Get the free Student Untaxed Income Worksheet

Get, Create, Make and Sign student untaxed income worksheet

How to edit student untaxed income worksheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out student untaxed income worksheet

How to fill out student untaxed income worksheet

Who needs student untaxed income worksheet?

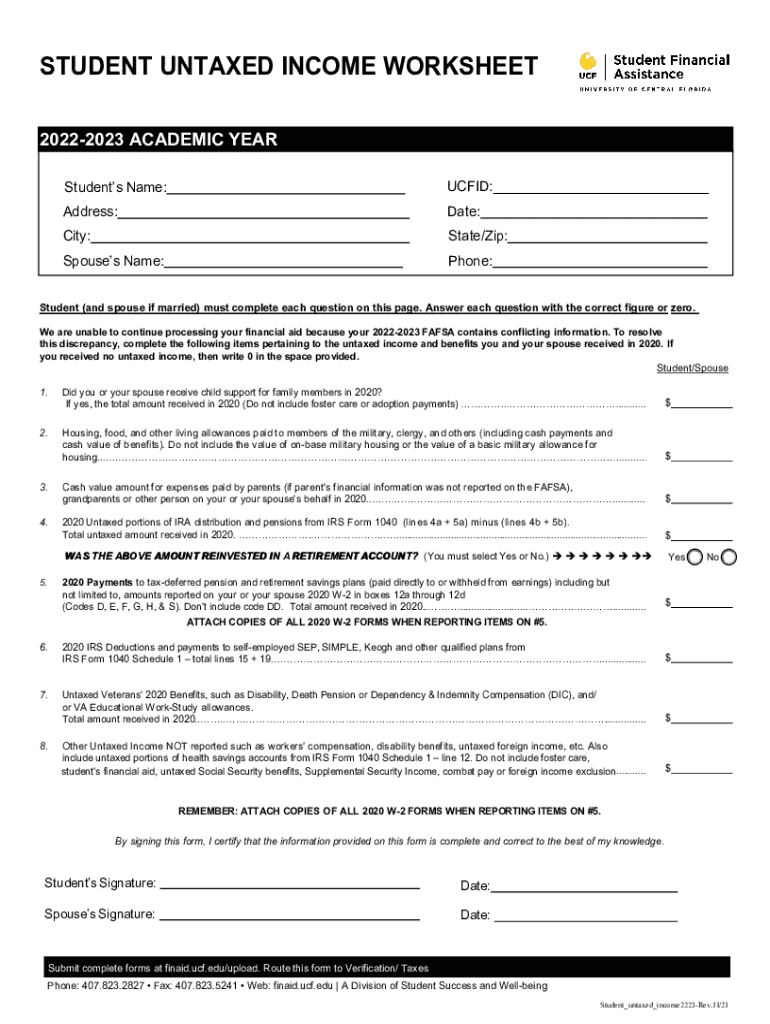

Understanding the Student Untaxed Income Worksheet Form

Understanding the purpose of the student untaxed income worksheet form

The student untaxed income worksheet form is a critical document in the financial aid process that provides insight into a student’s financial situation beyond what's captured in tax returns. This form allows students to report various types of untaxed income they might receive, which can help determine their eligibility for financial aid, scholarships, and loans.

Completing this form accurately is crucial for students who depend on financial assistance to pay for their education expenses. Financial aid officers utilize the information on this worksheet to assess the full picture of a student's financial standing, particularly in cases where conventional taxable income does not fully represent their economic reality.

Key components of the student untaxed income worksheet form

The student untaxed income worksheet form requires students to summarize various types of income that are not subject to federal income tax. Common categories of untaxed income include child support received, welfare benefits, non-taxable interest income, and more. Each of these income sources impacts the overall financial aid calculation.

To accurately complete the worksheet, students need to gather documentation that validates their reported untaxed income. This documentation can include bank statements, benefit award letters, and any other relevant financial records which substantiate the figures they present on the form.

Step-by-step guide for completing the worksheet

Completing the student untaxed income worksheet form involves several essential steps, which when followed closely, ensure accurate reporting of finances.

Step 1 involves gathering your financial information. Make a checklist to ensure you have all necessary documents such as bank statements, benefit letters, and any other sources of untaxed income. Step 2 is about filling out personal information accurately, including your name, contact details, and any identification numbers that may be required.

In Step 3, you will report your untaxed income by filling in the relevant sections of the worksheet. It's vital to report each source accurately. Finally, step 4 is crucial—review your entries meticulously before submitting the worksheet to ensure there is no missing or incorrect information.

Common mistakes to avoid

Despite the straightforward nature of the student untaxed income worksheet form, many students fall victim to common mistakes that can hinder their financial aid applications. One frequent error is providing incomplete information, which can delay the processing of their application.

Misreporting income is another pitfall; students must be diligent in ensuring that all income sources are reported fully. Additionally, failing to include necessary supporting documents can lead to complications and potential denial of financial aid eligibility. Rectifying these mistakes can be cumbersome, often requiring additional time and effort.

Utilizing pdfFiller for enhanced management of your worksheet

Using pdfFiller can significantly improve your experience when managing the student untaxed income worksheet form. This platform empowers students to edit and customize the worksheet, ensuring they can tailor it to their specific financial situation without hassle. The intuitive editing tools provided make it easy to complete forms accurately.

One of the standout features of pdfFiller is the ability to eSign forms and collaborate efficiently. Students can share their worksheets with family members or financial advisors for input or review, streamlining the process. Being cloud-based, pdfFiller also allows access to your documents anytime and anywhere, which is incredibly beneficial for students always on the go.

Next steps after completing the worksheet

Once the student untaxed income worksheet form is complete, the next steps are crucial for ensuring financial aid applications move forward smoothly. This includes determining where to submit the form, which typically involves the financial aid office of your educational institution or specific online systems outlined in financial aid guidelines.

Following submission, it's important to track your financial aid status regularly. This includes monitoring for any updates, responding promptly to any requests for additional information, and staying in contact with the financial aid office to address any issues that arise during the review process.

FAQs about the student untaxed income worksheet

Students often have questions regarding the nuances of the student untaxed income worksheet form. Common queries include deadlines for submission, how to handle unique financial situations, or what to do in cases of unexpected income fluctuations. Being aware of these concerns can significantly ease the application process.

For example, students might wonder if they need to report income that was recently terminated or decreased. Understanding how to navigate these scenarios is vital for presenting an accurate financial profile. Institutions often provide resources or direct answers to these questions through their financial aid offices.

Additional tips for financial transparency

Maintaining financial transparency is paramount for students applying for financial aid. One effective way to achieve this is by keeping meticulous records of all sources of untaxed income. This can streamline the process of completing the student untaxed income worksheet form and foster a clearer picture of your financial background.

Additionally, students should be proactive in seeking resources available through their educational institutions. Many colleges and universities offer financial counseling services to assist students in navigating the complexities of financial aid, budgeting, and managing expenses effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send student untaxed income worksheet to be eSigned by others?

Can I create an electronic signature for the student untaxed income worksheet in Chrome?

How do I fill out student untaxed income worksheet using my mobile device?

What is student untaxed income worksheet?

Who is required to file student untaxed income worksheet?

How to fill out student untaxed income worksheet?

What is the purpose of student untaxed income worksheet?

What information must be reported on student untaxed income worksheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.