Last updated on Feb 17, 2026

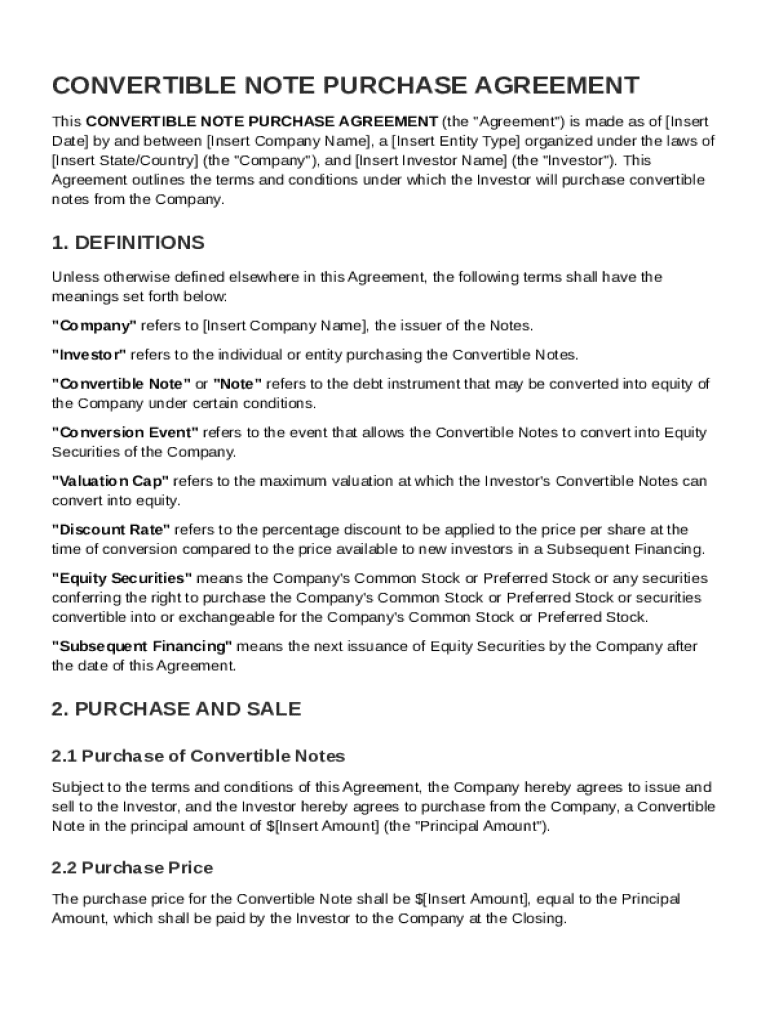

Convertible Note Purchase Agreement Template free printable template

Show details

This document outlines the terms and conditions under which an investor will purchase convertible notes from a company, including definitions, purchase details, terms of the notes, representations,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Convertible Note Purchase Agreement Template

A Convertible Note Purchase Agreement Template is a legal document outlining the terms under which an investor can convert a debt investment into equity in a startup company.

pdfFiller scores top ratings on review platforms

great service

helps me alot to ease daily struggle with documents

Most features are there

Most features are there. Rearranging pages a bit confusing.

Great Product

For not being free ;)

easy to use

Very easy to use.

it's easy to use but runs rather slowly on my desktop

I love this application

Who needs Convertible Note Purchase Agreement Template?

Explore how professionals across industries use pdfFiller.

Convertible Note Purchase Agreement Guide

What is a convertible note?

A convertible note is a type of debt instrument that converts into equity. This financial tool allows startups to secure early investments without having to determine their valuation immediately. Often used in seed financing, convertible notes offer unique benefits for both investors and companies.

-

Convertible notes are short-term debt that converts into equity during a future financing round.

-

They help bridge the gap between initial funding and later rounds, minimizing early-stage valuation complexities.

-

Important terms include Conversion Event (the moment the note converts), Valuation Cap (the maximum valuation for conversion), and Discount Rate (percentage discount on shares at conversion).

How do prepare for the convertible note agreement?

Preparation is crucial to avoid pitfalls while creating a convertible note purchase agreement. Proper identification of all parties, understanding company specifics, and establishing clear terms set the foundation for a successful agreement.

-

Clearly indicate the company name and investor involved in the agreement.

-

Specify whether the company is a Corporation, LLC, etc., and its geographical location, as different states may have various regulations.

-

Detail the principal amount being raised, and set a reasonable valuation cap and discount rate to incentivize investors.

What steps are involved in filling out the convertible note purchase agreement?

Filling out the convertible note purchase agreement requires attention to detail. Each section must be completed accurately to ensure the legal validity and clarity of the document.

-

Include the official date to mark when the agreement commences.

-

Provide necessary identification details for the company, including registration information.

-

Collect and accurately fill in the investor's details, ensuring that their identity and investment amount is clear.

-

Transparent detailing of the purchase price and the principal amount is vital for both parties.

What are the key terms and conditions of the agreement?

Understanding the terms and conditions of a convertible note purchase agreement is essential for all parties involved. This section outlines the rights, obligations, and processes linked to the investment.

-

Clearly outline the conditions under which the purchase and sale will occur, ensuring mutual understanding.

-

Clarify the investor's rights when the note converts into equity securities, including any limitations or conditions.

-

Identify specific events, such as subsequent financing rounds, that would trigger the conversion of notes into equity.

How can pdfFiller help manage your convertible notes?

pdfFiller streamlines the management of your convertible note purchase agreement, making it easier to edit, sign, and store documents. Its cloud-based platform ensures that you can access your documents from anywhere.

-

Utilize pdfFiller's editing tools to modify your completed form as required.

-

Implement electronic signatures and collaborate with other stakeholders on your documents in real time.

-

Benefit from cloud storage features that allow for easy tracking and management of your agreement.

What common mistakes should avoid?

Awareness of common pitfalls in convertible note agreements can save you from future complications. Proper preparation and attention to terms are crucial.

-

Ensure that all contract language is clear and all terms are understood by both parties.

-

Check local laws and compliance requirements to avoid legal issues later on.

-

Be detailed in defining how and when the note converts to avoid disputes down the line.

What are the next steps after the agreement?

Once the convertible note purchase agreement is signed, follow-up actions are essential for both parties to maximize the investment's potential. Monitoring and reporting can ensure ongoing compliance and future financing opportunities.

-

Stay in touch with investors and keep them informed about developments in the company.

-

Regularly assess the company's financial health and provide documented updates to investors.

-

Anticipate future rounds and prepare necessary documentation to attract additional investment.

How to fill out the Convertible Note Purchase Agreement Template

-

1.Download the Convertible Note Purchase Agreement Template from pdfFiller.

-

2.Open the template using pdfFiller's editor.

-

3.Fill in the date of the agreement at the top of the document.

-

4.Enter the names and addresses of the issuer and investor in the designated fields.

-

5.Specify the principal amount of the convertible note.

-

6.Set the interest rate applicable to the note.

-

7.Define the conversion terms detailing how the debt converts to equity.

-

8.Include any special provisions or conditions for conversion.

-

9.Review all entered details for accuracy.

-

10.Save your completed agreement in pdfFiller or export it as a PDF.

What is a convertible note purchase agreement?

The convertible note purchase agreement (NPA) is the principal agreement between the issuer and the investors and sets out the price, terms, and conditions on which the investors agree to buy the convertible notes from the issuer.

What is the rule 144A for convertible notes?

Rule 144A requires that the conversion price of the convertible notes be at least 10% above the market value of the Page 3 Capital Markets Practice Group 3 underlying shares, but the market generally supports premiums in excess of 10% over the market price of the underlying shares and so this is not usually an issue.

What is the difference between a SAFE agreement and a convertible note?

SAFEs have no maturity date, there's no obligation for startups to repay the invested amount. In convertible notes, investors can demand repayment if the startup fails to raise a qualified financing round by the maturity date. On the other hand, SAFEs do not allow for this demand, as no maturity or debt is involved.

How to create a convertible note?

Steps to create a Convertible Note Agreement Step 1: Open negotiations. One might make a Convertible Note Term Sheet to promote discussion and negotiation with their investors. Step 2: Creation of the convertible note. Step 3: Subscription by investors. Step 4: Completion of subscription.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.