Last updated on Feb 17, 2026

Revolving Credit Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a lender provides a revolving line of credit to a borrower, including definitions, terms of credit, interest rates, fees, and obligations

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Revolving Credit Agreement Template

A Revolving Credit Agreement Template is a legal document outlining the terms and conditions between a lender and a borrower for a revolving line of credit.

pdfFiller scores top ratings on review platforms

PDF filler is VERY easy to use

PDF filler is VERY easy to use. The only sticky point for me sometimes is finding forms. There is a library connected to the app but I often find the forms there confusing. So I google them and import.

excellent service

audit life insurance policies for employers

great

The best

Nice

Who needs Revolving Credit Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Revolving Credit Agreement Template Form

What is a revolving credit agreement?

A revolving credit agreement is essentially a flexible financing option that enables borrowers to access funds up to a specified limit over time. This type of agreement is particularly useful for individuals and businesses that require ongoing access to credit. Unlike traditional loans that require a lump sum repayment, revolving credit allows for repeated borrowing and repayment according to the borrower’s needs.

-

A revolving credit agreement grants borrowers access to a credit line that they can draw upon repeatedly.

-

The primary goal is to provide financial flexibility to manage cash flow effectively.

What are the key components of the agreement?

Understanding the key components of the Revolving Credit Agreement is crucial for effective management. The main components include terms that define the borrower’s obligations, the lender’s responsibilities, and the exact nature of the credit arrangement.

-

The introductory section sets the context of the agreement, outlining parties, purpose, and terms.

-

Key financial terms like 'interest rate' and 'draw requests' are defined for clarity.

-

Specifies the credit amount and conditions under which the borrower can access funds.

How to establish an account for a revolving credit agreement?

Creating and managing accounts associated with a revolving credit line requires careful documentation. Accurate completion of all required forms significantly impacts the approval process and future borrowing.

-

Ensure that both lender and borrower details are correct to avoid processing delays.

-

Utilize alerts to monitor credit utilization and outstanding balances to maintain account health.

What are the terms and conditions of the agreement?

The terms and conditions outline the expectations and responsibilities of both parties. It's imperative to understand these as they cover financial implications and adherence to agreed-upon guidelines.

-

Borrowers must be aware of how interest rates determine the cost of borrowing.

-

Understanding the repayment schedule is essential to avoid late payments and potential penalties.

-

Know the fees for delinquent payments and any prepayment penalties as they affect overall costs.

What financial implications do borrowers face?

For borrowers, grasping the financial implications of their revolving credit agreement is crucial. Not paying on time could lead to significant obligations that can spiral out of control.

-

Develop a budget reflecting your repayment schedule to avoid defaults.

-

Defaults can result in increased fees and adversely impact credit scores.

How to manage credit access flexibly?

Flexibility is one of the main advantages of a revolving credit agreement. Understanding the process of submitting draw requests ensures that borrowers can efficiently utilize available funds for various needs.

-

Being timely with draw requests helps manage available credit without incurring additional fees.

-

Regularly check your credit limit and remaining balance to make informed financial decisions.

What should borrowers know about governing laws and compliance?

Regulations governing revolving credit agreements vary by region, and being informed about these laws is essential for compliance. Failure to adhere to local standards can lead to legal complications.

-

Understanding regional laws will help ensure adherence to all terms and conditions.

-

Borrowers should keep abreast of changes in financial legislation to avoid penalties.

What is the cancellation policy and available remedies?

Each revolving credit agreement should clearly outline the conditions for cancellation. Knowing these terms helps borrowers navigate options should the need arise.

-

Clear terms around cancellation and the necessary steps involved should be delineated upfront.

-

Understanding how disputes are handled prevents costly misunderstandings.

How does pdfFiller enhance agreement management?

pdfFiller offers a comprehensive array of interactive tools designed to assist users in editing, signing, and managing documents. By utilizing a cloud-based platform, users can access their revolving credit agreement forms from anywhere, streamlining the document management process.

-

Users can eSign documents quickly and efficiently, reducing turnaround times.

-

Centralizing all agreements in one platform simplifies tracking and access.

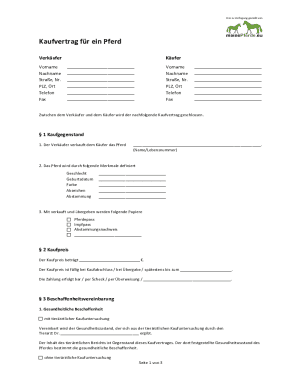

How to fill out the Revolving Credit Agreement Template

-

1.Download the Revolving Credit Agreement Template from pdfFiller.

-

2.Open the document in pdfFiller and review the pre-filled sections.

-

3.Fill in the borrower’s full legal name and address in the designated fields.

-

4.Enter the lender's information, including name and address.

-

5.Specify the credit limit amount and any applicable fees.

-

6.Outline the repayment terms, including minimum payments and due dates.

-

7.Include provisions for interest rates and any penalties for late payments.

-

8.If necessary, provide details about collateral securing the credit.

-

9.Review the entire agreement to ensure all information is accurate.

-

10.Save the completed document and export it in the desired format, like PDF.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.