Get the free Campus Gift Acceptance Report

Get, Create, Make and Sign campus gift acceptance report

Editing campus gift acceptance report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campus gift acceptance report

How to fill out campus gift acceptance report

Who needs campus gift acceptance report?

Campus Gift Acceptance Report Form: A Comprehensive Guide

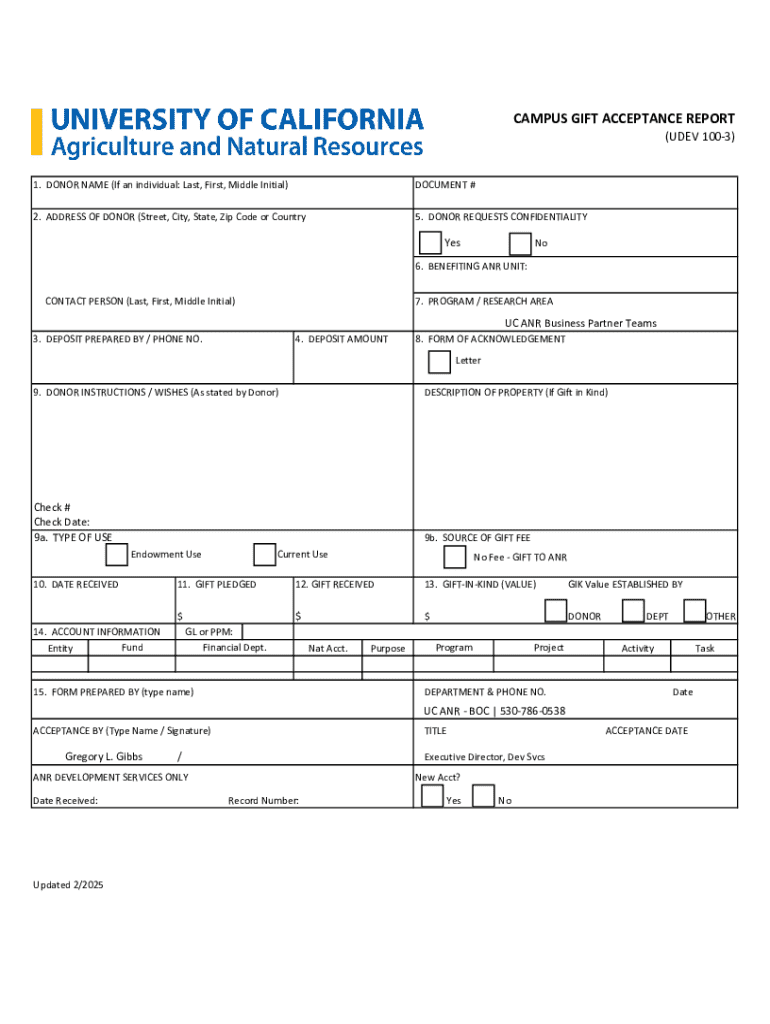

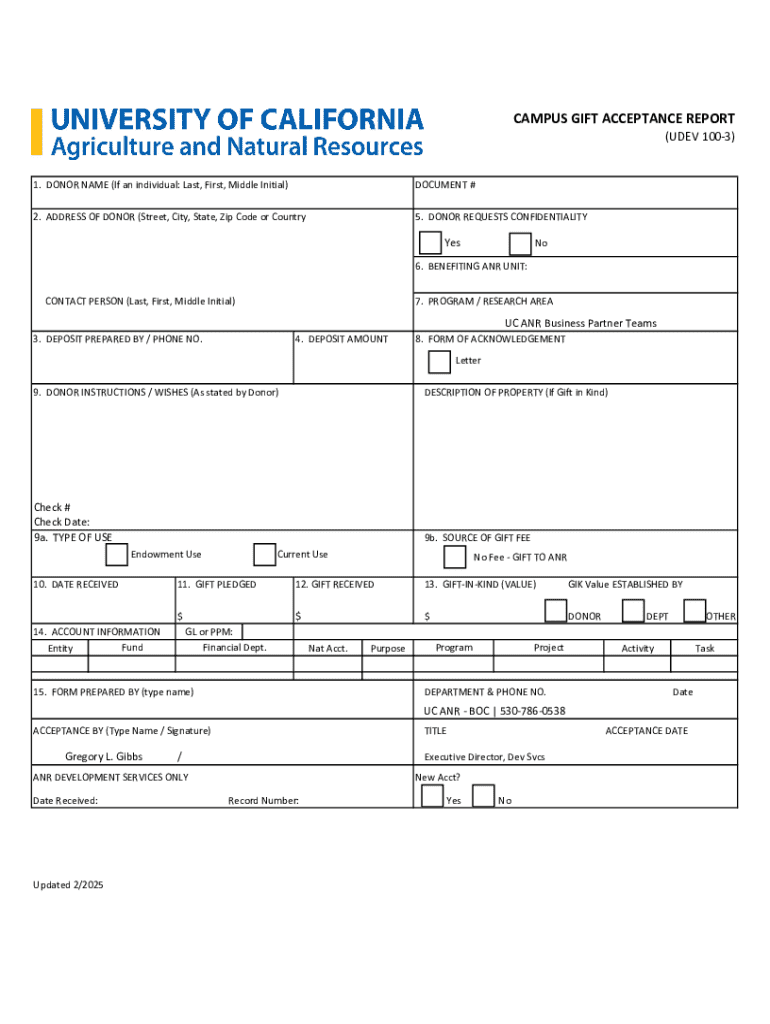

Understanding the campus gift acceptance report

The Campus Gift Acceptance Report is a foundational document that serves to formalize the acceptance of gifts for institutions, ensuring that both donor intent and institutional policies are properly documented. Its primary purpose is to provide a structured framework for assessing gifts within the institutional context, facilitating clear communication between donors and the institution.

In addition to documenting gifts, the Campus Gift Acceptance Report plays a crucial role in fostering positive donor relations. By adhering to institutional policies, this report helps maintain transparency and trust, which are essential for securing ongoing support and contributions from donors.

Types and categories of gifts

Institutions typically accept a variety of gift types, each with its unique set of considerations. Understanding these categories is vital for ensuring compliance with institutional rules and regulations.

It's important to distinguish between restricted and unrestricted gifts. Restricted gifts are earmarked for specific purposes, while unrestricted donations provide the institution with flexibility in using the funds. Certain types of gifts, such as those that come with conditions that conflict with institutional values or missions, may also be deemed unacceptable.

Navigating the gift acceptance process

Navigating the gift acceptance process begins with understanding the procedure for submitting the Campus Gift Acceptance Report. This report serves as the first step in formalizing the gift within the institution’s framework.

Each party involved has responsibilities throughout this process. Donors must ensure that all provided information is accurate and complete, while the institution is responsible for conducting thorough evaluations. The Gift Acceptance Committee plays a key role in this process, examining gifts and making recommendations based on institutional guidelines.

Completing the campus gift acceptance report form

Completing the Campus Gift Acceptance Report Form requires attention to detail and a clear understanding of its sections. Each part of the form serves a specific purpose that helps in documenting the gift accurately.

Common pitfalls include incomplete sections, outdated information, and failure to provide proper valuations for non-cash gifts. To avoid errors, ensure all fields are filled thoroughly and double-check the information prior to submission. To enhance the form's usability, individuals can leverage tools like pdfFiller to edit and customize documents seamlessly.

Signing and acknowledging gifts

The signing process of the Campus Gift Acceptance Report is integral to formalizing the acceptance of a gift. Utilizing eSigning features transforms this process by allowing both donors and representatives to sign digitally, making the process more efficient and convenient.

Gift acknowledgment procedures are equally important. Institutions should create formal acknowledgment letters addressing the donor, thanking them for their generosity and outlining how their gift will be used. It is essential to cover legal considerations, such as compliance with tax regulations, to ensure donors receive applicable tax deductions.

Monitoring and reporting gift impact

Monitoring the acceptance and usage of gifts is fundamental for both compliance and transparency. Institutions must adhere to strict policies regarding the accounting of received gifts, which includes documenting how funds are utilized and reporting the impact to stakeholders.

Valuations significantly affect financial statements and reports. Institutions must prioritize accurate estimation to reflect the true impact and position of the received gifts.

Ensuring compliance and ethical standards

Adhering to legal frameworks surrounding gift acceptance ensures that institutions operate within the bounds of current laws and regulations. Key legal aspects include proper documentation, adherence to tax laws, and compliance with donor intention.

Transparent practices not only safeguard the institution but also promote trust and openness with current and potential donors.

Enhancing donor relations

Effective communication with donors is crucial in building and enhancing relationships. Personalized acknowledgment letters that articulate gratitude help to forge stronger connections, while following up post-gift acceptance reassures donors about the impact of their contributions.

Building long-term engagement strategies through personalized interactions and consistent communication can lead to repeat contributions and a thriving donor community.

Related forms and templates

Institutions may need several complementary documents to navigate the gift acceptance process seamlessly. Accessing additional document templates through pdfFiller enhances organizational efficiency.

Proper use of these templates streamlines operations and supports compliance with institutional policies.

Ensuring security and privacy

Protecting donor information is paramount in the gift acceptance process. Institutions should implement best practices to safeguard personal data and ensure compliance with data protection regulations.

By prioritizing security and privacy, institutions reinforce their commitment to ethical practices and instill trust among their donors.

Frequently asked questions

Frequently asked questions regarding the Campus Gift Acceptance Report often arise from both donors and institutions. Addressing these concerns is essential for smooth operations and fostering transparency.

Ultimately, addressing these queries enhances understanding and ensures all parties are aligned throughout the gift acceptance process.

Closing notes

The importance of ethical gift acceptance cannot be overstated. Institutions must reaffirm their commitment to ethical fundraising practices through every step of the gift acceptance process.

Encouraging proactive communication between donors and institutions is essential in building solid relationships. By prioritizing clarity, transparency, and donor engagement, institutions can lay the groundwork for a supportive funding environment that fosters enduring contributions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit campus gift acceptance report from Google Drive?

How can I send campus gift acceptance report for eSignature?

How do I edit campus gift acceptance report in Chrome?

What is campus gift acceptance report?

Who is required to file campus gift acceptance report?

How to fill out campus gift acceptance report?

What is the purpose of campus gift acceptance report?

What information must be reported on campus gift acceptance report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.