Get the free 1023

Get, Create, Make and Sign 1023

Editing 1023 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 1023

How to fill out 1023

Who needs 1023?

1023 Form - A Comprehensive How-to Guide

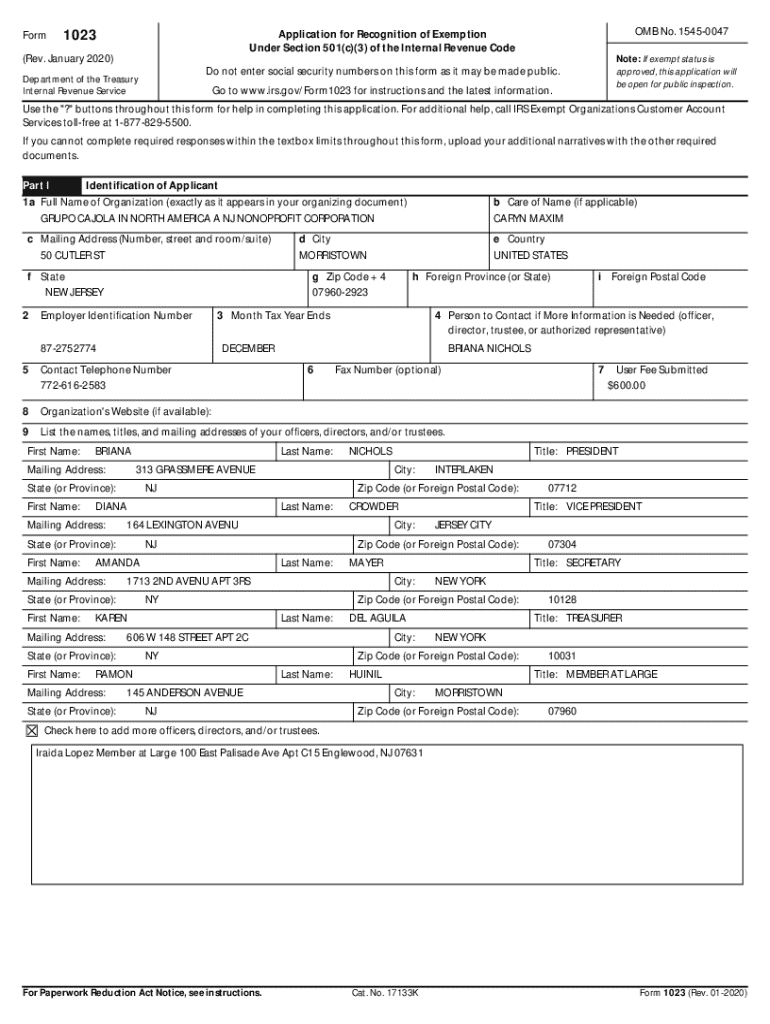

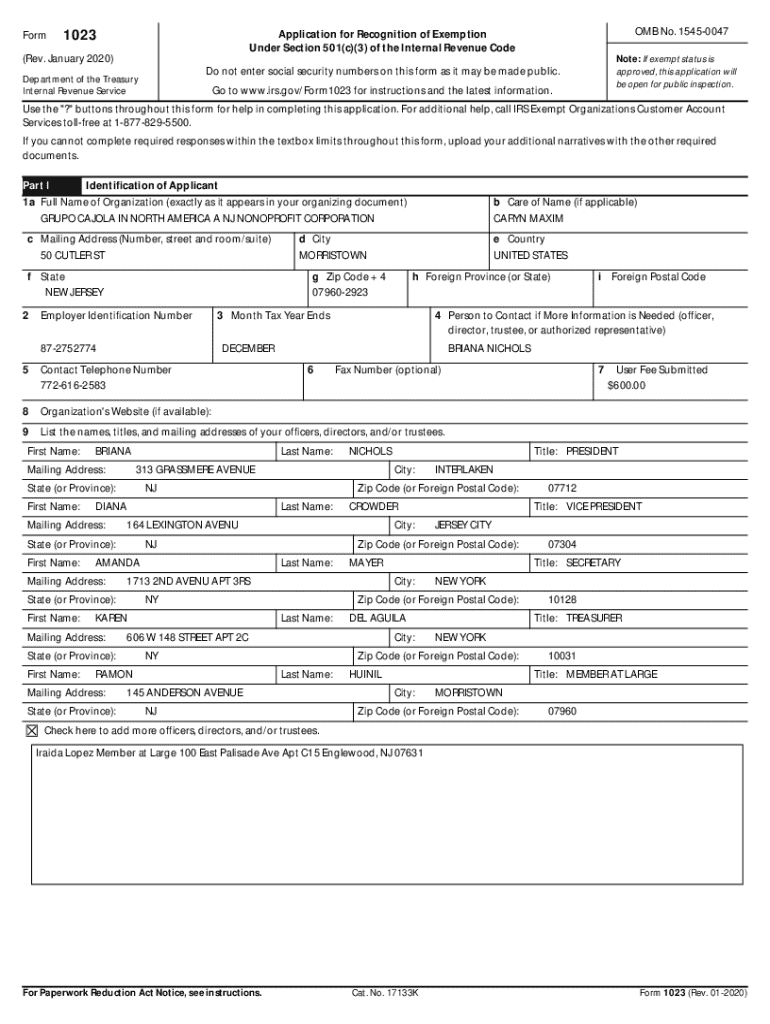

Understanding the 1023 Form

The IRS Form 1023 is an essential document for organizations seeking tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This form serves as a comprehensive request to the Internal Revenue Service that must be completed accurately to be accepted. Filing the 1023 Form grants your organization the privilege of being recognized as a tax-exempt entity, allowing for various benefits, including eligibility for public and private grants, reduced postal rates, and tax-deductible donations.

Filing the 1023 Form can significantly impact your organization’s ability to operate effectively. It assures donors that their contributions are tax-deductible and affirms your legitimacy as a nonprofit entity. However, the process can be daunting for many, making a clear understanding paramount.

Who should use the 1023 Form?

The 1023 Form is primarily designed for nonprofit organizations that aim to qualify for tax exemption. Generally, you should consider filing if your organization meets certain eligibility criteria. To be eligible, your organization must be organized and operated exclusively for charitable, educational, religious, or scientific purposes, among others.

Common types of organizations that typically file the 1023 Form include charitable organizations, educational institutions, churches, and museums. If your organization primarily serves the public interest and meets the IRS criteria, it is advisable to prepare and file this crucial document.

Preparing to complete the 1023 Form

Before diving into the form itself, gathering the necessary information and documents is crucial. To ensure a streamlined process, ensure you have your articles of incorporation, bylaws, and detailed mission statement at hand. Additionally, an overview of your organization’s programming, operational plans, and current financial data shapes the narrative you will present in your application.

Let’s also address the financial aspect of filing. The IRS requires a filing fee, which varies based on your organization’s projected revenue. As of now, the fees are segmented into categories, generally ranging from $275 to $600. Payment methods encompass checks and credit or debit cards, providing flexibility for many organizations.

Step-by-step guide to filling out the 1023 Form

Filling out the 1023 Form is a meticulous process requiring attention to detail. Here’s a section-by-section breakdown of the form to help guide you through this essential undertaking.

To ensure clarity and professionalism, avoid common errors such as vague language or incomplete financial disclosures. Keeping your writing clear and direct will strengthen your application.

Editing and finalizing the 1023 Form

Before submission, conducting a thorough review of your 1023 Form is paramount. A comprehensive checklist can help you verify that all essential elements are present and correct. Utilize tools like pdfFiller, which offers helpful features for reviewing and ensuring your document meets the necessary standards.

Editing tools on pdfFiller allow you to enhance the clarity and professionalism of your application. You can insert digital signatures or annotations as necessary, ensuring adherence to the formal requirements the IRS expects.

Filing the 1023 Form

Once your 1023 Form is complete and reviewed, it's time for submission. There are two primary submission methods: electronic and paper filing. Each has its nuances; electronic filing is generally faster and more efficient but requires familiarity with the IRS system.

After submission, tracking your application’s status is advisable. You can check the status on the IRS website. Generally, the processing time for a 1023 Form can range from two to six months, depending on the IRS’s workload and the completeness of your submission.

Post-filing considerations

Once your organization receives approval for tax-exempt status, maintaining compliance is critical. Tax-exempt organizations must adhere to ongoing reporting requirements, including submitting annual IRS Form 990. Accurate record-keeping and documentation of the organization's activities will help uphold your status and ensure transparency.

If, however, your application is denied, do not panic. Understanding the common reasons for denial—such as incomplete information or failing to meet eligibility requirements—can help you address these issues. Submit an appeal with a revised application or take the necessary steps to reapply after correcting the stated deficiencies.

Utilizing pdfFiller for ongoing management

Managing your documents efficiently is vital for any organization, especially after filing the 1023 Form. pdfFiller provides features that help organize and manage all your documents in a cloud-based platform. This ensures your team has easy access to critical documents from anywhere.

With pdfFiller, it's easier than ever to ensure all team members can access and contribute to important documentation and processes, enhancing productivity and ensuring compliance.

FAQs about the 1023 Form

Navigating the complexities of the 1023 Form can lead to many questions. Common inquiries often include the timeline for approval and what detailed information must be included in the application. Being informed about these aspects empowers you to approach the filing process with confidence.

If unexpected challenges arise during the filing process, resources are available through your local nonprofit support centers or online resources to ensure you have the guidance needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 1023?

Can I sign the 1023 electronically in Chrome?

How do I fill out the 1023 form on my smartphone?

What is 1023?

Who is required to file 1023?

How to fill out 1023?

What is the purpose of 1023?

What information must be reported on 1023?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.