Get the free Gift Designation Form

Get, Create, Make and Sign gift designation form

Editing gift designation form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out gift designation form

How to fill out gift designation form

Who needs gift designation form?

A comprehensive guide to the gift designation form

Understanding gift designations

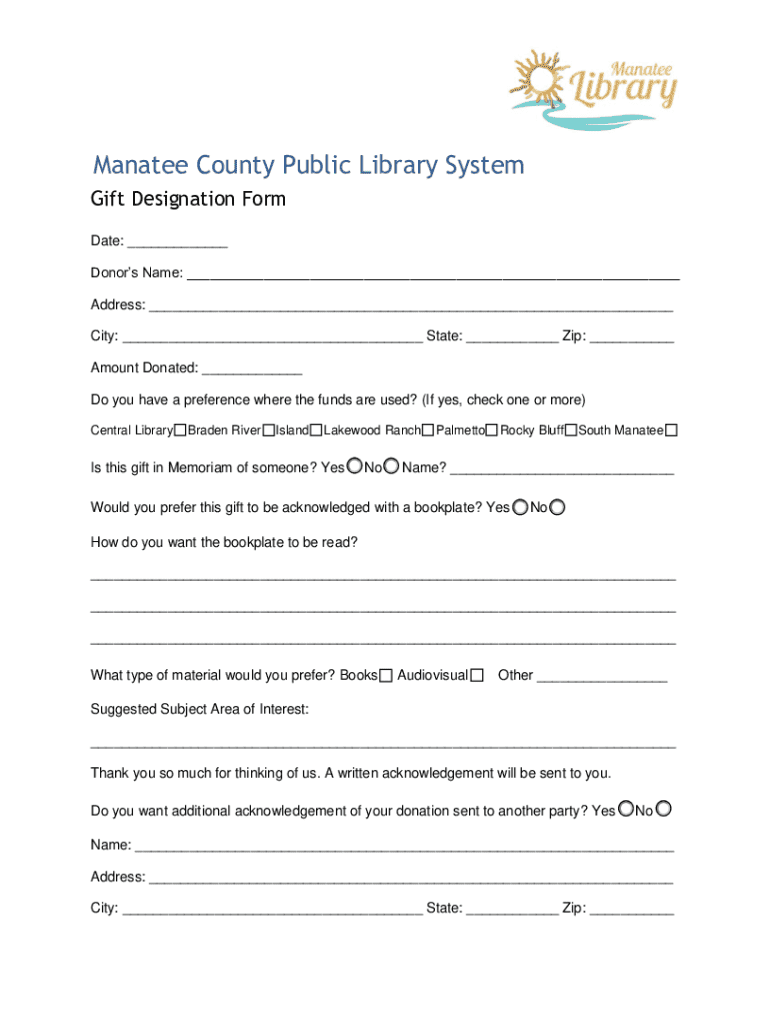

A gift designation form is a crucial document used in charitable giving that allows donors to specify how their contributions should be utilized. This form ensures that the intent of the donor is clearly communicated and honored by the receiving organization. Understanding the specifics of gift designations is vital for both donors and organizations to enhance the effect of giving.

The importance of gift designations in charitable giving cannot be overstated. They allow donors to support causes that resonate with them personally, like education, health care, or community development. This not only consolidates the donor's relationship with the organization but also increases the likelihood of continuous support. Organizations, in turn, benefit from understanding the precise needs of their supporters.

Types of gift designations

Gift designations can broadly be categorized into specific and general designations. Specific designations direct the funds to a particular program, project, or use, while general designations contribute to the overall mission of the organization.

The benefits of using a gift designation form

Utilizing a gift designation form streamlines the donation process for donors. It helps clarify their intentions, ensuring that their contributions align with their philanthropic desires. A well-defined gift designation can reduce misunderstandings about how the funds will be spent, thus fostering trust between donors and organizations.

For organizations, having a structured gift designation form facilitates the management of incoming donations. Clarity in designations enhances donor relations since organizations can directly communicate how the designated funds will be used, fostering transparency. By providing donors with a clear understanding of their contributions, organizations can also increase donor satisfaction and retention.

Preparing to fill out your gift designation form

Before jumping into completing the gift designation form, gather all necessary information. This typically includes personal information like your name, address, and contact details, as well as any specific beneficiary information required for the designation. Accuracy is critical—small errors can lead to significant miscommunications.

When choosing your designation, consider factors such as the purpose behind your gift and the organization’s focus areas. It’s important to reflect on how your contributions can have lasting impacts on the beneficiaries. Your designation should resonate with your values and the causes you care deeply about, allowing you to maximize the potential impact of your donation.

Step-by-step instructions for completing the gift designation form

Accessing the gift designation form is the first step. You can find it easily on the pdfFiller platform, where various templates are available for download. Once you have the form open, start filling in your personal information accurately—this includes fields like your name, address, and contact information.

Next, specify the type of gift you are providing, along with the monetary amount. The form will also prompt you to select the intended beneficiary or designation. If applicable, use the optional fields to add any special notes or messages for the organization. Before finalizing, review all the entered information thoroughly to ensure its correctness.

Once everything is confirmed, you can use pdfFiller’s eSigning feature to sign your document electronically, which enhances the security and efficiency of the submission process. Thereafter, proceed to submit the form via the chosen method, whether that’s through email, printing it out, or uploading directly.

Managing your gift designation

After submitting your gift designation form, tracking your donation is crucial. PDFfFiller provides tools that allow you to monitor the status of your donation, keeping you informed and connected to the impact of your contribution. This transparency fosters a strong relationship with the organization, letting you see how your support is making a difference.

Should you need to modify your gift designation, pdfFiller makes this straightforward. Follow simple steps to access your previously submitted forms, and changing details is easy from there. Maintaining open communication with the recipient organization is also vital. Regular updates regarding your gift help in understanding the results of your support and can enhance your future giving.

Understanding the tax implications of gift designations

Gift designations can have various tax benefits, potentially allowing donors to deduct their contributions from taxable income. However, understanding the specifics of these benefits is key to maximizing your gift's impact. Generally, charitable donations of specified amounts qualify for deductions, but donors must adhere to regulations and requirements to take advantage of these benefits.

Collecting proper documentation and maintaining accurate records concerning your gift is necessary for tax purposes. The organization receiving your donation should provide a receipt detailing the designation, which can be used as proof during tax season. Engaging a tax professional or advisor can further clarify how to benefit from tax deductions related to charitable contributions.

Frequently asked questions (FAQs)

Many individuals have common queries about the gift designation form and its processes. Common concerns include how to fill out specific parts of the form, how to ensure that the donation reaches the intended cause, and the timeline for processing donations. Addressing these questions can ease any apprehensions donors might have about using the form.

Another important aspect involves troubleshooting any issues that may arise while completing or submitting the form. Providing guidance on resolving typical problems, such as digital errors or misunderstandings in the form's requirements, can assist users in successfully navigating the process.

Testimonials and success stories

Real-life examples of the impact of gift designations can inspire others to contribute meaningfully. Many organizations and individuals have shared stories of how designated gifts created scholarships, funded community programs, or even transformed lives. These testimonials showcase the direct connection between donor intention and positive outcomes.

Encouraging engagement through sharing these stories can motivate others to also consider making designated gifts, demonstrating how their contributions will affect the community or cause they feel passionate about. Inspirational narratives can strengthen the understanding of the power of collective giving.

Best practices for gift designation

For a successful giving experience, several best practices should be followed. New and seasoned donors alike can benefit from ensuring they understand the nuances of their chosen designation, including how their gift will be used. Thorough research about the organization and its projects solidifies the decision-making process.

Clear communication regarding their wishes is vital for donors as well. Formal documentation of designations should reflect the donor’s intent, ensuring that all parties involved are on the same page regarding the use of the funds. These practices will uphold the integrity of charitable contributions and ensure meaningful impact.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my gift designation form in Gmail?

How do I edit gift designation form in Chrome?

How do I complete gift designation form on an Android device?

What is gift designation form?

Who is required to file gift designation form?

How to fill out gift designation form?

What is the purpose of gift designation form?

What information must be reported on gift designation form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.