Get the free Customer Credit Application & Agreement

Get, Create, Make and Sign customer credit application agreement

How to edit customer credit application agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out customer credit application agreement

How to fill out customer credit application agreement

Who needs customer credit application agreement?

Customer Credit Application Agreement Form: A Comprehensive Guide

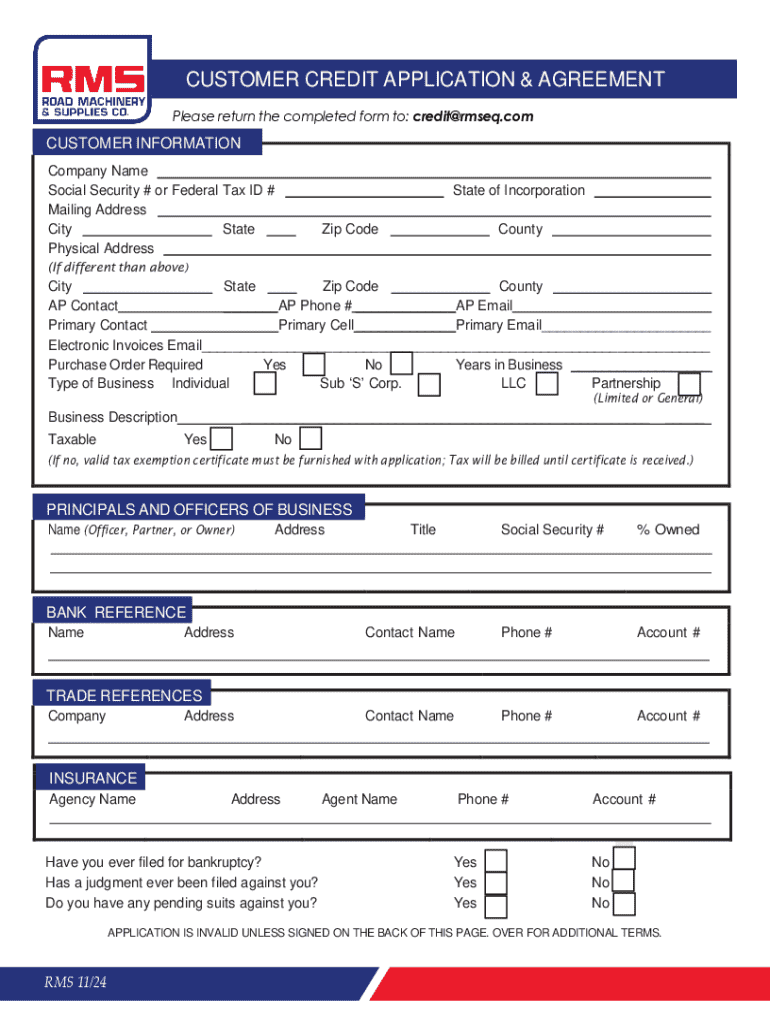

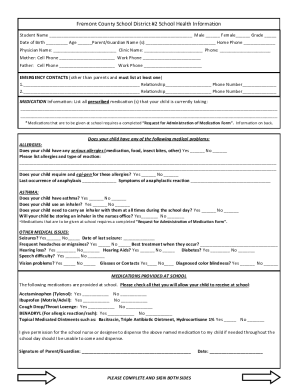

Overview of customer credit application agreement forms

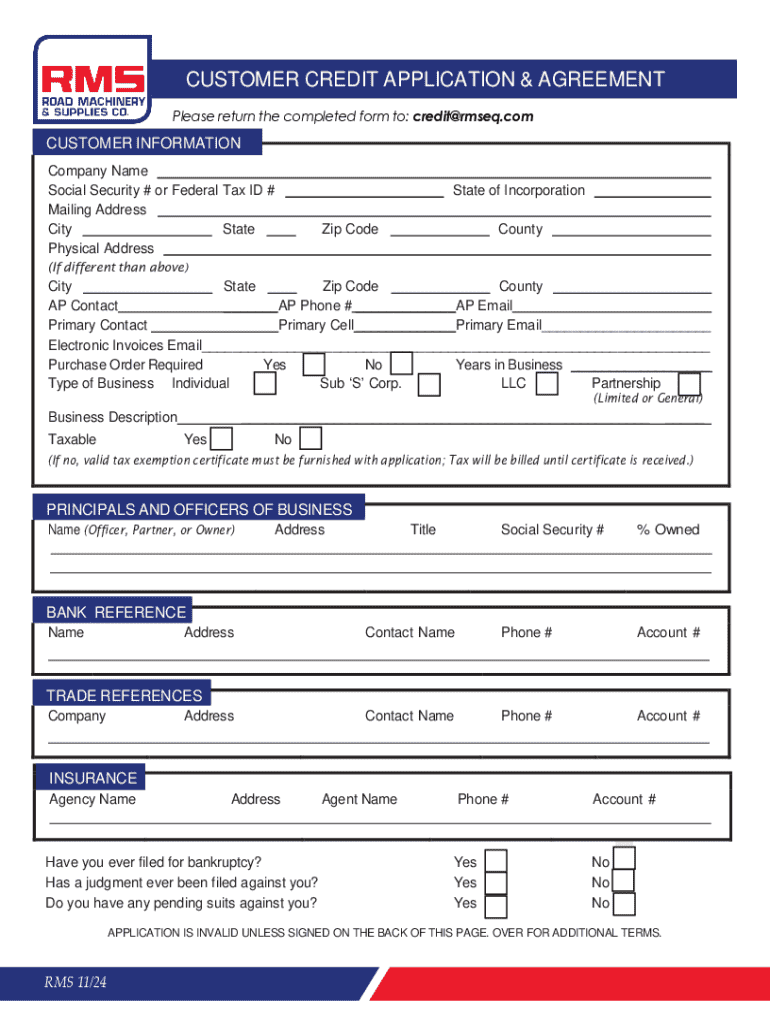

A customer credit application agreement form is a formal document that potential borrowers fill out to apply for credit. This form gathers essential personal and financial information to help lenders assess the creditworthiness of applicants. Crediting institutions, including banks and retail businesses, use this form to make informed decisions regarding loan approvals or credit limits.

Accurate information in the customer credit application agreement form is paramount. Incomplete or incorrect details can lead to delays or denials in application processing, affecting the customer’s ability to acquire necessary credit. Furthermore, common misunderstandings often arise regarding privacy and the implications of submitted information, which can dissuade applicants from providing complete information.

Key components of the customer credit application agreement form

The customer credit application agreement form consists of several key components that outline an applicant's identity, employment, and financial status. Understanding these sections ensures applicants present themselves accurately to potential lenders and increases their chances of approval.

The personal details section typically requires basic identifying information such as the applicant’s name, current address, and contact number. Additionally, financial institutions might ask for date of birth and Social Security Number (SSN) as a means of verifying the applicant's identity.

Personal details section

The personal details section must be filled out accurately. This includes:

Employment and income information

Applicants must also furnish employment details, including current job title, employer name, and length of employment. Lenders require proof of income, which may include pay stubs or tax returns, in order to estimate repayment capability.

Financial information

Lastly, the financial information section focuses on credit history and current debt obligations. Applicants may need to provide their credit score details, current loans or lines of credit, and disclose any significant financial assets such as bank statements.

Step-by-step guide to completing the form

Completing the customer credit application agreement form accurately is crucial. Here’s a step-by-step guide to ensure a smooth application process.

Step 1: Gathering required documents

Before starting, gather the necessary documents to avoid delays. These typically include:

Step 2: Filling out the personal details section

Take time to accurately fill in your personal details. Double-check your name, address, and SSN to avoid discrepancies.

Step 3: Providing employment and income information

When disclosing your employment and income, ensure you have supporting documentation on hand. Common pitfalls include underestimating income or omitting part-time jobs.

Step 4: Disclosing financial information

Be transparent about your financial situation. Full disclosure of all debts and assets increases trust with your lender and facilitates a smoother application process.

Editing your customer credit application agreement form with pdfFiller

Once you've completed your form, it's essential to review and edit it before submission. pdfFiller offers interactive tools that facilitate easy revisions.

Utilizing interactive tools for revisions

With pdfFiller, you can highlight sections that need changes and make direct edits, ensuring everything is accurate before finalizing your submission.

Collaborating with others

If you're working as part of a team, you can invite members to review your form and provide feedback. This collaborative approach ensures accuracy and completeness.

Saving different versions

Managing multiple iterations of the form is straightforward with pdfFiller. Save various versions to track changes, making it simple to revert if necessary.

Signing the customer credit application agreement form

After editing, the next step involves signing your application form. Understanding eSignature requirements will help streamline this process.

Understanding eSignature requirements

Electronic signatures are legally binding and accepted by most lenders, simplifying the signing process. It's essential, however, to ensure that your digital signature complies with the specific requirements set by your lender.

How to add your eSignature with pdfFiller

Adding your eSignature with pdfFiller is straightforward. Follow these steps: Go to the 'Sign' option, choose to create a signature, and drag it to the designated area on your form.

Managing signature requests

If you need to send your form for others to sign, manage signature requests easily through pdfFiller. You can send invitations and track the status of the requests, ensuring all documentation is signed without hassle.

Tips for submitting your completed application

Now that you’ve completed and signed your customer credit application agreement form, it's time for submission. Choosing the right submission method can make a big difference in processing time.

Recommended submission methods

Consider your options, which may include:

Follow-up steps

After submitting your application, don't forget to follow up. Allow a few days before reaching out to the lender to inquire about the status of your application, demonstrating your proactive approach.

Frequently asked questions (FAQs)

When navigating credit applications, applicants often have several questions. Here are some of the most common inquiries.

Troubleshooting common issues

Sometimes, issues may arise during the application process. Here’s how to tackle some common problems.

Problem: Application is declined

If your application is denied, review your credit report. Possible reasons for denial include low credit scores, high debt-to-income ratios, or insufficient income.

Problem: Missing documentation

If your application is incomplete due to missing documents, provide the necessary paperwork as quickly as possible and inform your lender about the same.

Problem: Delayed processing times

In cases of delay, call the lender's customer service. They can provide insight into the status of your application and any pending requirements.

Advantages of using pdfFiller for your customer credit application agreement form

Employing pdfFiller to manage your customer credit application agreement form is beneficial in numerous ways. The platform allows you to create, edit, and manage forms seamlessly from anywhere.

Access from anywhere

With pdfFiller, users have the convenience of accessing their forms on any device—whether mobile or desktop—ensuring they can work on their applications anytime, anywhere.

Streamlined document management

The platform centralizes your document storage, allowing for a structured approach to document creation and management which reduces confusion and error in the application process.

Enhanced security for sensitive information

pdfFiller prioritizes security, employing measures that protect your personal data throughout the credit application process, generating peace of mind as you submit sensitive information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my customer credit application agreement directly from Gmail?

How do I make edits in customer credit application agreement without leaving Chrome?

How do I complete customer credit application agreement on an iOS device?

What is customer credit application agreement?

Who is required to file customer credit application agreement?

How to fill out customer credit application agreement?

What is the purpose of customer credit application agreement?

What information must be reported on customer credit application agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.