Get the free Deed of Gift - swanguildfordhistoricalsociety org

Get, Create, Make and Sign deed of gift

Editing deed of gift online

Uncompromising security for your PDF editing and eSignature needs

How to fill out deed of gift

How to fill out deed of gift

Who needs deed of gift?

Comprehensive Guide to the Deed of Gift Form

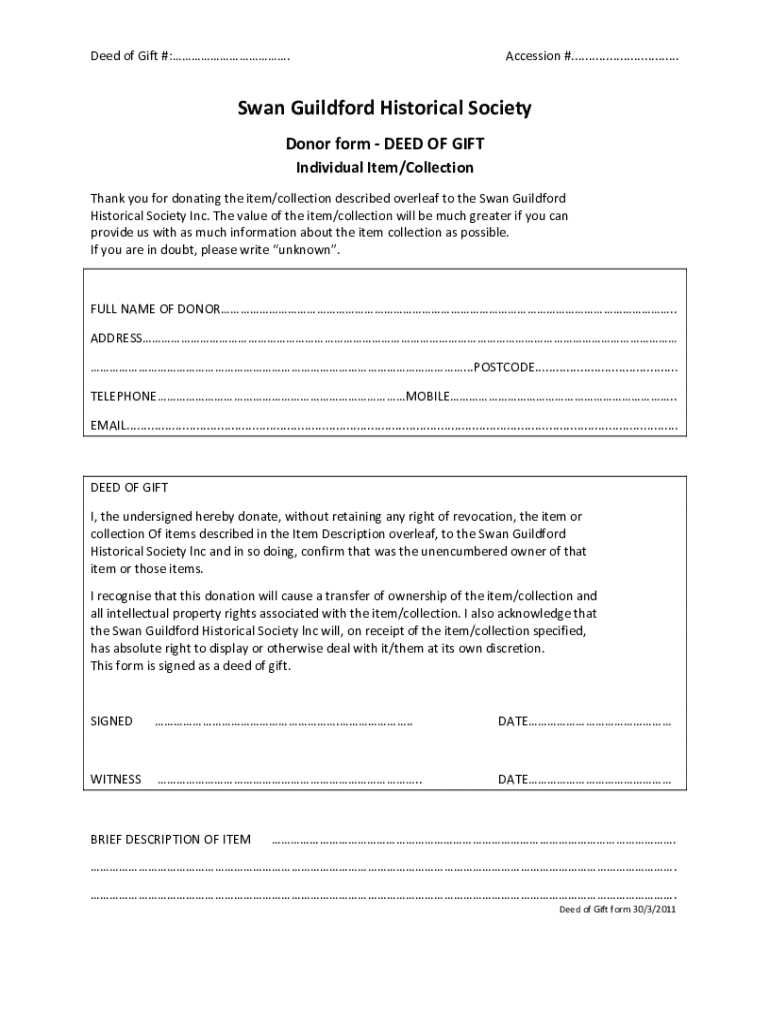

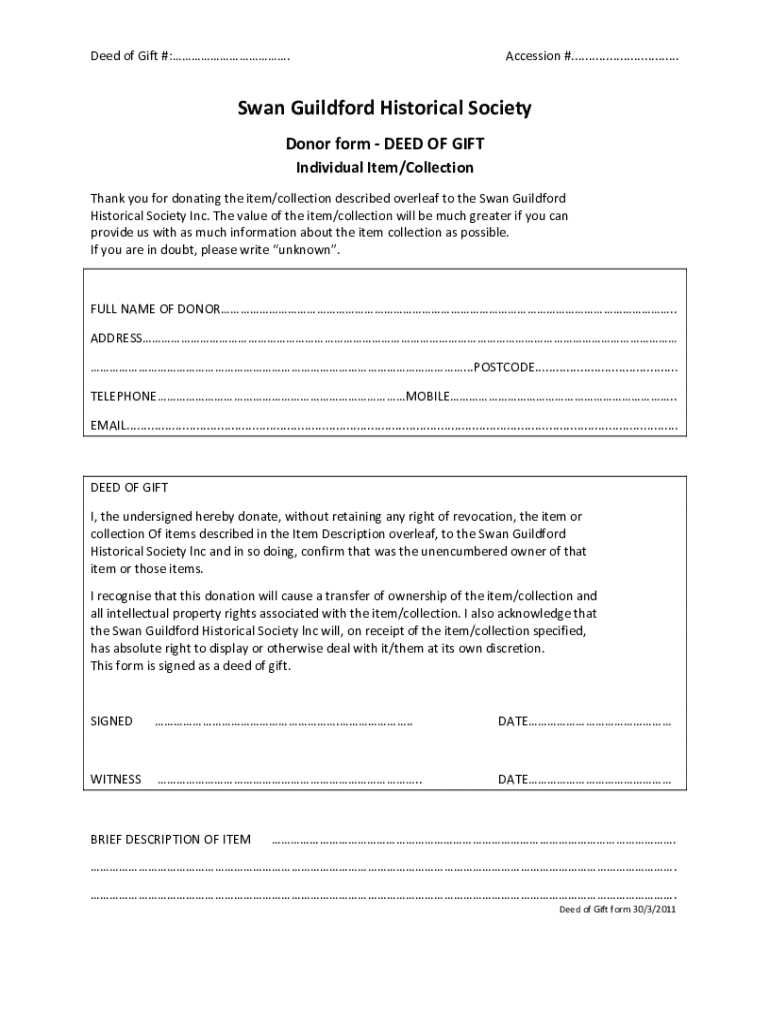

Overview of the deed of gift form

A deed of gift form is a legal document that establishes a voluntary transfer of property or assets from one individual, the donor, to another, the recipient, without any expectation of compensation. This document is crucial in legal transactions as it formalizes the intentions of the parties involved, ensuring transparency and clarity. The deed serves to protect the rights of both the donor and recipient, providing a clear record of the transaction.

Using a deed of gift is appropriate in various situations, such as when transferring family heirlooms, real estate, financial assets, or artworks. It is also often employed in charitable donations where no strings are attached. Understanding when and how to use this document helps ensure that the legal process is adhered to and that both parties are protected.

Understanding the components of the deed of gift

A deed of gift form is composed of several key elements that must be clearly defined to ensure its validity. These components include:

Avoiding common mistakes when filling out a deed of gift can save legal issues down the line. Check for accuracy in spelling names, addresses, and the description of the gift. Ensure all parties review the document before finalization.

How does the deed of gift form work?

Filling out a deed of gift form is a straightforward process, but it requires attention to detail. Here’s a step-by-step guide to assist you in properly completing the deed of gift:

Utilizing interactive tools available on pdfFiller can simplify this process further, allowing users to easily fill out, edit, and sign their deeds of gift from anywhere.

Tax considerations related to deeds of gift

One essential aspect to understand about deed of gift forms is their tax implications. Generally, when a gift exceeds a specific amount, the donor may be subject to gift tax. In the United States, for example, the annual exclusion limit means that gifts below a certain value are not taxed. As of 2023, this limit is about $15,000 per recipient.

Both the donor and recipient must also be aware of their reporting requirements. Donors are typically responsible for reporting taxable gifts, while recipients must claim gifts if they acknowledge receiving such assets. Additionally, a gift with reservation of benefit occurs when the donor retains certain rights over the gifted property, which can complicate tax matters. Understanding these financial implications can prevent unexpected tax liabilities.

Legal considerations for using a deed of gift

To ensure a deed of gift is valid, it must adhere to specific requirements that vary by jurisdiction. Fundamental validity criteria include voluntary transfer, an intention to make a gift, capacity of the donor, and clarity of description regarding the gift and recipient.

Registration may not always be necessary, but certain jurisdictions may require it for the transfer of real estate. Comparing a deed of gift to other legal instruments highlights its unique purpose. For instance, a deed of variation modifies terms of a will, whereas a deed of gift involves outright transfers with no return obligation. Understanding these distinctions can help individuals choose the right instrument for their needs.

Specialized scenarios involving deeds of gift

Deeds of gift are versatile and can be employed in various specialized scenarios, including property and financial asset transfers. In cases of property transfer, it is essential to ensure the deed is properly executed to avoid complications in ownership rights.

For financial assets, understanding implications such as capital gains tax and asset evaluation is vital. Additionally, unique situations often arise, such as when a donor is facing insolvency, or if a deed of gift may impact benefits or divorce settlements. Putting assets into trust could also be affected, making it crucial to consult legal advice in these circumstances.

FAQs on deeds of gift

Individuals often have common questions regarding deeds of gift. Here are some of the most frequently asked questions with expert answers:

Clauses typically found in a deed of gift

In addition to the standard components, several important clauses are often included in a deed of gift, enhancing its legal robustness. The interpretation of terms clause defines any key terminology used within the document, ensuring that there is no confusion.

Warranties by the donor ensure that they have the legal right to gift the asset. An entire agreement clause guarantees that the deed encapsulates the full understanding of the parties, while rights of third parties state that the deed does not grant any rights to third parties unless expressly stating otherwise.

Useful information for completing your deed of gift form

Completing a deed of gift form successfully requires careful attention. A checklist can be a helpful tool, ensuring that each important step is accounted for. Here are key elements to watch for:

Additionally, first-time users of pdfFiller should take advantage of tutorials and resources available on the platform. They can greatly assist in understanding how to use the system efficiently.

Legal bits and necessary legal framework

Navigating the legal landscape of a deed of gift is essential, especially regarding jurisdiction and applicable laws. Different regions may have varying requirements that can significantly affect the validity and enforceability of a deed.

Familiarizing yourself with relevant legal precedents and statutes can provide additional insight. Consulting with legal professionals knowledgeable in your jurisdiction can assist in ensuring compliance with all legal requirements and potentially avoiding disputes in the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify deed of gift without leaving Google Drive?

How do I edit deed of gift online?

How can I edit deed of gift on a smartphone?

What is deed of gift?

Who is required to file deed of gift?

How to fill out deed of gift?

What is the purpose of deed of gift?

What information must be reported on deed of gift?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.