Idaho Independent Contractor Agreement Form: A Comprehensive Guide

Understanding independent contractors in Idaho

An independent contractor is an individual or business entity contracted to provide services to another business or individual under terms specified in a contract. In Idaho, these contractors maintain a degree of autonomy in how they carry out their tasks, distinguishing them from traditional employees who typically work under direct supervision.

The primary differences between employees and independent contractors are based on control, benefits, and tax obligations. Employees have a set schedule, are entitled to benefits like health insurance, and have taxes withheld from their paychecks. Conversely, independent contractors set their schedules, are not entitled to employee benefits, and are responsible for managing their tax obligations.

Correct classification as either an independent contractor or an employee is crucial, as misclassification can lead to legal and financial repercussions. For instance, misclassified workers may claim back benefits owed or challenge their classification for tax purposes, creating potential liabilities for the employer.

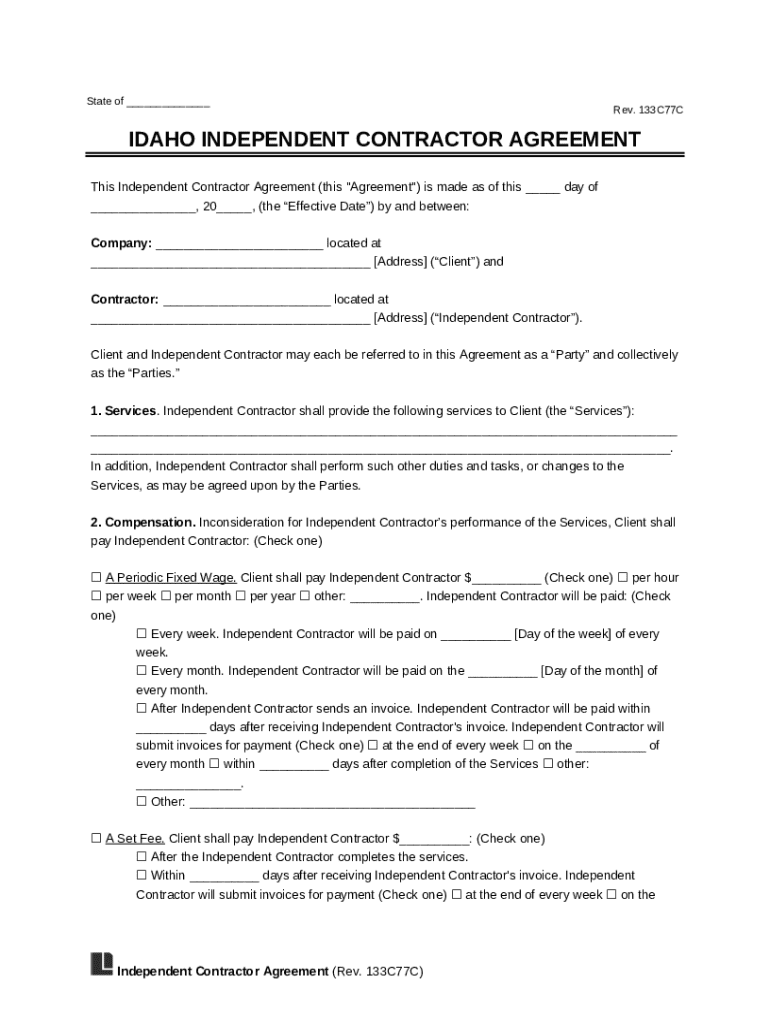

The Idaho independent contractor agreement

An independent contractor agreement is a formal document that outlines the terms of the relationship between the contractor and the hiring party. This document not only specifies the nature of the work but also codifies any payments, deadlines, and other crucial elements of service delivery.

In Idaho, an independent contractor agreement is crucial to ensure clarity and prevent disputes between the parties involved. A well-drafted agreement can mitigate risks by clearly defining expectations and responsibilities, thus providing a solid legal framework.

Legal standards governing independent contractor agreements in Idaho stem from state labor laws and the IRS guidelines. Familiarity with these regulations is essential for both contractors and businesses to avoid unlawful practices and ensure compliance.

Key components of an Idaho independent contractor agreement

A comprehensive Idaho independent contractor agreement should include several essential clauses, which are critical for protecting both parties. Understanding these components is vital for creating an effective working relationship.

Scope of Work: Clearly define the tasks and services the contractor will perform.

Payment Terms: Outline the compensation structure, including the payment schedule and rates.

Duration of Agreement: Specify the effective period of the contract, including start and end dates.

Confidentiality Provisions: Include clauses to protect sensitive information shared during the engagement.

Termination Conditions: Determine how either party may terminate the agreement and the procedures involved.

In addition to these essential clauses, optional clauses such as non-compete and non-solicitation provisions may also be included. These can help protect business interests. Ownership of intellectual property is another critical area that should be clearly defined to avoid future disputes.

Legal considerations and compliance in Idaho

Understanding the legal landscape in Idaho is fundamental for independent contractors and their hiring entities. Relevant state laws dictate various aspects of the contracting process and protect both parties' rights. One critical component is ensuring that the independent contractor is registered appropriately, following Idaho’s tax regulations.

Tax implications for independent contractors can also be complex. Unlike employees, contractors are responsible for paying their taxes, including self-employment taxes, which cover Social Security and Medicare. This structure necessitates a clear understanding of one’s financial obligations to avoid penalties.

It is also essential to comply with federal regulations, including the Fair Labor Standards Act (FLSA) and the Internal Revenue Service (IRS) guidelines regarding contractor classification. Misconceptions surrounding legal protections for independent contractors are common, particularly concerning workers' compensation and unemployment benefits, which are generally not available to contractors.

How to effectively create an Idaho independent contractor agreement

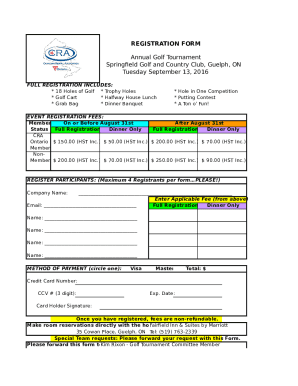

Creating an Idaho independent contractor agreement involves several key steps. Starting with a comprehensive understanding of the requirements, both parties can engage in drafting an agreement that defines their expectations clearly.

Gathering Necessary Information: Collect all details needed for the agreement, including the scope of work, payment details, and contact information.

Using Templates and Forms: Leveraging tools like pdfFiller can simplify the process of creating and managing documents effectively, saving time while ensuring compliance.

Reviewing for Compliance and Completeness: Once the initial draft is complete, both parties should carefully review the document to ensure that it meets all legal standards and encompasses all negotiated terms.

Best practices for editing and signing include using collaborative features in online document management platforms, which allow for easy revisions and mutual agreement. If discrepancies arise, both parties should feel empowered to communicate openly to achieve a mutually agreeable resolution.

Common challenges and solutions

Creating an independent contractor agreement can come with its own set of challenges. Identifying common pitfalls in the agreement's drafting is essential to ensuring effectiveness. Misclassification of contractors is among the top issues, as businesses may unintentionally classify workers incorrectly, putting them at risk for legal liabilities.

To address these issues, parties should consider seeking legal guidance if uncertainty arises during the drafting process. Additionally, incorporating a clear dispute resolution process in the agreement can streamline conflict resolution should any disagreements arise later.

Frequently asked questions (FAQs)

An independent contractor agreement is legally binding when it meets specific requirements, including mutual consent of both parties and lawful purpose. All elements, like terms of compensation and service delivery, must be clearly stated.

To safely terminate an independent contractor agreement, it is vital to follow the stipulated termination conditions within the agreement itself. Providing written notice of termination is often considered best practice.

Both parties should ensure that the agreement protects their interests by including clear confidentiality, payment, and termination clauses. It's generally advisable to consult legal counsel when drafting an agreement to ensure all bases are covered.

While it is technically possible to write your own independent contractor agreement, utilizing templates from platforms like pdfFiller can significantly reduce risk and ensure that necessary legal language and structures are included.

Interactive tools and resources

Utilizing platforms like pdfFiller allows users to create, edit, and manage an Idaho independent contractor agreement seamlessly. The interactive tools available enable users to tailor agreements to their specific needs without starting from scratch.

Editing features on pdfFiller provide an easy way to modify documents in real-time, thus simplifying collaboration between parties. Additionally, the eSigning capability ensures that agreements can be executed legally and conveniently, even remotely.

Related forms and templates

Besides the independent contractor agreement, other important documents may include non-disclosure agreements, service contracts, and various tax forms specific to independent contractors. Each form serves a unique role in managing the contractor relationship and protecting both parties involved.

Non-Disclosure Agreement: Protects confidential information shared between parties.

Service Contract: Details the specific services provided alongside payment terms.

Tax Forms: Ensures compliance with federal and state tax obligations.

If you’re seeking to explore various contractor scenarios, pdfFiller offers numerous templates and tools to assist in navigating these requirements effectively.

Tips for managing independent contractor relationships

Managing relationships with independent contractors effectively enhances productivity and collaboration. Regular communication is paramount; setting up routine check-ins and feedback loops can help maintain alignment between both parties.

Enhancing team collaboration involves integrating independent contractors into the team structure, allowing them to participate in relevant meetings and initiatives. Performance monitoring is also essential; using agreed-upon metrics helps ensure that deliverables are met on time and to standard.

Utilizing platforms like pdfFiller can also streamline document management, ensuring all parties have access to updated contracts and related documentation as needed.