Last updated on Feb 17, 2026

Payroll Service Contract Template free printable template

Show details

This document outlines the agreement between a Client and a Payroll Service Provider for the delivery of payroll services, specifying the terms, responsibilities, fees, confidentiality, and dispute

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Payroll Service Contract Template

A Payroll Service Contract Template is a formal agreement that outlines the terms and conditions between a business and a payroll service provider.

pdfFiller scores top ratings on review platforms

I am having difficulties printing my documents. I click done but it doesn't take me to print

FIRST TIME USING. EASY TO FOLOW AND UNDERSTAND

So far, so good. Looking forward to testing sending this and having someone fill out and send back to me.

Good but asking me for my opinion is annoying

I can never speak to anyone live. Also, I can not find all the documents I need whenever, I need them.

This is a very simply PDF filler form to use. Once you get use to the navigation of the site, you will love this program

Who needs Payroll Service Contract Template?

Explore how professionals across industries use pdfFiller.

Payroll Service Contract Template Guide

What is a Payroll Service Agreement?

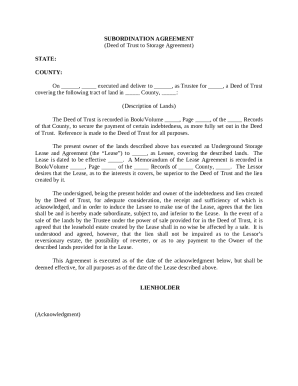

A Payroll Service Agreement is a contract between a business and a payroll service provider outlining the terms and conditions under which payroll services will be performed. This agreement serves key purposes including defining responsibilities, establishing expectations, and ensuring compliance with legal standards. By clearly detailing the roles and responsibilities of both parties, it helps prevent misunderstandings that can arise during payroll processing.

What key components should be included?

-

The date when the agreement comes into force, indicating when services will commence.

-

The legal name of the organization contracting for payroll services, ensuring clarity in accountability.

-

The legal name of the payroll provider, crucial for defining the service responsibilities.

Why is it important to detail roles and responsibilities?

Clearly defined roles and responsibilities in a Payroll Service Agreement are essential to mitigate risks associated with payroll processing errors. When each party understands their specific obligations, it fosters accountability and streamlines communication, ultimately enhancing efficiency. Furthermore, having explicit expectations can help prevent disputes over service delivery and responsibilities.

What definitions are essential in the agreement?

Certain terms must be clearly defined in any Payroll Service Agreement to prevent ambiguity. These include the description of services to be provided, the classification of client data needed for payroll processing, and the handling of confidential information. Additionally, defining the term of the agreement, including its duration and any renewal clauses, ensures both parties are aligned on expectations.

What is covered under the scope of payroll services?

-

Typical payroll processing activities provide a comprehensive overview of what the agreement entails.

-

Options for payroll schedules including weekly, bi-weekly, semi-monthly, and monthly to accommodate different business needs.

-

Responsibilities such as calculating wages, tax withholdings, and managing employee payments ensure compliance and accuracy.

-

Preparing and filing necessary tax documents is a key duty that helps maintain compliance with federal and state regulations.

What additional services can be included?

Beyond the standard payroll processing services, additional offerings can enhance the value of your Payroll Service Agreement. For instance, services like an employee self-service portal, and benefits administration, can significantly improve user experience. Moreover, integrating with time and attendance tracking systems streamlines payroll accuracy.

-

Utilizing Human Resource Information Systems for reporting and data management can lead to more effective payroll oversight.

-

This provides tailored reports that help businesses analyze payroll-related data for better decision-making.

-

Understanding the potential costs associated with these services is crucial for budget alignment.

How can you create a Payroll Service Agreement?

Creating a Payroll Service Agreement can be streamlined using tools like pdfFiller. Start by logging in to your account and selecting the Payroll Service Contract template. The platform guides you step-by-step, ensuring you fill out all necessary fields accurately.

-

Log into your account for easy access to templates.

-

Choose the Payroll Service Contract from the available templates.

-

Follow step-by-step instructions for properly inputting information.

-

Utilize editing tools and eSigning features provided by pdfFiller for a comprehensive document management experience.

What compliance considerations should be taken into account?

Understanding compliance issues related to payroll processing is vital for legal protection. Local and federal regulations dictate how payroll services should be managed, thus it's essential to stay updated with any legal changes. Not adhering to these regulations can lead to significant consequences, including financial and reputational damage.

-

Regularly review tax laws to ensure compliance and avoid issues.

-

Errors in payroll can lead to penalties and complications with tax authorities.

-

Missed tax submission deadlines can have severe repercussions.

How to fill out the Payroll Service Contract Template

-

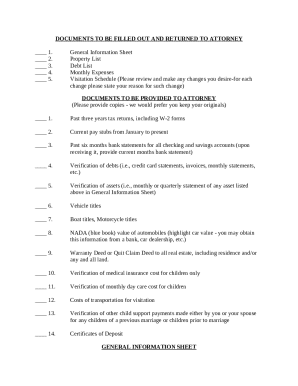

1.Download the Payroll Service Contract Template from pdfFiller.

-

2.Open the document in pdfFiller's editing tool.

-

3.Begin filling in the date at the top of the contract.

-

4.Enter your business name and contact details in the designated fields.

-

5.Fill in the payroll service provider's name and contact information.

-

6.Specify the scope of services to be provided in the section provided.

-

7.Outline the payment terms, including pricing and scheduling of payments.

-

8.Insert the duration of the contract, detailing start and end dates; consider any renewal options.

-

9.Add any additional clauses or terms that are relevant to your specific agreement.

-

10.Review the entire document to ensure all information is correct and complete.

-

11.Sign the document digitally or print to sign manually, then save the completed contract.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.