Get the free Mortgage Loan Application

Get, Create, Make and Sign mortgage loan application

How to edit mortgage loan application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage loan application

How to fill out mortgage loan application

Who needs mortgage loan application?

Your Complete Guide to the Mortgage Loan Application Form

Understanding the mortgage loan application process

A mortgage loan application is a crucial document that initiates the process of securing financing to purchase a home. This application not only serves as a request for funding but also provides lenders with essential information about your financial situation and creditworthiness. Understanding the mortgage process helps demystify what can often seem like a daunting task.

Familiarize yourself with these key terms as they frequently appear throughout the mortgage loan application form. Knowing these can help you better understand your financial obligations and the lender's criteria.

Preparing to fill out your mortgage loan application form

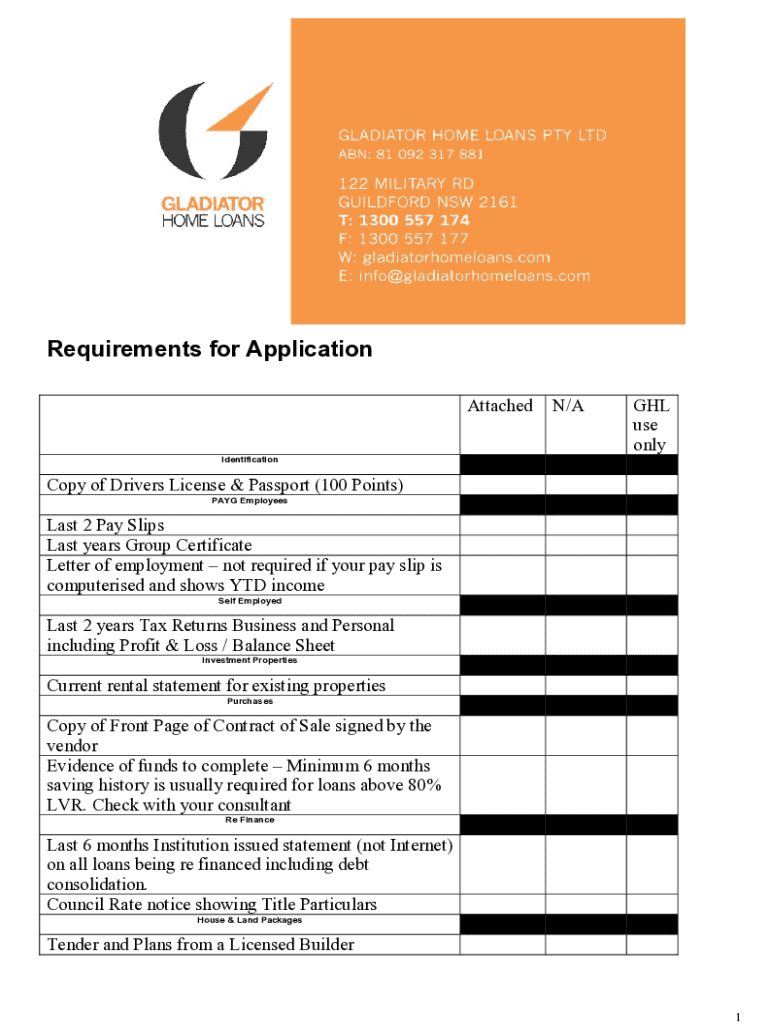

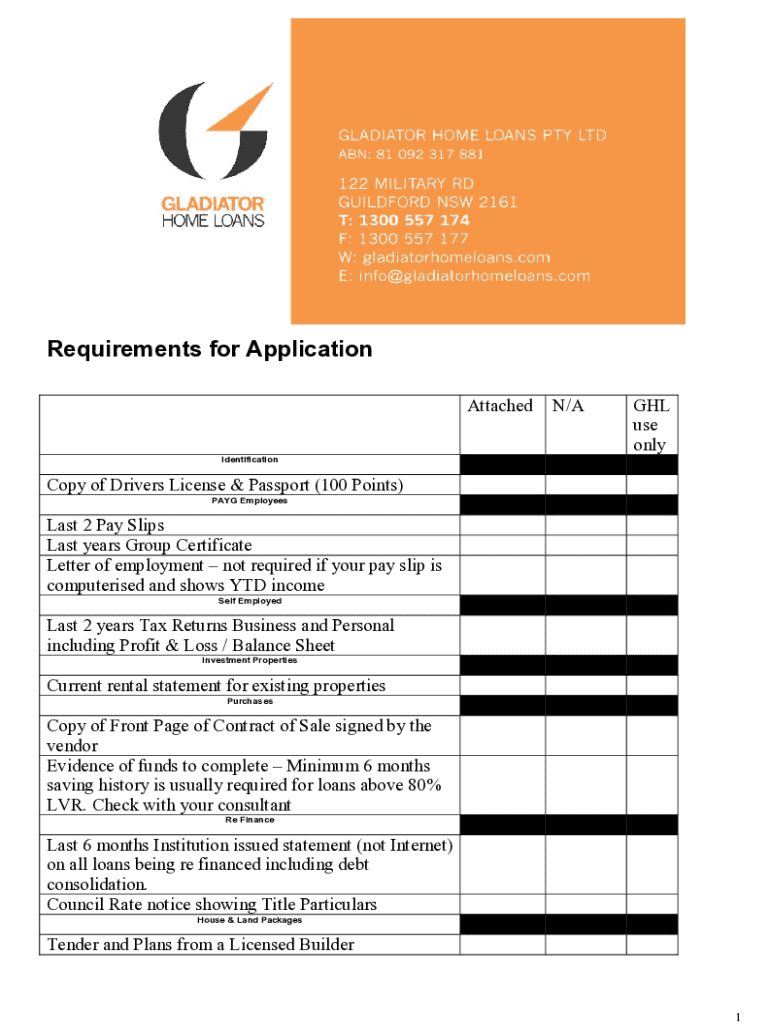

Before you begin filling out your mortgage loan application form, preparation is essential. Gather all necessary documentation to ensure a smooth process. Start with proof of income, such as recent pay stubs and tax returns. These documents demonstrate your financial stability and ability to make monthly payments.

Additionally, understanding the types of mortgages available can significantly impact your application. Fixed-rate mortgages offer consistent payments, while adjustable-rate mortgages may adjust in response to market conditions. Familiarize yourself with government-insured loans, such as FHA and VA loans, as they can provide unique advantages.

Step-by-step guide to completing the mortgage loan application form

Once you have all your documents ready, it's time to dive into filling out the mortgage loan application form. Understanding each section is vital for accuracy and ensuring a smooth approval process. The first section typically asks for personal information. Be meticulous when providing details such as your full name, address, and contact information.

Moving forward, detail your financial information carefully, listing all assets and liabilities. It’s essential to calculate your debt-to-income ratio accurately, as this ratio helps lenders assess your financial health. Lastly, when filling out the loan details section, choose the loan amount and type that suits your needs, and understand how the purpose of the loan might influence your application.

Tips for a successful mortgage application

Accuracy is paramount on your mortgage loan application form. Even minor discrepancies can lead to delays or, worse, denial of your application. Be diligent in providing truthful and consistent information throughout the form. Additionally, improving your credit score before applying can enhance your chances for approval and possibly secure better interest rates.

Finally, avoid common mistakes such as neglecting to fully read terms and conditions or miscalculating your income. Maintaining a checklist of dos and don’ts can help steer you clear of pitfalls during this process.

Enhancing your mortgage loan application with pdfFiller

Utilizing pdfFiller for your mortgage loan application form can make the process not only easier but more efficient. With pdfFiller’s user-friendly interface, you can seamlessly edit and customize your forms online. This means you can fill out the application at your own pace and ensure all necessary questions are answered correctly.

eSigning your application not only speeds up the process but also enhances security. The platform also allows you to share the document with family members or advisors for collaborative input or signature, ensuring that everyone involved can contribute to the application.

Next steps after submitting your mortgage loan application

After submitting your mortgage loan application, there are several steps to anticipate. The review process usually involves the lender verifying your information and conducting a credit analysis. Expect a timeline that varies from a few days to several weeks, depending on the complexity of your financial situation.

Properly handling any requests for additional information can significantly impact the approval speed. Being proactive and responsive will help maintain a positive process.

Managing your mortgage application and documentation

Once your application is submitted, storing and organizing your mortgage documents is crucial. Utilize pdfFiller not only for filling out your application but also for comprehensive document management. With its cloud-based capabilities, you can easily store all related documents in one secure place, accessible from anywhere.

Understanding how to monitor and manage your application will give you peace of mind, knowing you are on top of the process.

FAQs about the mortgage loan application form

When pursuing a mortgage, potential applicants often have questions that arise about the process. For instance, many wonder how long the application process typically takes, which can range from a few days to several weeks, depending on the lender and your financial situation. If you're concerned about having a bad credit score, exploring options with lenders who specialize in working with individuals who have less-than-perfect credit can be beneficial.

These FAQs often highlight essential aspects of the application that applicants need to focus on to enhance their chances for approval.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mortgage loan application from Google Drive?

How can I edit mortgage loan application on a smartphone?

How do I edit mortgage loan application on an iOS device?

What is mortgage loan application?

Who is required to file mortgage loan application?

How to fill out mortgage loan application?

What is the purpose of mortgage loan application?

What information must be reported on mortgage loan application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.