Get the free Cyber Insurance Proposal Form (sme)

Get, Create, Make and Sign cyber insurance proposal form

How to edit cyber insurance proposal form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cyber insurance proposal form

How to fill out cyber insurance proposal form

Who needs cyber insurance proposal form?

A Comprehensive Guide to the Cyber Insurance Proposal Form

Understanding cyber insurance: why it matters

Cyber insurance serves as a critical safety net for businesses navigating the complexities of the digital landscape. Specifically, it offers protection against financial losses resulting from various cyber threats such as data breaches, hacking incidents, and ransomware attacks. With many companies shifting their operations online, the risk of cyber incidents has escalated, prompting the need for comprehensive coverage.

The importance of cyber insurance cannot be overstated. In 2022 alone, the cost of cybercrime to businesses skyrocketed to over $6 trillion globally, a figure projected to reach $10.5 trillion by 2025. This staggering statistic highlights the urgent need for robust cyber insurance policies that allow organizations to mitigate potential financial fallout. Common threats include phishing scams, denial of service attacks, and insider threats, all of which can severely damage a company's reputation and bottom line.

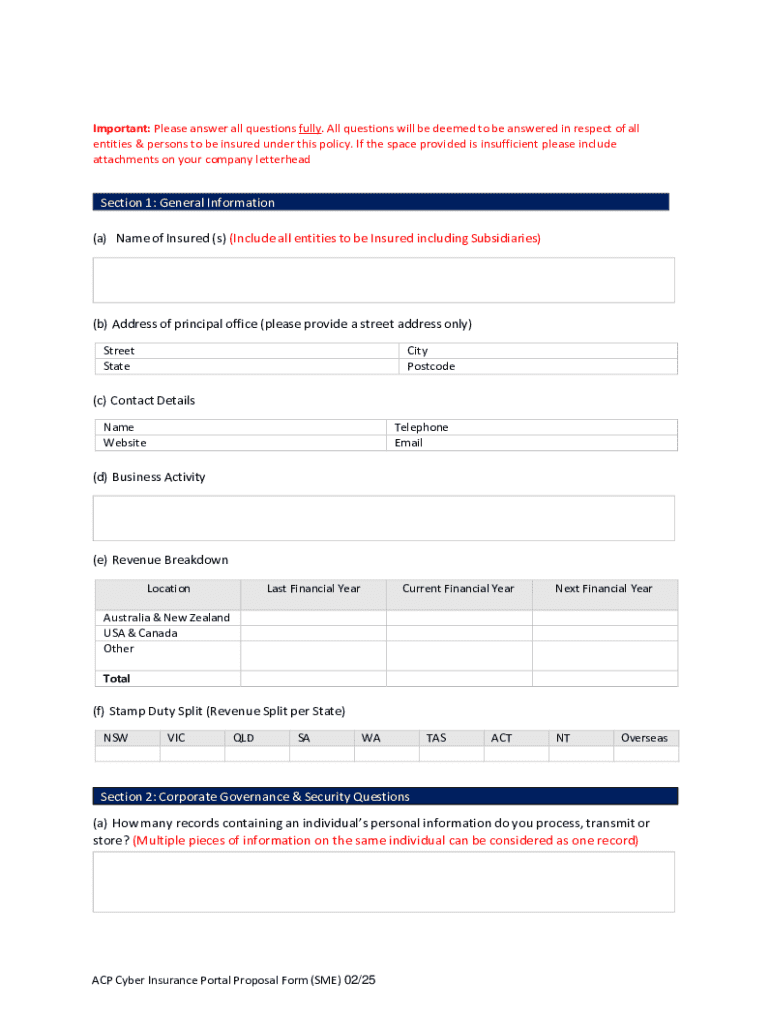

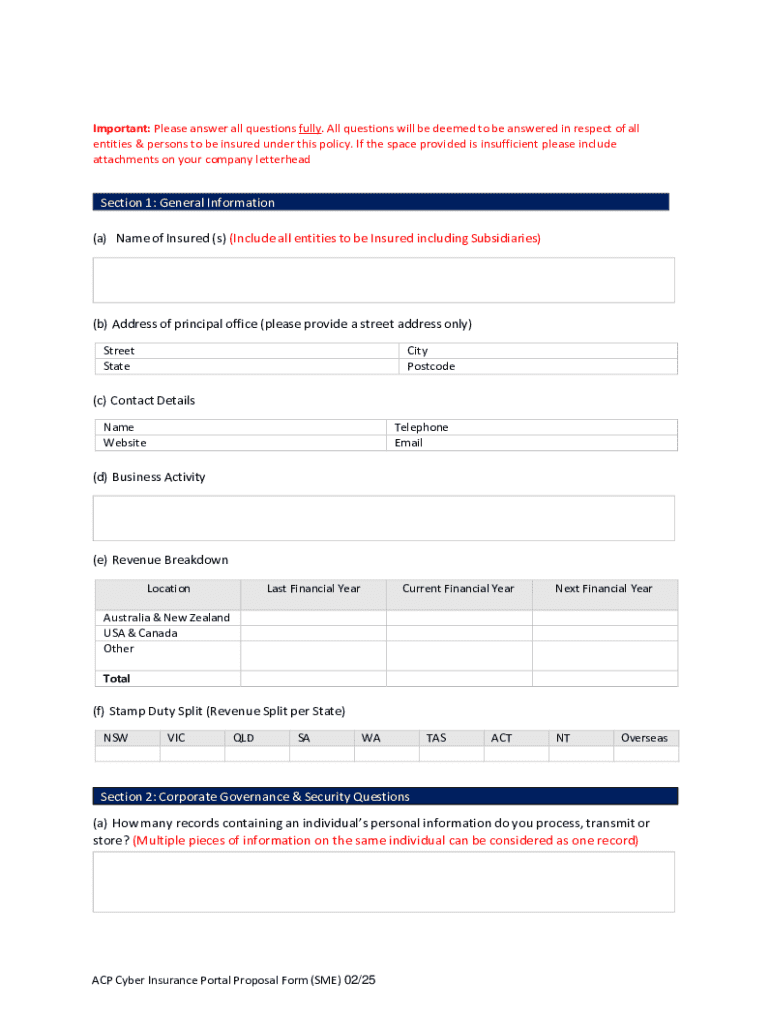

Overview of the cyber insurance proposal form

The cyber insurance proposal form serves as the initial step in acquiring coverage for your business. Its purpose is to gather detailed information about your organization’s operations, cybersecurity practices, and risk exposure. Completing this form accurately is vital, as it enables insurance providers to assess your coverage needs effectively.

Key stakeholders in this proposal process often include risk managers, compliance officers, and IT security personnel, all of whom contribute insights that enhance the proposal's accuracy. By providing vital information about your company’s current cybersecurity posture and potential risks, the proposal form facilitates tailored insurance coverage that addresses your unique needs.

Essential components of the cyber insurance proposal form

A well-structured cyber insurance proposal form contains several essential components that help insurers evaluate your coverage needs. These sections guide the process and assist in tailoring your policy.

Step-by-step instructions for filling out the cyber insurance proposal form

Completing the cyber insurance proposal form involves a systematic approach to ensure thoroughness and accuracy. Here’s a step-by-step guide.

Interactive tools for managing your cyber insurance proposal

pdfFiller offers valuable interactive tools designed to simplify the management of your cyber insurance proposal. By utilizing a cloud-based platform, users can access their documents from anywhere and collaborate seamlessly with team members.

Collaboration tools allow multiple stakeholders to review and provide input on the proposal, enhancing its quality. Moreover, pdfFiller’s tracking system keeps a record of all changes and comments, ensuring transparency throughout the proposal's development.

Common mistakes to avoid in the proposal process

Navigating the proposal process successfully means avoiding several common pitfalls.

Frequently asked questions (FAQs)

As you prepare to fill out the cyber insurance proposal form, you may encounter several FAQs that can guide your process.

The role of cyber insurance in risk management strategy

Cyber insurance should be a cornerstone of any comprehensive risk management strategy. Integrating it with other plans establishes a holistic approach to addressing cyber threats.

Leveraging pdfFiller's features for future document needs

Beyond just the cyber insurance proposal form, pdfFiller can support your wider business documentation needs. The platform allows you to create, manage, and store various forms, streamlining interfaces and enhancing productivity.

With a centralized document management system, teams can enjoy improved collaboration, making it easier to share information, collect feedback, and finalize important documents. Efficiency is key, and pdfFiller excels at integrating tools that facilitate seamless teamwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the cyber insurance proposal form in Chrome?

Can I create an electronic signature for signing my cyber insurance proposal form in Gmail?

How can I fill out cyber insurance proposal form on an iOS device?

What is cyber insurance proposal form?

Who is required to file cyber insurance proposal form?

How to fill out cyber insurance proposal form?

What is the purpose of cyber insurance proposal form?

What information must be reported on cyber insurance proposal form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.