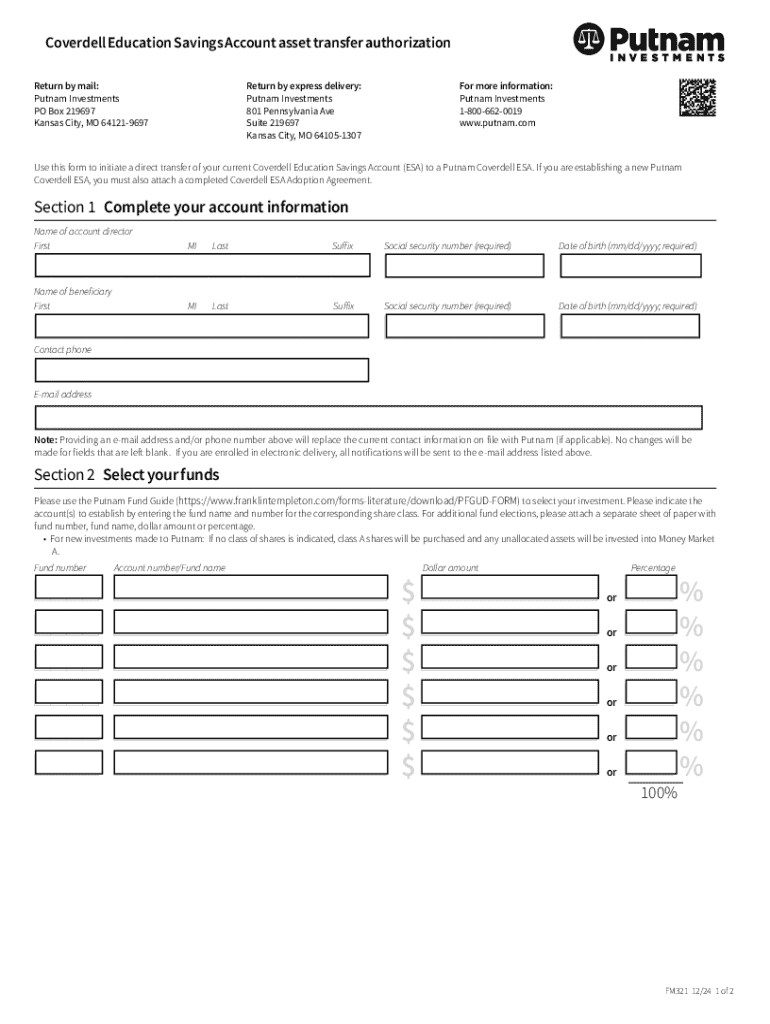

Get the free Coverdell Education Savings Account Asset Transfer Authorization

Get, Create, Make and Sign coverdell education savings account

Editing coverdell education savings account online

Uncompromising security for your PDF editing and eSignature needs

How to fill out coverdell education savings account

How to fill out coverdell education savings account

Who needs coverdell education savings account?

Coverdell Education Savings Account Form - How-to Guide

Understanding the Coverdell Education Savings Account (ESA)

The Coverdell Education Savings Account (ESA) is a tax-advantaged savings plan designed to help families save for future education expenses. This account allows individuals to contribute toward the education costs of a designated beneficiary, whether for elementary, secondary, or post-secondary education. To qualify, the beneficiary must be under the age of 18 or a special needs beneficiary. The contribution limit stands at $2,000 per year per beneficiary, making it a valuable tool for educational financial planning.

One of the key benefits of a Coverdell ESA is its tax advantages. Contributions grow tax-free, and withdrawals for qualified education expenses are also tax-free, making it an excellent option for tax-conscious families. Families can use the funds for a wide range of educational costs, including tuition, books, and room and board. Compared to 529 plans, which often focus solely on college costs, the Coverdell ESA covers a broader spectrum of educational expenses and can be used at various types of educational institutions.

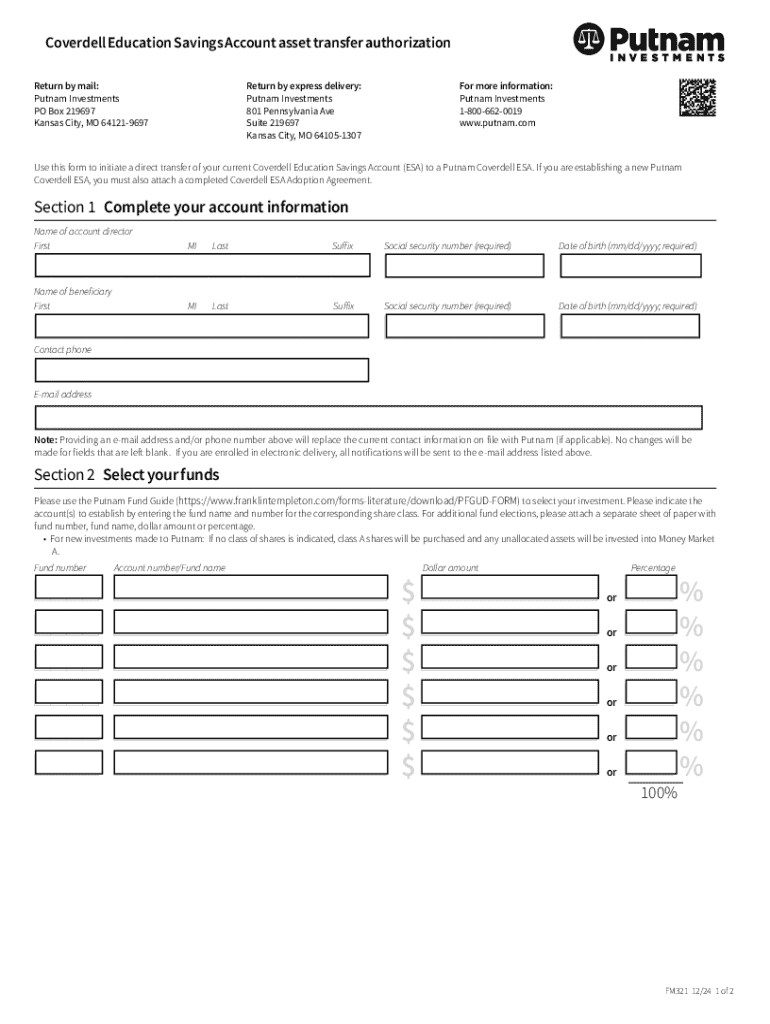

Navigating the Coverdell ESA Form

The Coverdell ESA form is the official document required to open and manage your Coverdell Education Savings Account. This form captures essential information about the account holder, beneficiary, contributions, and any amendments to the account. Accuracy in filling out this form is crucial, as it ensures compliance with IRS regulations and allows for the expected tax benefits associated with this savings vehicle.

Moreover, submitting an improperly filled out Coverdell ESA form could lead to processing delays or rejection, which can hinder the educational funding process. Therefore, an understanding of the form and its components is essential for anyone considering a Coverdell ESA.

Step-by-step instructions for completing the Coverdell ESA form

Before tackling the Coverdell ESA form, preparation is key. Make sure to gather necessary documents such as Social Security numbers of both the account holder and beneficiary, proof of educational expenses, and any relevant tax documents. Using a tool like pdfFiller can streamline the process, allowing for easy editing and submission.

Common mistakes to avoid when filling out the form

Filling out the Coverdell ESA form can be complex, and mistakes can lead to significant delays. Common errors include omitting required fields, such as contact information or beneficiary details, which can result in the form being rejected. Incorrectly entering Social Security numbers or failing to provide documentation for contributions can also complicate the process.

To mitigate errors, create a checklist of items to review before submitting your form. This checklist could include verifying all entered data, confirming that signatures are provided, and ensuring that you have attached all necessary documents. Double-checking your work will save time and hassle in the long run.

Submitting the Coverdell ESA form

Once your Coverdell ESA form is completed, it's time to submit it. One efficient method is to utilize pdfFiller, which allows for seamless electronic submission. Simply upload the completed form to the platform, sign electronically, and send it out directly from there.

Alternatively, if you prefer traditional methods, mailing or faxing your Coverdell ESA form is also an option. When choosing to mail, make sure to send it via certified mail with a return receipt requested to confirm it reaches the intended destination. Each method has its pros and cons. Electronic submission through pdfFiller is generally faster, while mailing could take longer, depending on postal service efficiency.

What happens after submission?

After you submit your Coverdell ESA form, it's essential to be aware of the processing time. Typically, it may take a few weeks for the IRS or the financial institution to process your submission. During this time, keep track of your submission status through the communication provided by the institution.

Staying proactive in confirming receipt of your form is crucial. If you haven't received confirmation within the expected timeframe, reaching out directly to the institution can help clarify your form's status and ensure any issues are addressed promptly.

Managing your Coverdell ESA account

Successfully managing your Coverdell ESA account requires a strategic approach. Use the funds wisely, focusing on qualified expenses to ensure tax-free withdrawal. This includes tuition, textbooks, and necessary supplies. Maintaining thorough records of all transactions and educational expenses is beneficial for both you and the IRS in case of future audits.

Collaboration is also important if you are managing the account with others. Tools like pdfFiller enable multiple users to access and manage documents efficiently, enhancing communication and ensuring all involved parties are on the same page.

Advanced tools and features on pdfFiller

pdfFiller provides a range of advanced tools to make managing the Coverdell ESA form easier. With the ability to edit and annotate PDFs seamlessly, users can make real-time adjustments and ensure that all information is current and accurate. The cloud-based storage feature allows access from anywhere, which is particularly beneficial for individuals on the go or teams collaborating across different locations.

In addition, pdfFiller's electronic signing feature offers a significant advantage. Users can eSign documents quickly and securely, reducing the need for physical paperwork and enabling faster processing times for the Coverdell ESA form. Embracing these tools can significantly enhance the overall user experience and efficiency.

FAQs on Coverdell ESA form completion

Completing the Coverdell ESA form can raise many questions among users. Common queries include how to handle contributions if multiple beneficiaries are named or what to do if the beneficiary reaches age 30. It's essential to know that contributions must cease for beneficiaries who do not meet age requirements, and the account must be distributed within a specific period, typically within 30 days following their 30th birthday.

For any challenges or uncertainties faced during the form completion process, pdfFiller's customer support is readily available to assist. Users can trust that dedicated professionals are on hand to navigate any hurdles, ensuring that individuals have access to the help they need to fill out the Coverdell ESA form correctly.

Success stories and user testimonials

Many users have successfully leveraged the Coverdell ESA form with the help of pdfFiller, leading to a more well-funded education for their children. One user shared how the streamlined process allowed them to keep track of educational expenses effortlessly, ultimately leading to increased savings. They felt empowered to manage their account effectively, ensuring their child's future educational costs were covered without financial strain.

Another user noted that using pdfFiller not only simplified the form completion but also made collaboration with their spouse seamless. They appreciated how the ability to edit and manage documents together allowed them to make informed decisions about educational funding, resulting in impactful outcomes for their family.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete coverdell education savings account online?

Can I sign the coverdell education savings account electronically in Chrome?

Can I create an electronic signature for signing my coverdell education savings account in Gmail?

What is coverdell education savings account?

Who is required to file coverdell education savings account?

How to fill out coverdell education savings account?

What is the purpose of coverdell education savings account?

What information must be reported on coverdell education savings account?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.