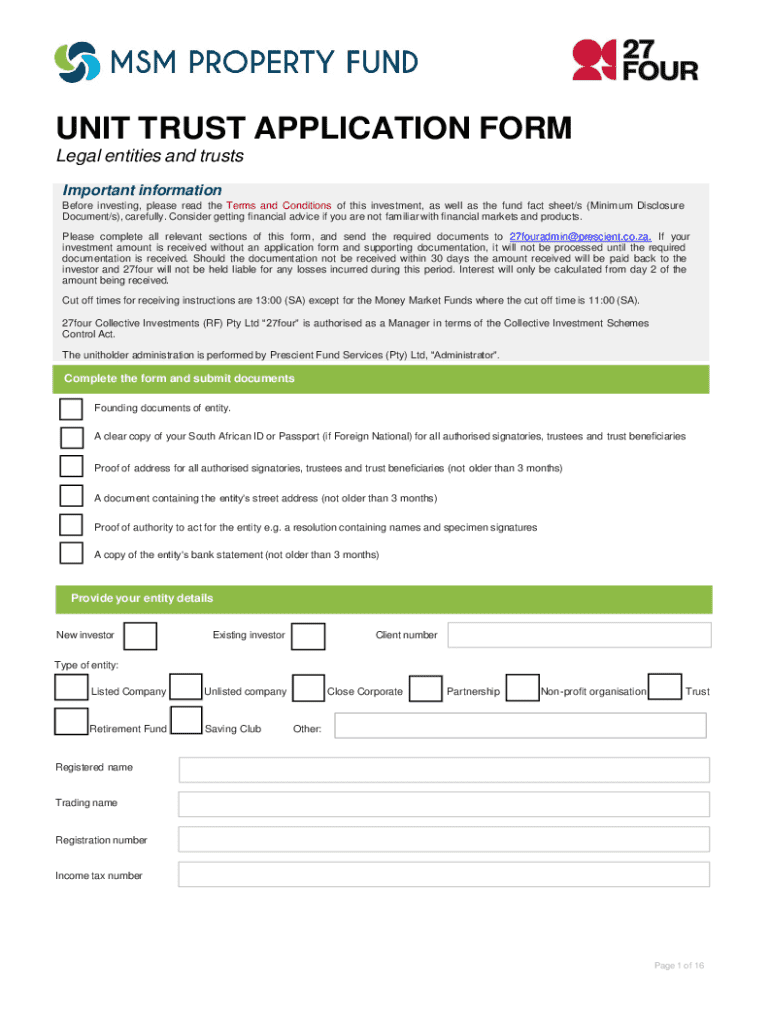

Get the free Unit Trust Application Form

Get, Create, Make and Sign unit trust application form

How to edit unit trust application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out unit trust application form

How to fill out unit trust application form

Who needs unit trust application form?

A Comprehensive Guide to the Unit Trust Application Form

Understanding unit trusts

Unit trusts are investment vehicles that pool funds from multiple investors to purchase a diversified portfolio of assets, typically managed by a professional fund manager. They allow individual investors to benefit from collective investment opportunities that they may not be able to afford on their own. The primary purpose of a unit trust is to provide a convenient way to invest in a diversified range of assets while minimizing risks and enhancing portfolio management.

Investing in unit trusts presents numerous benefits: investors can gain access to professional management, diversification, and affordability, as well as the ability to invest with smaller amounts. Some unit trusts also offer the flexibility to buy and sell units easily, making them an attractive option for many.

Types of unit trusts available

Unit trusts come in various types to cater to diverse investment objectives and risk profiles. The most common types include:

Benefits of using the pdfFiller platform

pdfFiller revolutionizes document management with its cloud-based platform, making it easy to create, edit, and manage documents like the unit trust application form. Users can access their documents from anywhere, ensuring convenience and flexibility in managing their investment applications.

One of the standout features of pdfFiller is its editability. Users can easily modify their application form with just a few clicks, allowing for quick updates or corrections. This is particularly useful as investors often need to revise their details before submission to ensure accuracy.

Additionally, pdfFiller simplifies the signing process. The platform allows users to eSign their unit trust application form electronically, streamlining the overall process and facilitating a faster submission. Collaborating with financial advisors or team members is also effortless, as users can work on the document in real-time and share it for feedback and approval.

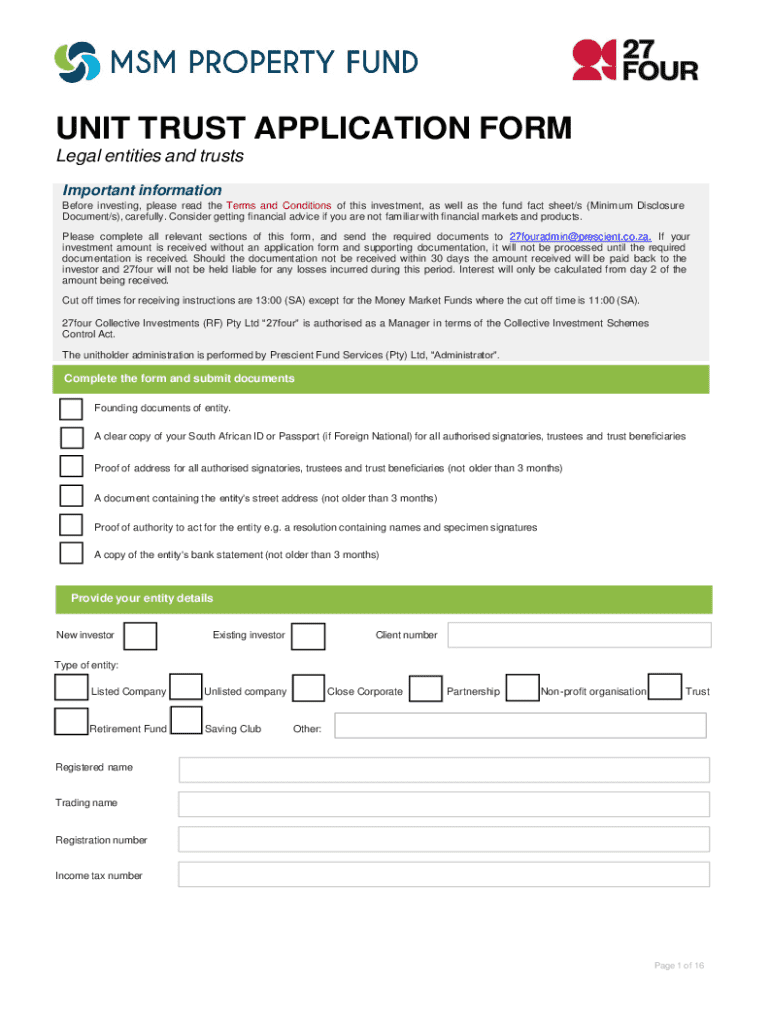

The unit trust application form: a detailed overview

The unit trust application form is a crucial document in the investment process, acting as the gateway for individuals to begin their investment journey. It captures essential information which helps the fund manager understand the investor’s profile and requirements.

Completing the form requires personal and financial information, including details like name, contact information, and employment status. Additionally, investors must disclose their financial objectives and risk tolerance to ensure they choose an appropriate unit trust option. Selecting the right investment type is pivotal, as it aligns with the investor's goals and preferences.

Step-by-step guide to filling out the unit trust application form

Filling out the unit trust application form can seem daunting, but with this step-by-step guide, you can simplify the process and ensure all necessary information is submitted accurately.

Common mistakes and how to avoid them

Completing the unit trust application form can come with its challenges. Common errors, such as missing information or incorrect financial disclosures, can result in processing delays or even rejection of your application. However, many of these mistakes can be easily avoided with careful attention.

To ensure completeness, consider maintaining a checklist of required information before you start filling out the form. This can help you keep track of the details that need to be entered and ensure that nothing is overlooked.

Managing your unit trust investment

Once you've submitted your unit trust application, understanding what to expect next is vital. The processing timeline can vary, typically taking a few days to weeks, depending on the institution’s internal procedures.

Investors can track their unit trust investments efficiently using the management tools provided by pdfFiller. This allows you to view updates about your investments, changes in unit prices, and even receive performance reports at your convenience. If you need to modify your investment details or make any changes post-submission, pdfFiller also provides a seamless way to revisit your application and update necessary fields.

Frequently asked questions about unit trust applications

Navigating through the unit trust application process may prompt various questions. Here are a few commonly asked ones reviewed to offer further clarity on the investment process.

Additional features on pdfFiller for unit trust investors

In addition to the straightforward application process, pdfFiller offers innovative tools designed to enhance the investment decision-making experience. Users can access interactive calculators that help in estimating potential returns based on their investment amounts and durations.

Moreover, testimonials from successful investors further illustrate how the integration of pdfFiller in their unit trust application process has streamlined their experience. These insights showcase real-world examples of efficiency and user satisfaction, bolstering confidence for new investors.

Should you encounter any difficulties during the unit trust application process, pdfFiller provides robust customer support. Users can easily contact support representatives for any inquiries regarding their applications or platform functionalities, ensuring that assistance is always within reach.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute unit trust application form online?

How do I edit unit trust application form in Chrome?

How can I fill out unit trust application form on an iOS device?

What is unit trust application form?

Who is required to file unit trust application form?

How to fill out unit trust application form?

What is the purpose of unit trust application form?

What information must be reported on unit trust application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.