Get the free Business Entities in Jamaica: Legal and Tax Considerations

Get, Create, Make and Sign business entities in jamaica

Editing business entities in jamaica online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business entities in jamaica

How to fill out business entities in jamaica

Who needs business entities in jamaica?

Business Entities in Jamaica Form: A Comprehensive Guide

Understanding business entities in Jamaica

Business entities in Jamaica are foundational structures that determine how a business operates legally. Establishing a suitable business entity is crucial for entrepreneurs as it influences tax obligations, liability issues, and regulatory compliance. Understanding the various types of business entities provides clarity and assists in making informed decisions when starting a venture.

Jamaica's legal framework acknowledges several business entity types, each with different features, advantages, and challenges. This classification allows businesses to select an entity that best aligns with their goals, industry requirements, and personal preferences.

Available business entity types in Jamaica

Limited liability company ()

A Limited Liability Company (LLC) combines the features of a corporation and a partnership. This structure offers the benefit of limited liability, safeguarding personal assets from business debts. LLCs are a favorite among small to medium-sized businesses due to their flexibility in management and taxation, where owners can choose to be taxed as a corporation or a partnership.

However, the formation of an LLC also comes with drawbacks. These include potential higher startup costs and ongoing compliance requirements, such as the need to maintain detailed records and annual filings.

Public limited company (PLC)

A Public Limited Company (PLC) is a business entity that can offer shares to the public on the stock exchange. It has a more regulated structure compared to an LLC, with requirements that enhance transparency and accountability. PLCs are suited for larger businesses looking to raise capital from public investors.

The complexities of governing a PLC, including stringent reporting obligations and higher costs related to compliance, are significant considerations for potential PLC founders.

Sole proprietorship

A sole proprietorship is the simplest business entity, owned and operated by a single individual. This entity type involves minimal regulatory requirements and is often the first choice for small business owners who prefer a straightforward operational structure.

Nonetheless, the primary disadvantage lies in unlimited liability, meaning personal assets are at risk if the business fails.

Partnerships

Partnerships in Jamaica can be classified into two types: general partnerships and limited partnerships. General partnerships require all partners to manage the business actively, sharing profits and liabilities equally, while limited partnerships consist of both general and limited partners, with at least one partner enjoying limited liability.

The importance of a well-drafted partnership agreement cannot be overstated, as it sets expectations and guidelines for interactions among partners.

Branches of foreign companies

Foreign companies looking to establish a presence in Jamaica can do so through a branch. This type of entity is not considered separate from the parent company and carries all liabilities and obligations directly tied to the foreign firm.

Key considerations for setting up a branch include compliance with Jamaican laws and regulations governing foreign entities and the requirement of appointing a local representative.

Subsidiaries of foreign firms

A subsidiary is an independent legal entity that is owned by a foreign firm. This structure allows for the management of local operations while maintaining ties to the parent company.

The establishment of a subsidiary can be advantageous due to access to local distribution networks and markets, making it an attractive option for foreign investors.

Legal requirements for business entities in Jamaica

To successfully register a business in Jamaica, understanding the legal requirements for each type of entity is essential. The registration process typically includes filing the necessary documentation with the Companies Office of Jamaica (COJ).

Documentation requirements vary by entity type. For LLCs, incorporation documents and identification of directors are crucial. Sole proprietorships require identification and a business name registration, whereas partnerships need a partnership agreement detailing roles and profit-sharing.

Ensuring compliance entails filing annual returns and maintaining adequate records. It is essential to understand that failure to comply with regulations can lead to penalties and potentially jeopardize the business’s existence.

Tax considerations for different entities

Navigating the tax landscape is crucial for any business in Jamaica, as corporate income tax rates can impact profitability. Understanding the nuances associated with the different business entities can provide clarity on tax obligations.

Each entity must follow these guidelines to ensure compliance and leverage potential tax incentives, reinforcing the importance of strategic tax planning.

Regulatory environment for foreign investments

Jamaica encourages foreign investments by offering several incentives and a supportive regulatory environment. The establishment of the Jamaica Promotions Corporation (JAMPRO) has streamlined processes and provided resources to assist foreign investors.

New businesses benefit from improved infrastructure, a growing market, and a strategic location. Navigating the regulatory framework can be intricate, but with adequate guidance, entrepreneurs can effectively establish their endeavors.

Steps to setting up a business in Jamaica

Step 1: Name reservation

The first step in forming a business entity is to reserve a unique business name with the Companies Office of Jamaica. This ensures that the name is available and complies with legal requirements.

Step 2: Prepare incorporation documents

Next, preparing the necessary incorporation documents is crucial. This includes the Articles of Incorporation, business registration forms, and identification documentation for all directors.

Step 3: Submit registration application

Once the incorporation documents are in order, businesses must submit their registration application to the COJ. Expect a review period which may require adjustments or clarifications.

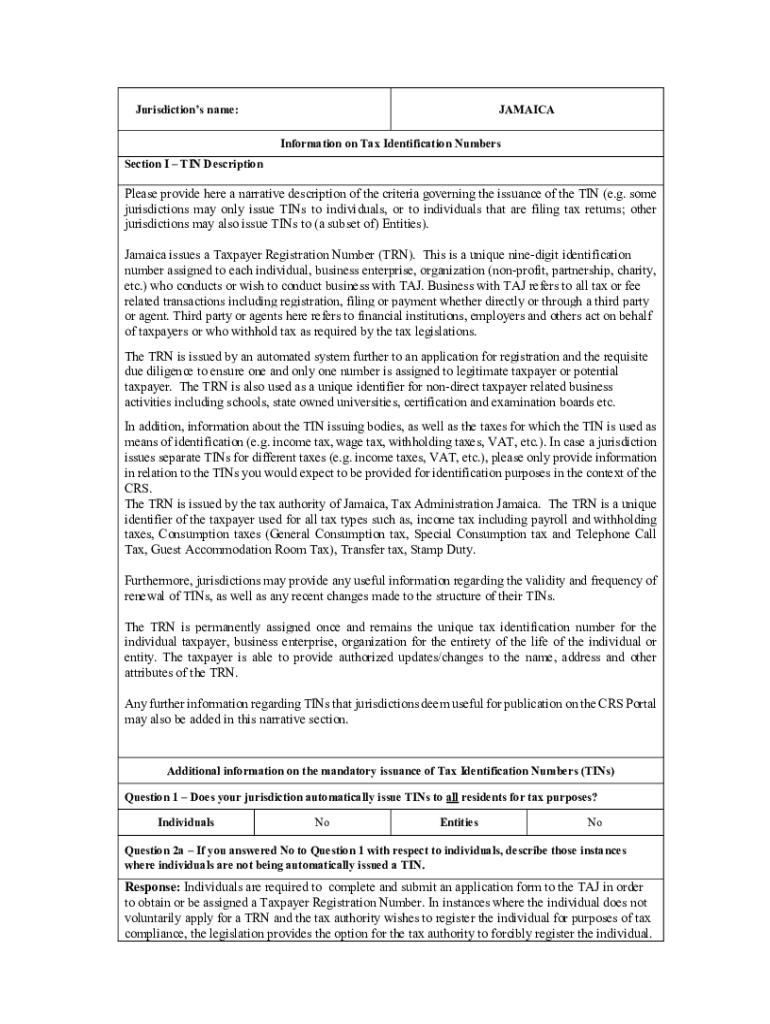

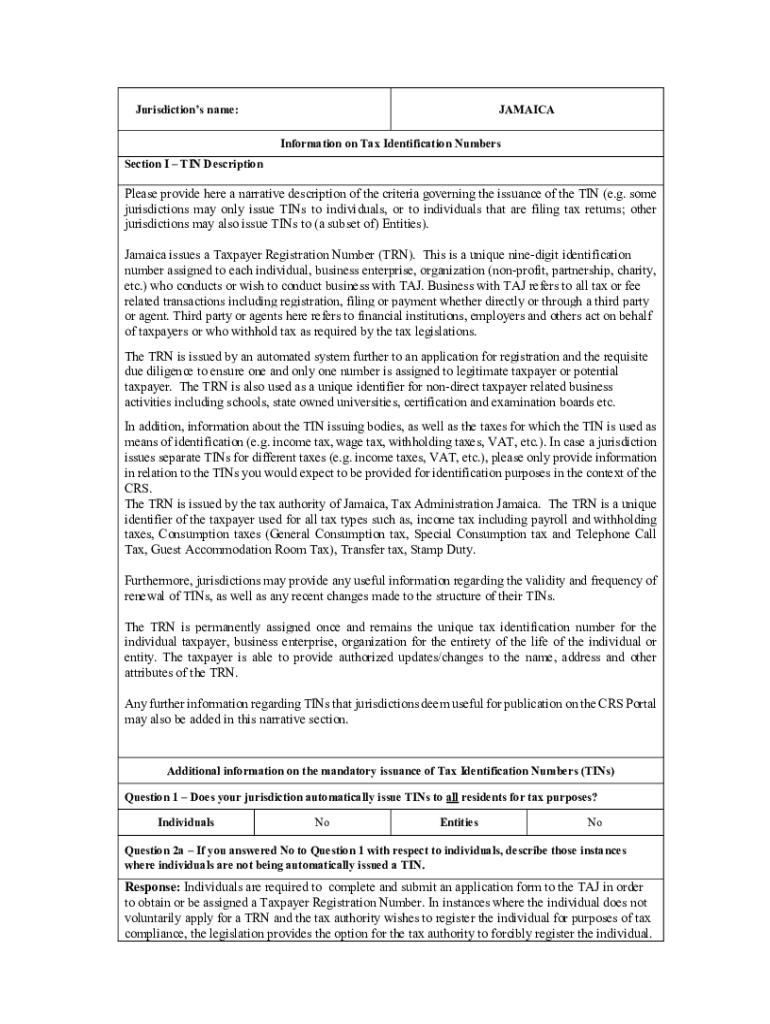

Step 4: Obtain a Taxpayer Registration Number (TRN)

Afterwards, acquiring a Taxpayer Registration Number (TRN) is necessary for tax purposes. This registration is essential to comply with the revenue authority's requirements.

Step 5: Register for National Insurance and statutory deductions

Registering for National Insurance ensures coverage under the Jamaican system, while statutory deductions protect both the employer and the employee.

Step 6: Open a corporate bank account

A corporate bank account is vital for separating personal and business finances. Explore various local banks to find features and benefits that align with your business needs.

Step 7: Obtain business licenses and permits (if required)

Depending on the nature of the business, specific licenses and permits may be required by local authorities. Research regulations applicable to your business sector.

Step 8: File annual returns and maintain compliance

Lastly, continuous compliance is essential. Annually file returns, keep accurate financial records, and stay updated with any regulatory changes affecting your business.

Navigating the business formation process

Engaging legal and financial advisors is a strategic move when starting a business. Their expertise can guide you through complex requirements and help navigate the interpretation of regulations.

Utilizing document management tools like pdfFiller can significantly enhance the business formation process. It empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform, reducing turnaround time for essential paperwork.

Frequently asked questions about business entities in Jamaica

When considering business structures, potential owners often have similar questions. Key inquiries revolve around the minimum requirements to incorporate entities and the possibility for foreigners to start businesses in Jamaica.

Market research and feasibility studies

Conducting thorough market research is paramount to gauge the viability of a business venture. Knowledge of market trends, consumer preferences, and competitive positioning are critical factors in establishing a successful business.

Resources for conducting feasibility studies can be invaluable sources of information to support business decisions, ensuring investments are sound and well-founded.

Conclusion and key takeaways

Understanding the types of business entities in Jamaica and their specific requirements is essential for entrepreneurs looking to establish a presence in the market. From limited liability companies to sole proprietorships, each structure offers distinct advantages and challenges.

Entrepreneurs are encouraged to consider their long-term objectives, engage with advisors, and leverage document management tools like pdfFiller to ease the journey of business formation. Taking informed steps today can lead to substantial growth in Jamaica’s vibrant economy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the business entities in jamaica in Gmail?

How do I fill out business entities in jamaica using my mobile device?

How do I edit business entities in jamaica on an Android device?

What is business entities in jamaica?

Who is required to file business entities in jamaica?

How to fill out business entities in jamaica?

What is the purpose of business entities in jamaica?

What information must be reported on business entities in jamaica?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.