Bookkeep Contract Template free printable template

Show details

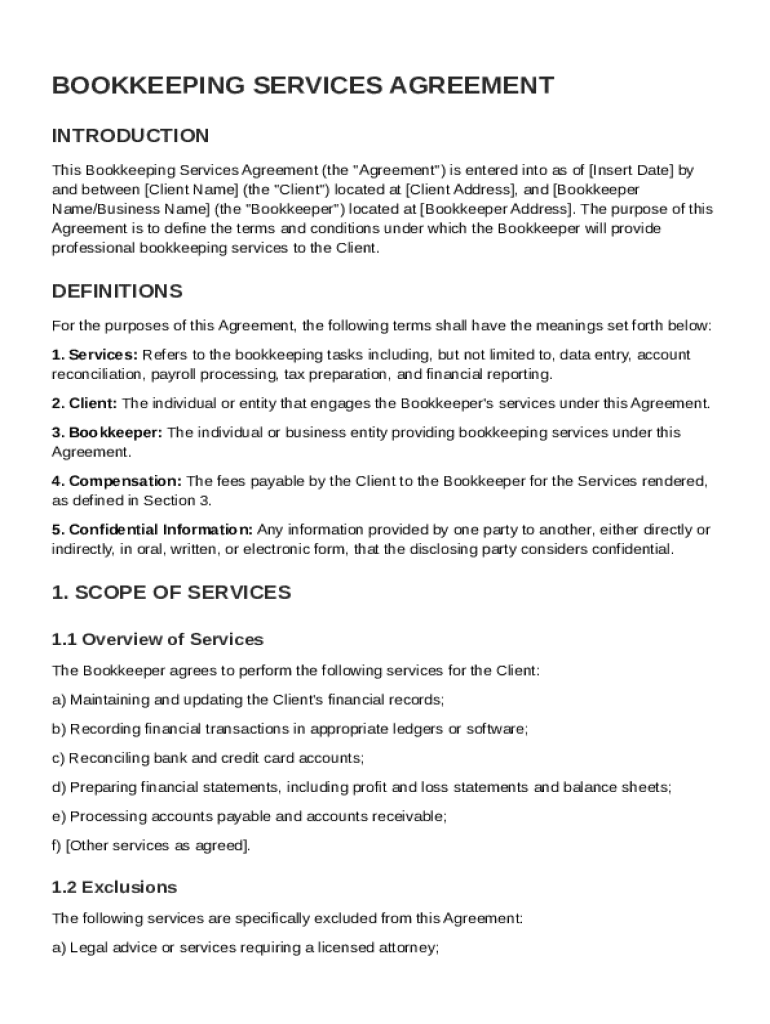

This Agreement outlines the terms and conditions under which a Bookkeeper will provide bookkeeping services to the Client, including definitions, scope of services, compensation, responsibilities,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

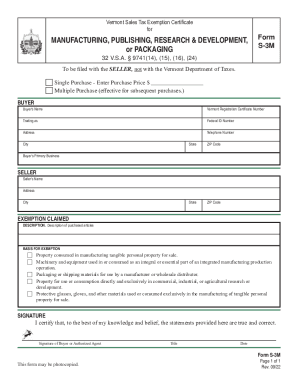

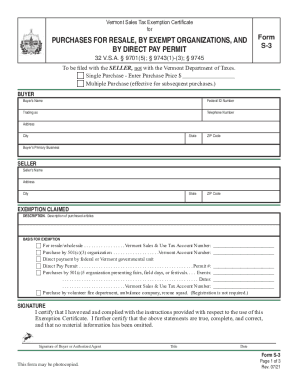

What is Bookkeep Contract Template

A Bookkeep Contract Template is a formal document that outlines the terms and conditions between a bookkeeper and their client regarding bookkeeping services.

pdfFiller scores top ratings on review platforms

Worked well

Thank you for the great product

Free trial

Edit: I appreciate the clarification and the time they took to reply to my initial review about the free trial. I will give it a go now and happy to leave it at 5 stars.

Cheers!

Great experience so far.

outstanding

This is great sarah pdf file editor

This is great sarah pdf file editor

its good

its good, but the problem is high subscription fee

Who needs Bookkeep Contract Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Bookkeeping Contract Template

This guide will help you navigate the intricacies of the Bookkeep Contract Template form. Knowing how to fill out a bookkeeping services agreement can ensure clarity between you and your bookkeeper, leading to smoother financial management.

What is a bookkeeping services agreement?

A bookkeeping services agreement defines the relationship and expectations between a client and a bookkeeper. This document ensures that both parties understand their responsibilities and protects their legal rights.

-

A bookkeeping services agreement outlines what services will be provided and sets clear guidelines, reducing potential misunderstandings.

-

Typically, these parties include the client (who needs bookkeeping services) and the bookkeeper (who provides those services).

-

This agreement can have legal implications, including liability and enforcement of the terms outlined within.

What are the essential components of the bookkeeping services agreement?

Establishing a clear and specific bookkeeping services agreement can prevent conflicts and misunderstandings. It should include detailed descriptions of the services rendered to ensure both parties are aligned.

-

An overview of the specific bookkeeping activities like record maintenance, reconciliations, and report generation.

-

Clarifying terms used in the contract helps in minimizing ambiguity. Common terms may include 'client', 'services', and 'payment'.

-

Details about payment terms and conditions, including frequency and method of payment, ensure clarity in financial transactions.

What services are detailed in the bookkeeping services agreement?

Outlining the specific services provided in a bookkeeping contract helps manage expectations and defines the limits of the engagement.

-

Includes keeping accurate records of all financial transactions.

-

Details the methods for recording transactions, such as software used or manual logs.

-

Describes how bank and credit card accounts will be reconciled each month.

-

Specifies key documents like balance sheets and income statements that will be prepared.

-

Outlines how the bookkeeper will handle invoicing and outstanding bills.

-

Discusses customizable options that can be included based on client needs.

What exclusions should you know about in the agreement?

Being aware of what services are not included in the agreement can prevent future misunderstandings.

-

Clarifies that the bookkeeper cannot provide legal advice.

-

Outlines that financial planning services are not included in the bookkeeping agreement.

-

Details any other exclusions such as tax preparation or auditing services.

What do you need to know about the term of the agreement?

Understanding the terms of the agreement's validity establishes a timeline for the bookkeeping relationship.

-

Indicates when the agreement comes into effect.

-

Specifies the length of the initial contract and any renewal terms.

-

Details the processes for either party to terminate the agreement.

How do you fill out the bookkeeping services agreement?

Filling out the Bookkeep Contract Template form correctly is crucial for establishing a clear agreement. pdfFiller offers tools to help streamline this process.

-

Follow detailed instructions for filling out each section of the contract.

-

Utilize pdfFiller’s interactive options for filling forms easily and accurately.

-

Review tips to ensure your contract complies with laws and is filled out accurately.

How can pdfFiller enhance your document management?

Utilizing pdfFiller allows for better management and customization of your documents.

-

Easily customize templates to fit your specific bookkeeping needs.

-

Quickly sign your agreement online for added convenience and security.

-

Work effectively with your team or clients using pdfFiller's collaborative tools.

What compliance considerations should you keep in mind?

Ensuring compliance with regulations is vital for avoiding issues. Different regions may have distinct rules governing bookkeeping services.

-

Know the local regulations that may impact bookkeeping practices in your area.

-

Be aware of and comply with industry standards applicable to bookkeeping services.

-

Understand that non-compliance can lead to legal repercussions and impact your business operations.

How to fill out the Bookkeep Contract Template

-

1.Download the Bookkeep Contract Template from pdfFiller.

-

2.Open the template in pdfFiller and review the pre-filled sections.

-

3.Start with the 'Client Information' section; enter the name and address of the client.

-

4.Move to the 'Bookkeeper Information'; fill in your name, contact details, and address.

-

5.In the 'Services Provided' section, specify the bookkeeping services you will deliver.

-

6.Review payment terms; input your hourly rate or flat fee and payment deadlines.

-

7.Fill in a start date for the services and the duration of the contract.

-

8.Ensure to include any conditions or clauses you want in the 'Additional Terms' section.

-

9.Finally, read through the contract for accuracy, and make adjustments if necessary.

-

10.Save the filled contract on pdfFiller, then download or share it as needed.

How to write a bookkeeping contract?

How to Write 1 – Access The Services Agreement Template On This Page. 2 – The Accountant And Client Must Be Fully Identified. 3 – Define The Accounting Services That Will Be Provided. 4 – Record The Agreed Upon Compensation For The Accountant's Services. 5 – Report The When And Where This Agreement Is Effective.

What should I charge as a bookkeeper?

On average, you should charge between $300 and $1,000 per month, considering factors like the number of transactions, the level of service required, and the bookkeeper's experience and qualifications.

What is the agreement between bookkeeper and client?

A bookkeeping service agreement is a legally binding document that formalizes the professional relationship between a bookkeeper (you) and a business owner (your client). It acts as a roadmap, outlining the specifics of the services provided and ensuring both parties are on the same page.

Does QuickBooks offer contract templates?

QuickBooks Contract Management offers a variety of features to help businesses manage their contracts and records. These include: Custom Templates: Create custom templates for different types of contracts, such as Sales Agreements and Non-Disclosure Agreements, so you can quickly create new contracts.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.