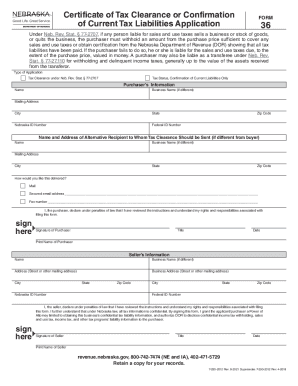

Payoff Agreement Template free printable template

Show details

This document outlines the terms under which one party will pay off a debt or obligation owed to another party, detailing responsibilities, repayment terms, and conditions for payoff.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

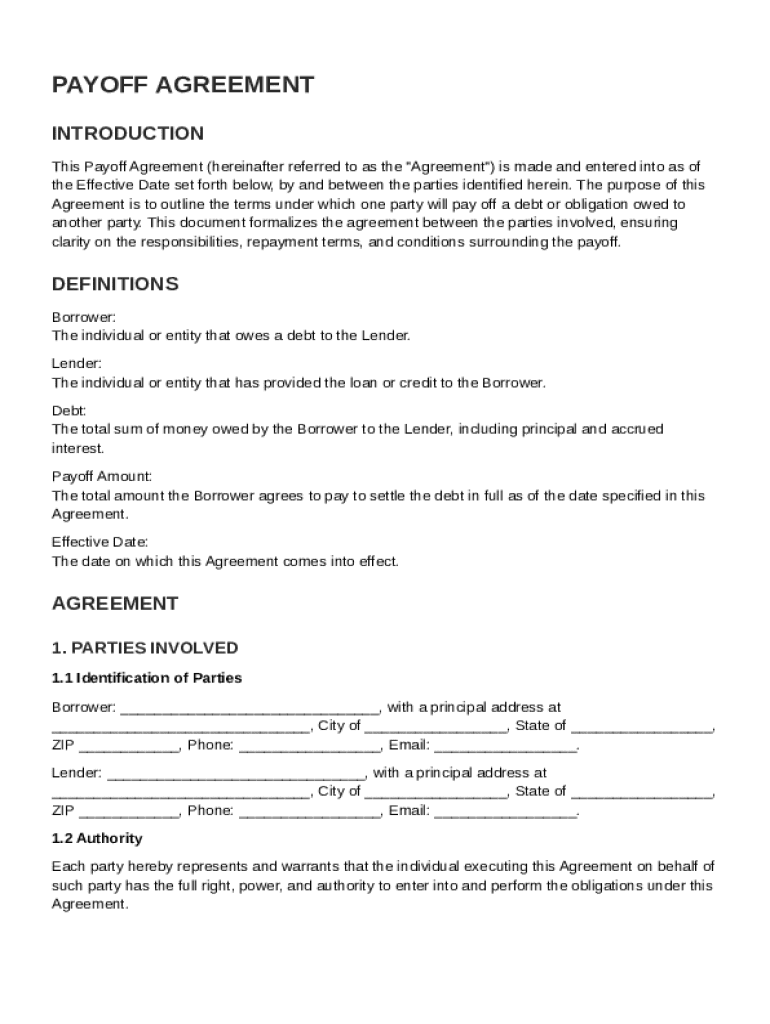

What is Payoff Agreement Template

A Payoff Agreement Template is a legal document that outlines the terms under which one party agrees to pay off a debt or obligation to another party.

pdfFiller scores top ratings on review platforms

It has been very good so far as I am able to

use the programs better,it will be less dificult

to ue.

So far it is working... I am still waiting on all but one of my customers to get back to me with their review of the digital signing experience

First time user. Did my forms get sent as a share document to a Dr Sabet? I never saw any thing to confirm that action.

IS BEEN DIFFICULT TO SEARCH FOR THE FORM

Good site/product. The only thing that bothers me is that is seems like when you email from the application (rather than save to your computer and forward) it seemingly wants the recipient to "buy" PDFfiller in order to print or use the pdf. I might have this wrong based on a hurried initial exchange.

It's convenient and it's the most acceptable readable accessible document out there.

Who needs Payoff Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Payoff Agreement Guide on pdfFiller

Navigating financial agreements can be challenging, and having a clear Payoff Agreement Template form is crucial for ensuring smooth transactions. In this guide, you will learn the essential components of a payoff agreement, how to fill out the template effectively, and the legal considerations involved.

What is a payoff agreement?

A payoff agreement is a formal document between a borrower and lender detailing the terms under which a debt can be settled. Its purpose is to provide clarity on the amount owed, payment methods, and consequences of default. Without a payoff agreement, misunderstandings could arise, leading to disputes.

-

This outline specifies the terms including the loan balance, interest, and repayment timeline.

-

Clear definitions help prevent conflicts and ensure both parties are aware of their responsibilities.

-

Common situations include settling credit card debt, mortgage agreements, and personal loans.

What key elements should be included in a payoff agreement?

A well-structured payoff agreement must contain specific elements for it to be effective and legally binding.

-

Clearly identify the Borrower and the Lender, including their contact information and roles.

-

Terms such as 'Outstanding Debt', 'Payoff Amount', and 'Effective Date' must be adequately defined to avoid confusion.

-

Outline how payments will be made, including due dates and accepted methods.

How to access a fillable payoff agreement template from pdfFiller?

pdfFiller offers a user-friendly platform where you can easily find a fillable Payoff Agreement Template form. To access it, simply visit the pdfFiller website and navigate to the template section.

-

Use the search feature on pdfFiller to locate the 'Payoff Agreement Template' directly.

-

The platform allows you to fill out, edit, sign, and manage the document seamlessly.

-

Users can modify the template to better fit specific requirements and situations.

What are the steps to fill out a payoff agreement?

Following a structured process simplifies filling out the Payoff Agreement Template form. Adhering to these steps ensures all necessary information is captured accurately.

-

Compile all relevant documents, including outstanding bills and personal identification.

-

Input data into each section methodically, ensuring accuracy in amounts and terms.

-

Thoroughly review the form for any errors or omissions before finalizing the agreement.

What legal considerations should be kept in mind?

Payoff agreements are contracts and must meet various legal standards. Ignoring these requirements could render an agreement invalid.

-

Both parties must understand the obligations outlined in the payoff agreement to fulfill their responsibilities.

-

Laws will vary by state, so it is crucial to stay informed about local regulations that could affect the agreement.

-

Ensure the agreement is signed by all parties, preferably in the presence of a witness or legal counsel.

How to fill out the Payoff Agreement Template

-

1.Download the Payoff Agreement Template from pdfFiller or create a new document using their editor.

-

2.Start by entering the date at the top of the document to establish a record of when the agreement is created.

-

3.Fill in the names and contact information for both the borrower and the lender in the designated sections.

-

4.Clearly specify the amount of the debt being paid off in the appropriate field.

-

5.Outline the terms of the payoff, including payment methods and due dates, in the specified areas.

-

6.Include any conditions or contingencies that apply to the payoff agreement.

-

7.Review the document thoroughly to ensure all information is accurate and complete.

-

8.Sign and date the document in the designated signature areas, and ensure the other party does the same.

-

9.Save the completed agreement and consider sending copies to all parties involved for their records.

How to write an agreement to pay back money?

Key elements of a repayment agreement Parties involved. Clearly define the lender and borrower, including their contact information. Loan amount and interest. Specify the principal amount and any interest to be charged. Repayment schedule. Late fees: Outline any penalties for late payments. Default terms. Governing law.

How do I make a simple payment agreement?

You can create a simple payment contract with these steps: Look for examples of payment agreement contracts online. Format your document. Write your title. Outline the parties involved in the agreement. Clearly write out the terms of the loan. Explain that the contract represents the entire agreement.

How to write a money agreement template?

The elements of a great payment agreement template The debt amount. The foundation of your payment agreement is based on the amount of the debtor wants from the creditor. Payments and Repayment schedule. Payment defaults. Amendments. Signatures.

What is a legal agreement to pay money?

A payment agreement, also known as a payment plan agreement or Installment Agreement, is a legal contract that outlines the terms of payment between two parties. It details the payment structure, timelines, amounts, and conditions under which payments must be made.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.