Get the free Custom Mobile Homeowners and Manufactured Housing Application

Get, Create, Make and Sign custom mobile homeowners and

How to edit custom mobile homeowners and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out custom mobile homeowners and

How to fill out custom mobile homeowners and

Who needs custom mobile homeowners and?

Custom mobile homeowners and form: A comprehensive guide

Understanding mobile homeowners insurance

Mobile homeowners insurance is a specialized form of insurance designed to protect individuals and families living in manufactured or mobile homes. Unlike traditional home insurance policies, mobile homeowners insurance addresses the unique aspects of these properties, which may involve different risks and coverage needs. For mobile homeowners, understanding this type of insurance is crucial for financial security and peace of mind.

The importance of insurance for mobile homes cannot be understated. In many cases, mobile homes are considered personal property rather than real estate, leading to a different insurance framework. Therefore, having the right coverage in place helps protect against potential losses due to disasters, theft, or accidents.

Customizing your mobile homeowners insurance

Customizing your mobile homeowners insurance starts with understanding specific coverage needs based on individual circumstances. Several key factors should be considered to tailor a policy that offers the right balance of protection and cost. By assessing these variables, homeowners can avoid overpaying while ensuring they have adequate coverage.

Home value assessment involves evaluating the market value of the mobile home, which is fundamental for determining the levels of coverage required. Additionally, it's essential to consider environmental risks, such as flooding or extreme weather conditions in particular areas, which can impact premium rates and coverage options. Lastly, taking inventory of personal property can help in proper valuation to ensure everything is sufficiently covered.

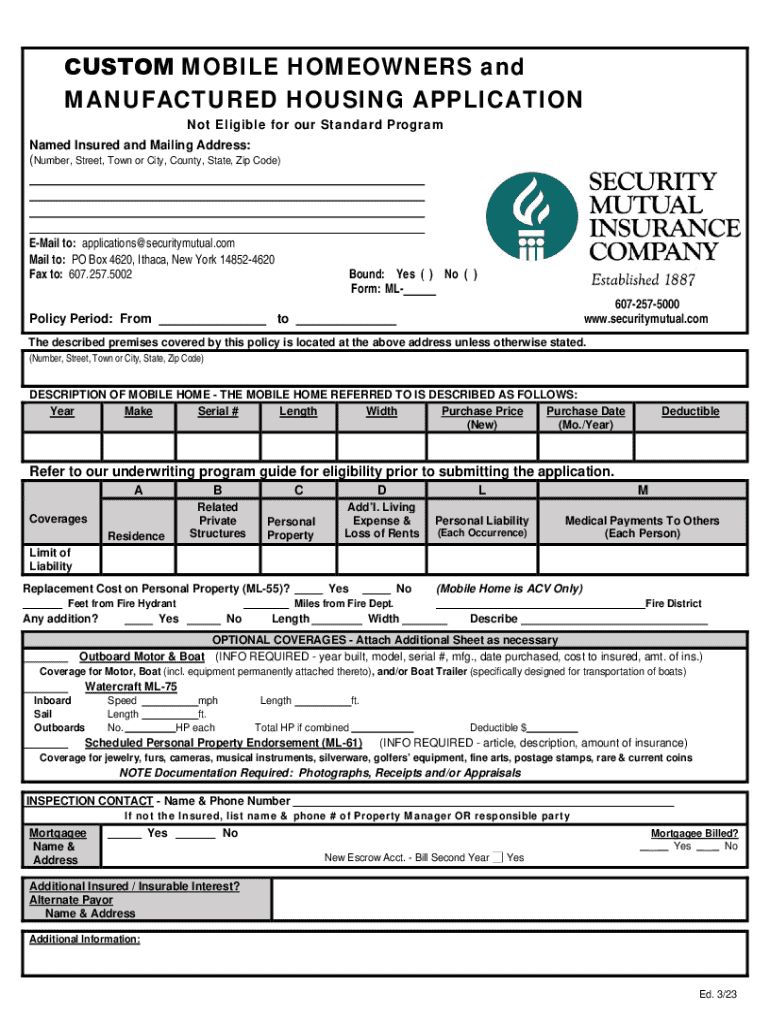

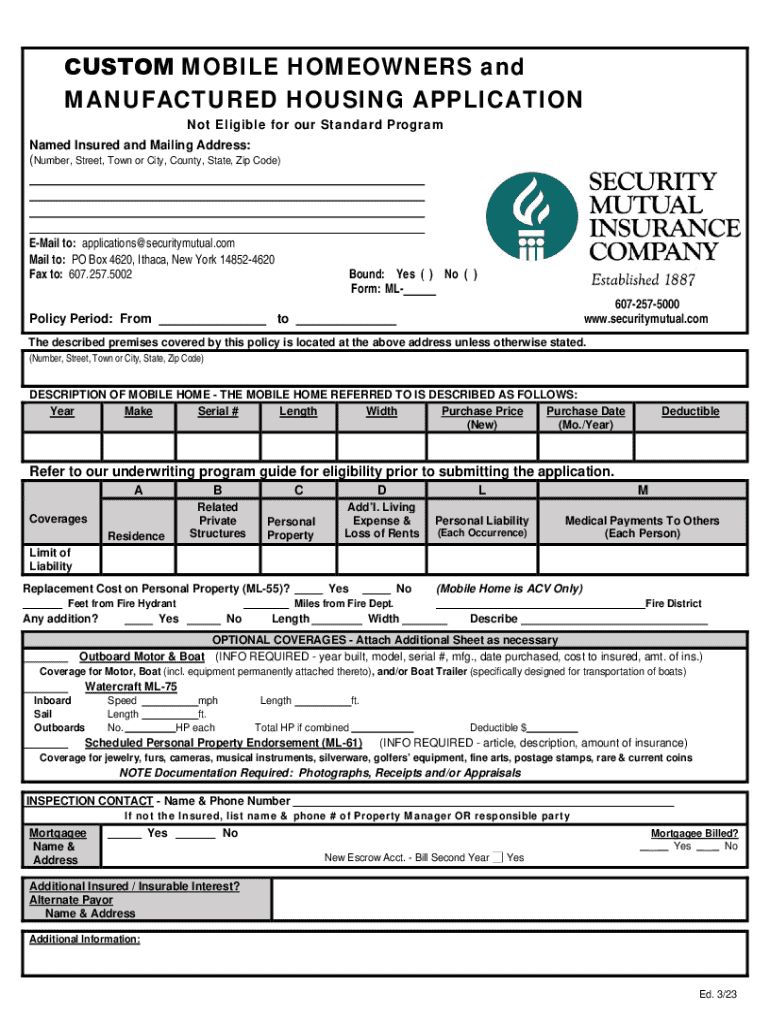

Steps to fill out the mobile homeowners form

Filling out the mobile homeowners insurance form accurately is a critical step in securing your insurance policy. Preparation is key, and having the necessary information readily available can simplify the process. Start by gathering personal identification information and specific details about your home and its specifications.

Once you have the information organized, proceed with a structured approach to complete the form. Input your basic information, including name, address, and other contact details. Follow this by specifying your coverage needs, which should reflect your assessment of home value and personal property. It’s also a good idea to review the form for eligibility for available discounts, such as multi-policy or safety device discounts.

Utilizing interactive tools on pdfFiller for your mobile homeowners form

pdfFiller offers a suite of interactive tools to streamline your insurance form management. Users can upload their mobile homeowners insurance form for editing directly on the platform, making it convenient to adjust or modify information as needed. With the digital signing features, users can sign documents securely and quickly without needing to print, scan, or fax.

Collaboration is enhanced on pdfFiller through options that allow users to share forms with insurance agents or family members easily. This ensures that all parties involved can review and make necessary contributions in real time, boosting accuracy and consensus on the information submitted.

Common pitfalls when filling out mobile homeowners forms

Filling out mobile homeowners forms can be straightforward, but several common pitfalls can lead to complications or denied claims. One frequent mistake is misunderstanding coverage terms; without clarity on policy language, homeowners may select insufficient coverage or overlook necessary riders. To avoid this issue, it's beneficial to study your policy terms or consult with a knowledgeable agent.

Omitting essential information is another danger; even minor details can affect the outcomes of claims. Always double-check that your form includes all required fields and accurate descriptions of your home and belongings. Lastly, ignoring state regulations and requirements can lead to legal challenges; it's crucial to ensure that your policy aligns with local laws to maintain compliance and protect your investment.

Comparing mobile homeowners insurance policies

Once you understand your insurance requirements, comparing various mobile homeowners insurance policies is the next step. Analyzing different policy options helps you to weigh the benefits and drawbacks of various coverages. For example, basic policies may cover only essential losses, while comprehensive policies may encompass a broader scope of protections.

Understanding the difference between deductibles and premiums is vital in this process. Generally, a higher deductible may lower premium costs, but it can mean more out-of-pocket expenses during a claim. When comparing policies, utilize tools like pdfFiller to organize your thoughts and information systematically for interplay across options. Key questions to ask your insurance agent include coverage limitations, exclusions, and potential discounts, ensuring that you make informed decisions.

Benefits of a cloud-based document solution for custom mobile homeowners

Adopting a cloud-based document solution like pdfFiller offers myriad benefits, particularly for custom mobile homeowners. One significant advantage is accessibility; users can access their documents from anywhere, whether at home, in the office, or on the go. This functionality ensures important documents are always available when needed, such as during policy discussions or claims.

Another benefit is enhanced security and compliance. pdfFiller safeguards sensitive insurance information through encryption and other security features, ensuring your documents remain private. Additionally, the time-saving features, such as eSign capabilities and easy editing, streamline document management, enabling users to focus more on home life and less on paperwork.

Additional considerations for mobile homeowners

Regular policy reviews are essential for mobile homeowners. Insurance needs can change over time, especially as you make upgrades to your home, purchase new assets, or move to a different location. Assessment of existing coverage regularly ensures that you maintain appropriate protection without unnecessary costs.

Staying informed about changes in coverage options is also vital. The insurance market is dynamic, and new updates or enhancements may arise that would benefit your situation. Engaging with resources such as homeowner associations or online forums can provide valuable insights and expert advice, ensuring you are never caught off guard when it comes to your insurance needs.

Related articles and resources

For those interested in further exploring mobile homeowners insurance and customization, several articles provide extensive guidance. Look for articles that delve deeper into the nuances of personalizing home insurance and guides focused on sustainable living in mobile homes.

Additionally, establishing contact with experts can offer personalized support tailored to your unique situations. These resources can help you navigate potential challenges and ensure that you are fully aware of your homeowners' rights and obligations. With the right knowledge and tools at your disposal, customizing your mobile homeowners insurance can be a streamlined and straightforward process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my custom mobile homeowners and in Gmail?

How can I edit custom mobile homeowners and on a smartphone?

How do I complete custom mobile homeowners and on an Android device?

What is custom mobile homeowners and?

Who is required to file custom mobile homeowners and?

How to fill out custom mobile homeowners and?

What is the purpose of custom mobile homeowners and?

What information must be reported on custom mobile homeowners and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.