Get the free Cost Audit Report Form

Get, Create, Make and Sign cost audit report form

How to edit cost audit report form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cost audit report form

How to fill out cost audit report form

Who needs cost audit report form?

A Comprehensive How-to Guide on the Cost Audit Report Form

Overview of cost audit reports

A cost audit report is a crucial tool for assessing the efficiency and accuracy of a company's costing systems. The primary purpose of a cost audit is to verify the cost records, ensuring compliance with established accounting standards and regulations. This scrutiny enhances the reliability of financial reporting and helps identify areas for cost reduction and efficiency improvement.

Cost audit reports play a vital role in financial management. They not only provide insights into how well a company controls its costs but also serve as a foundation for strategic decision-making. By examining these reports, management can make informed choices about resource allocation, pricing strategies, and operational improvements, ultimately driving business success.

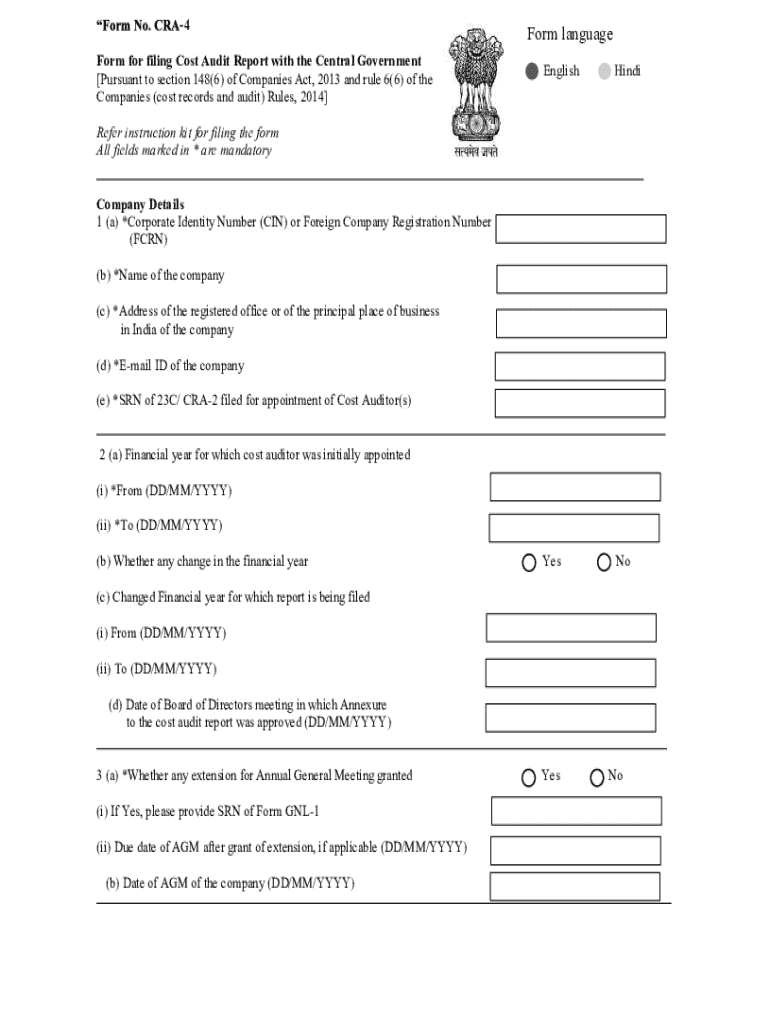

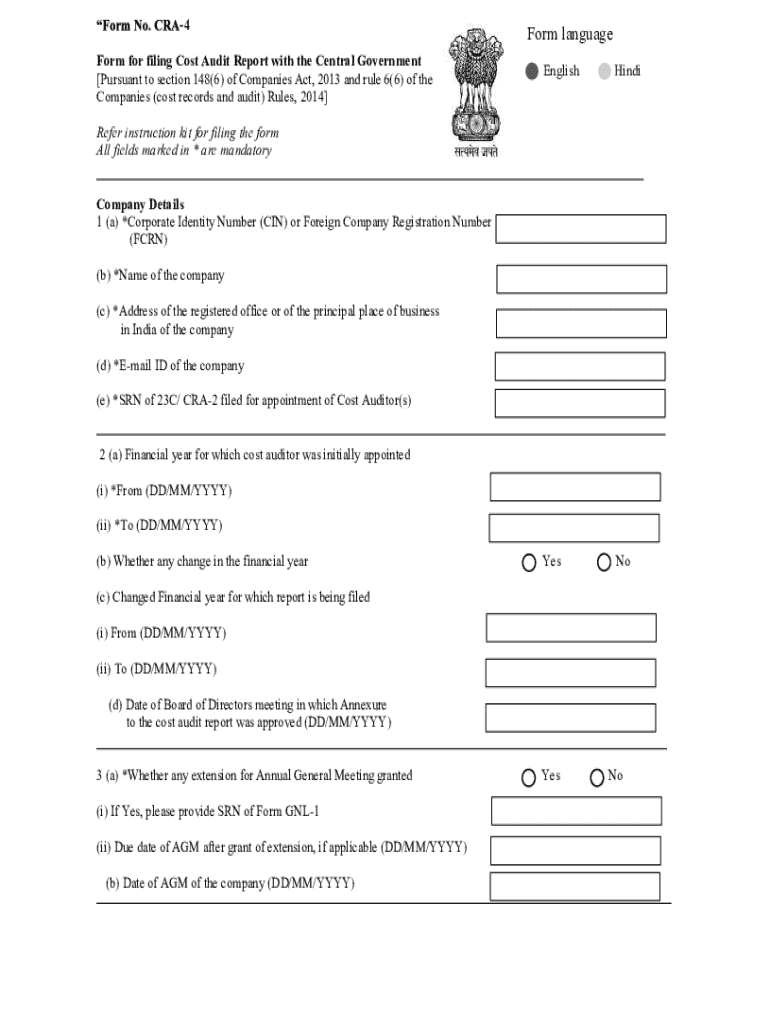

Understanding the cost audit report form

The cost audit report form is a structured document that summarizes the findings of a cost audit. Its design ensures that all relevant information is captured in a clear and organized manner, facilitating easy analysis. Key components of the form include:

Beyond the standard layout, there are various formats and variants of the cost audit report form tailored to specific industries or regulatory requirements, making it essential for auditors to be familiar with the appropriate format for their context.

Step-by-step guide to filling out the cost audit report form

Filling out the cost audit report form requires a systematic approach. Here’s a step-by-step guide:

Editing and customizing your cost audit report form

After gathering and inputting the necessary information, you may need to customize your cost audit report form to better fit your needs. Using pdfFiller simplifies this process with various features that enhance document usability.

Utilizing templates can significantly boost efficiency. Pre-made templates available on pdfFiller can save time and ensure compliance with industry standards, allowing you to focus on the content rather than the format.

Signing and submitting your cost audit report form

Once your cost audit report form is complete, it’s essential to properly sign and submit it. Follow these steps to ensure compliance and accuracy.

Tracking and managing your cost audit reports with pdfFiller

Managing cost audit reports requires diligent organization and tracking. pdfFiller provides various document management features that can enhance your efficiency throughout the audit process.

Frequently asked questions about cost audit reports

To further assist users working with the cost audit report form, here are some common queries and their answers:

Best practices for cost audits

Conducting effective cost audits requires preparation and attention to detail. Here are several best practices to consider:

Additional tools and resources

To further equip yourself in managing cost audit reports, pdfFiller offers various interactive tools and resources, including support services.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify cost audit report form without leaving Google Drive?

How can I send cost audit report form for eSignature?

How do I edit cost audit report form on an iOS device?

What is cost audit report form?

Who is required to file cost audit report form?

How to fill out cost audit report form?

What is the purpose of cost audit report form?

What information must be reported on cost audit report form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.