Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

How to edit sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Sec Form 4 Form: A Comprehensive How-To Guide

Overview of Sec Form 4

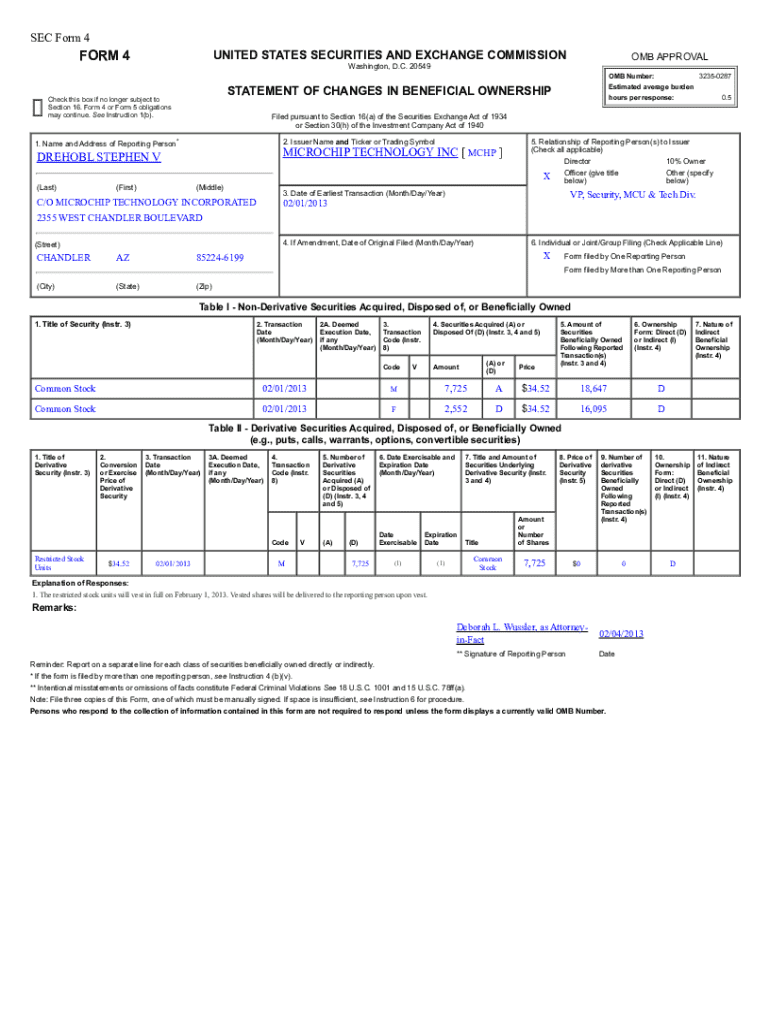

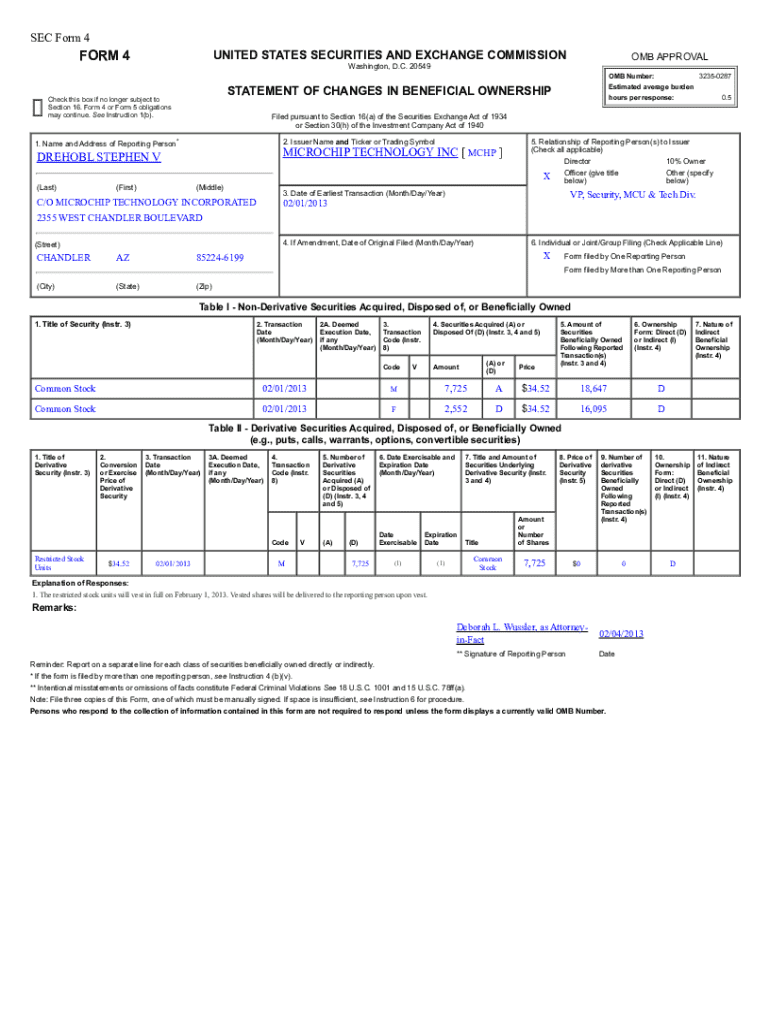

Sec Form 4 is a crucial document required by the Securities and Exchange Commission (SEC) for public companies. It serves as a report of changes in the ownership of a company’s securities by its insiders, such as executive officers, directors, and significant shareholders. The primary purpose of this form is to enhance transparency in the financial markets by disclosing transactions that could influence an investor's decisions.

The relevance of Sec Form 4 in financial reporting and compliance cannot be overstated. By mandating the disclosure of insider trading activities, it aims to prevent fraudulent practices and uphold the integrity of the financial system. For companies and their executives, this form is not just a bureaucratic requirement; it is an essential tool for maintaining the trust of investors and regulatory bodies alike.

Key features of Sec Form 4

Understanding the structure of Sec Form 4 is vital for anyone tasked with completing this document. The form is divided into several sections, each designed to capture specific information related to the reporting of securities transactions. Key sections include identifying details about the insider, the transaction details, and specific insights into the type of securities involved.

The common uses of Sec Form 4, aside from simply ensuring compliance, include the necessity for timely disclosures related to insider trading activities. This not only keeps the market informed but also serves as a deterrent against potential misconduct. Companies must adhere to these reporting guidelines to maintain their reputation and safeguard against regulatory scrutiny.

Preparing to complete Sec Form 4

Before attempting to complete Sec Form 4, gather essential background information critical for accurate reporting. This includes basic company details such as the issuer’s name, SEC Central Index Key (CIK), and the names of the insiders involved. Understanding the insider's relationship to the company, including their role and existing holdings, is equally important.

Several tools and resources can streamline this process. pdfFiller offers interactive tools that simplify the completion of various forms, including Sec Form 4. Through pdfFiller, users can easily access relevant financial data and reports needed to inform the entries on the form, ensuring that all information is accurate and compliant with SEC regulations.

Step-by-step guide to filling out Sec Form 4

Step 1: Accessing the Form - The first step is locating Sec Form 4 on the SEC website. Navigate to the SEC's EDGAR database, where all forms are available for download in PDF format. Using pdfFiller can simplify this process, as the platform enables easy access to the form without the hassle of downloading or printing.

Step 2: Gathering Necessary Information - Once the form is accessed, collect all required documentation. This includes any prior filings, current ownership details, and specifics on the transaction being reported. Ensuring accuracy here is essential; incorrect or omitted information could lead to significant penalties.

Step 3: Completing Each Section - As you fill out the form, pay close attention to each part. Provide full details regarding insider information, including the insider’s principal residence address and job title. When reporting transaction information, specify the nature of the security, the number of shares involved, and the transaction date.

Step 4: Reviewing the Completed Form - Review your entries carefully. Double-checking for typos or inaccuracies ensures compliance and mitigates risks associated with incorrect filings. Common mistakes often include missing signatures or failing to account for all transactions correctly.

Editing and signing Sec Form 4

Utilizing pdfFiller for editing facilitates two main aspects: making changes to a signed form and collaborating with team members. If an error is found post-signature, pdfFiller’s tools allow for easy editing while retaining the original version for record-keeping. This feature is especially valuable in team environments where multiple stakeholders need to review and contribute to the document.

For eSigning the document, pdfFiller provides a robust platform that ensures signatures are legally valid and compliant with electronic signature laws. The benefits of eSigning include speed, convenience, and a secure way to manage document workflows. By leveraging these features, you not only save time but also reduce the risk of delay in submission, which could have serious implications.

Submitting Sec Form 4

When it comes to submission channels for Sec Form 4, there are two primary routes: e-submissions and paper filings. E-submissions via the SEC's EDGAR system are encouraged for their efficiency and added security. Paper filings are generally less preferred due to longer processing times and potential mailing delays.

It's critically important to be aware of deadlines and important dates related to Sec Form 4 submissions. Companies must regularly file these forms whenever there are changes in insider ownership, typically within two business days of the transaction. Establishing a filing calendar can help keep all stakeholders on track and compliant with filing requirements.

Managing Sec Form 4 after submission

After submitting Sec Form 4, keeping track of your submission status is paramount. The SEC provides tools within the EDGAR system for users to monitor their filings and ensure they have been received. Understanding the SEC's possible feedback or queries is beneficial, providing an opportunity for clarification if discrepancies arise.

In cases where amendments or corrections to the submitted form are necessary, familiarize yourself with the procedures for filing these changes. Amendments must also be submitted promptly to reflect accurate ownership details, and knowing when and how to file these can save time and help maintain compliance.

Best practices for using Sec Form 4

To enhance compliance through effective reporting, leverage the various features offered by pdfFiller when managing Sec Form 4. Version control and document history tracking can significantly improve transparency and accuracy as it allows users to refer back to previous versions of the form and understand the changes made over time.

Exploring case studies where executives successfully navigated the filing process can provide valuable insights. Understanding their challenges, solutions, and the timelines involved can offer a practical perspective, demonstrating the importance of diligent reporting and the role of tools such as pdfFiller in those processes.

FAQs about Sec Form 4

There are several common pitfalls and misunderstandings surrounding Sec Form 4 that many insiders face. A frequent issue lies in misinterpreting SEC guidelines regarding timely reporting, which can lead to penalties. Clarifying what constitutes a reportable transaction is crucial for compliance.

Leverage pdfFiller’s resources for additional support to navigate the complexities of SEC regulations. Their knowledge base and customer support can guide you through common issues and ensure you understand your responsibilities under the law.

Additional considerations

Stay informed about emerging regulations that could impact Sec Form 4 reporting requirements. The legal and compliance landscape continues to evolve, and new rules may necessitate changes in how filings are completed. Regular training and updates for involved stakeholders can mitigate risks and ensure ongoing compliance.

When managing Sec Form 4 over the long term, focus on document security and data protection strategies. Using platforms like pdfFiller, which prioritizes encryption and secure access, allows organizations to safeguard sensitive information while streamlining the document management process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my sec form 4 in Gmail?

How can I modify sec form 4 without leaving Google Drive?

How do I fill out sec form 4 on an Android device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.