Get the free Charitable Contributions Overview

Get, Create, Make and Sign charitable contributions overview

How to edit charitable contributions overview online

Uncompromising security for your PDF editing and eSignature needs

How to fill out charitable contributions overview

How to fill out charitable contributions overview

Who needs charitable contributions overview?

Charitable contributions overview form: How-to guide

Understanding charitable contributions

Charitable contributions refer to the donations made to organizations that are recognized as charitable under IRS regulations. These contributions can take various forms, including cash, goods, and services, and they play a critical role in supporting non-profit organizations, community initiatives, and social causes. Understanding the various aspects of charitable giving is essential, as it not only benefits the recipient organizations but also the donors in terms of potential tax deductions.

The importance of charitable giving extends beyond financial support; it fosters a sense of community, encourages civic engagement, and creates a culture of generosity. Many individuals and businesses engage in philanthropy to give back to their communities, enhance their public image, or fulfill social responsibilities. The benefits associated with making charitable contributions include tax benefits, boosting morale, and the intrinsic satisfaction of making a positive impact.

Types of charitable contributions

Understanding the various types of charitable contributions is crucial for individuals and organizations looking to give back effectively. These contributions can be categorized into several main types.

Tax deduction limitations

Charitable contributions can significantly impact your tax return, offering potential deductions that can lower your taxable income. However, there are several tax consideration factors to keep in mind when engaging in charitable giving.

Substantiation and documentation requirements

Proper documentation is crucial when it comes to claiming charitable deductions on your taxes. The IRS requires substantiation for charitable contributions to ensure accurate and legitimate reporting.

Disclosure requirements for goods and services

Understanding what qualifies as goods and services for donations is essential, as it affects how contributors must disclose their contributions for tax purposes.

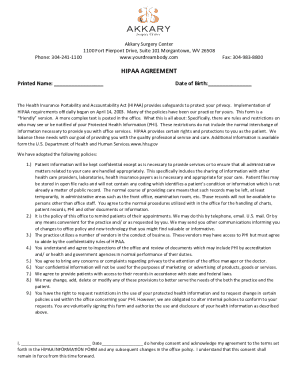

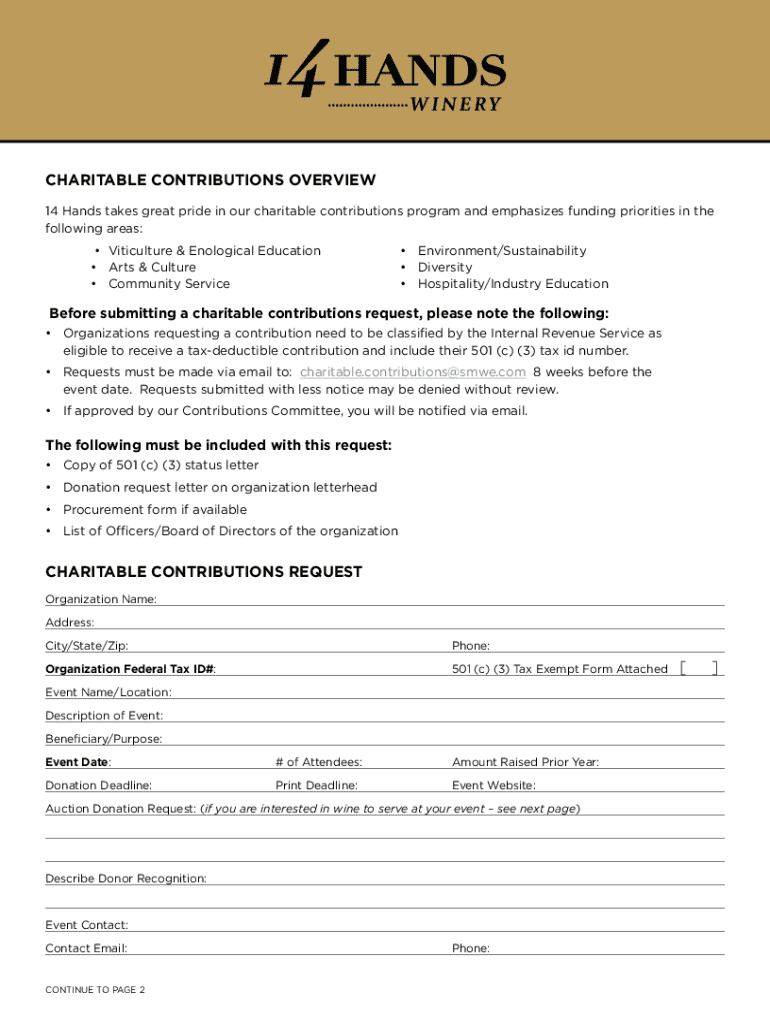

Filling out the charitable contributions overview form

Completing the charitable contributions overview form requires careful attention to detail, ensuring accurate reporting of your charitable gifts.

Tools and resources for managing charitable contributions

Utilizing technology effectively enhances the management of charitable contributions, making it easier to document and track donations.

Legal and ethical considerations

Navigating the landscape of charitable contributions necessitates a clear understanding of legal and ethical implications.

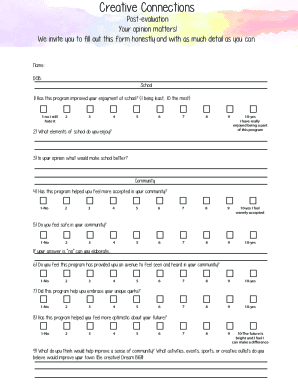

Engaging with your community through charitable giving

Charitable contributions not only support organizations but also deeply engage communities, promoting unity and shared values.

Frequently asked questions (FAQs)

Addressing common queries surrounding charitable contributions helps clarify any uncertainties and builds confidence in the giving process.

Getting help

When in doubt, seeking professional guidance can ensure all aspects of charitable giving are properly navigated.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my charitable contributions overview in Gmail?

Can I sign the charitable contributions overview electronically in Chrome?

How do I complete charitable contributions overview on an Android device?

What is charitable contributions overview?

Who is required to file charitable contributions overview?

How to fill out charitable contributions overview?

What is the purpose of charitable contributions overview?

What information must be reported on charitable contributions overview?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.