Get the free Cdtfa-403-c

Get, Create, Make and Sign cdtfa-403-c

Editing cdtfa-403-c online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cdtfa-403-c

How to fill out cdtfa-403-c

Who needs cdtfa-403-c?

Understanding the CDTFA-403- Form: A Comprehensive Guide

Understanding the CDTFA-403- form

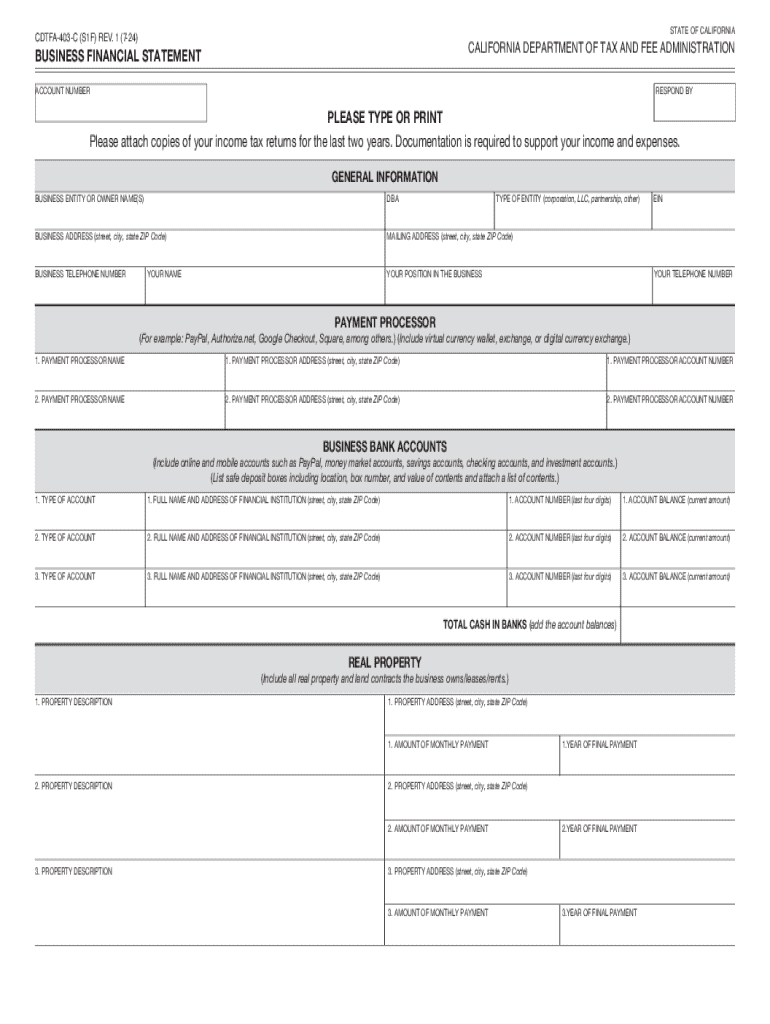

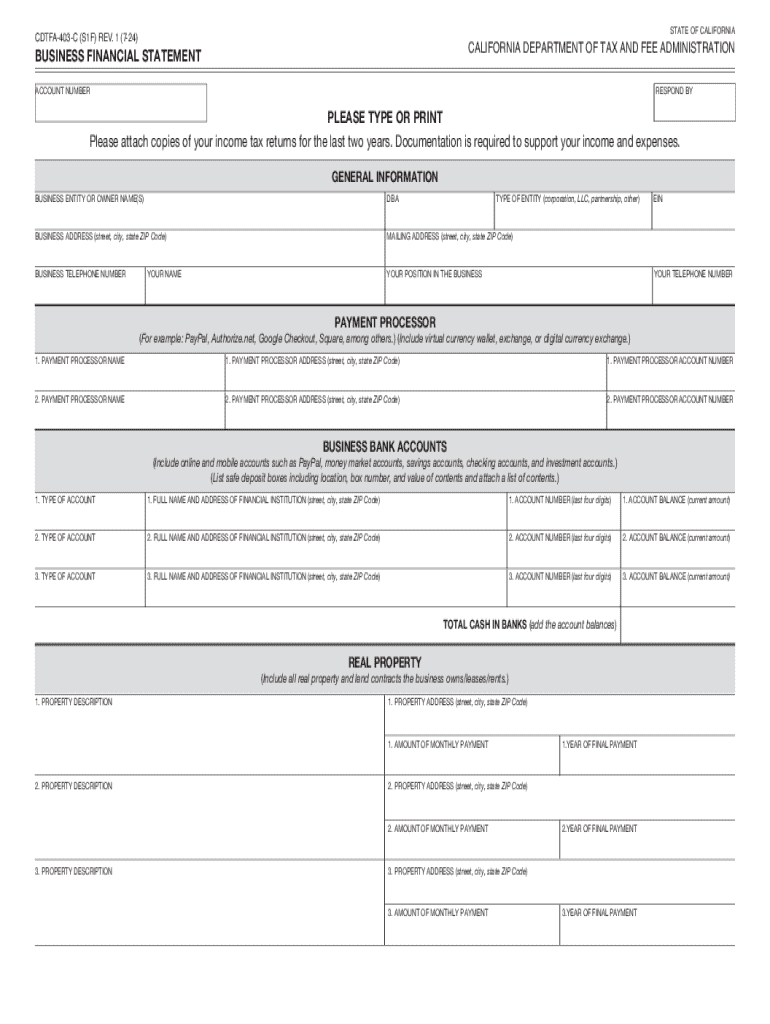

Form CDTFA-403-C is a crucial document utilized by businesses and individuals for various tax-related purposes in California. This form is specifically designed to report a collection of financial transactions and declare any necessary tax liabilities associated with those transactions. Whether you're a burgeoning entrepreneur or an established company, understanding when and how to use this form can significantly impact your financial responsibilities.

The purpose of the CDTFA-403-C form extends beyond simple reporting; it plays a vital role in ensuring compliance with California's tax regulations. By accurately completing this form, taxpayers help avoid potential penalties and streamline their dealings with the California Department of Tax and Fee Administration (CDTFA).

Who needs to fill out the CDTFA-403-C form? Typically, businesses and individuals engaged in various taxable activities must file this form. It is particularly relevant for those who need to report sales tax, use tax, or other tax liabilities arising from their operations. Common scenarios include retailers, service providers, and businesses providing tangible goods.

Common use cases for the CDTFA-403-C form include making periodic sales tax payments or addressing adjustments based on prior reporting periods. As the tax landscape in California evolves, being adept in using this form is increasingly beneficial to ensure ongoing compliance.

Accessing the CDTFA-403- form

To locate the CDTFA-403-C form online, visit the official CDTFA website where you can access not only the form but also supporting resources and guidelines on how to fill it out. This form is available for download in PDF format, which makes it easy to print.

You have two options when it comes to handling this form: you can print a physical version to fill out by hand, or you can complete the form digitally. Digital submissions are increasingly encouraged, as they help expedite the entire process, reducing mailing times and minimizing the risk of errors associated with manual entries.

Using pdfFiller, a cloud-based document solution, offers valuable tools to access, edit, and manage the CDTFA-403-C form seamlessly. This platform simplifies the process, allowing you to work from anywhere and ensuring your form is completed efficiently.

Filling out the CDTFA-403- form

Completing the CDTFA-403-C form accurately is critical to avoid unnecessary complications later. Here's a step-by-step guide to help you navigate filling out this form.

Common mistakes to avoid when filling out the form include failing to provide necessary explanations for deductions or miscalculating tax liabilities. Taking your time and being methodical in your approach can prevent issues from arising after submission.

Editing and customizing your CDTFA-403- form

Editing the CDTFA-403-C form is straightforward with pdfFiller. This platform facilitates real-time adjustments, giving you the flexibility to ensure all information is current and accurate before submission.

To edit the form, simply upload the CDTFA-403-C PDF into pdfFiller. You can use various editing tools to add notes, comments, and annotations directly onto the form. This feature is particularly useful for collaborative projects, allowing team members to contribute insights or additional information on the same document.

After making necessary edits, it's essential to save your customized form securely. pdfFiller enables you to store all your forms in the cloud, ensuring they are accessible whenever you need them. This means you can retrieve, review, and update your documents with ease.

eSigning the CDTFA-403- form

The eSigning process for the CDTFA-403-C form is designed to streamline finalizing your document without needing to print and physically sign it. Understanding the eSigning process is important to ensure that your submission is compliant and legally binding.

To eSign the form, simply use the signature feature in pdfFiller. After completing your form and reviewing all entries, you will click the eSign option, which provides a secure method to sign electronically. Following the guided prompts, you can create your signature or use a saved version.

Legal considerations for eSignatures in California confirm that electronically signed documents hold the same validity as physical signatures provided they meet specific criteria. Familiarizing yourself with these regulations can assure you of the standing of your submissions.

Submitting the CDTFA-403- form

Once you have completed and signed your CDTFA-403-C form, the next step is submission. The CDTFA allows for multiple methods of submission, providing flexibility based on what works best for you or your organization.

You may submit the form electronically through the CDTFA's online platform, which is generally the fastest option. Alternatively, the form can be printed and mailed to the designated address provided on the form. Always check for the most recent submission addresses listed by the CDTFA to ensure compliance.

Deadlines for submission vary, depending on your reporting period. Ensure that you are aware of your reporting schedule to avoid late penalties. After submitting, tracking your submission status through the CDTFA website can provide peace of mind, ensuring your form has been received.

Managing your CDTFA-403- form documents

Once you’ve submitted the CDTFA-403-C form, maintaining organization with your tax documents is essential. pdfFiller offers an excellent solution for keeping track of forms, notifications, and supporting documents associated with your tax filings.

With pdfFiller, documents can be easily organized in folders, making retrieval simple whenever you need past forms for reference or audits. Another benefit is that collaborating with team members or stakeholders becomes effortless, allowing for smooth sharing of documents.

Additionally, archiving features help manage the historical records of past forms submitted. Keeping these records can not only support future filings but also provide essential references in case of queries or audits by the tax authority.

Frequently asked questions (FAQ) about the CDTFA-403- form

When filing any tax-related form, questions may arise about the process. Here are some commonly asked questions regarding the CDTFA-403-C form.

Related forms and publications

Understanding the context of the CDTFA-403-C form can be enhanced by being aware of related tax forms and publications. Various forms complement the reporting process depending on your tax needs.

Linking to other useful resources, such as the CDTFA website or instructional publications, can provide greater clarity and insights needed for the effective completion of various forms.

Tips for effective document management

Managing tax forms and documents requires a systematic approach. Here are best practices to enhance your form handling and ensure you remain compliant.

By adopting these practices, you can assure a smooth experience when dealing with your tax responsibilities, safeguarding your documents from potential issues.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my cdtfa-403-c in Gmail?

How can I get cdtfa-403-c?

How do I edit cdtfa-403-c online?

What is cdtfa-403-c?

Who is required to file cdtfa-403-c?

How to fill out cdtfa-403-c?

What is the purpose of cdtfa-403-c?

What information must be reported on cdtfa-403-c?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.