Get the free Automated Payment Processing

Get, Create, Make and Sign automated payment processing

Editing automated payment processing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out automated payment processing

How to fill out automated payment processing

Who needs automated payment processing?

Understanding Automated Payment Processing Forms: A Comprehensive Guide

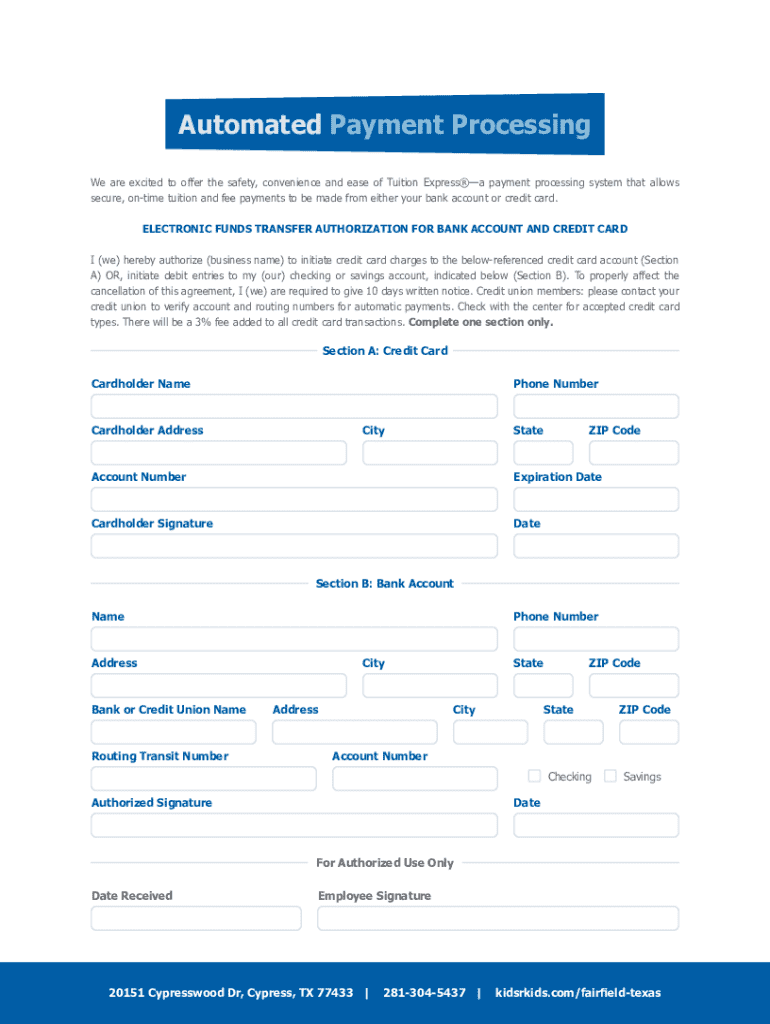

Understanding automated payment processing

Automated payment processing refers to the use of technology to manage and complete financial transactions without human intervention. This system is essential for individuals and organizations alike and allows for smoother, more efficient operations. With an automated payment processing form, businesses and individuals can significantly reduce the time it takes to manage financial transactions, thereby enhancing overall productivity.

The significance of automated payment processing cannot be understated. It streamlines payment workflows, reduces errors, and enhances customer experience. Particularly in a fast-paced business environment, automation plays a pivotal role in keeping operations agile and responsive to customer needs.

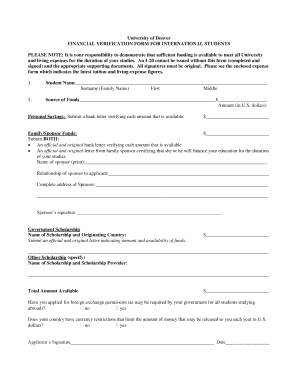

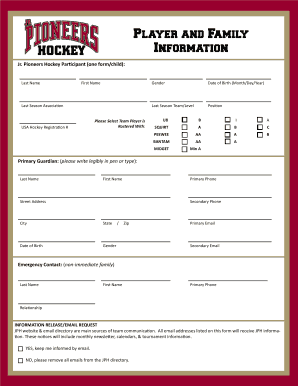

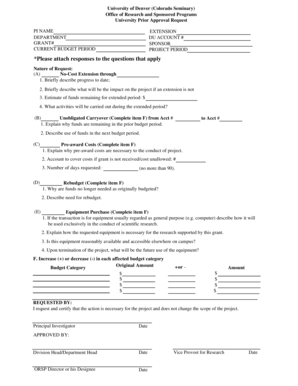

The importance of payment processing forms

Payment processing forms are critical assets in any automated payment system. They act as the gateway for collecting information required to complete transactions while ensuring that important data is captured without any gaps. By utilizing these forms, users can facilitate a seamless transaction process that promotes efficiency and accuracy.

Moreover, automated payment processing forms simplify the monitoring of transactions, allowing both businesses and users to trace payment histories and statuses effortlessly. This level of automation significantly enhances both user experience and operational efficiency.

Key features of automated payment processing forms

The effectiveness of an automated payment processing form is heavily influenced by its design and functionality. A user-friendly interface is paramount, allowing users to navigate seamlessly through the form without confusion. This intuitive design facilitates quick data entry and minimizes the potential for errors.

Customizable templates are another key feature. The ability to personalize forms not only helps in branding but also ensures that all necessary fields are included to match specific transactional requirements. Common customizable elements include payment amounts, payment methods, and customer details, allowing full control over how the form looks and operates.

Real-time payment tracking enhances the user experience by enabling individuals to see the current status of their transactions. With live updates, users can stay informed about their payments without having to make additional inquiries.

Step-by-step guide to creating an automated payment processing form

Creating an automated payment processing form using pdfFiller is a straightforward process. Let's break it down into digestible steps to help you get the most out of your document management.

Following these straightforward steps can enhance the functionality of your payment processing forms, ensuring a fluid transaction experience for your customers.

Benefits of using automated payment processing forms

Utilizing automated payment processing forms yields significant benefits, particularly regarding efficiency and accuracy. One of the primary advantages is time efficiency; automation eliminates many manual tasks associated with payment processing, allowing teams to focus their efforts on more strategic initiatives.

Enhanced accuracy is another major benefit. Automated forms significantly reduce the likelihood of human error, which can occur during data entry and transaction processing. With an accurate and reliable system in place, businesses can enhance their credibility and ensure that their customers have a positive experience.

Finally, a streamlined user experience enables businesses to meet customer expectations effectively. With quicker processing and fewer issues, clients are likely to return for services and recommend the experience to others.

Collaborating with teams using automated payment forms

Collaboration is essential for teams managing documents, and automated payment processing forms facilitate this with ease. pdfFiller allows users to manage team access and roles effectively, ensuring that the right people can edit and review forms as needed.

The collaborative editing features enable real-time updates and comments, allowing team members to communicate effectively as they work on the document. This functionality is vital for cross-departmental collaborations where different insights may be required.

These collaboration tools ultimately lead to more refined processes, as feedback and revisions can be implemented swiftly, promoting a more efficient workflow overall.

Regulatory compliance and security measures

When dealing with financial transactions, understanding regulatory standards is crucial. Compliance with regulations such as PCI-DSS (Payment Card Industry Data Security Standard) and GDPR (General Data Protection Regulation) helps ensure that payment data is handled securely and responsibly.

Implementing robust encryption and authentication protocols is also vital. Adopting such best practices will protect sensitive data during processing to foster trust among users and clients.

Creating audit trails is essential for tracking modifications, ensuring that you can always revert to previous document versions or inspect who made changes and why. This level of accountability greatly strengthens any organization's compliance posture.

Common challenges and solutions

While automation streamlines payment processing, several challenges may arise. For instance, users might face issues with the integration of various payment gateways or experience difficulties with the forms not functioning as expected. Identifying these potential pitfalls early can minimize disruption.

Technical issues are common, especially when form fields or integrations aren't set up correctly. Comprehensive testing before deployment can mitigate these challenges, and maintaining forms can prevent common issues from reoccurring.

Establishing a routine for updating and maintaining forms ensures users are working with the most current version, enhancing user experience and operational effectiveness.

Staying up to date with automated payment processing innovations

The world of payment processing is in constant evolution. Keeping pace with emerging trends is critical for any business utilizing automated payment solutions. Technology innovations such as artificial intelligence and machine learning are shaping how businesses approach financial transactions, making them faster and more secure.

Adapting to changing consumer behaviors is also essential. Monitoring user feedback can help organizations pivot their strategies to meet customer expectations. This responsiveness is crucial in a competitive market where customers demand convenience more than ever.

Analyzing feedback as well as payment processing analytics offers insights into areas needing improvement, allowing for ongoing optimization of automated payment processing forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my automated payment processing directly from Gmail?

How can I edit automated payment processing from Google Drive?

Can I sign the automated payment processing electronically in Chrome?

What is automated payment processing?

Who is required to file automated payment processing?

How to fill out automated payment processing?

What is the purpose of automated payment processing?

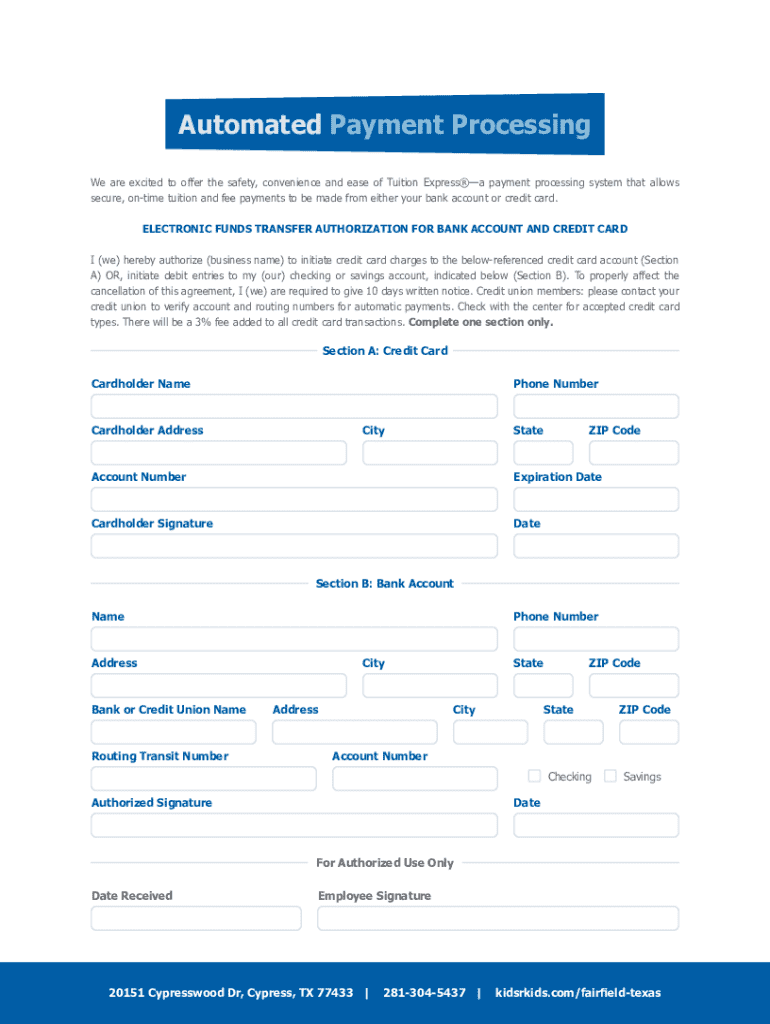

What information must be reported on automated payment processing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.