Get the free Cdtfa-504-c

Get, Create, Make and Sign cdtfa-504-c

Editing cdtfa-504-c online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cdtfa-504-c

How to fill out cdtfa-504-c

Who needs cdtfa-504-c?

Comprehensive Guide to the CDTFA-504- Form

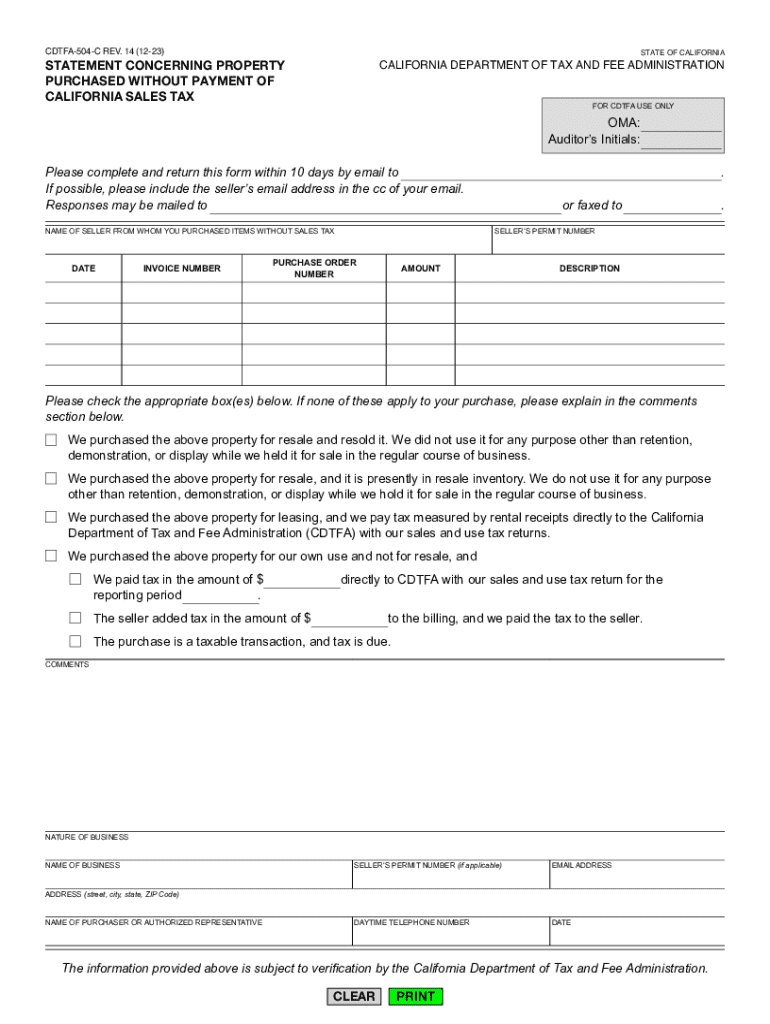

Overview of CDTFA-504- Form

The CDTFA-504-C form is a crucial document used by California taxpayers to report changes in their taxable status. It serves multiple purposes, including updating business information, reporting address changes, and confirming the tax obligations of entities within the state. This form is essential for maintaining compliance with the California Department of Tax and Fee Administration (CDTFA) regulations.

The importance of the CDTFA-504-C form cannot be understated. Accurate and timely submission helps prevent penalties and ensures that businesses are appropriately reflected within California's tax system. Often, businesses may not realize their requirement to use this form until they face a compliance check.

Any individual or business that operates in California and has incurred taxable changes needs to submit the CDTFA-504-C form. This includes sole proprietors, partnerships, corporations, and nonprofits. Understanding when and how to utilize this necessary form is key to staying informed and compliant.

Key features of the CDTFA-504- Form

The CDTFA-504-C form is structured into several essential sections, each designed to capture specific information related to the taxpayer's account. Firstly, the personal information requirement section requests details such as your name, business name, and contact details. This section ensures that the CDTFA can identify and reach the correct taxpayer smoothly.

The tax information and calculation fields follow, allowing users to report their taxable sales, adjustments, or compensation claims appropriately. Accuracy in these areas is vital to ensure correct tax calculations and obligations.

Finally, the signature and confirmation section assures that the information provided is accurate to the best of the signer’s knowledge. This section is critical as it denotes the fine line between compliance and potential tax disputes.

Common use cases for the CDTFA-504-C form include businesses changing their operational structures, companies adjusting their tax reporting practices, or entities merging and requiring updates to their status with the CDTFA.

Step-by-step instructions for completing the CDTFA-504- Form

Before filling out the CDTFA-504-C form, it's essential to gather all necessary documentation. This may include previous tax filings, business licenses, or any changes to your entity status. Having all information on hand streamlines the process, making it less daunting.

Recommended tools include a reliable PDF editing software, such as pdfFiller, which can help in creating an organized approach to filling out forms. Once you've gathered your documentation, you can begin the completion process.

Start by filling out the personal information section accurately. Ensure all names are spelled correctly and contact information is up to date. Next, move on to the tax calculation fields, where meticulous attention to detail is crucial. Using tools like an online tax calculator can assist in ensuring that you are accurately reporting your obligations.

Once completed, reviewing the form for accuracy is imperative. Double-check figures in tax sections and make sure all boxes are filled where required. Common mistakes include transposing numbers or leaving required fields blank, which can delay processing.

Interactive tools for managing the CDTFA-504- form

Utilizing pdfFiller's PDF editor can significantly enhance your experience with the CDTFA-504-C form. One notable feature is the ability to seamlessly make edits to the existing document. You can easily highlight sections, insert required information, or delete unnecessary text to tailor the form just right.

The eSign feature stands out as well, allowing users to add signatures and initials electronically. The ease of sending the document for electronic signature makes it convenient for businesses busy managing multiple compliance tasks.

Collaboration becomes a breeze with pdfFiller’s platform, where teams can work in real-time on the same document—an essential feature for ensuring everyone is on the same page regarding critical compliance documents like the CDTFA-504-C form. The ability to leave comments in the document creates an invaluable way to discuss revisions and updates.

Submitting the CDTFA-504- form

Submitting the CDTFA-504-C form can be done in multiple ways, ensuring flexibility for users. The most efficient option is online submission through the California Department of Tax and Fee Administration's portal. This method allows for instant confirmation of receipt and speeds up processing time.

For those preferring traditional methods, paper submission is also available. Be sure to follow specific guidelines: the form should be printed clearly, signed, and mailed to the appropriate address to prevent delays. The CDTFA provides a detailed guide on the necessary contact information based on your submission method.

It's essential to keep track of the important deadlines associated with filing this form. Failure to submit the CDTFA-504-C form by the designated deadlines may result in penalties or increased scrutiny from tax authorities.

After submission, you can typically expect confirmation of receipt from the CDTFA, either via email for online submissions or postal mail for paper submissions. Keeping an eye on your submission status will help ensure your compliance is up-to-date.

Frequently asked questions about CDTFA-504- form

Many users frequently ask what to do if they make an error on the form. In such cases, it's recommended to refile an amended form (if applicable) along with a letter explaining the changes. If you’ve submitted online, contact their support to ensure your amendment is noted.

Tracking the status of your submission can typically be done through your CDTFA online account; users can view their submission history for updates. If deadlines are missed, it's crucial to reach out to the CDTFA promptly to mitigate any penalties that may arise.

Additionally, there are numerous resources available for assistance with the CDTFA-504-C form, including online guides from the CDTFA website and platforms like pdfFiller that offer helpful documentation.

Related documents and resources

In addition to the CDTFA-504-C form, several related documents can aid taxpayers in navigating their obligations. Such documents include the CDTFA-401 (Sales and Use Tax Return) and various business tax guidance publications available through the CDTFA's website.

Users looking for additional support on pdfFiller can access various video tutorials and guides specifically for the CDTFA forms. Moreover, customer support contact information is readily available, ensuring you can get help whenever necessary.

Case studies: Successful management of CDTFA-504- form

Several organizations have successfully employed pdfFiller to streamline their management of the CDTFA-504-C form. For instance, a local California retailer reduced their administrative burden by implementing pdfFiller, ensuring their forms were filled out accurately and submitted on time. This led to fewer compliance issues and a more organized record-keeping process.

From these case studies, key lessons learned include the value of utilizing electronic document management tools to facilitate quicker responses, real-time collaboration among team members, and maintaining an organized approach to compliance documentation.

Conclusion: Empower your document management with pdfFiller

The CDTFA-504-C form represents an essential aspect of tax compliance for California businesses, and leveraging the right tools can significantly ease the management process. pdfFiller offers an intuitive solution for seamlessly editing, signing, and collaborating on this vital document.

By using pdfFiller, taxpayers can enhance their document management practices, ensuring they stay compliant while saving valuable time and resources. Businesses are encouraged to explore these tools to streamline their processes and reduce the risks associated with compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my cdtfa-504-c in Gmail?

How do I edit cdtfa-504-c straight from my smartphone?

Can I edit cdtfa-504-c on an iOS device?

What is cdtfa-504-c?

Who is required to file cdtfa-504-c?

How to fill out cdtfa-504-c?

What is the purpose of cdtfa-504-c?

What information must be reported on cdtfa-504-c?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.