Get the free W-8ben-e

Get, Create, Make and Sign w-8ben-e

Editing w-8ben-e online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-8ben-e

How to fill out w-8ben-e

Who needs w-8ben-e?

W-8BEN-E Form How-to Guide

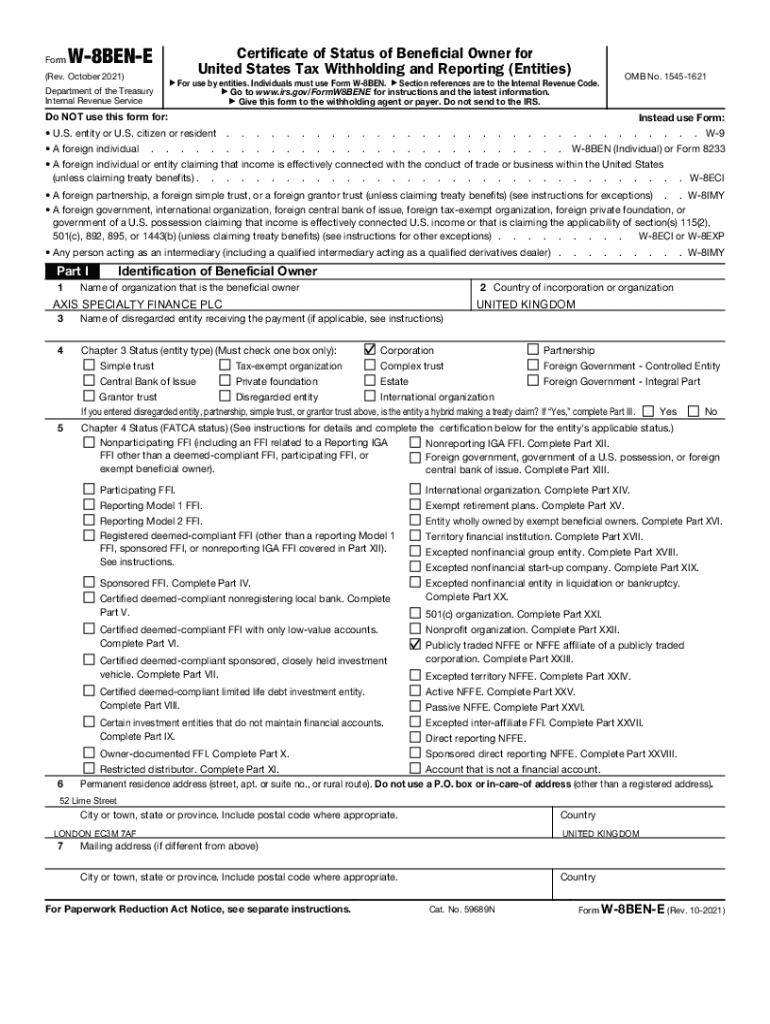

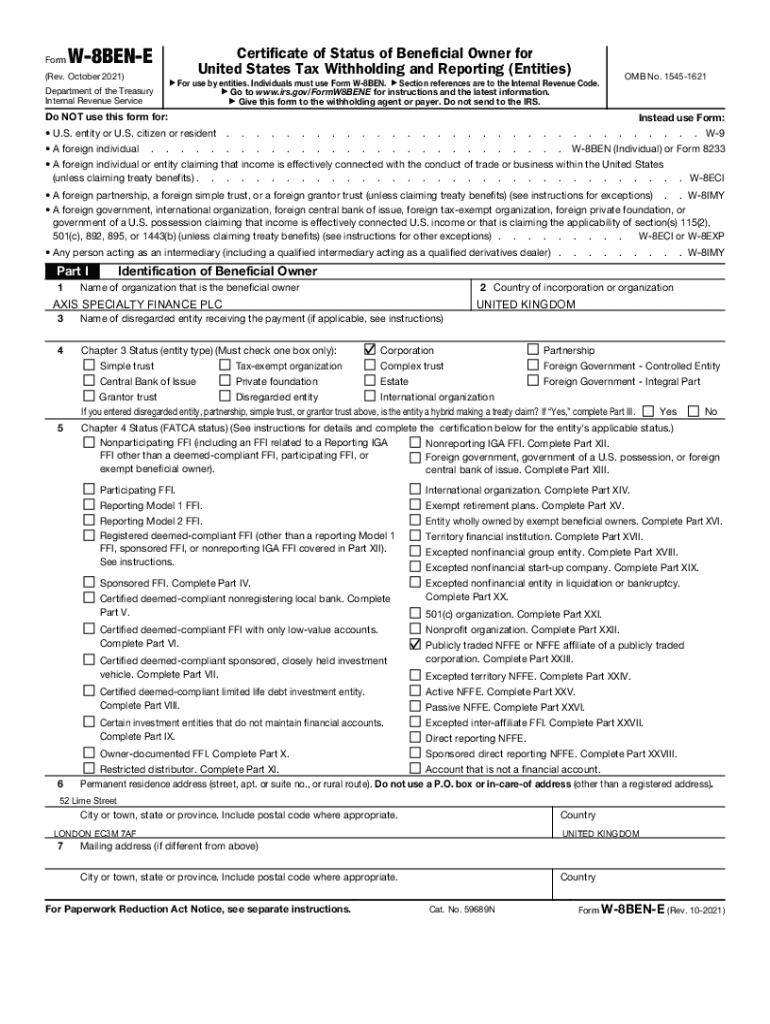

Overview of the W-8BEN-E form

The W-8BEN-E form is a crucial document for foreign entities deriving income from U.S. sources. Designed by the IRS, this form certifies the foreign status of the beneficial owner, helping to avoid or reduce withholding tax rates. Without the proper documentation, U.S. payers may withhold taxes at higher rates, making understanding this form essential for international tax compliance.

The primary purpose of the W-8BEN-E is to declare the entity's foreign status and potentially claim any applicable tax treaty benefits. This helps facilitate smooth cross-border transactions while ensuring compliance with U.S. tax laws. It is critical for foreign partnerships, corporations, and other entities to utilize the form effectively.

Understanding the audience for W-8BEN-E

The W-8BEN-E form is specifically required for entities that receive income from U.S. sources but are structured outside the U.S. This may include partnerships, corporations, estates, and trusts. If your organization has a foreign entity structure, filling out this form is essential for compliance.

Common scenarios where the W-8BEN-E becomes indispensable include receiving dividends, interest, or royalties from the U.S., as well as earning income from services performed in the U.S. By ensuring compliance with the IRS’s requirements, entities can significantly mitigate their tax liabilities.

Detailed breakdown of the W-8BEN-E sections

Understanding how to fill each section of the W-8BEN-E form is crucial for accurate tax processing and compliance. The form is divided into several parts, each requiring specific information.

Part : Identification of beneficial owner

In this section, the entity must provide its legal name, the country of incorporation, and a permanent address. Accurate identification is vital, as discrepancies can lead to complications with the IRS.

Part : Claim of tax treaty benefits

Entities eligible for tax treaty benefits can claim reduced withholding tax rates in this section. It requires an understanding of the tax treaty between the U.S. and the entity's country of residence.

Part : Chapter 3 and Chapter 4 status

This section defines the entity's status under IRS Chapter 3 and FATCA (Foreign Account Tax Compliance Act). Understanding these statuses helps ensure that the correct tax treatments are applied.

Parts and : Address information and TIN

Permanent residence and mailing addresses must align with the IRS’s requirements. Provide the TIN (Taxpayer Identification Number) of the entity if applicable, as this information is crucial for the IRS’s record-keeping.

Step-by-step guide to completing the W-8BEN-E form

Filling out the W-8BEN-E form doesn’t have to be a daunting task. Following a systematic approach can significantly simplify the process.

Signature and submission requirements

Determining who is authorized to sign the W-8BEN-E is crucial. Generally, an individual with sufficient authority within the organization must sign the form.

Both digital and electronic signatures are acceptable, provided they meet the IRS’s standard for authenticity. Submitting the completed form to the appropriate withholding agents helps ensure compliance with U.S. tax laws.

Best practices for utilizing the W-8BEN-E form

To prevent issues in compliance, consider the following best practices: Regularly update W-8BEN-E forms to align with changing tax regulations. Additionally, utilizing automated solutions can streamline compliance-related tasks.

Establish a robust record-keeping strategy. Retain copies of submitted forms and any related correspondence to safeguard against IRS audits.

Consequences of non-compliance with W-8BEN-E submission

Failure to submit the W-8BEN-E form can lead to significant consequences. Non-compliance may result in higher withholding tax rates being applied to U.S. income, ultimately affecting your bottom line.

Moreover, persistent non-compliance could lead to audits by the IRS, resulting in additional scrutiny and potential penalties. Therefore, adhering to compliance standards is essential for avoiding future complications.

Automation and efficiency in the W-8BEN-E process

Automation tools like pdfFiller can transform the daunting process of completing the W-8BEN-E form into a streamlined experience. By leveraging cloud-based solutions, you can fill, edit, eSign, and manage documents seamlessly.

The platform offers a unique advantage: access your forms from any location. In a global business environment, having this flexibility can greatly enhance productivity.

Helpful resources and interactive tools

For added support while navigating the complexities of the W-8BEN-E form, utilizing interactive tools such as calculators can guide you in demonstrating tax treaty benefits. Templates of completed forms can provide valuable reference points.

Frequently asked questions (FAQs) can clarify common doubts, ensuring that you understand every aspect of the form. Engaging with these resources helps demystify the process.

Next steps after completing the W-8BEN-E

After successfully submitting the W-8BEN-E form, expect to have reduced withholding taxes applied to your income, where applicable. It’s essential to continually monitor your tax obligations to ensure ongoing compliance.

Establish reminders for renewals or updates of your W-8BEN-E form, as changed regulations or ownership structures may require revisions.

Conclusion: The value of mastering W-8BEN-E

Mastering the W-8BEN-E form is vital for anyone involved in cross-border transactions. Being proactive and thorough with documentation ensures compliance with U.S. tax laws while minimizing unnecessary costs.

Utilizing tools like pdfFiller empowers users to seamlessly edit, eSign, and manage documents from a single, cloud-based platform. Streamlined document processes not only save time but also reduce stress, allowing entities to focus more on their core functions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute w-8ben-e online?

Can I sign the w-8ben-e electronically in Chrome?

Can I edit w-8ben-e on an iOS device?

What is w-8ben-e?

Who is required to file w-8ben-e?

How to fill out w-8ben-e?

What is the purpose of w-8ben-e?

What information must be reported on w-8ben-e?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.