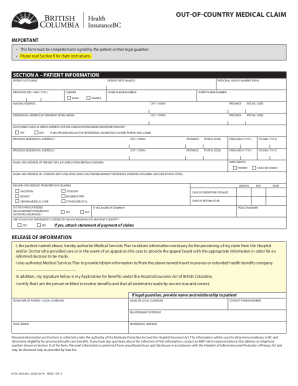

Installment Payment Plan Agreement Template free printable template

Show details

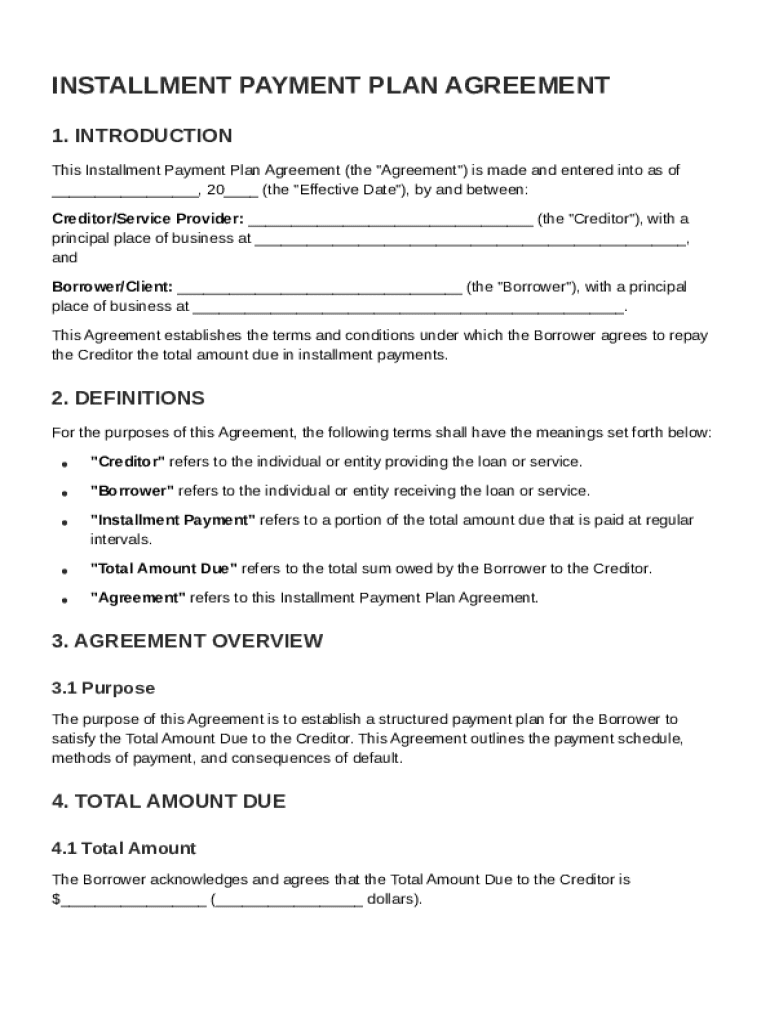

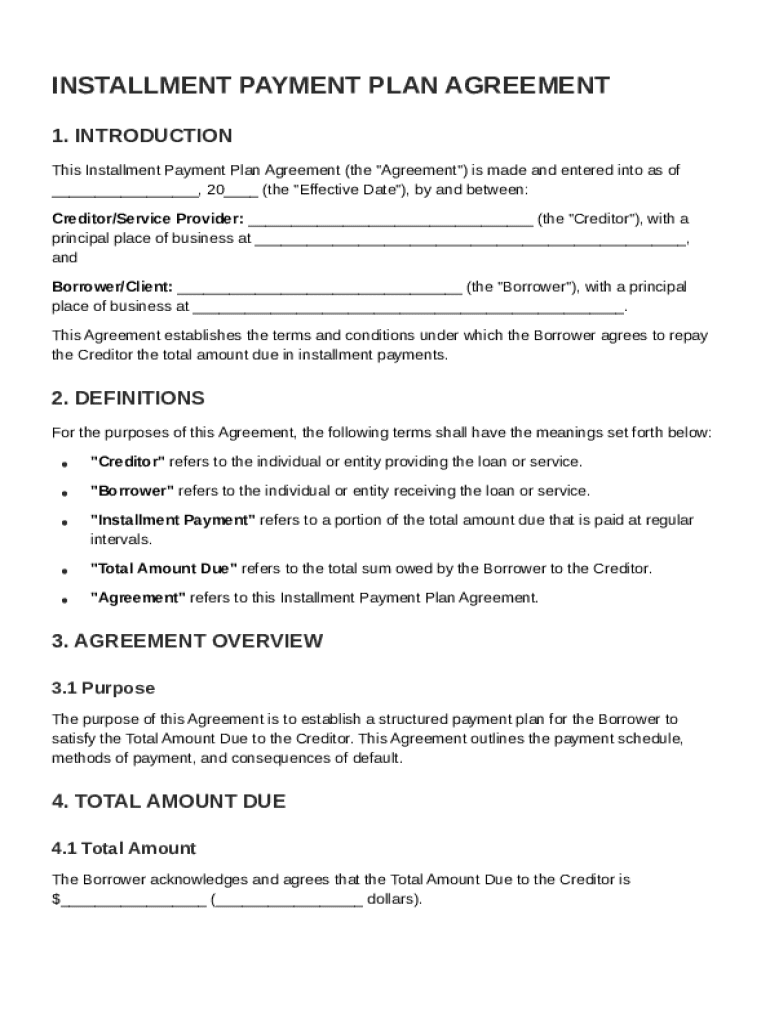

This Agreement establishes the terms and conditions under which the Borrower agrees to repay the Creditor the total amount due in installment payments.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Installment Payment Plan Agreement Template

An Installment Payment Plan Agreement Template is a legal document outlining the terms under which a borrower agrees to make payments over time for goods or services received.

pdfFiller scores top ratings on review platforms

I recognize that it is a good application however I feel that I need to learn more on how to maneuver around it.

thanks

It would have been easier if it auto moved to the next fill area but maybe that wasn't possible for this type of document?

So far it has worked great better than adobe

Somewhat difficult to navigate.

Images of docs. faint.

A pretty good set of pdf edit features - give a 5th star if better integration with google drive

This is an awesome tool to have and it makes filling out documents way easier. I had to fill out a document in which everything has to be perfect and the PDFfiller helped tremendously.

Who needs Installment Payment Plan Agreement Template?

Explore how professionals across industries use pdfFiller.

Installment Payment Plan Agreement Guide

How to fill out an installment payment plan agreement form

To fill out an installment payment plan agreement form, begin by defining the parties involved: the creditor and the borrower. Next, clearly outline the total amount due, followed by specific payment terms like the schedule and methods accepted. Ensure all clauses are present, especially around defaults and indemnifications to protect both parties.

Understanding the installment payment plan agreement

An installment payment plan agreement is a contract that allows a borrower to repay debt in regular installments. This is particularly important for borrowers who may need structured repayment terms to manage their finances better. Structuring repayments through installments offers significant benefits, including making the debt more manageable and providing clarity on expectations for both parties.

What are the key components of the agreement?

A comprehensive installment payment plan agreement contains several key components, including identification of the parties, total amount due, and payment terms.

-

Clearly define the roles of the creditor and borrower, ensuring both parties are accurately identified to avoid misunderstandings.

-

Define the total amount due, including any interest and fees. Example calculations can provide clarity and prevent disputes down the line.

How to structure payment terms and schedule?

Effective payment terms delineate how and when payments will be made. A clear payment schedule is crucial for both parties.

-

Determine how many installments will be needed based on the total amount due and affordability.

-

Choose the payment frequency: weekly, bi-weekly, or monthly, based on what works best for both the borrower and creditor.

-

Provide an illustration of the payment schedule to set realistic expectations.

What are the potential defaults and acceleration clauses?

Including a default and acceleration clause helps define the conditions under which a borrower would default on their payments. The consequences of default can be severe, potentially including legal action or acceleration of the entire debt.

Why is indemnification important in the agreement?

An indemnification clause protects both parties by outlining the responsibilities in case of disputes or claims. This is critical in maintaining trust and clarity between the creditor and borrower.

How to edit and manage your agreement with pdfFiller?

pdfFiller enables users to seamlessly edit their installment payment plan agreements, ensuring that all terms reflect the parties' current understanding. Collaborative features facilitate team management, and eSignature options streamline the signing process.

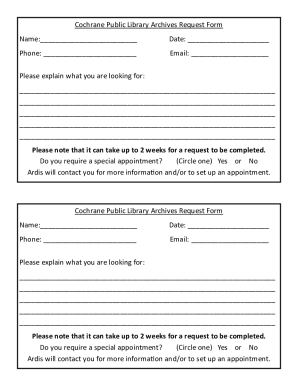

How to fill out the Installment Payment Plan Agreement Template

-

1.Open the Installment Payment Plan Agreement Template on pdfFiller.

-

2.Begin by entering the full names of both parties involved (the borrower and the lender) in the designated fields.

-

3.Fill in the date the agreement is initiated.

-

4.Specify the total amount due under the agreement in the appropriate box.

-

5.Outline the payment schedule by entering the number of installments and the amount of each installment.

-

6.Indicate the due date for each payment, ensuring consistency with the overall payment plan.

-

7.Include any interest rate, if applicable, as well as any additional fees associated with the payment plan.

-

8.Ensure to review any specific terms and conditions that may be necessary for your agreement, such as default terms.

-

9.Finally, both parties should sign and date the document electronically for validity before saving and sharing it.

How do I write a payment plan agreement?

A Payment Plan Agreement should include the following details: Names and contact information of both the creditor and debtor. Description of the debt being repaid. Total amount owed. Payment schedule, including due dates and amounts. Interest rate (if applicable) Consequences of late or missed payments.

How to set up a payment plan with someone?

Setting up the payment plan Calculate the total amount due and the payment schedule. Determine the payment amounts, due dates and payment method. Write the agreement, detailing the payment plan. Include the date of the agreement and the parties involved. Get both parties to sign the agreement.

What is an example of a payment arrangement?

Example of a payment arrangement clause "The Client agrees to pay the total sum of [$amount] to the Supplier as follows: an upfront deposit of [$amount], due upon signing this Agreement; a second payment of [$amount] due on [specified date], and the remaining balance of [$amount] due upon completion of the project.

How do I offer someone a payment plan?

Explain the total cost of your services and the proposed length of time the payment plan will run. Outline the payment schedule, including the due date for each work milestone and the expected payments. Discuss any interest or fees that may be associated with the plan, including how you calculate those costs.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.