Get the free pdf filler

Get, Create, Make and Sign pdf filler form

How to edit pdf filler form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdf filler form

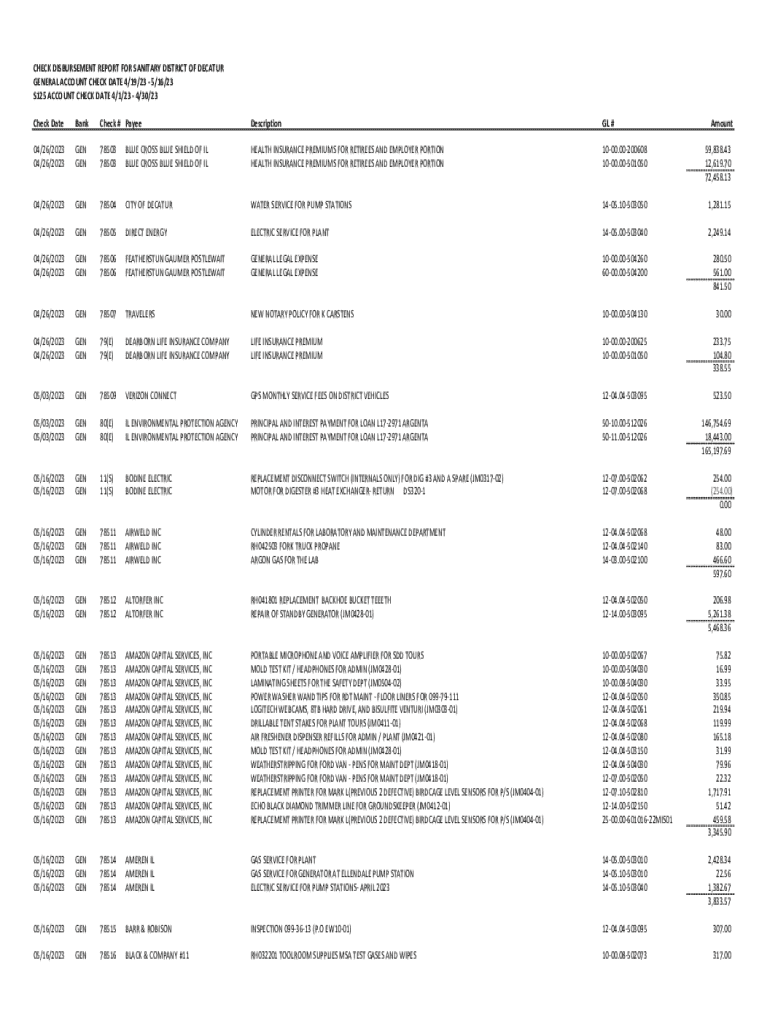

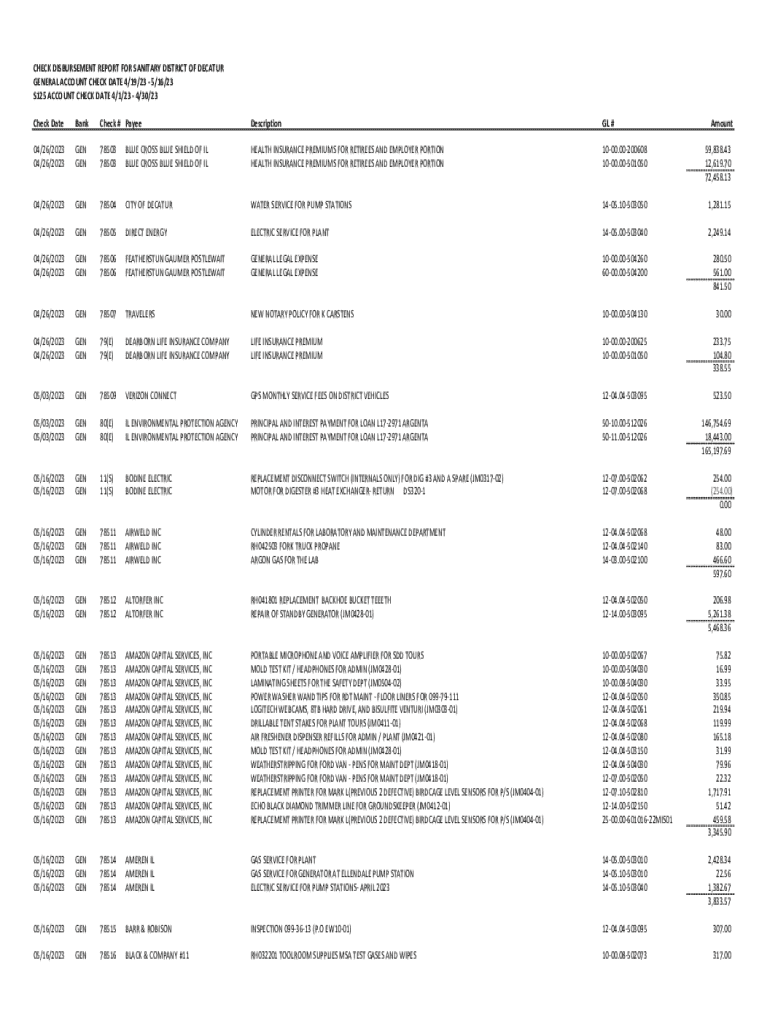

How to fill out check disbursement report for

Who needs check disbursement report for?

A comprehensive guide to check disbursement report for form

Understanding disbursement reports

Disbursement reports are essential financial documents that track and outline the distribution of funds by an organization or service provider. They provide a detailed account of payments made, detailing the amounts, recipients, and the purpose of each disbursement. Understanding disbursement reports is crucial, as they ensure transparency and accountability in financial operations.

The primary purpose of disbursement reports is to facilitate effective financial management. They aid in budgeting, tracking expenditures, and maintaining compliance with regulations. Moreover, accurate disbursement reporting is vital for both individuals and teams, as it enables them to monitor cash flow and make informed decisions, thereby preventing financial discrepancies.

Overview of the disbursement reporting process

The disbursement reporting process is systematic, involving several key steps to ensure accuracy and completeness. It begins with the collection of required data, which includes information about recipients, payment amounts, and the purpose of disbursements. This step is fundamental as it lays the groundwork for the entire reporting process.

Following data collection, the next phase involves selecting and preparing the appropriate disbursement report form. This form can be customized based on specific needs, which enhances its relevance and utility. Data entry must then be executed with precision, followed by a thorough verification to ensure all information is correct and in compliance with organizational policies.

The review and approval process is critical as it verifies that the disbursement aligns with budgetary guidelines and authorization procedures, providing a final check to maintain accuracy.

Accessing the disbursement report form

To check disbursement report for form, users can easily access the disbursement report form through pdfFiller. This platform is user-friendly, allowing for seamless navigation to locate the necessary forms quickly. Users can perform a simple search or browse through categories to find the report form that suits their needs.

Once located, pdfFiller offers options to customize the form. Users can tailor the template to include specific fields or instructions, ensuring the reporting aligns perfectly with the unique requirements of their organization or project. This flexibility aids in simplifying the reporting process, making it more efficient.

Filling out the disbursement report form

Completing the disbursement report form requires careful attention to detail. Essential fields to fill out include recipient information, the amount disbursed, the date of disbursement, and a narrative explanation of the purpose of the payment. Each of these fields plays a pivotal role in establishing clarity and accountability.

To ensure accuracy in data entry, it's beneficial to double-check all information against supporting documents, such as invoices or receipts. Establishing a routine for verifications can significantly reduce the potential for errors, allowing teams to produce accurate and reliable disbursement reports.

Checking and editing the disbursement report

After filling out the disbursement report, users must check for accuracy. If amendments are necessary, pdfFiller provides tools to edit or amend the report easily. This functionality helps in correcting mistakes without needing to redo the entire document.

Additionally, pdfFiller's collaboration features allow teams to involve multiple members in reviewing the document. This collaborative approach ensures diverse perspectives are accounted for, contributing to the report's accuracy and completeness.

eSigning the disbursement report

Once reviewed, the disbursement report must be signed electronically, which is a straightforward process on pdfFiller. Users can follow simple steps to add their signatures, ensuring that the document is authenticated and ready for submission.

Collecting signatures from multiple parties is also streamlined within pdfFiller. The platform allows documents to be shared with relevant stakeholders, who can sign from any device, thus saving time and enhancing workflow. It's important to note that eSignatures in disbursement reporting hold legal validity, ensuring that electronically signed documents are binding and enforceable.

Managing and storing disbursement reports

Effective document management is crucial for disbursement reports. Users on pdfFiller can implement best practices for organizing their reports for easy access and future reference. This organization not only enhances efficiency but also ensures that individual and team efforts in financial management can be easily traced and audited when necessary.

Moreover, ensuring compliance and security of these documents is paramount. pdfFiller offers robust security features that safeguard sensitive information. Regular backups and application of document classification methods further enhance the safety and organization of disbursement reports.

Common issues when checking disbursement reports

When checking disbursement reports, various issues may arise. Common errors include incorrect data entry, missing signatures, or even discrepancies between reported amounts and actual expenditures. Recognizing these issues early is crucial to maintaining accuracy in financial reporting.

If problems occur, troubleshooting tips can assist. For instance, re-checking figures against original transaction documents can illuminate any discrepancies. In cases of persistent issues, users should not hesitate to seek support from pdfFiller customer service, which provides resources and assistance tailored to their needs.

Additional tools for optimizing disbursement management

To further enhance disbursement management, pdfFiller offers a range of interactive tools designed to provide insights and streamline processes. These features include advanced analytics, automated workflows, and integration capabilities with other financial software, ensuring that users can manage disbursement reporting efficiently.

As organizations adopt more digitized processes, tools that enhance document management become critical. pdfFiller simplifies the entire lifecycle of document creation and management, providing users with the flexibility to adapt and refine their approaches to disbursement reporting.

Frequently asked questions (FAQs)

When issues arise, it's essential to understand how to navigate challenges effectively. Users often wonder what steps to take if they can't find their disbursement report. The answer lies in the platform's robust search functionalities, which allows for quick retrieval of documents based on keywords or tags.

Another common concern is ensuring that disbursement reports are legally binding. Using pdfFiller, eSignatures comply with global eSignature laws. Additionally, users may query the consequences of inaccurate reporting, which can include financial penalties or loss of trust. Engaging with pdfFiller enhances the disbursement reporting experience, providing tools tailored for successful audits and legal compliance.

Real-life scenarios of successful disbursement reporting

Several teams have successfully improved their efficiency in disbursement reporting through pdfFiller. For example, one non-profit organization streamlined their reporting processes by adopting custom templates on pdfFiller, which reduced report preparation time by 30%. This not only saved valuable time but also ensured compliance, leading to better funding relationships.

User testimonials highlight the satisfaction with pdfFiller's features, emphasizing how document collaboration and eSigning capabilities have transformed their workflow. Insights from these real-life scenarios underscore the effective practices adopted in disbursement reporting, showcasing how pdfFiller empowers users to achieve precise and timely financial documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get pdf filler form?

How do I edit pdf filler form in Chrome?

How do I complete pdf filler form on an iOS device?

What is check disbursement report for?

Who is required to file check disbursement report for?

How to fill out check disbursement report for?

What is the purpose of check disbursement report for?

What information must be reported on check disbursement report for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.