Get the free California Corporation Tax Booklet

Get, Create, Make and Sign california corporation tax booklet

Editing california corporation tax booklet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california corporation tax booklet

How to fill out california corporation tax booklet

Who needs california corporation tax booklet?

Navigating the California Corporation Tax Booklet Form: A Comprehensive Guide

Navigating California corporation tax regulations

California's corporation tax regulations can be complex and often differ significantly from federal tax laws. Understanding these regulations is crucial for corporations operating within the state. California levies a minimum franchise tax on most corporations, and compliance is essential to avoid penalties. Failure to comply with these laws can result in steep fines and even the suspension of corporate rights.

It is imperative for businesses to regularly review the California Franchise Tax Board (FTB) guidelines to ensure they follow proper tax procedures. Distinctions exist between California's corporate tax framework and the federal system, including differences in how income is reported and deductions claimed, making familiarity with the state law crucial for successful tax management.

Inside the California corporation tax booklet

The California Corporation Tax Booklet is a crucial document for businesses required to file corporate taxes in California. This booklet provides the necessary forms and detailed instructions on how to accurately report income, calculate taxes owed, and claim deductions and credits. It serves a dual purpose: guiding taxpayers through the complexities of the tax filing process and ensuring compliance with state tax regulations.

In addition to the primary tax forms, the booklet contains supplementary schedules and appendices that clarify various tax rules. Many corporations rely on this booklet not only for filing but also as a reference point throughout the fiscal year. By consistently consulting the California Corporation Tax Booklet, corporations can maintain organized records and ensure that they meet all legal tax obligations.

Key updates for 2024

For the 2024 tax year, several key updates affect the California corporation tax landscape. Business owners should keenly watch for changes in tax law that may influence their filing strategies. Notably, adjustments may include changes to tax rates, alterations in minimum tax thresholds, and any new available credits that could mitigate tax liability.

The FTB has introduced additional reporting requirements designed to enhance transparency within California's business sector. Corporations must familiarize themselves with these developments to avoid adverse consequences. It is essential to review updated tax credits and deductions closely, as the state seeks to encourage specific industries and practices through financial incentives.

Understanding your tax obligations

Corporations in California need to understand the distinction between franchise tax and income tax. The franchise tax is a fee imposed on corporations for the privilege of conducting business in California, while income tax refers to taxes on profit. Many companies are often subject to both taxes, placing an added emphasis on thorough tax planning and accurate filings to minimize liabilities.

Corporations must pay at least the minimum franchise tax, which affects most businesses operating in California. As of 2024, this tax is set at a fixed rate that doesn’t depend on actual profits, thus acting as a baseline tax requirement. Establishing the right accounting period and method is also critical in meeting state tax obligations, as improper bookkeeping can lead to incorrect filings. It's also vital to be aware of the deadlines for filing tax returns and for applying for extensions to avoid unnecessary penalties.

Preparing the California corporation tax return

Once corporations have reviewed their tax obligations, the next critical step is preparing the California corporation tax return. Completing the return requires meticulous attention to detail, as even minor errors can lead to delays or audits. The California Corporation Tax Booklet provides a step-by-step guide for accurately filling out the form, highlighting important sections and common pitfalls to avoid.

In understanding specific lines of the form, taxpayers will benefit from a breakdown. For instance, detailing revenue sources must be precise and supported with appropriate documentation. Deduction claims also need to be accurately attributed to prevent discrepancies. Utilizing software or assistance tools, such as pdfFiller, can streamline this process, ensuring compliance while minimizing complications in document management.

Schedules and additional forms

In addition to the primary forms, several schedules must be completed for a comprehensive tax filing. These schedules include Schedule A, which handles taxes deducted, Schedule D for capital gains or losses, and Schedule F, which details net income calculations. Each schedule serves its purpose and helps in breaking down the information needed for accurate tax assessments and claims.

Tax credits and deductions specific to California

California offers a range of tax credits and deductions aimed at fostering economic growth and supporting various industries. A comprehensive review of available credits, such as the California Competes Tax Credit and the Research & Development Tax Credit, can uncover significant savings for businesses. Understanding which credits apply to specific operations or expenditures is critical for optimizing tax positions.

It's also important to note that some previously available credits may have been repealed but may still offer carryover provisions. Corporations should strategize around these past credits to maximize potential future claims. Additionally, industry-specific credits provide unique advantages to corporations engaged in particular sectors, making targeted research an essential consideration for California businesses.

Special considerations for corporations

Corporations must address several special considerations in preparing their tax returns for California. Understanding how to handle Net Operating Loss (NOL) deductions is paramount. California allows corporations to carry forward NOLs, providing that these deductions are appropriately documented and calculated to offset future taxable income effectively.

Furthermore, for multinational corporations, compliance with both local and foreign tax regulations becomes essential. Navigating the complexities of dual tax obligations requires meticulous record-keeping and accurate reporting. Limited Liability Companies (LLCs) that elect to be treated as corporations face different compliance standards as well, and those interested in choosing this route should seek expert guidance to enhance understanding of associated compliance measures.

Filing process and payment options

The process of filing the California corporation tax return can be completed electronically or via traditional paper filing. E-filing is often recommended due to its efficiency, reduced processing time, and provisions for immediate confirmation of receipt. Corporations must evaluate their preferences when determining the best filing method to align with their operational practices.

When it comes to payment options, corporations can choose from electronic funds transfers, credit card payments, or electronic check payments. It’s essential to choose a method that suits their financial processing capabilities. Understanding different payment options, including the ability to set up installment plans for larger tax debts, will help corporations manage their cash flows effectively while ensuring timely compliance.

Resolving issues and navigating IRS challenges

Filing issues and challenges with the IRS can arise for numerous reasons, such as discrepancies in income reporting or missing documentation. Knowing how to address and resolve these problems is crucial for maintaining compliant corporate records. Corporations should keep a comprehensive log of any communications with tax authorities and be ready to provide supporting documentation for claims.

For assistance, businesses can reach out to the FTB or consult with tax professionals equipped to handle specific inquiries. Understanding taxpayer rights under California law is vital in challenging situations, ensuring that corporations are treated fairly during the resolution of tax disputes.

Additional resources for taxpayers

Corporations seeking additional resources can find various California tax forms and publications online through the FTB website. Automated phone services are also available for quick assistance with simple queries, providing businesses with immediate access to critical filing information. Utilizing online tools for calculation and submission stands out as one of the most effective ways to enhance efficiency during tax season.

Platforms like pdfFiller play a significant role in making tax management smoother and more organized. With interactive tools and features, businesses can ensure they always have the required access to forms and can file their returns accurately and on time. Developing an organized system for managing tax documentation is essential to prevent last-minute challenges.

Frequently asked questions (FAQs)

As tax season approaches, many corporations have common questions related to the California corporation tax booklet form. Understanding the implications of missing filing deadlines is crucial. Corporations can incur penalties and interest on unpaid taxes, which further impacts their financial standing. Options are available for amending returns, allowing businesses to correct any inaccuracies post-filing.

Another prevalent concern is the status of corporations that are suspended or forfeited. These corporations may need to navigate specific protocols to restore good standing with the state before filing any returns. Addressing these FAQs not only aids in clarity but empowers corporations to manage their responsibilities proactively.

Success stories: Seamless tax management with pdfFiller

Numerous businesses have successfully navigated the complexities of tax filing in California through the use of pdfFiller. Real-life examples highlight how users have effectively utilized the platform's document management tools to streamline their corporation tax filing process. Customers report a notable reduction in stress and time invested thanks to features that enable easy editing, signing, and secure collaboration.

Testimonials from satisfied users emphasize the importance of having a reliable solution like pdfFiller to navigate the California corporation tax booklet efficiently. By leveraging pdfFiller, businesses can ensure they have the latest forms, provide accurate filings, and maintain compliance from anywhere, ultimately making tax season a smoother experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

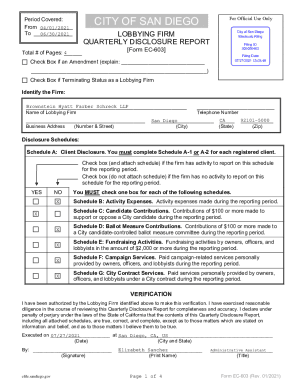

How do I execute california corporation tax booklet online?

How do I edit california corporation tax booklet straight from my smartphone?

Can I edit california corporation tax booklet on an iOS device?

What is California corporation tax booklet?

Who is required to file California corporation tax booklet?

How to fill out California corporation tax booklet?

What is the purpose of California corporation tax booklet?

What information must be reported on California corporation tax booklet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.