses not only streamline the bond application process but also ensure compliance through effective documentation management, enhancing overall operational efficiency.

Latest insights and trends in continuous bonding

As industries evolve, so do the regulations and market trends surrounding continuous bonds. Keeping informed about these developments is key to maintaining compliance and capitalizing on opportunities.

Future insights reveal potential areas for growth, urging business leaders to be adaptive in response to industry changes, positioning themselves advantageously in competitive landscapes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get continuous bond form?

How do I edit continuous bond form straight from my smartphone?

Can I edit continuous bond form on an iOS device?

What is continuous bond form?

Who is required to file continuous bond form?

How to fill out continuous bond form?

What is the purpose of continuous bond form?

What information must be reported on continuous bond form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.