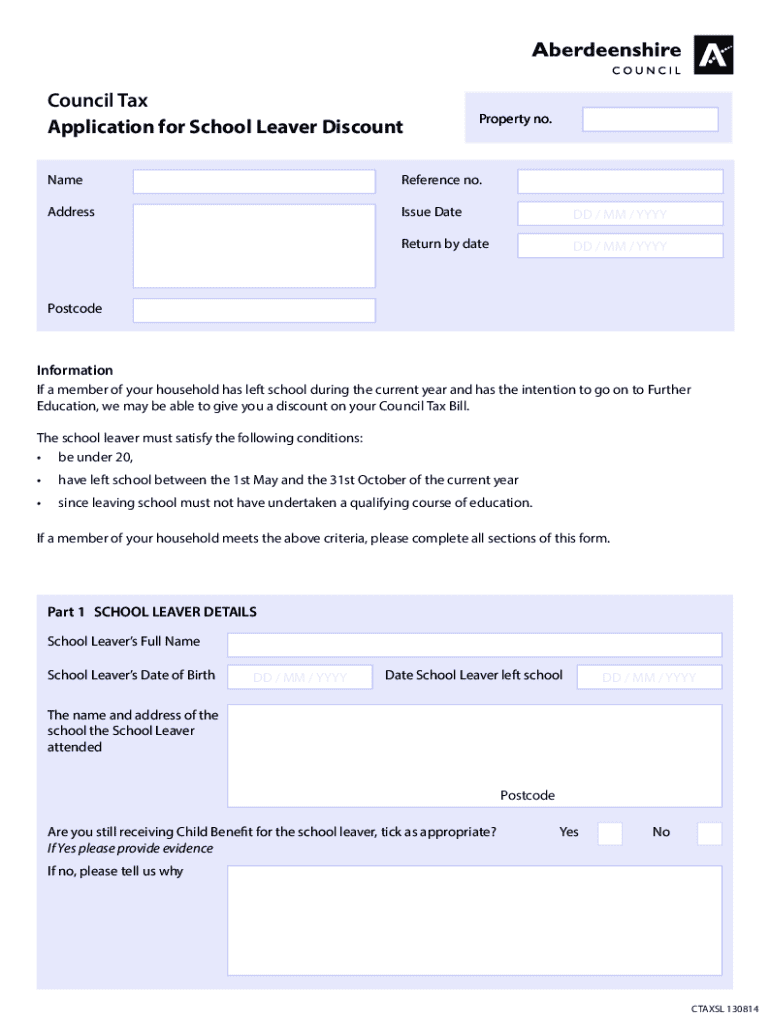

Get the free Council Tax Application for School Leaver Discount

Get, Create, Make and Sign council tax application for

Editing council tax application for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out council tax application for

How to fill out council tax application for

Who needs council tax application for?

Council Tax Application for Form: A Comprehensive Guide

Understanding council tax

Council tax is a municipal levy imposed on residential properties in the UK, designed to fund local services such as education, waste collection, and emergency services. Each borough sets its council tax rates based on the value of homes, ensuring a collaborative effort to maintain and enhance community living standards.

Paying council tax is crucial as it plays a significant role in local governance and the upkeep of public services. Proper funding enables councils to address community needs efficiently, thus fostering growth and safety.

Who is responsible for paying council tax?

Generally, the adult occupants of a property are liable for council tax. However, exemptions may apply for certain individuals, such as full-time students or someone under the age of 18. It's essential to understand your eligibility, as many people mistakenly believe they're automatically exempt just because of their circumstances.

Types of council tax forms

When applying for council tax reduction or exemptions, it’s crucial to select the appropriate form. Among the most common are the application for council tax reduction, forms for various exemptions, and those for discounts like single occupancy.

Choosing the right form often depends on your specific circumstances. For instance, if you are a full-time student, you will need to complete a different form compared to someone seeking a reduction due to low income.

Getting started with your council tax application

Before diving into the application process, gather all necessary information and documentation. This includes proof of residence, income statements, and identification. Additionally, understand the specifics of your property—its valuation band, and any local regulations that pertain to council tax.

Taking the time to prepare effectively can streamline your application process significantly. Ensure you have all relevant details handy, as missing information can lead to unnecessary delays.

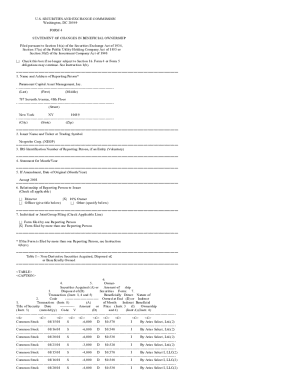

Filling out the council tax application form

Filling out the council tax application form can seem daunting, but breaking it down into manageable sections can help. Start with Section 1, which requires your personal information such as name, address, and contact details.

Next, move on to Section 2, which focuses on property details—this includes the property type, council tax band, and occupancy status. Finally, Section 3 covers financial circumstances, where you will detail your income sources, expenses, and any relevant financial support received.

Submitting your council tax application

After completing your application form, you have several options for submission: online, by post, or in person, depending on your local council's preferred methods. Each method has specific requirements—for example, online submissions typically require a registered account on your local council’s website.

Using the online method can often lead to faster processing times, while postal submissions might take longer due to mail delivery delays. If submitting in person, be sure to check council hours and whether you need to make an appointment.

Tracking your application status

Once you’ve submitted your council tax application, you can track its status through your local council’s online portal. Many councils offer an application tracking tool that allows applicants to check their application progress quickly.

If you find yourself waiting longer than expected, don’t hesitate to reach out directly to your local council's support team for updates. They can provide additional information and clarify any doubts about the process.

Dealing with common issues

If your application is rejected, don't panic. Understanding the common reasons for rejection—like missing documentation or inaccuracies in your information—can help you adjust your application accordingly. Ensure that all paperwork is complete and accurate before resubmission.

If you wish to dispute a decision, you are entitled to appeal. Ensure you gather necessary evidence to support your case and follow the council's appeal procedures carefully to maximize your chances of success.

Additional applications related to council tax

Depending on your specific circumstances, various additional forms may be available to apply for discounts or exemptions. Applications can vary significantly based on factors like disability, age, or student status. Each category typically requires different documentation and processes.

If you are unsure about the forms you need, checking with your local council’s support team or their website will help clarify what you need for your application.

Managing your council tax online

Accessing your council tax information and managing your accounts online can save you time and effort. Most councils have user-friendly portals where residents can view bills, submit applications, and track payments. To get started, create an account on your local council’s website, which is a straightforward process.

Once you're registered, you can use online tools for managing payments, checking your application status, and even eSigning important documents. Tools like pdfFiller make it incredibly easy to create, edit, sign, and submit your council tax forms electronically, ensuring a seamless experience.

Alternative support and resources

If you have questions or encounter issues during the application process, don't hesitate to seek help from your local council's support. Most councils have dedicated teams ready to assist with queries related to council tax.

There are also numerous online resources available, including government websites that outline council tax regulations, as well as community forums that can provide peer support for those dealing with similar issues.

Frequently asked questions (FAQs)

Throughout the application process, many common questions arise. If you move home, you typically must update your council tax application to reflect your new circumstances. Furthermore, if your financial situation changes, be proactive about updating your application to ensure accurate billing.

Feedback and improvement

Providing feedback on your experience with the council tax application process is incredibly important. This input helps councils refine their processes and serve the community better. Participate in community consultations or surveys as they arise, contributing to potential improvements.

Engaging with local authorities ensures that your voice matters in shaping policies that affect your financial obligations and community services.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my council tax application for directly from Gmail?

Can I create an eSignature for the council tax application for in Gmail?

How do I edit council tax application for on an Android device?

What is council tax application for?

Who is required to file council tax application for?

How to fill out council tax application for?

What is the purpose of council tax application for?

What information must be reported on council tax application for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.