Get the free Alabama Schedule Ec – 2025

Get, Create, Make and Sign alabama schedule ec 2025

How to edit alabama schedule ec 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out alabama schedule ec 2025

How to fill out alabama schedule ec 2025

Who needs alabama schedule ec 2025?

Alabama Schedule EC 2025 Form: A Comprehensive Guide

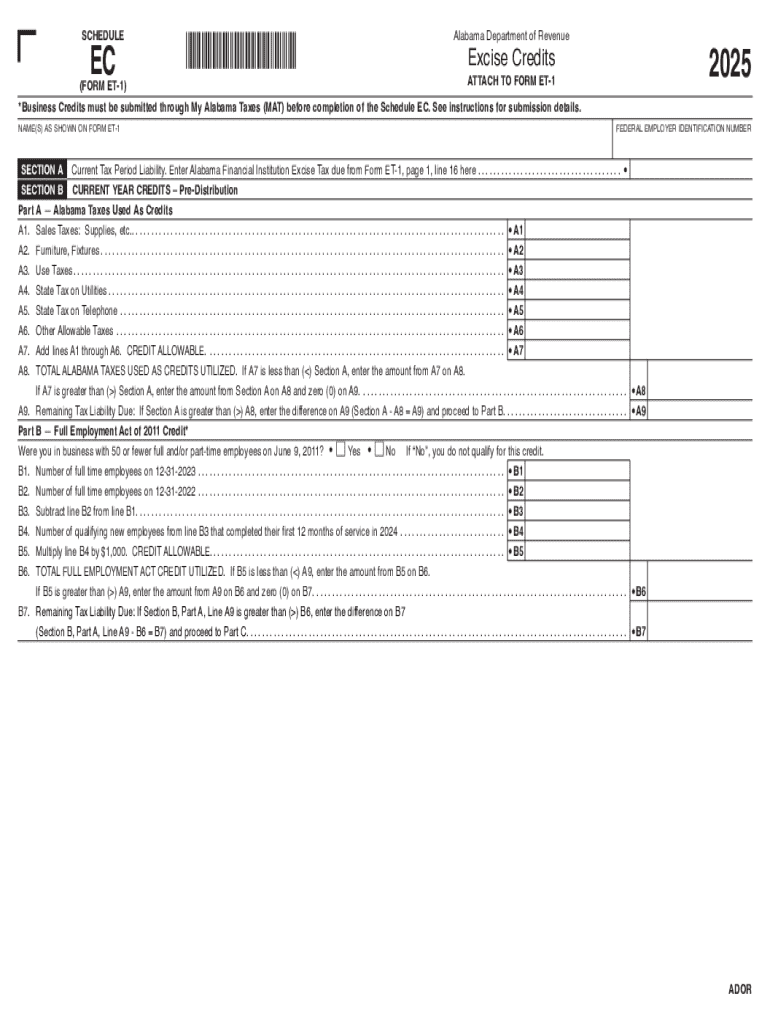

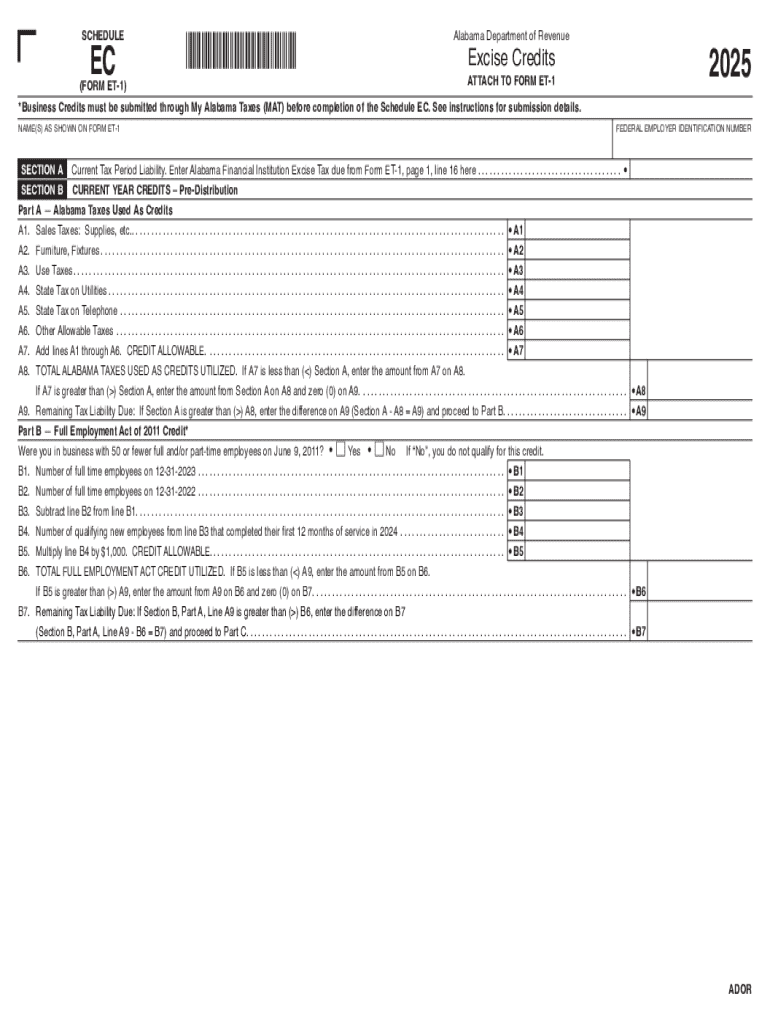

Overview of Alabama Schedule EC 2025 Form

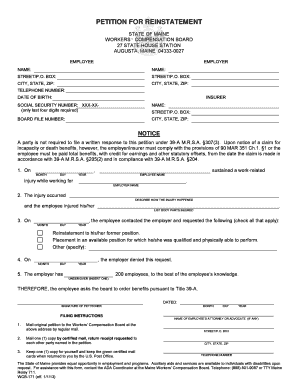

The Alabama Schedule EC 2025 Form is an essential document for taxpayers in Alabama, especially those involved in specific types of income-generating activities. This form is crucial not only for compliance with state tax regulations but also for optimizing one's tax filings. Filing on time is vital, with specific deadlines set forth by the Alabama Department of Revenue. Failure to submit could lead to penalties or missed opportunities for deductions. Thus, understanding who needs to file—particularly those with certain income streams or deductions—is paramount.

What is the Schedule EC?

The Schedule EC serves as a supplemental form specifically designed to collect information on various types of income and expenses. It aids taxpayers in reporting income from sources which may not be captured in other forms. The types of income reported on the Schedule EC can encompass things like business profits, rental income, and investment earnings, which are vital for an accurate assessment of tax liability. This systematic approach contrasts with other tax schedules in Alabama, such as the standard tax forms, which might not delve as deeply into specific income or deduction categories.

Preparing to Complete the Schedule EC

Completing the Alabama Schedule EC requires meticulous preparation. Taxpayers should gather essential documentation before starting the form. Necessary items include identification information, such as Social Security numbers, and comprehensive financial statements that reflect income and expenditures for the tax year. A checklist ensures you do not overlook any required documentation. Common errors during preparation can lead to delays or issues with your filing, such as incorrect figures, improper categorization of income or expenses, and missing documentation.

Step-by-Step Guide to Filling Out the Schedule EC Form

Filling out the Schedule EC form can become straightforward when approached systematically. Start with the personal information section, ensuring that all identification details are accurate. Proceed to report various sources of income, being aware of which types to include and noting any exemptions that may apply. The expense declaration section will require careful categorization; differentiate between deductible and non-deductible expenses clearly. Lastly, the signature and declaration section must be completed to validate your submission.

Submitting Your Schedule EC Form

Once filled out, the Alabama Schedule EC form can be submitted through a variety of pathways. The easiest and most efficient way is via the Alabama state tax website, where you can submit electronically. For those who prefer traditional methods, mailing the completed form is an option, but ensure it’s sent to the correct address for effective processing. Additionally, individuals may opt for in-person submission at designated state or local tax offices, allowing for immediate confirmation of submission and resolution of any queries.

Common FAQs about Schedule EC

Taxpayers often have questions regarding the Alabama Schedule EC form. For those who realize they've made an error after filing, it’s crucial to act promptly; errors can sometimes be amended easily. Amendments to the Schedule EC can be made, but specific guidelines must be followed to avoid complications. Further, understanding eligibility for certain exemptions and deductions can significantly impact tax savings, and taxpayers should research or contact a tax professional for clarification.

Strategies for Reducing Tax Liability with Schedule EC

Leveraging the Alabama Schedule EC form can lead to significant tax savings through specific strategies. Familiarizing oneself with available tax credits is essential, as these can offset tax liabilities and increase refunds. Understanding the nuances of carryforwards and carrybacks can facilitate optimal tax planning. Furthermore, maintaining thorough documentation throughout the year fosters readiness in case of audits and ensures accuracy during the filing process.

Resources for Further Assistance

For additional support regarding the Alabama Schedule EC 2025 Form, several resources are available. The Alabama Department of Revenue offers detailed guidance and documentation on their website, ensuring taxpayers have access to up-to-date information. Local tax professionals specializing in Alabama taxes can provide tailored assistance. Lastly, online tools and calculators can help estimate tax obligations, making tax preparation much more manageable.

Interactive Tools and Templates

Navigating the Alabama Schedule EC form can be simplified using interactive tools available on pdfFiller. Users can access downloadable and editable templates tailored for the Schedule EC, facilitating ease of completion and submission. Furthermore, pdfFiller provides eSigning capabilities and collaboration features that allow multiple stakeholders to engage effectively. Utilizing cloud storage offers users the advantage of managing documents without localized limitation.

Recent Updates and Changes to Alabama Tax Laws Affecting Schedule EC

Staying ahead of changes in Alabama tax legislation is vital for ensuring compliance and maximizing tax benefits. The year 2025 has introduced significant updates that impact filing processes and requirements. Awareness of these changes is crucial for taxpayers as they may alter eligibility for credits, deductions, or even influence the overall amount owed. Therefore, periodic checks on legislative changes directly affecting the Schedule EC are recommended to ensure taxpayers remain informed.

Tips for Future Tax Planning with Schedule EC

A proactive approach towards tax planning can make completing the Alabama Schedule EC in the future less daunting. Best practices include regular record-keeping throughout the year, which reduces the end-of-year scramble. Setting financial goals related to income and expenses also directs focus towards potential tax-saving strategies. Utilizing the cloud-based features of pdfFiller can make document management seamless, allowing taxpayers to update and store pertinent records readily while having access anytime and anywhere.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find alabama schedule ec 2025?

How do I execute alabama schedule ec 2025 online?

Can I sign the alabama schedule ec 2025 electronically in Chrome?

What is alabama schedule ec?

Who is required to file alabama schedule ec?

How to fill out alabama schedule ec?

What is the purpose of alabama schedule ec?

What information must be reported on alabama schedule ec?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.