Get the free Doc-1024

Get, Create, Make and Sign doc-1024

Editing doc-1024 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out doc-1024

How to fill out doc-1024

Who needs doc-1024?

Navigating the doc-1024 Form: A Comprehensive Guide

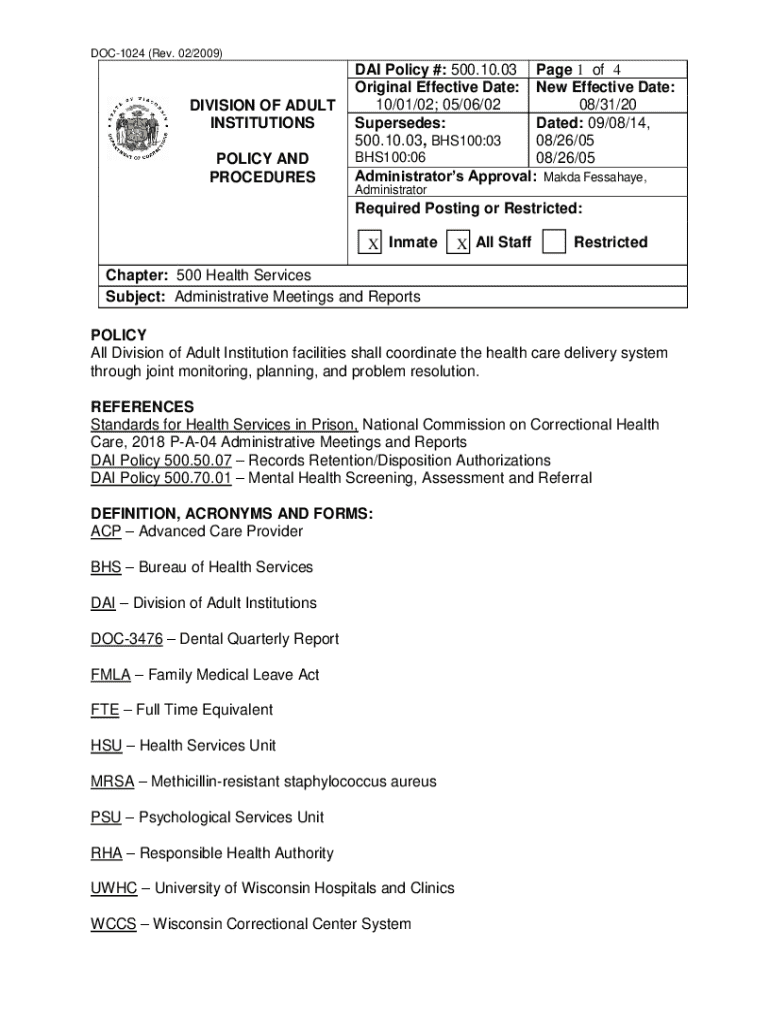

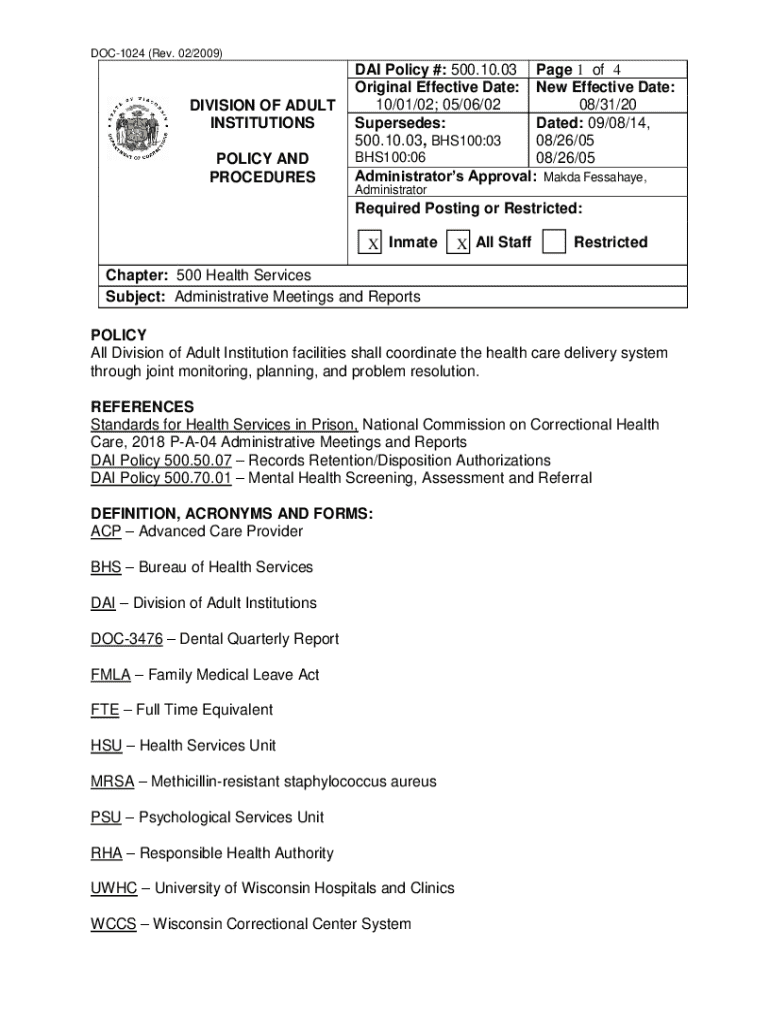

Overview of doc-1024 form

The doc-1024 form is a crucial document used primarily in the realm of financial disclosures, specifically designed for reporting income, exemptions, and deductions. This form helps individuals and organizations maintain transparency in their financial dealings, which is vital for regulatory compliance, tax reporting, and funding applications. Accurate documentation via the doc-1024 is not only a best practice but also a legal obligation for various entities.

The importance of accurate documentation cannot be overstated. Errors or omissions on the form can lead to significant issues, ranging from financial penalties to legal consequences. Therefore, understanding who is required to use the doc-1024 form is essential. Typically, it is mandated for individuals or organizations engaged in activities subject to financial disclosure requirements, including non-profit organizations, businesses seeking tax deductions, and others involved in transactions that require detailed income reporting.

Detailed analysis of the doc-1024 form

To effectively navigate the doc-1024 form, it is essential to understand its various sections, each serving a distinct purpose. Here’s a breakdown of the form's structure:

Despite the structured layout, many misunderstandings persist regarding what information to include, especially in terms of calculating income accurately and claiming deductions. It is vital to consult specific regulations or seek assistance to avoid common pitfalls.

Step-by-step instructions for accessing the doc-1024 form

Accessing the doc-1024 form is straightforward. It is readily available on various official websites, including government portals and organizations that offer tax-related services. Here's how to find and download the form efficiently:

When selecting the right version of the form, ensure it aligns with any recent updates or specific state requirements, as variations may exist to accommodate local regulations.

Filling out the doc-1024 form: detailed instructions

Completing the doc-1024 form requires careful preparation. Before diving in, gather essential information, including financial statements, previous tax forms, and any records related to exemptions or deductions. This will streamline the process and reduce the chances of errors.

Here’s a step-by-step guide on filling out each section:

Utilizing pdfFiller's tools can enhance your efficiency in completing the form. Through its platform, users can streamline filling processes, making their submissions smoother and error-free.

Editing and managing the doc-1024 form

Once the doc-1024 form is filled out, you may find that changes are necessary. This could range from minor corrections to substantial updates. Here’s how to effectively manage your completed form:

Streamlined management of forms translates into less time spent searching and more focus on other critical tasks.

eSigning the doc-1024 form

Implementing electronic signatures is now commonplace, and the doc-1024 form is no exception. eSigning provides a convenient and legally recognized way to authenticate documents. Understanding the eSigning process involves several key steps.

The eSigning process not only expedites document handling but also enhances security and reduces clutter from physical paperwork.

Common questions and answers regarding the doc-1024 form

As you navigate the doc-1024 form, questions often arise about common issues. Here are some frequently asked questions along with answers that can clarify those uncertainties:

pdfFiller can assist in addressing these concerns directly, providing tailored tools and resources to help you manage your documents efficiently.

Document retention and submission guidelines

Proper submission guidelines and document retention are crucial when dealing with the doc-1024 form. Here’s how to ensure your form is submitted correctly and retained appropriately.

Following these guidelines can help prevent issues related to lost documents or unrecorded submissions.

Additional insights for specific use cases

Certain entities, like tax-exempt organizations, have specific guidelines when dealing with the doc-1024 form. Recognizing these diverse requirements is vital to ensuring all applicable rules are adhered to.

Understanding these nuances can significantly ease the burden of compliance and foster more effective document management.

Interactivity and tools

To enhance user experience, pdfFiller offers an interactive fillable version of the doc-1024 form. This feature not only simplifies the filling process but also allows users to benefit from collaborative features.

These tools not only augment user efficiency but foster a more communicative approach to document preparation.

Troubleshooting common issues

Users may face several challenges while accessing or filling out the doc-1024 form. Here’s how to troubleshoot common issues effectively.

Navigating these challenges promptly helps maintain workflow and prevents unnecessary delays.

Navigation and support

For an optimal experience on pdfFiller, users should be familiar with the platform's navigation features. This enhances document management and reduces frustration.

With these tips, users can maximize their use of pdfFiller, leading to a smoother document management experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my doc-1024 in Gmail?

Can I edit doc-1024 on an iOS device?

How do I edit doc-1024 on an Android device?

What is doc-1024?

Who is required to file doc-1024?

How to fill out doc-1024?

What is the purpose of doc-1024?

What information must be reported on doc-1024?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.