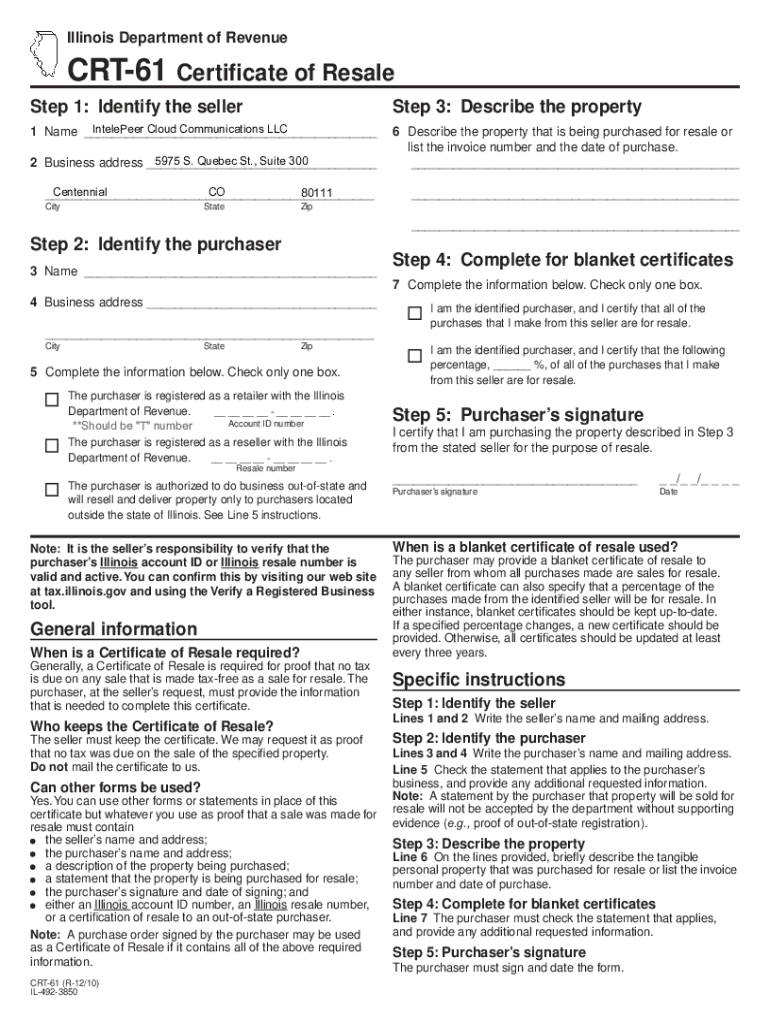

Get the free Crt-61 Certificate of Resale

Get, Create, Make and Sign crt-61 certificate of resale

How to edit crt-61 certificate of resale online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crt-61 certificate of resale

How to fill out crt-61 certificate of resale

Who needs crt-61 certificate of resale?

CRT-61 Certificate of Resale Form: A Comprehensive How-To Guide

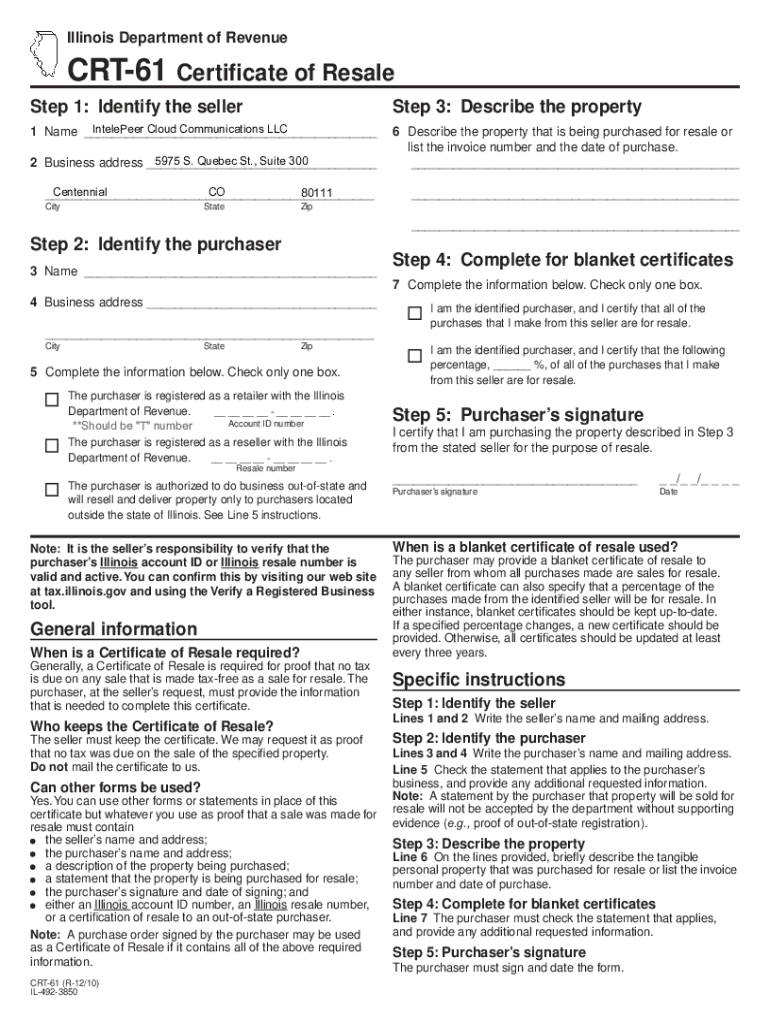

Understanding the CRT-61 certificate of resale form

The CRT-61 certificate of resale form is a vital document used by business owners or resellers to make tax-exempt purchases of goods intended for resale rather than consumption. This form allows sellers to purchase items without paying sales tax upfront, as long as the goods will eventually be resold.

The importance of the CRT-61 form in sales tax exemption cannot be understated. By utilizing this certificate, businesses conserve cash flow and avoid unnecessary financial strain resulting from preemptively paying sales taxes. This document is indispensable for any business model that relies on reselling products.

Small business owners, large retailers, wholesalers, and any entity engaged in buying goods for resale purposes will find the CRT-61 certificate beneficial. It's a legal tool designed to streamline the purchasing process while ensuring compliance with state tax regulations.

The legal framework surrounding the CRT-61 form

Understanding the legal framework surrounding the CRT-61 certificate requires insight into sales tax laws specific to your state. Each state has unique regulations governing the utilization of resale certificates, which dictate how and when a business can claim sales tax exemptions.

Moreover, differences can be noted between various state resale certificates, as some states accept a standard form while others may have unique formats and stipulations. This can affect how a CRT-61 certificate is perceived and accepted in different jurisdictions.

The legal implications of using the CRT-61 cannot be ignored. Misuse of the resale certificate—either by improper claims of tax exemption or failure to comply with state regulations—can result in heavy fines, back taxes owed, and even criminal charges in severe cases.

How to obtain a CRT-61 certificate

Obtaining a CRT-61 certificate involves several key steps. To start off, gather the required information to complete the form accurately. This typically includes your business name, address, and seller's permit number, among other details.

Once you've completed the CRT-61 form, the next step is determining where to submit it. Typically, you would submit the certificate to your vendors for their records. Make sure to keep copies of the submitted forms as they may be necessary for tax audits. Submission deadlines may vary by state, so check your local regulations to ensure compliance.

Using the CRT-61 certificate of resale form

Presenting the CRT-61 certificate to vendors requires understanding how to effectively communicate its purpose. When providing the CRT-61 certificate, ensure that it’s presented clearly and that the vendor recognizes it as a legitimate document for tax exemption on resale purchases.

It's also essential to be aware of the conditions for acceptance by sellers. Not all vendors are obligated to accept the CRT-61 certificate, especially if they suspect it’s being misused. Sellers will often require proof that your business is legitimate and registered to resell goods.

When making purchases using the CRT-61, keep in mind the importance of adhering to all related laws and regulations. Missing the requirement not only jeopardizes your tax-exempt status but can also lead to significant financial repercussions, including back taxes and fines.

Managing and renewing your CRT-61 certificate

Managing your CRT-61 certificate involves a proactive approach, particularly regarding keeping track of expiration dates. While many states do not issue a renewal requirement for resale certificates, it's crucial to stay informed about your state’s policies and regularly confirm that your information remains up to date.

Updating business information on your CRT-61 certificate is another critical aspect. If your business undergoes any changes—like a shift in ownership or changes to your seller’s permit number—it’s essential to revise your CRT-61 accordingly. This ensures seamless operations and avoids potential complications during vendor transactions.

If your CRT-61 certificate does expire, the renewal process typically requires resubmitting the form and all associated documentation. Consult your state’s tax authority to understand the specifics regarding what documentation is necessary and if any past compliance issues need addressing.

Common questions and troubleshooting tips

What happens if your CRT-61 is denied? Denials can occur for reasons such as incomplete information or if the vendor believes you’re not engaged in a legitimate resale operation. In such cases, directly communicating with the vendor to clarify details or resubmitting the CRT-61 with the correct information can help resolve the issue.

For businesses that do not qualify for a CRT-61, alternative options exist. You might consider looking into different types of resale certificates or exploring other local exemptions specific to your product line. Engaging with a tax consultant can also provide valuable insights tailored to your business model.

Lastly, frequently asked questions about resale certificates often include inquiries about what items are eligible for resale, the appropriate methods for maintaining records, and how to properly educate staff about using the CRT-61 form correctly. Consider creating a small internal guide to address these common concerns, ensuring your team is informed and compliant.

Real-world scenarios involving CRT-61 certificates

Exploring real-world scenarios where the CRT-61 certificate has been successfully utilized can shed light on its profound impact. For example, a retailer in the apparel industry that made consistent and effective use of the CRT-61 certificate was able to streamline its procurement process, avoiding unnecessary sales taxes, thereby maximizing its profit margins.

Conversely, consider the challenges faced by a new business that began operations without knowing the importance of the CRT-61 form. For this company, failure to obtain and utilize the certificate resulted in impacting cash flow, which put them at a competitive disadvantage against established sellers who were minimizing their tax burdens through proper use of the CRT-61.

Additional resources for further learning

For those looking to expand their knowledge about the CRT-61 certificate and related topics, various resources are available. State and local tax authorities provide updates on regulations and guidelines regarding sales tax and resale certificates. Additionally, comprehensive guides can help identify proper procedures for maintaining compliance.

Consider using document management solutions, such as pdfFiller, which provides a user-friendly platform for editing, signing, and managing your CRT-61 and other crucial business documents. For efficiency, utilizing cloud-based tools enhances accessibility, allowing for real-time edits and quick updates as required.

Lastly, for easy access to forms and submissions, downloading the CRT-61 certificate and other related documents through recommended channels ensures that you have the right tools in helping your business stay compliant.

Related topics you may find helpful

Understanding the CRT-61 certificate of resale form is just one part of broader sales tax education. For those operating in marketplaces, it is crucial to learn how to handle sales tax for different types of goods, differentiating between what items can be included or excluded from taxation.

The growing concept of economic nexus emphasizes the need to stay compliant with tax laws that may have changed due to online sales and expanding business territories. Furthermore, keeping track of marketplace facilitator laws in your state may provide additional insights into compliant tax practices to better prepare your business as it grows.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit crt-61 certificate of resale online?

How do I make edits in crt-61 certificate of resale without leaving Chrome?

How do I fill out the crt-61 certificate of resale form on my smartphone?

What is crt-61 certificate of resale?

Who is required to file crt-61 certificate of resale?

How to fill out crt-61 certificate of resale?

What is the purpose of crt-61 certificate of resale?

What information must be reported on crt-61 certificate of resale?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.