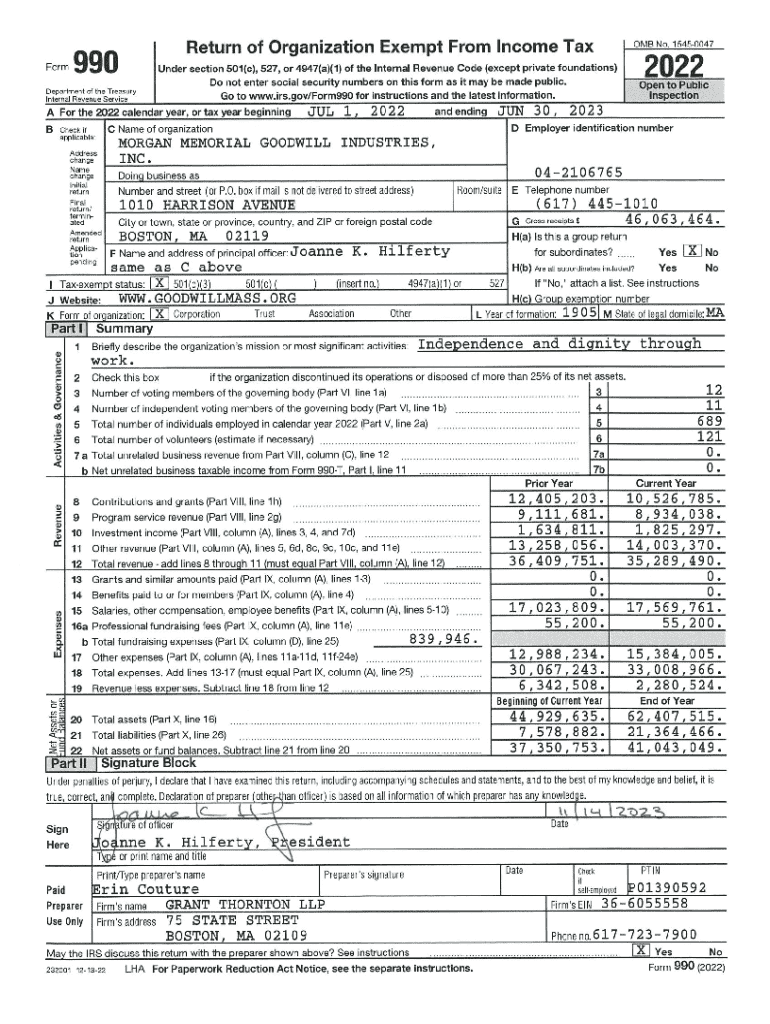

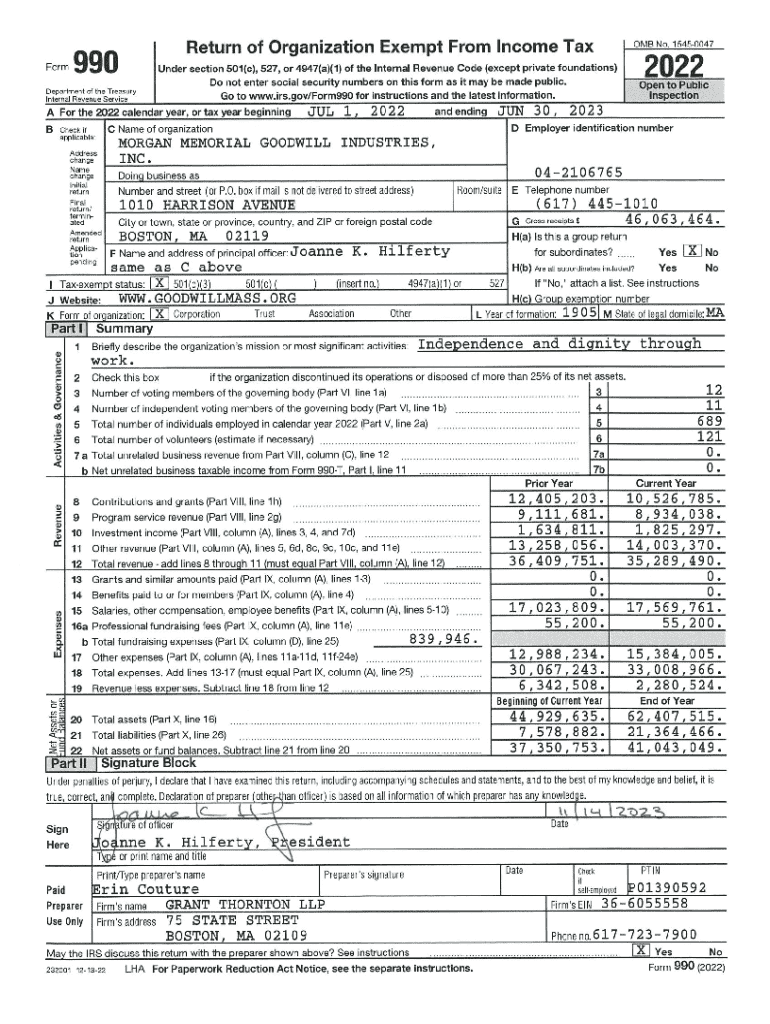

Get the free Form 990 (2022)

Get, Create, Make and Sign form 990 2022

How to edit form 990 2022 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990 2022

How to fill out form 990 2022

Who needs form 990 2022?

Form Guide: Understanding, Preparing, and Filing

Understanding Form 990

Form 990 is a crucial document in the nonprofit sector, serving to provide transparency regarding an organization’s financial activities and governance practices. This informational return, required by the IRS, is not only a means to maintain tax-exempt status but also offers significant insights for donors, regulators, and the general public about the operations of nonprofit entities.

Essentially, Form 990 helps the IRS ensure that nonprofits are operating within the guidelines outlined for tax-exempt organizations. Nonprofits with gross receipts over $200,000 or total assets exceeding $500,000 must file Form 990, while smaller organizations may use the streamlined Form 990-EZ or Form 990-N, also known as the e-Postcard.

Key components of Form 990

Form 990 comprises several sections that provide detailed insights into a nonprofit's financial health, governance, and operations. Each section of the form is vital for both compliance and accountability.

Its key components include:

Preparing to complete Form 990

Before embarking on filling out Form 990, it is imperative to gather all necessary documentation and financial records. Having everything organized will simplify the completion process and help ensure accuracy.

Key documents to assemble include:

To avoid common pitfalls, nonprofits should be vigilant about accuracy and completeness. Frequent errors to watch out for include incorrect figures in financial statements and failure to report significant changes in governance.

Step-by-step guide to filling out Form 990

Completing Form 990 can seem daunting, but breaking it down section by section makes it manageable. Here’s a detailed overview:

To assist you in this process, pdfFiller offers interactive tools that facilitate filling out Form 990, including customizable templates to expedite completion.

How to edit and modify your Form 990

Once the initial draft of Form 990 is complete, reviewing and editing are vital to ensure clarity and compliance. pdfFiller provides robust editing features that enable users to modify PDF forms efficiently.

To edit your Form 990:

Keeping your Form 990 updated is crucial for ongoing compliance, so it's wise to create strategies for regular reviews and updates, especially as your nonprofit grows.

E-signing and submitting Form 990

E-signatures are legally valid and widely accepted for nonprofit filings, adding a layer of convenience to the submission process. pdfFiller simplifies this with a streamlined e-signature feature.

To e-sign and submit your Form 990:

Post-submission, it's crucial to confirm that the filing was successful. pdfFiller helps track submissions, ensuring that everything is filed correctly.

Tracking and managing Form 990 filings

Nonprofits must remain vigilant about compliance and deadlines associated with Form 990. Failure to file timely can lead to severe repercussions.

Important aspects to consider include:

Effective document management systems will help ensure compliance and provide easy access to important files.

Case studies: Successful use of Form 990

Several nonprofits excel in transparency by meticulously preparing Form 990, which helps build trust with stakeholders and the public.

Profiles of standout organizations include:

These organizations have demonstrated how transparent reporting can enhance operational efficiency and stakeholder trust.

Future changes to Form 990

The IRS consistently reviews Form 990, leading to potential updates in response to evolving nonprofit practices and regulatory needs. Anticipated changes may focus on further enhancing transparency and reducing the filing burden for smaller nonprofits.

Nonprofits should stay aware of these potential changes and adapt their reporting practices accordingly. Strategies include:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form 990 2022 online?

How do I make edits in form 990 2022 without leaving Chrome?

Can I edit form 990 2022 on an iOS device?

What is form 990 2022?

Who is required to file form 990 2022?

How to fill out form 990 2022?

What is the purpose of form 990 2022?

What information must be reported on form 990 2022?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.