Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Credit Card Authorization Form: A Comprehensive Guide

Understanding credit card authorization forms

A credit card authorization form is a document that grants a seller permission to charge a customer's credit card for a specified transaction. This form serves as a protector for both parties involved in the transaction, establishing a clear agreement regarding payment. By obtaining written consent, businesses can prevent unauthorized transactions, thus enhancing the credibility of payment processing.

The importance of credit card authorization forms in payment processing cannot be overstated. They serve as a critical line of defense against fraud while also acting as a tool for maintaining customer trust. Legitimate transactions are safer when documented properly, allowing businesses to minimize disputes and chargebacks.

The role of authorization forms in preventing chargeback abuse

Chargebacks occur when consumers dispute transactions they've made, leading to refunds initiated by the customer's bank. A credit card authorization form plays a pivotal role in preventing chargeback abuse by providing a documented consent that can be referenced if a chargeback is made. This form can effectively substantiate the legitimacy of a sale and protect businesses from incurring financial losses due to false disputes.

Common scenarios of chargeback abuse include cases where customers claim they never authorized a transaction, despite having made the purchase. The presence of a signed authorization form can challenge such claims, proving that the transaction was valid and authorized. Businesses that utilize these forms have a better defense against chargeback claims, thereby maintaining their revenue and reputation.

When to use a credit card authorization form as a seller

There are specific situations where using a credit card authorization form becomes essential for sellers. For instance, in recurring billing scenarios, such as subscription services or installment payments, these forms ensure that sellers have permission to charge a customer’s card multiple times over a specified period.

Other key situations for using authorization forms include large purchases or services where the total amount may change, such as hotel bookings or car rentals. Implementing authorization forms not only helps secure payments but also instills confidence in customers, as they are informed about transaction expectations and their rights.

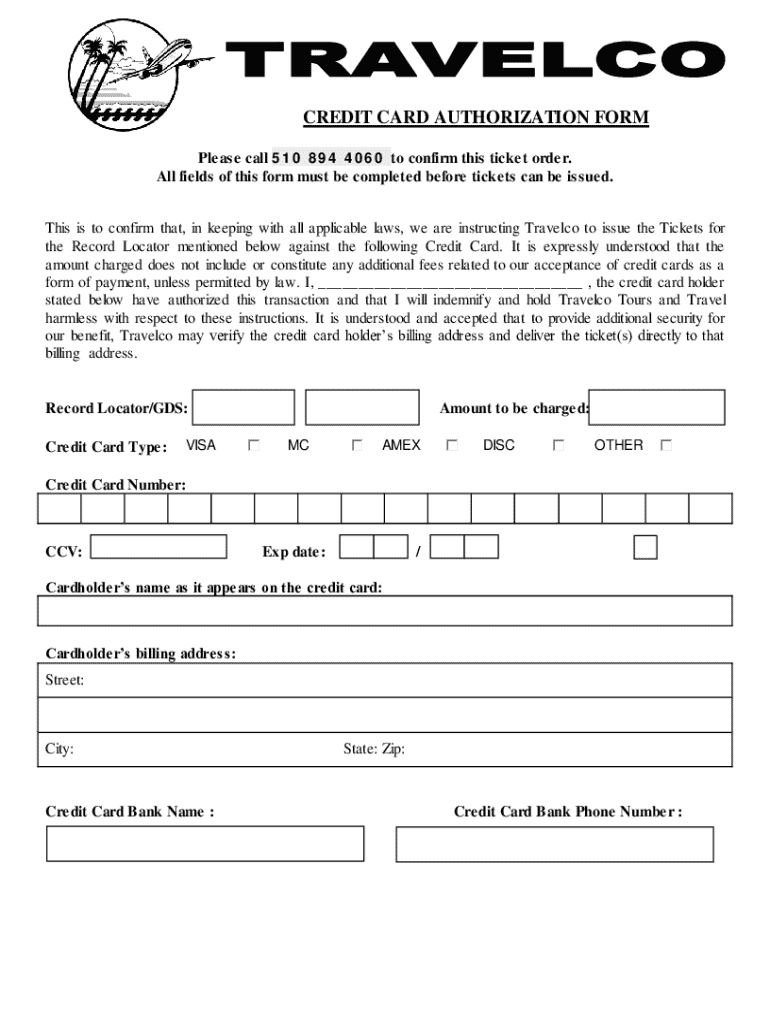

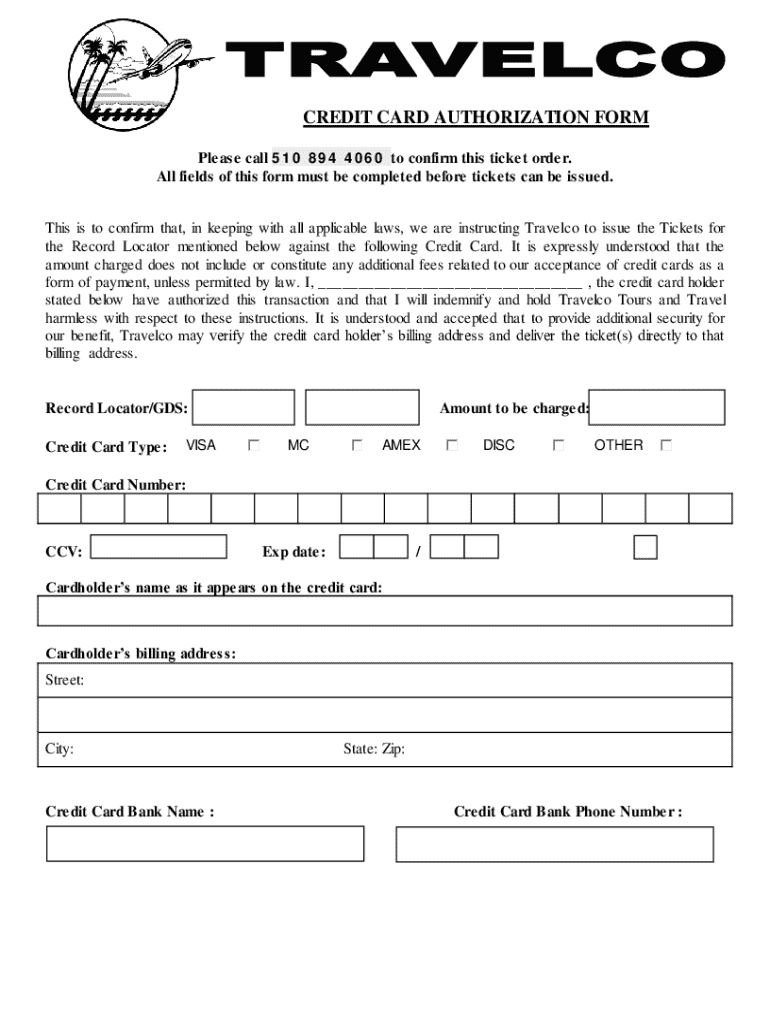

Components of an effective credit card authorization form

An effective credit card authorization form must include several mandatory elements to ensure clarity and compliance. Essential information includes the customer’s personal details, such as their name and address, along with specific payment information like the card number, expiration date, and billing address. Additionally, allowing for an authorization statement indicating the customer's consent for the transaction is crucial.

While those components are mandatory, optional elements can enhance the form’s security. For instance, including the CVV² can prevent unauthorized usage of the card. Clear terms and conditions should also be part of the form, ensuring that customers are well-informed about what they are consenting to.

Creating your own credit card authorization form

Creating a customized credit card authorization form is a straightforward process that can enhance your transaction security. Here’s a step-by-step guide to drafting a form that meets your business needs.

Once completed, users can easily store or send their forms digitally. Downloadable templates through pdfFiller are also available to simplify the process, allowing for quick access and customization.

E-signatures and their impact on authorization forms

E-signatures provide a convenient and legally binding way to authorize transactions through credit card authorization forms. Not only do they speed up the process, but they also improve user experience by eliminating the need for physical signatures in many cases. Juridical acceptance of e-signatures in most regions reinforces their credibility and reliability.

pdfFiller facilitates secure e-signing, ensuring that signatures are encrypted and accessible only to authorized users. This innovative solution supports businesses in achieving compliance and maintaining accurate records while speeding up approval times.

Best practices for storing signed authorization forms

Proper storage of signed credit card authorization forms is vital for security and compliance. Businesses should maintain electronic copies of these documents, preferably in secure cloud storage solutions to prevent unauthorized access. Regular backups and encryption should accompany these storage practices to ensure data safety.

Determining how long to retain records is also important. Legal requirements may dictate a specific retention period, typically ranging from three to seven years, depending on local regulations. Ensure your process complies with data privacy laws like GDPR or HIPAA, adjusting your practices based on the nature of your business and customer transactions.

Addressing common questions about credit card authorization forms

Many professionals have questions surrounding the use of credit card authorization forms. One common query is whether there is a legal obligation to use them. While there is no federal law mandating their use, many businesses choose to implement them as a best practice to protect against disputes.

If a customer disputes a charge, it's essential to have a protocol in place. This includes accessing the signed authorization form as proof of consent. Proper documentation significantly enhances your chances of successfully countering disputes. Additionally, ensuring the form is secure helps prevent unauthorized transactions, protecting both your business and your customers.

Related considerations for businesses

Understanding credit card authorization forms also involves broader financial concepts such as 'Card on File' and its implications for customer relationships and payment processing fees. Card on file refers to instances where businesses retain a customer’s attached card information for ease of future transactions. While this convenience has benefits, it also introduces financial responsibilities and risks that managers must understand.

Moreover, processing fees associated with credit card transactions often vary depending on the nature of the authorization form agreement. This diversification in fees is essential to consider during the budgeting and forecasting process within any business plan, allowing for effective financial management.

Explore more resources

By diving deeper into the topic of credit card authorization forms, businesses can stay ahead of trends in payment processing. Articles and resources that address how to accept transactions over the phone or understanding the nuances of different payment methods can be beneficial for growth and adaptation in a competitive market. Regularly updating knowledge on these topics will empower organizations to make informed decisions and improve financial operations.

Subscription and updates

For ongoing insights and updates regarding credit card authorization forms and payment processing, subscribing to our newsletter can keep you informed. Regular updates ensure that you stay current with best practices and innovations available through platforms like pdfFiller.

Engage with pdfFiller

We encourage users to share their experiences related to credit card authorization forms. Engaging openly can cultivate a supportive community and generate discussions that benefit everyone involved. By joining our community, you can stay informed on new features and enhancements from pdfFiller, ensuring you’re equipped with the best tools for managing your documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get credit card authorization form?

How do I edit credit card authorization form on an iOS device?

Can I edit credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.