Get the free Corporate Investment Application

Get, Create, Make and Sign corporate investment application

How to edit corporate investment application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate investment application

How to fill out corporate investment application

Who needs corporate investment application?

Corporate Investment Application Form - How-to Guide

Understanding corporate investment applications

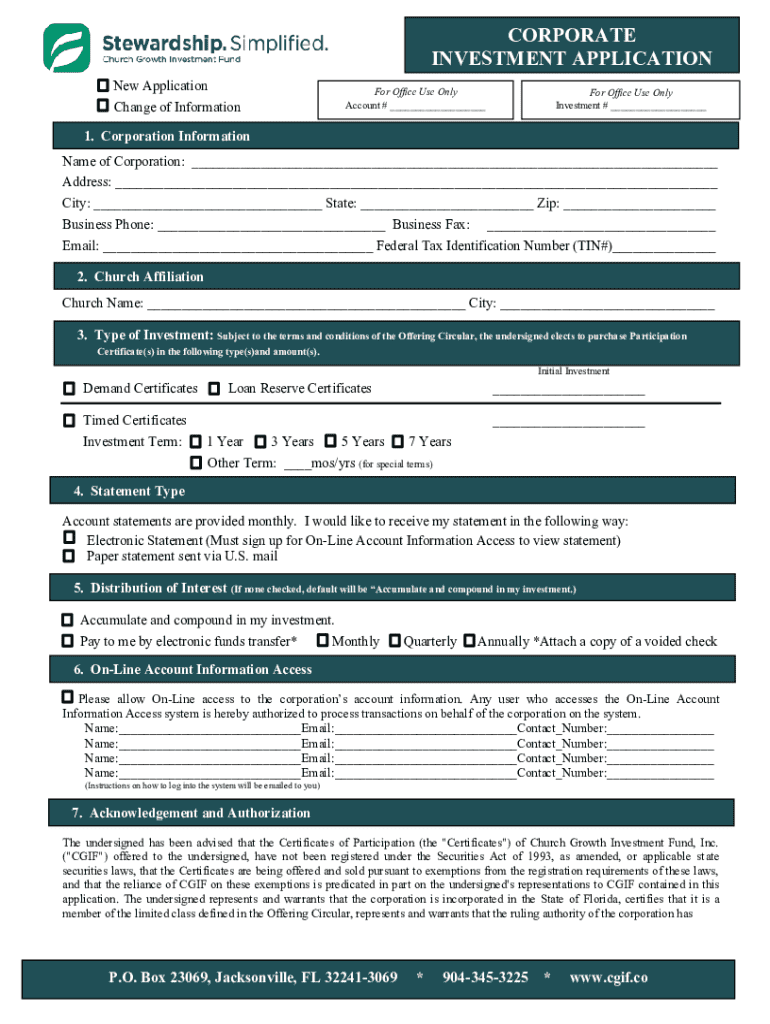

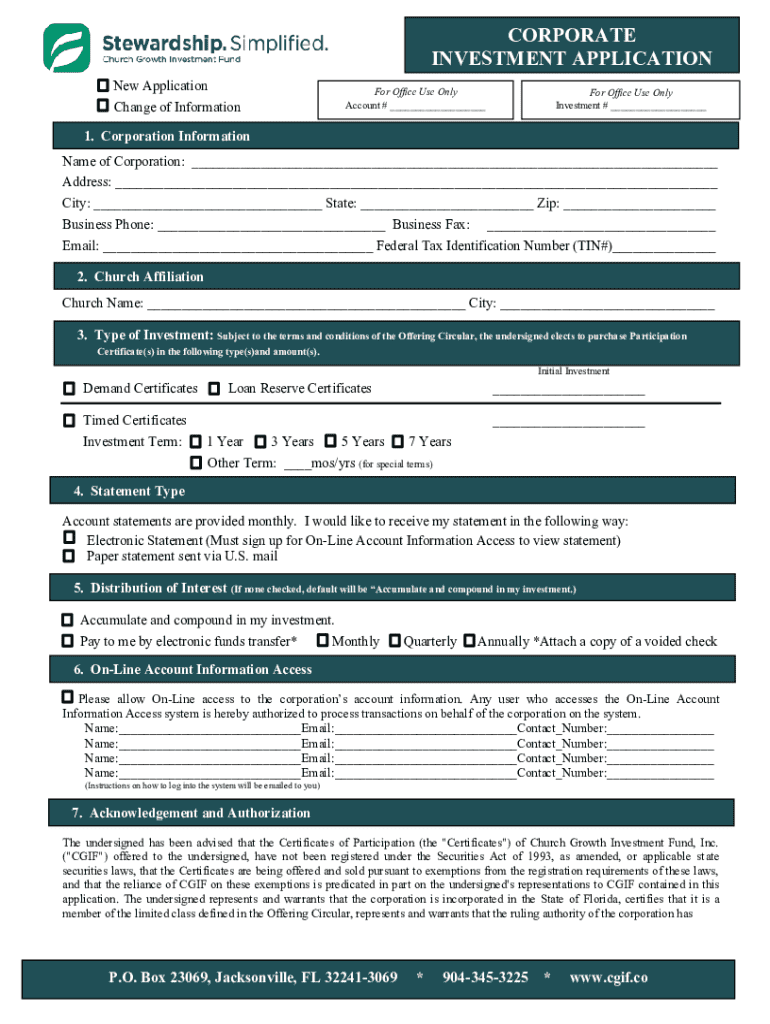

A corporate investment application form is a formal document utilized by businesses seeking financial investment from various sources. This form serves to articulate the company’s funding needs, investment strategies, and the expected outcomes of the proposed investment. It plays a pivotal role in business financing, enabling companies to present their cases to potential investors, banks, or financial institutions. By understanding the significance of this form, businesses can better position themselves to secure necessary funding.

The importance of a corporate investment application form cannot be understated. This document acts as the initial touchpoint for communication with investors, providing them with critical insights into the company's financial health, objectives, and potential return on investment. A well-structured application can significantly enhance the chances of attracting the necessary investment.

Key components of the form

An effective corporate investment application form consists of essential components designed to capture both personal and corporate information. Typically, it includes sections for contact information, business overview, financial statements, and details about the investment being solicited. Additionally, accompanying documentation may be necessary to substantiate claims made within the application.

Preparing to fill out the application form

Preparing to fill out a corporate investment application form requires thorough preparation. This begins with gathering necessary documents, including identification and verification papers, such as tax identification numbers and company registrations. Most investors will also request comprehensive financial statements, including profit and loss reports, cash flow statements, and recent tax returns, to assess the company’s financial standing.

Understanding your investment goals is equally important, as it informs how you present your case. Differentiating between short-term and long-term goals will help structure your application. A risk assessment can also offer insight into potential challenges and how they may impact the desired investment outcomes.

Step-by-step guide to filling out the corporate investment application form

Filling out the corporate investment application form involves several key sections. Start with the basic information section, where you will include your company name, business type, and registration number. Ensure that all contact information is up-to-date, including phone numbers and emails, as inaccurate details can delay correspondence.

Next, provide a comprehensive overview of corporate financial information. Input data regarding revenue, assets, and liabilities accurately. Reporting financial information can be daunting, but it's crucial to avoid common mistakes, such as overestimating revenues or failing to disclose debts, as these errors can jeopardize your application.

Investment details

Clearly outline the type of investment you are seeking. Specify the amount requested and provide a proposed use for the funds, ensuring that this aligns with your business strategy. Investors need to understand how their capital will be utilized for future growth or operational efficiencies.

Compliance and regulatory disclosures

Include all required declarations, such as compliance checks and any relevant regulatory requirements, as ignoring these aspects can lead to the disqualification of your application. Completing a thorough review of your entries is then vital; errors can lead to delays or denials.

Using platforms like pdfFiller can simplify the editing process. The editing tools ensure accuracy by allowing for easy adjustments to the form before submission.

Interactive tools for enhanced experience

Utilizing pdfFiller for document creation and management transforms your application process. Its editing capabilities for PDFs enhance the readability and presentation of your corporate investment application, while eSigning options facilitate quick approvals. This means you can manage the entire document lifecycle from a single platform, improving efficiency and reducing time spent on manual processes.

Collaboration features within pdfFiller also allow teams to share the form for input. You can easily manage feedback and comments, ensuring that everyone involved in the application is informed and onboard with the proposed submission.

Submitting your application form

Deciding between digital and physical submission varies by institution, but opting to submit online offers numerous advantages. Online submissions can expedite the review process, reduce paperwork, and enhance tracking capabilities. If you are utilizing pdfFiller, submitting your application through the platform ensures that your documents remain organized and easily accessible.

Once submitted, tracking your application status is crucial. Utilize the platform’s features to follow up on your submission efficiently. Prepare to engage with potential queries from the investors or financial institutions reviewing your application.

Common challenges and solutions

Several common errors plague corporate investment applications. Misunderstandings about financial information, such as misreporting revenue streams or missing pertinent liabilities, can disqualify an application. Incomplete or inaccurate entries can lead to delayed responses and create doubts about the integrity of the submission.

To resolve issues and inquiries, maintain contact information handy for the financial institutions you are applying to. Checking their FAQs can often provide quick answers to common concerns, ensuring you're well-prepared as you navigate through potential challenges.

Case studies: successful corporate investment applications

Exploring real-life examples of successful corporate investment applications can provide invaluable insight. Analyzing effective submissions reveals strategies that work, from presenting clear financials to demonstrating a compelling use of funds. Lessons learned from successful applications highlight the importance of clarity and transparency in submissions.

By examining case studies, aspiring applicants can build a framework for their submissions, understanding what resonates with potential investors and how best to approach their own applications.

Beyond investment applications: other related forms

Beyond the corporate investment application form, various related documents may be needed. This includes corporate investor applications and agreements, which may outline specific terms of the investment. Understanding these additional forms can expedite the financing process and create a smoother experience overall.

Consider other related forms such as switch forms, stock transfer forms, and cash withdrawal forms. Each serves a unique purpose and can play a critical role in managing your corporate finances and ensuring that you have the necessary documentation for various transactions.

Navigating the process

Navigating the pdfFiller platform should be straightforward. The structure is designed for ease of use, allowing for efficient document management. Utilize the off-canvas menu to access features quickly, ensuring a seamless experience while working on your corporate investment application.

Storing and managing your forms in the cloud offers several benefits, including access from any device and enhanced document security. By maintaining your forms in a secure environment, you can ensure that sensitive information remains protected while being readily available when needed.

Final steps: after submission

After submission, it’s crucial to understand what happens next. Typically, a review timeline will be provided. Being prepared for potential follow-up questions can enhance your credibility and present your organization as professional and organized.

Additionally, keeping your corporate information updated through platforms like pdfFiller ensures that your submissions are current and relevant. Regularly reviewing documents associated with your investments can help maintain clarity and protect your interests as your business evolves.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send corporate investment application for eSignature?

How do I make edits in corporate investment application without leaving Chrome?

How can I fill out corporate investment application on an iOS device?

What is corporate investment application?

Who is required to file corporate investment application?

How to fill out corporate investment application?

What is the purpose of corporate investment application?

What information must be reported on corporate investment application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.