Get the free Cypress Property & Casualty Insurance Company Commercial Residential Policy

Get, Create, Make and Sign cypress property casualty insurance

Editing cypress property casualty insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cypress property casualty insurance

How to fill out cypress property casualty insurance

Who needs cypress property casualty insurance?

Cypress Property Casualty Insurance Form: A Comprehensive Guide

Understanding Cypress Property Casualty Insurance

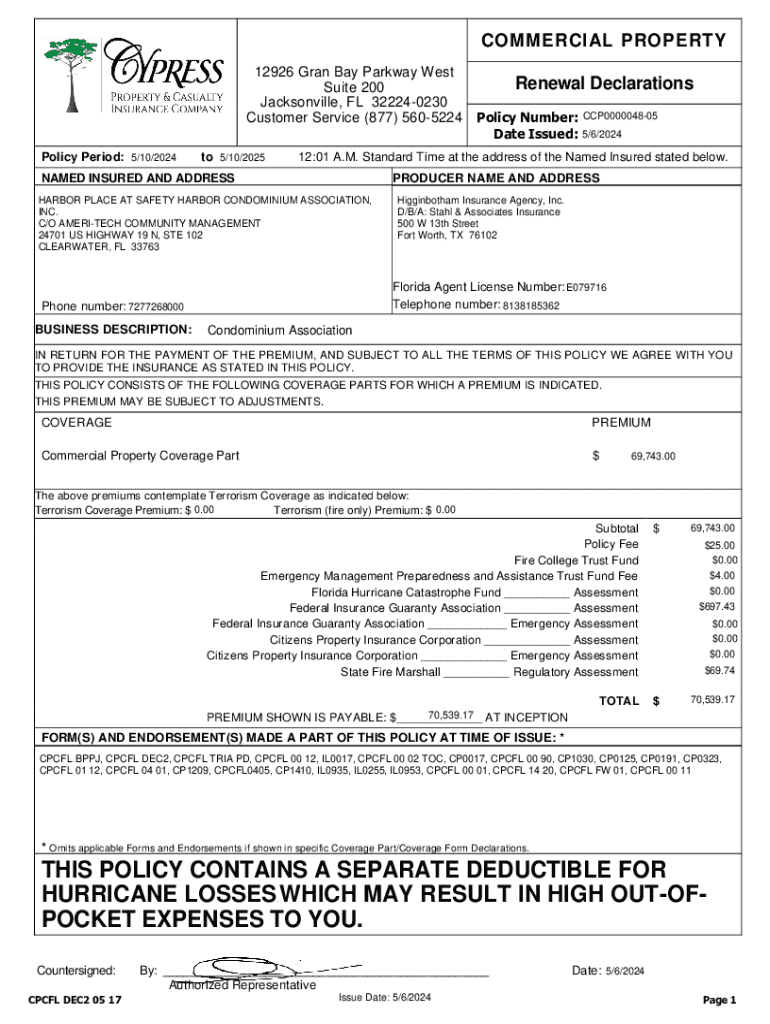

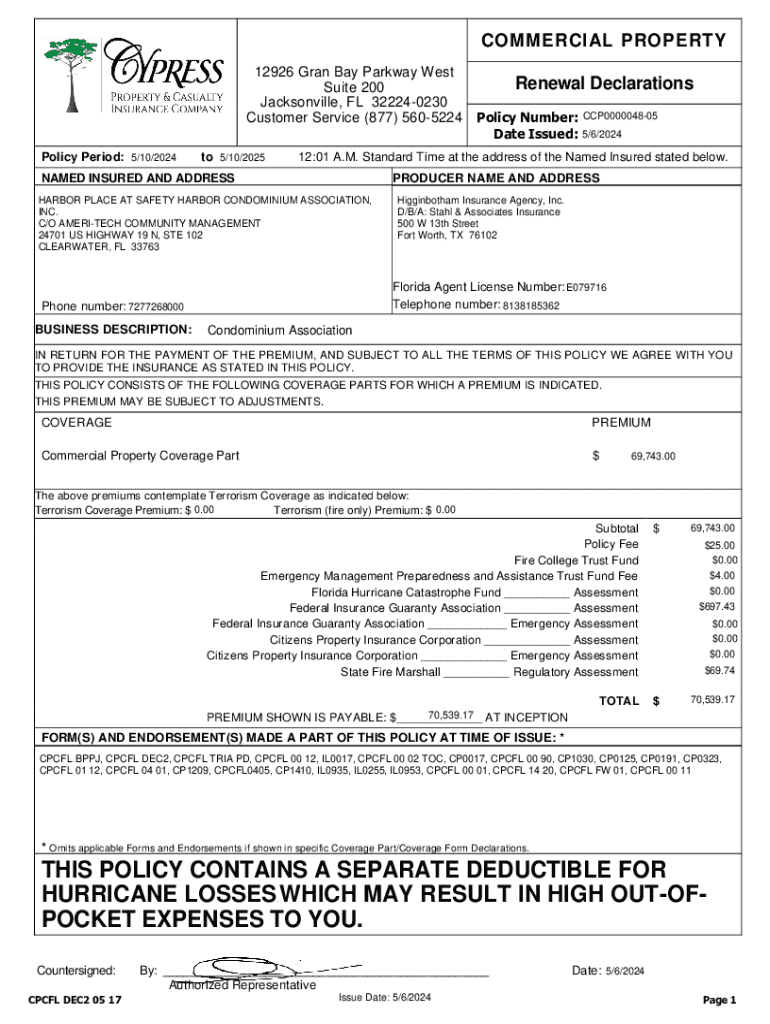

Cypress Property Casualty Insurance is a key player in the insurance market, offering tailored coverage solutions to meet the needs of individuals and businesses alike. In a world where assets and liability risks are ever-increasing, having the right property casualty insurance is more crucial than ever. Cypress has positioned itself as a reliable provider of these essential services, ensuring that clients are protected against unforeseen events, from natural disasters to liability claims.

Property casualty insurance encompasses both property and liability coverage, protecting clients from damage to their physical assets and against claims resulting from injuries or damage to others. In choosing Cypress for your coverage, you benefit from a tailored insurance approach where they prioritize customer service, competitive pricing, and comprehensive coverage options.

The Cypress Property Casualty Insurance Form: An In-Depth Look

The Cypress Property Casualty Insurance Form serves a vital function in the application process for obtaining coverage. This form allows individuals and businesses to clearly specify their insurance needs, ensuring adequate coverage is provided. The form is designed to be user-friendly and straightforward, allowing potential policyholders to provide necessary details in a systematic manner.

Key components of the insurance form include the Personal Information Section, which collects data about the applicant, the Coverage Options Section that lets them choose their desired policies, and the Premium Estimation and Payment Options section that outlines potential costs.

Step-by-step guide to filling out the Cypress Property Casualty Insurance Form

Filling out the Cypress Property Casualty Insurance Form doesn't have to be daunting. By following this step-by-step guide, you can ensure you provide accurate information and choose the best coverages for your needs.

Step 1: Preparing Necessary Documentation

Before diving into the form, gather essential documentation that will help you complete it accurately. This can include identification documents, property details, previous insurance policies, and any relevant claims history.

Step 2: Completing the Personal Information Section

Accurate completion of the Personal Information Section is crucial. Double-check to ensure there are no mistakes in your name, address, and contact details. These errors can lead to processing delays or issues in claims.

Step 3: Selecting Coverage Options

Now, it’s time to choose your coverage options. Consider the specifics of your property and potential liabilities. Cypress offers various types of coverage, including homeowners, renters, and liability insurance. Evaluate your needs based on your assets and potential risks.

Step 4: Reviewing and Finalizing the Form

After filling in all sections of the form, take the time to thoroughly review your entries. Common mistakes include incorrect names or missing information. A careful review can prevent delays in processing your insurance application. It is always beneficial to double-check your information, ensuring all necessary areas are completed.

Interactive tools for easy form management

pdfFiller offers robust tools designed for seamless document management, enhancing the experience of filling out the Cypress Property Casualty Insurance Form.

Using pdfFiller’s features for form creation

With pdfFiller, you can use drag-and-drop editing, making it easy to customize your form. Users can also take advantage of eSigning capabilities, reducing turnaround time for signatures. Collaborating with teams becomes smoother, allowing multiple users to work on the document in real time.

Moreover, pdfFiller allows users to save and store documents in the cloud, ensuring easy access from anywhere at any time. This accessibility is particularly beneficial for users who need to frequently update and manage their documents.

Frequently asked questions (FAQ)

As with any insurance process, questions may arise while completing the Cypress Property Casualty Insurance Form. Below are some frequently asked questions that can clarify common concerns.

Additional insights and resources on property casualty insurance

Understanding your insurance policy deeply is crucial for maximizing its benefits. This includes knowing about insurance claims processes, regular policy reviews, and preventive measures for protecting your assets. Claims can be complicated; having a thorough comprehension helps you navigate them efficiently when needed.

Periodic policy reviews ensure that your coverage aligns with any changes in your circumstances or market conditions. This means updating your insurance when you acquire new assets or move to a more valuable property. Additionally, taking simple preventive steps, such as winterizing your property, can help in avoiding damage and subsequent claims.

Getting support with your Cypress Property Casualty Insurance Form

If you need assistance while filling out your Cypress Property Casualty Insurance Form, various support avenues are available. Users can access pdfFiller's customer service for queries on form features or troubleshooting issues.

Online chat options and help centers are also designed to guide you through your document management journey effectively. With such resources, leveraging the functionality of pdfFiller becomes a smooth experience.

Assessing your insurance needs with Cypress

As your life circumstances change, it's essential to re-evaluate your property and casualty insurance needs. Major life events such as moving, purchasing a new home, or starting a business can alter your coverage requirements. Knowing when to re-assess can save you from being under-insured.

Customizing your policy is also essential to fit your lifestyle and financial situation. Review your policy regularly to ensure it meets your evolving needs, thus providing you with the comfort and security you deserve in a constantly changing environment.

Success stories: Real users of Cypress Property Casualty Insurance

Hearing from satisfied customers can provide insight into the efficacy of Cypress Property Casualty Insurance and the benefits of utilizing pdfFiller for managing forms. Testimonials highlight positive experiences, showcasing how the company's responsive service and reliable coverage options have transformed their insurance experience.

Moreover, users frequently report that pdfFiller has significantly enhanced their form-filling experience. The ease of use, combined with features that facilitate quick edits and eSigning, has become a game-changer for many. These success stories emphasize not only the importance of the insurance itself but also the streamlined process enabled by effective document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my cypress property casualty insurance in Gmail?

How can I modify cypress property casualty insurance without leaving Google Drive?

How do I edit cypress property casualty insurance straight from my smartphone?

What is cypress property casualty insurance?

Who is required to file cypress property casualty insurance?

How to fill out cypress property casualty insurance?

What is the purpose of cypress property casualty insurance?

What information must be reported on cypress property casualty insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.