Get the free Change of Beneficiary

Get, Create, Make and Sign change of beneficiary

Editing change of beneficiary online

Uncompromising security for your PDF editing and eSignature needs

How to fill out change of beneficiary

How to fill out change of beneficiary

Who needs change of beneficiary?

A comprehensive guide to the change of beneficiary form

Understanding the change of beneficiary form

The change of beneficiary form is a crucial document used to update the individuals who will receive benefits from a policy, account, or asset upon the policyholder's death. This form serves to ensure that your final wishes regarding asset distribution are honored and can prevent disputes among potential heirs. After all, your intentions should be clearly reflected in who stands to benefit from your estate.

There are several common scenarios that necessitate a change of beneficiary form, including major life changes such as marriage or divorce, which often alter your wishes regarding who should benefit from your policy. Additionally, the birth of a child prompts many to revise their beneficiary designations to include new family members. If a previous beneficiary passes away, updating the form becomes essential to avoid uncertainty during the claims process.

Keeping beneficiary information updated is vital for ensuring clarity and minimizing complications when it comes time to distribute your assets. If you neglect updating your form, your intended beneficiaries may inadvertently miss out on their rightful benefits.

Types of beneficiary changes

Understanding the different types of beneficiaries is key to effectively managing your change of beneficiary form. Beneficiaries can be classified as either revocable or irrevocable. Revocable beneficiaries can be changed at any time, allowing for flexibility. On the other hand, irrevocable beneficiaries cannot be altered without their consent, thus providing them with guaranteed access to benefits, which can be beneficial for certain financial planning strategies.

Moreover, within your beneficiary selections, you can designate primary and contingent beneficiaries. Primary beneficiaries are the first in line to receive benefits, while contingent beneficiaries receive benefits only if the primary beneficiary is unavailable. This designation is significantly important, especially when navigating complex family dynamics.

Changes in relationships, such as marriage, the introduction of children, or shifts in family dynamics, necessitate reflecting these developments in your beneficiary designations to mitigate potential future disputes.

Legal considerations

Legal implications surrounding the change of beneficiary form cannot be overlooked. Each state has its own laws and regulations governing estate planning, which can impact how your beneficiary designations are interpreted and enforced. It's imperative to be aware of these laws to ensure the proper legal legibility of your changes.

Additionally, there may be potential tax consequences tied to the assets your beneficiaries will receive. For instance, certain inheritances can trigger estate taxes, and the change of beneficiary form should be accompanied by an understanding of these implications. Therefore, seeking legal advice or consulting with a financial planner can help mitigate unexpected tax burdens.

In summary, legalities surrounding beneficiary designations are multifaceted and significantly influence the distribution process. Knowledge is critical, as is ensuring that decisions made on the change of beneficiary form align with legal requirements.

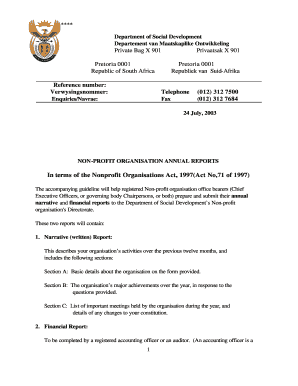

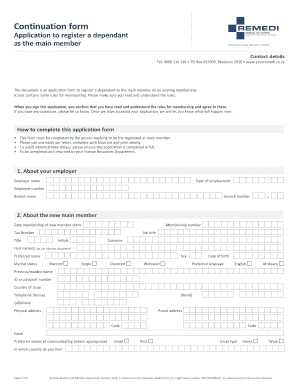

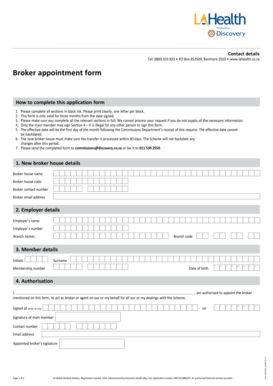

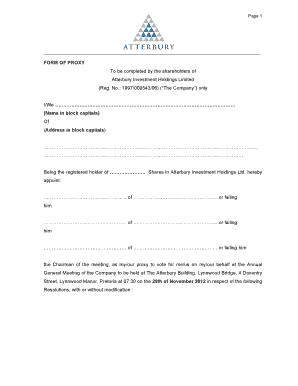

How to complete a change of beneficiary form

Completing a change of beneficiary form can seem daunting, but it can be straightforward with the right guidance. Here’s a step-by-step breakdown to help you navigate the process.

By following these steps closely, you can minimize errors and ensure that your beneficiary designations are updated efficiently.

Updating your change of beneficiary form

Life is full of changes, and it's vital to review your change of beneficiary form regularly. Major life events, such as marriages, divorces, births, or even the death of a loved one, can all influence how you’d like your assets distributed. Whenever such events occur, revisiting your beneficiary designations ensures that they accurately reflect your current intentions.

Frequency of updates is essential; for example, yearly reviews or whenever a significant life event occurs can prevent complications down the line. Not keeping your forms updated can lead to unintended beneficiaries, stirring familial disputes and leaving your assets in the hands of those whom you did not intend to receive them.

It’s best to treat your change of beneficiary form as a living document that evolves alongside your life stage and relationships. Staying proactive is key.

Digital solutions for managing beneficiary changes

Managing your change of beneficiary form digitally can streamline the process significantly. Platforms like pdfFiller offer a repository of features tailored to facilitate your document management needs. With pdfFiller, you can seamlessly edit PDF forms, eSign documents, and collaborate effectively within teams.

Using a cloud-based platform has its advantages; access is available from any device, ensuring that updates can be made on-the-go. Document management tools simplify the process of filling out, storing, and retrieving your forms whenever necessary.

This accessibility paired with robust editing features alleviates stress and provides peace of mind, knowing your beneficiary forms are well-managed and up to date.

FAQ section

Questions often arise regarding the change of beneficiary form and the process associated with it. Understanding these frequently asked questions can mitigate misunderstandings.

Clarifications on misconceptions are also key; many believe they cannot change beneficiaries in certain situations, whereas the proper guidelines will generally allow for changes under most circumstances.

Best practices for handling beneficiary changes

Documenting any changes you make to your beneficiary forms is vital for personal record-keeping as well as for clarity during asset distribution. Keeping informed about the terms and conditions of your policies is equally important; from deadlines to asset allocation rules, knowledge empowers you to make informed decisions.

Regular reviews of all legal documents, including wills and trusts, alongside your change of beneficiary forms, is recommended to ensure consistency and alignment with your overall estate plan.

Additional tips for effective document management

Digital tools for document security play a critical role in protecting your sensitive information. Using platforms like pdfFiller ensures that your documents are securely stored with encrypted access, protecting them from unauthorized use.

The importance of backing up important documents should never be underestimated. Regularly updating your backup systems ensures that whether through physical or digital means, your documents remain intact and retrievable after potential loss or damage.

Integration with financial planning goes hand-in-hand with managing beneficiary changes. Making your financial decisions cohesive can significantly enhance your overall financial well-being and simplify future planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find change of beneficiary?

Can I create an electronic signature for the change of beneficiary in Chrome?

Can I create an electronic signature for signing my change of beneficiary in Gmail?

What is change of beneficiary?

Who is required to file change of beneficiary?

How to fill out change of beneficiary?

What is the purpose of change of beneficiary?

What information must be reported on change of beneficiary?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.