Get the free Charity Vat Exemption

Get, Create, Make and Sign charity vat exemption

How to edit charity vat exemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out charity vat exemption

How to fill out charity vat exemption

Who needs charity vat exemption?

Understanding Charity VAT Exemption Form: A Comprehensive Guide

Understanding charity VAT exemption

Charity VAT exemption refers to the relief from Value Added Tax (VAT) that eligible charitable organizations can claim on specific supplies of goods and services. This exemption is significant because it allows charities to alleviate some of their financial burdens, enabling them to focus more on their core mission rather than on administrative costs.

For charitable organizations, the importance of VAT exemption cannot be overstated. It not only helps in reducing operational costs but also plays a crucial role in maximizing the impact of donations. The reduced tax liability may encourage more donations, as funds can be directed toward charitable activities rather than tax payments.

Who qualifies for VAT exemption?

To qualify for VAT exemption, charities must meet specific criteria. Primarily, they need to be registered as charitable organizations with the relevant regulatory authority in their country. In many jurisdictions, this means having a recognized charitable status that demonstrates the organization operates for charitable purposes and not for profit.

Additionally, the nature of the activities carried out by the organization is crucial in determining eligibility. Charities that primarily engage in providing welfare, education, health care, or other public benefit activities typically qualify. Examples include soup kitchens, educational programs, and health services that support disadvantaged groups.

Key benefits of VAT exemption for charities

The financial advantages of VAT exemption for charities are substantial. By reducing the necessary tax expenses, charities can redirect these funds toward enhancing programs, services, and community support. This improved financial standing supports long-term sustainability and growth.

Moreover, VAT exemption encourages donor engagement. When potential donors see that their contributions can make a more significant impact due to tax relief, they are likely to increase their support. This chain of financial benefits ultimately elevates the charity's capacity to fulfill its mission.

Types of goods and services eligible for VAT exemption

Charities can benefit from VAT exemption on both specific goods and services. Typically, VAT-exempt goods include those essential to the charity's mission. For instance, medical equipment used in healthcare programs, educational materials for teaching, and community provisions such as food and shelter all fall under this category.

In terms of services, charities can also enjoy VAT exemptions on professional services tailored to disabled individuals, as well as costs incurred during fundraising events and activities. By ensuring these crucial engagements remain tax-free, charities can maximize the funds available for their programs.

The application process for VAT exemption

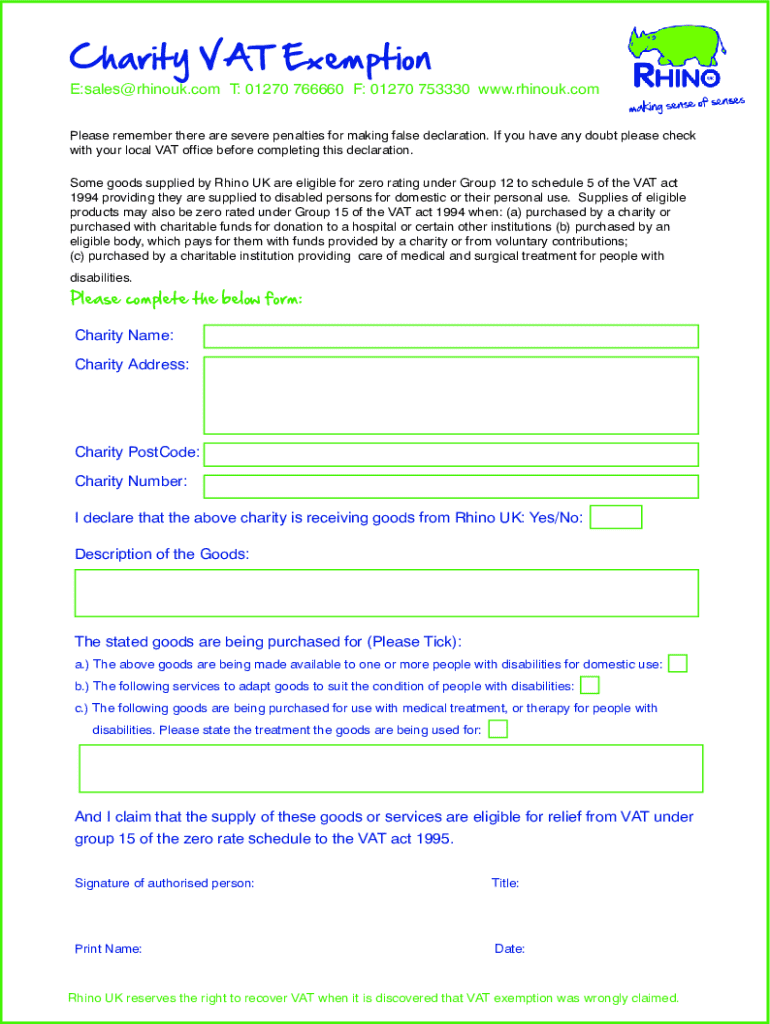

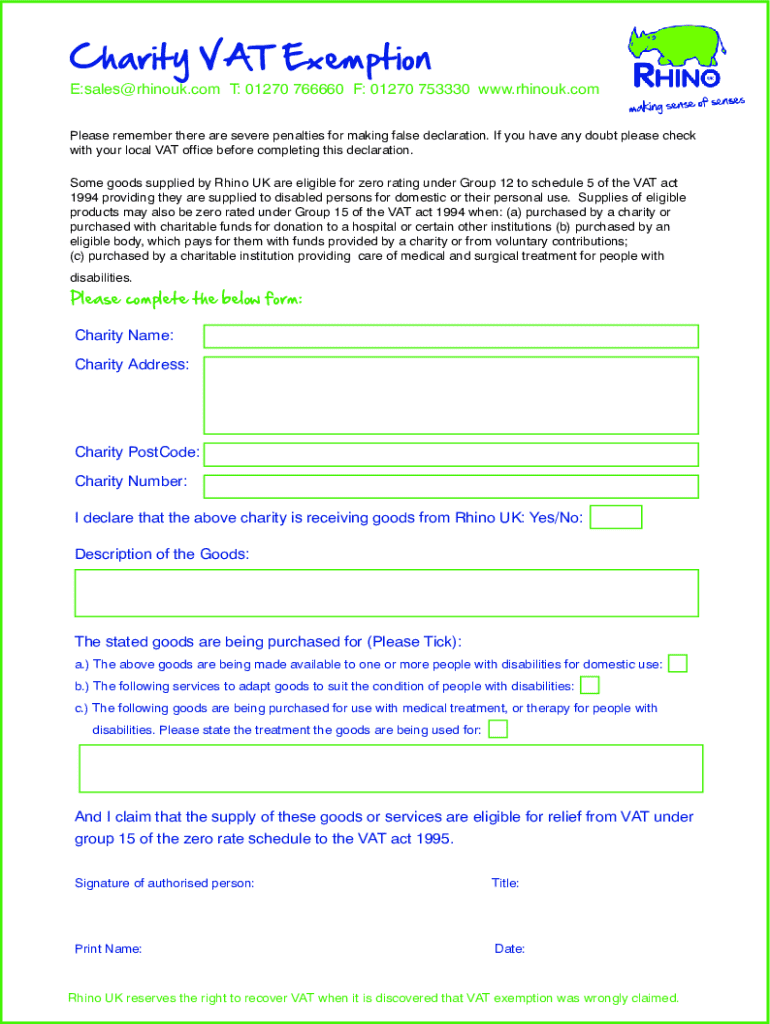

Applying for VAT exemption requires completing a specific form designated by the tax authority. This process can vary by jurisdiction, but a general step-by-step outline includes several key stages.

Staying organized during this process is key, as incomplete submissions can delay approval.

Common challenges and solutions

Many charities face misconceptions regarding VAT exemption, often thinking that they are automatically exempt by merely holding charitable status. However, it's essential to understand that VAT exemption must be applied for and isn't granted by default. Another common challenge arises during the application process, where missing documentation or misinterpretation of the form can lead to rejections.

To troubleshoot, maintain a checklist of required documents and clarify any questions with the tax authority before submission. Engaging with resources such as guides or templates can help facilitate a smooth application process.

Evidence requirements for VAT exemption

Proving your charity's eligibility for VAT exemption requires submitting specific types of evidence. This includes detailed registration information that confirms the charity is officially recognized. Furthermore, financial records that demonstrate the charity's operations and expenses related to the activities for which VAT exemption is being requested can be crucial.

Establishing meticulous documentation is key to maintaining eligibility and supporting future exemption applications.

Specific considerations for different types of charities

Different types of charities may encounter unique nuances regarding VAT exemption. For example, small charities might find the application process more straightforward due to less documentation, whereas larger organizations often have more complex financial statements that require thorough examination.

Charities providing mixed supplies could face additional scrutiny, needing to accurately allocate supplies between taxable and exempt goods. Case studies show that some charities have thrived under VAT exemption while needing to adapt their operational structures to comply with complex tax regulations.

Managing VAT exemption status

Once a charity has obtained its VAT exemption status, compliance becomes essential. Charities must be vigilant in maintaining their compliance and ensuring that any changes in their operational status are reported promptly to the relevant authorities.

Regular reviews and audits of the charity's financial records can help identify areas that may change its eligibility. Being proactive about VAT regulations and any updates is crucial to preserving exemption status.

Interactive tools for charities

Utilizing interactive tools can significantly streamline the process for charities managing their VAT exemption forms. pdfFiller offers a variety of resources including PDF templates for VAT exemption forms, online calculators that estimate potential VAT savings, and collaboration tools specifically designed for team-assisted document management.

These resources empower charities to efficiently navigate their documentation tasks and maintain clarity throughout the application process.

Frequently asked questions (FAQs)

Many charities have questions regarding the VAT exemption form. One frequent query is what happens if the organization changes its operations and whether that could affect the VAT exemption. The truth is that any substantial changes should be reported to the VAT authority, as this could potentially impact eligibility.

Another common question is whether charities can claim back VAT on purchases. Generally, if the charitable organization has completed the requisite procedures correctly, it can reclaim VAT on admissible purchases tied to exempt goods and services, maximizing operational budgets.

Conclusion

Understanding and utilizing the charity VAT exemption form is an important aspect of operational management for charitable organizations. By navigating this exemption effectively, charities can boost their funding capacity and ensure that more resources are allocated to impactful charitable activities.

For an enhanced experience in managing your charity’s VAT exemption, consider using pdfFiller’s tools to simplify the form creation and management process, ensuring you can focus more on your mission and less on paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my charity vat exemption directly from Gmail?

How do I make changes in charity vat exemption?

Can I edit charity vat exemption on an Android device?

What is charity vat exemption?

Who is required to file charity vat exemption?

How to fill out charity vat exemption?

What is the purpose of charity vat exemption?

What information must be reported on charity vat exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.