Get the free Council Tax - learn which properties are exempt

Get, Create, Make and Sign council tax - learn

How to edit council tax - learn online

Uncompromising security for your PDF editing and eSignature needs

How to fill out council tax - learn

How to fill out council tax - learn

Who needs council tax - learn?

Council Tax - Learn Form

Understanding council tax

Council tax is a local taxation system used in England, Scotland, and Wales, primarily to fund local services including education, emergency services, and infrastructure. It is assessed on residential properties and is based on their estimated market value as of April 1, 1991, in England and April 1, 2003, in Wales. Each property is assigned to one of eight valuation bands, and the amount payable differs based on this band. Understanding council tax is crucial for residents, as it directly affects local governance and services.

The importance of council tax extends beyond mere payment; it serves as a critical revenue source for local authorities. This funding enables councils to fund essential community services which are vital for public welfare. Every adult residing in a property is placed under the legal obligation to pay council tax, with certain exceptions for specific groups such as students and individuals residing in care homes.

Types of council tax documents

Individuals must familiarize themselves with various council tax documents to manage their obligations effectively. Common forms include bill statements, which itemize the amount due, payment deadlines, and any applicable discounts. Additional essential documents comprise application forms for discounts and exemptions. These documents are crucial for residents who may qualify for reduced rates or other financial support.

Furthermore, assessment notices are important documents that inform taxpayers of how their property has been valued and the associated council tax band. Understanding the intricacies of these various documents facilitates informed decision-making in managing council tax responsibilities.

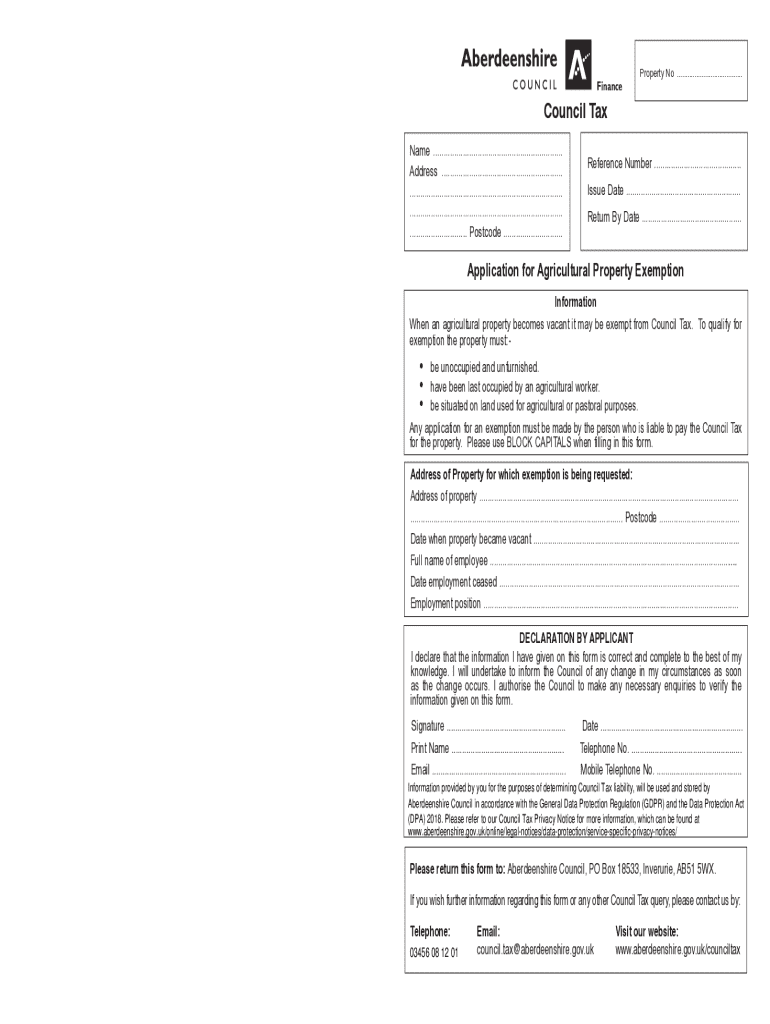

Filling out the council tax form

Completing your council tax form accurately is essential to ensure correct taxation and avoid penalties. To begin, gather your documentation, including your property details and any relevant financial information. A step-by-step walkthrough typically begins with entering personal details such as your name, address, and unique identification number, usually found on previous tax documentation.

Ensure to pay close attention to key sections of the form. Details regarding household members, including their ages and status (students or non-students), significantly impact your tax rate. Accurately entering financial information, including any sources of income, is vital for managing potential discounts or benefits. Any discrepancies could lead to issues with your council tax bill, making it crucial to double-check these details.

Editing council tax documents

If you need to make adjustments to your council tax forms, utilizing tools like pdfFiller can streamline this process. The platform provides interactive editing capabilities that allow users to adjust existing documents with ease. Users can modify text, add or delete information, and integrate signatures directly onto the form.

To make real-time changes, take advantage of pdfFiller's comprehensive toolset, which simplifies navigation around your document. Editing is not just about correcting mistakes; it's also about ensuring that all information is accurate and reflective of your current situation, thus making sure your council tax assessments are error-free.

Signing and submitting your council tax form

Once your council tax form is complete, the next step is to sign and submit it. Various e-signing options are now available that cater to your preference for digital submissions. With eSigning on pdfFiller, you can create a legally binding signature that can be applied directly to your documents.

It's essential to follow the correct submission guidelines to ensure your form is accepted. Familiarize yourself with the local council's specific requirements regarding submission methods. You have the option to submit digitally via email or an online portal, or traditionally through postal mail, each requiring distinct handling precautions.

Managing your council tax documents

After submission, proper management of your council tax documents becomes essential. Keeping track of your submissions and maintaining a well-organized record system aids in avoiding potential issues in the future. Using a tool like pdfFiller can assist in document organization with cloud storage capabilities, making it easier to access your files from anywhere.

Moreover, cloud storage allows for the easy sharing of documents among team members or household members, ensuring everyone stays informed about council tax responsibilities and deadlines. This systematic approach to document management can alleviate stress and enhance clarity around your financial commitments.

Understanding council tax reductions and exemptions

Many individuals may find themselves eligible for reductions in their council tax bills. Various categories of people, such as full-time students, individuals with disabilities, and those on certain benefits, can often receive discounts. The first step to secure any potential support is to complete the relevant forms accurately and submit them on time.

To apply for council tax support, you should provide evidence of your eligibility enclosed with your application, including proof of status or income. Keep in mind important deadlines for submitting these forms to ensure you don’t miss out on possible savings. It's beneficial to regularly review your circumstances, as changes may impact your discounts.

Handling common issues with council tax forms

Individuals often encounter common errors when filling out council tax applications. These can range from misreported personal details to inaccuracies in financial data. Addressing these errors promptly is crucial to avoid unnecessary penalties or complications with your local council.

If you notice a mistake after submission, refer to your local council's processes to amend your form. Taking prompt action can help clarify any overstated charges or rectify any misinformation that could lead to legal issues. Staying proactive in managing your documents is fundamental to ensuring a smooth council tax experience.

Resources for further assistance

For users needing additional help with council tax forms and related processes, reaching out to your local council tax team is a great first step. They can provide guidance tailored to your specific situation. Several online tools and resources are also at your disposal, including government websites and community forums that discuss council tax issues.

Accessing government guidelines ensures you stay informed about your rights and responsibilities regarding council tax. These resources can help provide clarity when dealing with complex issues surrounding your council tax documentation.

FAQs about council tax forms

FAQ sections are invaluable for addressing common concerns related to council tax processes. Questions often arise around eligibility for discounts, how to accurately fill in forms, and rights regarding billing disputes. Understanding these FAQs can alleviate anxiety surrounding any part of the council tax journey.

Additionally, diving into legalities helps clarify how local councils operate, ensuring you're protected and informed. If queries persist regarding billing or dismissals of applications, knowing whom to contact can save a great deal of frustration.

Additional tips for successful council tax management

For long-term management of your council tax obligations, implement best practices that streamline your financial record-keeping. Regularly reviewing your council tax documents can help in identifying discrepancies promptly. Staying updated on upcoming changes to council tax laws and processes is important, as this information can impact your obligations and financial planning.

Leveraging tools like pdfFiller for document management ensures you can access, edit, and share your documents seamlessly. This cloud-based platform not only simplifies filling out forms but also supports ongoing updates and organization of your council tax documents even in changing legislative landscapes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in council tax - learn without leaving Chrome?

Can I edit council tax - learn on an iOS device?

How do I complete council tax - learn on an iOS device?

What is council tax - learn?

Who is required to file council tax - learn?

How to fill out council tax - learn?

What is the purpose of council tax - learn?

What information must be reported on council tax - learn?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.